- First quarter 2024 organic orders up 60% compared to first

quarter 2023, book-to-bill ratio 1.5x in first quarter 2024 and

record high $6.3 billion backlog at the end of first quarter

2024

- First quarter 2024 net sales of $1,639 million, 8% higher than

first quarter 2023

- First quarter 2024 operating profit of $203 million and

adjusted operating profit(1) of $249 million, up 42% from first

quarter 2023

- Accelerated capital deployment with $600 million in share

repurchases (~9.1 million shares at $66/share weighted average

price) in first quarter 2024

- Raising full year 2024 guidance, expect net sales growth of 12%

at the midpoint, operating profit of $1,150 to $1,200 million and

adjusted operating profit of $1,325 to $1,375 million, a 28%

increase at the midpoint compared to full year 2023

Vertiv Holdings Co (NYSE: VRT), a global provider of critical

digital infrastructure and continuity solutions, today reported

financial results for its first quarter ended March 31, 2024.

Vertiv reported first quarter 2024 net sales of $1,639 million, an

increase of $118 million, or 8%, compared to last year’s first

quarter. The book-to-bill ratio was 1.5x in the first quarter and

organic orders (excluding foreign exchange) increased 60% from last

year’s first quarter as underlying market demand remains strong,

benefiting from AI deployments, including liquid cooling

technologies, that are ramping up.

First quarter 2024 operating profit of $203 million reflects an

increase of $72 million and adjusted operating profit of $249

million reflects an increase of $73 million, or 42%, compared to

first quarter 2023. Adjusted operating margin expanded 370 basis

points to 15.2% in the first quarter 2024 compared to first quarter

2023, driven by benefits from favorable price-cost and increased

volume and productivity partially offset by growth investments in

R&D and capacity.

“Vertiv’s robust momentum in 2023 continued into the first

quarter of 2024, led by strength in orders, which grew 60%,

exceeding our expectations and reflecting increasing pipeline

velocity and acceleration of AI-driven demand,” said Giordano

Albertazzi, Vertiv’s Chief Executive Officer. “We are seeing order

patterns with longer lead times based on customer build schedules,

largely in 2025 and beyond, suggesting AI is starting to scale.

Though still in its early stages, AI is quickly becoming a

pervasive theme across our end markets. Continued advances in GPU

development and other AI-enabling technologies are necessitating

changes and upgrades to the critical digital infrastructure. We are

continuing to advance our portfolio to enable high-density and GPU

based deployments. With our global capacity, the most complete

portfolio of critical digital infrastructure solutions across the

entire thermal and power technology spectrum, vast global service

network and alignment with key technology partners, Vertiv is

uniquely positioned and ready to bring scale and support

development of the entire AI ecosystem.”

Dave Cote, Vertiv’s Executive Chairman, added: “Delivering

strong performance across the board, Vertiv is demonstrating its

true potential, driven by the continued strides Gio and his team

are making in improving execution and building a high-performance

culture. I am equally excited about the potential that remains for

further improvement. We are still in the early stages of unlocking

the potential of this business. The data center market remains

extremely positive for the foreseeable future, and Vertiv is

well-positioned for continued growth and operational improvement

over the long-term, which supports our capital deployment strategy

and enables us to invest in long-term value-creation while also

returning capital to shareholders.”

Adjusted Free Cash Flow(1) and

Liquidity

Net cash generated by operating activities in the first quarter

was $138 million, an increase of $96 million from first quarter

2023 and adjusted free cash flow was $101 million, an increase of

$76 million from first quarter 2023. First quarter 2024 adjusted

free cash flow performance was driven by higher adjusted operating

profit, improvement in working capital management and lower

interest expense which were partially offset by an $8 million

increase in capital expenditures to support growth.

Consistent with our capital deployment strategy, we repurchased

$600 million of shares (or 9.1 million shares) in the first quarter

2024, including the repurchase of Platinum Advisors’ remaining ~8.0

million shares. Liquidity was $860 million and borrowings under our

ABL credit facility remained at zero at the end of first quarter

2024. Net leverage at the end of first quarter 2024 was 2.2x,

impacted by the opportunistic share repurchases in the first

quarter.

Updated Full Year and Second Quarter

2024 Guidance

The data center market continues to accelerate, including the

deployment of high-performance compute, and we have seen increased

velocity from our opportunity pipeline to orders. We believe Vertiv

is well-positioned to capture this market growth with our

systems-level approach to critical digital infrastructure, across

the power train and thermal chain, with 3,500+ field service

engineers around the globe who are ready to support AI deployment

at scale.

Second Quarter 2024 Guidance

Net sales

$1,900M - $1,950M

Organic net sales growth(2)

11% - 13%

Adjusted operating profit(1)

$315M - $335M

Adjusted operating margin(2)

16.7% - 17.1%

Adjusted diluted EPS(1)

$0.53 - $0.57

Full Year 2024 Guidance

Net sales

$7,540M - $7,690M

Organic net sales growth(2)

11% - 13%

Adjusted operating profit(1)

$1,325M - $1,375M

Adjusted operating margin(2)

17.5% - 17.9%

Adjusted diluted EPS(1)

$2.29 - $2.35

Adjusted free cash flow(2)

$800M - $850M

(1)

This release contains certain non-GAAP

metrics. For reconciliations to the relevant GAAP measures and an

explanation of the non-GAAP measures and reasons for their use,

please refer to sections of this release entitled “Non-GAAP

Financial Measures” and “Reconciliation of GAAP and non-GAAP

Financial Measures.”

(2)

This is a forward-looking non-GAAP

financial measure that cannot be reconciled for those reasons set

forth under “Non-GAAP Financial Measures” of this release.

First Quarter 2024 Earnings Conference

Call

Vertiv’s management team will discuss the Company’s results

during a conference call on Wednesday, April 24, starting at 11

a.m. Eastern Time. The call will contain forward-looking statements

and other material information regarding Vertiv’s financial and

operating results. A webcast of the live conference call will be

available for interested parties to listen to by going to the

Investor Relations section of the Company’s website at

investors.vertiv.com. A slide presentation will be available before

the call and will be posted to the website, also at

investors.vertiv.com. A replay of the conference call will also be

available for 30 days following the webcast.

About Vertiv Holdings Co

Vertiv (NYSE: VRT) brings together hardware, software, analytics

and ongoing services to enable its customers’ vital applications to

run continuously, perform optimally and grow with their business

needs. Vertiv solves the most important challenges facing today’s

data centers, communication networks and commercial and industrial

facilities with a portfolio of power, cooling and IT infrastructure

solutions and services that extends from the cloud to the edge of

the network. Headquartered in Westerville, Ohio, USA, Vertiv does

business in more than 130 countries. For more information, and for

the latest news and content from Vertiv, visit vertiv.com.

Category: Financial News

Non-GAAP Financial

Measures

Financial information included in this release has been prepared

in accordance with Generally Accepted Accounting Principles

(“GAAP”). Vertiv has included certain non-GAAP financial measures

in this news release, as indicated above, that may not be directly

comparable to other similarly titled measures used by other

companies and therefore may not be comparable among companies.

These non-GAAP financial measures include organic net sales growth

(including on a segment basis), adjusted operating profit, adjusted

operating margin, adjusted diluted EPS and adjusted free cash flow,

which management believes provides investors with useful

supplemental information to evaluate the Company’s ongoing

operations and to compare with past and future periods. Management

also uses certain non-GAAP measures internally for forecasting,

budgeting and measuring its operating performance. These measures

should be viewed as supplementing, and not as an alternative or

substitute for, the Company's financial results prepared in

accordance with GAAP. Pursuant to the requirements of Regulation G,

Vertiv has provided reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measures.

Information reconciling certain forward-looking GAAP measures to

non-GAAP measures related to second quarter and full-year 2024

guidance, including organic net sales growth, adjusted free cash

flow and adjusted operating margin, is not available without

unreasonable effort due to high variability, complexity and

uncertainty with respect to forecasting and quantifying certain

amounts that are necessary for such reconciliations. For those

reasons, we are unable to compute the probable significance of the

unavailable information, which could have a potentially

unpredictable, and potentially significant, impact on our future

GAAP financial results.

See “Reconciliation of GAAP and Non-GAAP Financial Measures” in

this release for Vertiv’s reconciliations of non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

Cautionary Note Concerning

Forward-Looking Statements

This news release, and other statements that Vertiv may make in

connection therewith, may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

with respect to Vertiv’s future financial or business performance,

strategies or expectations, and as such are not historical facts.

This includes, without limitation, statements regarding Vertiv’s

financial position, capital structure, indebtedness, business

strategy and plans, and objectives of Vertiv management for future

operations, as well as statements regarding growth, anticipated

demand for our products and services, and our business prospects

during 2024, as well as expected impacts from our pricing actions,

and our guidance for second quarter and full year 2024. These

statements constitute projections, forecasts and forward-looking

statements, and are not guarantees of performance. Vertiv cautions

that forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time. Such

statements can be identified by the fact that they do not relate

strictly to historical or current facts. When used in this news

release, words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “strive,”

“would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking.

The forward-looking statements contained in this release are

based on current expectations and beliefs concerning future

developments and their potential effects on Vertiv. There can be no

assurance that future developments affecting Vertiv will be those

that Vertiv has anticipated. Vertiv undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities laws. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond Vertiv’s control) or other assumptions

that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking

statements. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect,

actual results may vary in material respects from those projected

in these forward-looking statements. Vertiv has previously

disclosed risk factors in its Securities and Exchange Commission

(“SEC”) reports, including those set forth in the Vertiv 2023

Annual Report on Form 10-K filed with the SEC on February 23, 2024.

These risk factors and those identified elsewhere in this release,

among others, could cause actual results to differ materially from

historical performance and include, but are not limited to: risks

relating to the continued growth of Vertiv’s customers’ markets;

disruption of Vertiv’s customers’ orders or Vertiv’s customers’

markets; less favorable contractual terms with large customers;

risks associated with governmental contracts; failure to mitigate

risks associated with long-term fixed price contracts; competition

in the infrastructure technologies industry; failure to obtain

performance and other guarantees from financial institutions;

failure to realize sales expected from Vertiv’s backlog of orders

and contracts; failure to properly manage Vertiv’s supply chain or

difficulties with third-party manufacturers; our ability to

forecast changes in prices, including due to inflation in material,

freight and/or labor costs, and timely implement measures necessary

to mitigate the impacts of any such changes; risks associated with

our significant backlog, including that the impacts of any measures

taken to mitigate inflation will not be reflected in our financial

statements immediately; failure to meet or anticipate technology

changes; risks associated with information technology disruption or

security; risks associated with the implementation and enhancement

of information systems; failure to realize the expected benefit

from any rationalization, restructuring and improvement efforts;

Vertiv’s ability to realize cost savings in connection with

Vertiv’s restructuring program; disruption of, or changes in,

Vertiv’s independent sales representatives, distributors and

original equipment manufacturers; changes to tax law; ongoing tax

audits; costs or liabilities associated with product liability; the

global scope of Vertiv’s operations; risks associated with Vertiv’s

sales and operations in emerging markets; risks associated with

future legislation and regulation of Vertiv’s customers’ markets

both in the United States and abroad; Vertiv’s ability to comply

with various laws and regulations and the costs associated with

legal compliance; adverse outcomes to any legal claims and

proceedings filed by or against Vertiv; risks associated with

current and potential litigation or claims against Vertiv; Vertiv’s

ability to protect or enforce its proprietary rights on which its

business depends; third party intellectual property infringement

claims; liabilities associated with environmental, health and

safety matters; failure to achieve environmental, social and

governance goals; failure to realize the value of goodwill and

intangible assets; exposure to fluctuations in foreign currency

exchange rates; exposure to increases in interest rates set by

central banking authorities; failure to maintain internal controls

over financial reporting; the unpredictability of Vertiv’s future

operational results, including the ability to grow and manage

growth profitably; potential net losses in future periods; Vertiv’s

level of indebtedness and the ability to incur additional

indebtedness; Vertiv’s ability to comply with the covenants and

restrictions contained in our credit agreements, including

restrictive covenants that restrict operational flexibility;

Vertiv’s ability to comply with the covenants and restrictions

contained in our credit agreements is not fully within our control;

Vertiv’s ability to access funding through capital markets; the

Vertiv Stockholder’s significant ownership and influence over

Vertiv; resales of Vertiv’s securities may cause volatility in the

market price of our securities; Vertiv’s organizational documents

contain provisions that may discourage unsolicited takeover

proposals; Vertiv’s certificate of incorporation includes a forum

selection clause, which could discourage or limit stockholders’

ability to make a claim against it; the ability of Vertiv’s

subsidiaries to pay dividends; the ability of Vertiv to grow and

manage growth profitably, maintain relationships with customers and

suppliers and retain its management and key employees; Vertiv's

ability to manage the succession of its key employees; and factors

relating to the business, operations and financial performance of

Vertiv and its subsidiaries, including: global economic weakness

and uncertainty; Vertiv’s ability to attract, train and retain key

members of its leadership team and other qualified personnel; the

adequacy of Vertiv’s insurance coverage; a failure to benefit from

future corporate transactions; risks associated with Vertiv’s

limited history of operating as an independent company; and other

risks and uncertainties indicated in Vertiv’s SEC reports or

documents filed or to be filed with the SEC by Vertiv.

Forward-looking statements included in this news release speak

only as of the date of this news release or any earlier date

specified for such statements. All subsequent written or oral

forward-looking statements attributable to Vertiv or persons acting

on Vertiv’s behalf may be qualified in their entirety by this

Cautionary Note Concerning Forward-Looking Statements.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

Vertiv Holdings Co

(Dollars in millions except

for per share data)

Three months ended

March 31, 2024

Three months ended

March 31, 2023

Net sales

Net sales - products

$

1,270.3

$

1,186.5

Net sales - services

368.8

334.6

Net sales

1,639.1

1,521.1

Costs and expenses

Cost of sales - products

846.3

819.5

Cost of sales - services

226.4

206.1

Cost of sales

1,072.7

1,025.6

Operating expenses

Selling, general and administrative

expenses

314.0

308.7

Amortization of intangibles

46.0

45.2

Restructuring costs

0.3

13.1

Foreign currency (gain) loss, net

3.2

3.1

Other operating expense (income)

0.3

(4.9

)

Operating profit (loss)

202.6

130.3

Interest expense, net

39.0

46.8

Change in fair value of warrant

liabilities

176.6

(4.2

)

Income (loss) before income

taxes

(13.0

)

87.7

Income tax expense (benefit)

(7.1

)

37.4

Net income (loss)

$

(5.9

)

$

50.3

Earnings (loss) per share:

Basic

$

(0.02

)

$

0.13

Diluted

$

(0.02

)

$

0.12

Weighted-average shares outstanding:

Basic

379,135,184

378,129,786

Diluted

379,135,184

381,683,511

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

Vertiv Holdings Co

(Dollars in millions)

March 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

275.8

$

780.4

Accounts receivable, less allowances of

$31.6 and $29.1, respectively

2,097.1

2,118.1

Inventories

987.1

884.3

Other current assets

271.8

218.7

Total current assets

3,631.8

4,001.5

Property, plant and equipment,

net

565.3

560.1

Other assets:

Goodwill

1,322.8

1,330.3

Other intangible assets, net

1,615.9

1,672.9

Deferred income taxes

159.3

159.8

Right-of-use assets, net

185.1

173.5

Other

111.2

100.4

Total other assets

3,394.3

3,436.9

Total assets

$

7,591.4

$

7,998.5

LIABILITIES AND EQUITY

Current liabilities:

Current portion of long-term debt

$

21.2

$

21.8

Current portion of warrant liabilities

371.6

—

Accounts payable

983.7

986.4

Deferred revenue

735.0

638.9

Accrued expenses and other liabilities

541.8

611.8

Income taxes

56.6

46.5

Total current liabilities

2,709.9

2,305.4

Long-term debt, net

2,916.1

2,919.1

Deferred income taxes

154.6

159.5

Warrant liabilities

—

195.0

Long-term lease liabilities

153.3

142.6

Other long-term liabilities

264.1

262.0

Total liabilities

6,198.0

5,983.6

Equity

Preferred stock, $0.0001 par value,

5,000,000 shares authorized, none issued and outstanding

—

—

Common stock, $0.0001 par value,

700,000,000 shares authorized, 373,969,346 and 381,788,876 shares

issued and outstanding at March 31, 2024 and December 31, 2023,

respectively

—

—

Treasury stock, at cost: 9,076,444 shares

and none at March 31, 2024 and December 31, 2023, respectively

(605.9

)

—

Additional paid-in capital

2,745.2

2,711.3

Accumulated deficit

(707.1

)

(691.9

)

Accumulated other comprehensive (loss)

income

(38.8

)

(4.5

)

Total equity

1,393.4

2,014.9

Total liabilities and equity

$

7,591.4

$

7,998.5

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Vertiv Holdings Co

(Dollars in millions)

Three months ended

March 31, 2024

Three months ended

March 31, 2023

Cash flows from operating

activities:

Net income (loss)

$

(5.9

)

$

50.3

Adjustments to reconcile net income (loss)

to net cash provided by (used for) operating activities:

Depreciation

19.8

17.7

Amortization

48.9

48.9

Deferred income taxes

(7.6

)

3.4

Amortization of debt discount and issuance

costs

2.1

2.7

Change in fair value of warrant

liabilities

176.6

(4.2

)

Changes in operating working capital

(99.7

)

(86.9

)

Stock based compensation

9.2

5.5

Other

(5.9

)

4.6

Net cash provided by (used for)

operating activities

137.5

42.0

Cash flows from investing

activities:

Capital expenditures

(35.8

)

(27.8

)

Investments in capitalized software

(0.7

)

(2.0

)

Proceeds from disposition of property,

plant and equipment

—

12.4

Net cash provided by (used for)

investing activities

(36.5

)

(17.4

)

Cash flows from financing

activities:

Borrowings from ABL revolving credit

facility and short-term borrowings

190.0

100.2

Repayments of ABL revolving credit

facility and short-term borrowings

(190.0

)

(110.2

)

Repayment of long-term debt

(5.3

)

(10.9

)

Dividend payment

(9.3

)

—

Repurchase of common shares

(599.9

)

—

Exercise of employee stock options

14.4

2.2

Employee taxes paid from shares

withheld

(3.0

)

(0.1

)

Net cash provided by (used for)

financing activities

(603.1

)

(18.8

)

Effect of exchange rate changes on cash

and cash equivalents

(6.0

)

1.8

Increase (decrease) in cash, cash

equivalents and restricted cash

(508.1

)

7.6

Beginning cash, cash equivalents and

restricted cash

788.6

273.2

Ending cash, cash equivalents and

restricted cash

$

280.5

$

280.8

Changes in operating working

capital

Accounts receivable

$

9.9

$

(90.1

)

Inventories

(106.5

)

(79.5

)

Other current assets

(31.7

)

(1.2

)

Accounts payable

9.8

(62.3

)

Deferred revenue

100.0

144.2

Accrued expenses and other liabilities

(68.5

)

(16.5

)

Income taxes

(12.7

)

18.5

Total changes in operating working

capital

$

(99.7

)

$

(86.9

)

Reconciliation of GAAP and non-GAAP Financial

Measures

To supplement this news release, we have included certain

non-GAAP financial measures in the format of performance metrics.

Management believes these non-GAAP financial measures provide

investors with additional meaningful financial information that

should be considered when assessing our underlying business

performance and trends. Further, management believes these non-GAAP

financial measures also enhance investors' ability to compare

period-to-period financial results. Non-GAAP financial measures

should be viewed in addition to, and not as an alternative for, the

company's reported results prepared in accordance with GAAP. Our

non-GAAP financial measures do not represent a comprehensive basis

of accounting. Therefore, our non-GAAP financial measures may not

be comparable to similarly titled measures reported by other

companies. Reconciliations of each of these non-GAAP financial

measures to GAAP information are also included. Management uses

these non-GAAP financial measures in making financial, operating,

compensation and planning decisions and in evaluating the company's

performance. Disclosing these non-GAAP financial measures allows

investors and management to view our operating results excluding

the impact of items that are not reflective of the underlying

operating performance.

Vertiv’s non-GAAP financial measures include:

- Adjusted operating profit (loss), which represents operating

profit (loss), adjusted to exclude amortization of

intangibles;

- Adjusted operating margin, which represents adjusted operating

profit (loss) divided by net sales;

- Organic net sales growth, which represents the change in net

sales adjusted to exclude the impacts of foreign currency exchange

rate;

- Adjusted free cash flow, which represents net cash provided by

(used for) operating activities adjusted to exclude capital

expenditures, investments in capitalized software and include

proceeds from disposition of PP&E; and

- Adjusted diluted EPS, which represents diluted earnings per

share adjusted to exclude amortization of intangibles and change in

warranty liability.

Regional Segment Results

Three months ended March 31,

2024

2023

Δ

Δ %

Organic Δ %(2)

Net sales

(1)

Americas

$

925.0

$

862.3

$

62.7

7.3

%

7.1

%

APAC

332.3

313.0

19.3

6.2

%

9.1

%

EMEA

381.8

345.8

36.0

10.4

%

9.8

%

Total

$

1,639.1

$

1,521.1

$

118.0

7.8

%

8.1

%

Adjusted

operating profit (loss)(3)

Americas

$

187.8

$

145.8

$

42.0

28.8

%

APAC

30.4

16.6

13.8

83.1

%

EMEA

70.3

46.1

24.2

52.5

%

Corporate (4)

(39.9

)

(33.0

)

(6.9

)

20.9

%

Total

$

248.6

$

175.5

$

73.1

41.7

%

Adjusted

operating margins (5)

Americas

20.3

%

16.9

%

3.4

%

APAC

9.1

%

5.3

%

3.8

%

EMEA

18.4

%

13.3

%

5.1

%

Vertiv

15.2

%

11.5

%

3.7

%

(1)

Segment net sales are presented excluding

intercompany sales.

(2)

Organic basis is adjusted to exclude

foreign currency exchange rate impact.

(3)

Adjusted operating profit (loss) is only

adjusted at the Corporate segment. There are no adjustments at the

reportable segment level between operating profit (loss) and

adjusted operating profit (loss).

(4)

Corporate costs consist of headquarters

management costs, stock-based compensation, other incentive

compensation, change in fair value of warrant liabilities, asset

impairments and costs that support centralized global functions

including Finance, Treasury, Risk Management, Strategy &

Marketing, and Legal.

(5)

Adjusted operating margins calculated as

adjusted operating profit (loss) divided by net sales.

Sales by product and service

offering

Three months ended March 31,

2024

2023

Δ

Δ %

Americas:

Products(1)

$

716.1

$

673.9

$

42.2

6.3

%

Services & spares

208.9

188.4

20.5

10.9

%

$

925.0

$

862.3

$

62.7

7.3

%

Asia Pacific:

Products(1)

$

224.0

$

208.9

$

15.1

7.2

%

Services & spares

108.3

104.1

4.2

4.0

%

$

332.3

$

313.0

$

19.3

6.2

%

Europe, Middle East &

Africa:

Products(1)

$

297.3

$

267.7

$

29.6

11.1

%

Services & spares

84.5

78.1

6.4

8.2

%

$

381.8

$

345.8

$

36.0

10.4

%

Total:

Products(1)

$

1,237.4

$

1,150.5

$

86.9

7.6

%

Services & spares

401.7

370.6

31.1

8.4

%

$

1,639.1

$

1,521.1

$

118.0

7.8

%

(1)

Refer to Exhibit 99.2 to Vertiv’s

current report on Form 8-K filed on February 21, 2024 for a fiscal

year 2023 summary of changes made to conform with the current year

presentation of sales by product and service offering.

Organic growth by product and service

offering

Three months ended March 31,

2024

Net Sales Δ

FX Δ

Organic growth

Organic Δ %(1)

Americas:

Products(2)

$

42.2

$

0.4

$

42.6

6.3

%

Services & spares

20.5

(1.9

)

18.6

9.9

%

$

62.7

$

(1.5

)

$

61.2

7.1

%

Asia Pacific:

Products(2)

$

15.1

$

6.1

$

21.2

10.1

%

Services & spares

4.2

3.2

7.4

7.1

%

$

19.3

$

9.3

$

28.6

9.1

%

Europe, Middle East &

Africa:

Products(2)

$

29.6

$

(4.7

)

$

24.9

9.3

%

Services & spares

6.4

2.5

8.9

11.4

%

$

36.0

$

(2.2

)

$

33.8

9.8

%

Total:

Products(2)

$

86.9

$

1.8

$

88.7

7.7

%

Services & spares

31.1

3.8

34.9

9.4

%

$

118.0

$

5.6

$

123.6

8.1

%

(1)

Organic growth percentage change is

calculated as organic growth divided by net sales for the three

months ended March 31, 2023.

(2)

Refer to Exhibit 99.2 to Vertiv’s current report on Form 8-K filed

on February 21, 2024 for a fiscal year 2023 summary of changes made

to conform with the current year presentation of sales by product

and service offering.

Segment operating profit (loss)

Operating profit

(loss)

Three months ended March 31,

2024

Three months ended March 31,

2023

Americas

$

187.8

$

145.8

Asia Pacific

30.4

16.6

Europe, Middle East & Africa

70.3

46.1

Total reportable segments

288.5

208.5

Foreign currency gain (loss)

(3.2

)

(3.1

)

Corporate and other

(36.7

)

(29.9

)

Total corporate, other and

eliminations

(39.9

)

(33.0

)

Amortization of intangibles

(46.0

)

(45.2

)

Operating profit (loss)

$

202.6

$

130.3

Reconciliation of net cash provided by

(used for) operating activities to adjusted free cash flow

Three months ended March 31,

2024

Three months ended March 31,

2023

Net cash provided by (used for) operating

activities

$

137.5

$

42.0

Capital expenditures

(35.8

)

(27.8

)

Investments in capitalized software

(0.7

)

(2.0

)

Proceeds from disposition of PP&E

—

12.4

Adjusted free cash flow

$

101.0

$

24.6

Reconciliation from operating profit

(loss) to adjusted operating profit (loss)

Three months ended March 31,

2024

Three months ended March 31,

2023

Operating profit (loss)

$

202.6

$

130.3

Amortization of intangibles

46.0

45.2

Adjusted operating profit

(loss)

$

248.6

$

175.5

Reconciliation from operating margin to

adjusted operating margin

Three months ended March 31,

2024

Three months ended March 31,

2023

Δ

Vertiv net sales

$

1,639.1

$

1,521.1

$

118.0

Vertiv operating profit (loss)

202.6

130.3

72.3

Vertiv operating margin

12.4

%

8.6

%

3.8

%

Amortization of intangibles

$

46.0

$

45.2

$

0.8

Vertiv adjusted operating profit

(loss)

248.6

175.5

73.1

Vertiv adjusted operating

margin

15.2

%

11.5

%

3.7

%

Reconciliation of Diluted EPS to

Adjusted Diluted EPS

Three months

ended March 31, 2024

Operating profit

(loss)

Interest expense,

net

Change in Warrant

Liability

Income tax

expense (benefit)

Net income

(loss)

Diluted EPS (1)

GAAP

$

202.6

$

39.0

$

176.6

$

(7.1

)

$

(5.9

)

$

(0.02

)

Amortization of intangibles

46.0

—

—

—

46.0

0.12

Change in warrant liability

—

—

(176.6

)

47.9

128.7

0.33

Non-GAAP Adjusted

$

248.6

$

39.0

$

—

$

40.8

$

168.8

$

0.43

Pro-forma diluted shares (in millions)

389.3

(1)

Diluted EPS is based on 379.1 million

shares. Adjusted diluted EPS is based on a pro-forma diluted share

count of 389.3 million which includes 379.1 million basic shares

and 10.2 million potential dilutive stock options, restricted stock

units and performance awards converted into RSUs upon achievement

of the related performance target which would have been in diluted

EPS if the Company had net income for the three months ended March

31, 2024. We believe that this presentation is more representative

of operating results by removing the impact of warrant liability

accounting and the associated impact on diluted share count.

Three months

ended March 31, 2023

Operating profit

(loss)

Interest expense,

net

Change in Warrant

Liability

Income tax

expense (benefit)

Net income

(loss)

Diluted EPS (1)

GAAP

$

130.3

$

46.8

$

(4.2

)

$

37.4

$

50.3

$

0.12

Amortization of intangibles

45.2

—

—

—

45.2

0.12

Change in warrant liability

—

—

4.2

—

(4.2

)

—

Non-GAAP Adjusted

$

175.5

$

46.8

$

—

$

37.4

$

91.3

$

0.24

Diluted Shares (in millions)

381.7

(1)

Diluted EPS and adjusted diluted EPS based

on 381.7 million shares (includes 378.1 million basic shares, 1.9

million potentially dilutive warrants, and 1.7 million potential

dilutive stock options and restricted stock units). Diluted EPS and

adjusted diluted EPS includes an adjustment to exclude $4.2 million

from net income which is attributable to the warrants as they were

dilutive in the period. We believe that this presentation is more

representative of operating results by removing the impact of

warrant liability accounting and the associated impact on diluted

share count.

Vertiv Holdings Co

2024 Adjusted Guidance

Reconciliation of Diluted EPS

to Adjusted Diluted EPS (1)

Second Quarter 2024

Operating profit

(loss)

Interest expense,

net

Income tax

expense

Net income

(loss)

Diluted EPS (2)

GAAP

$

282.0

$

47.0

$

66.0

$

169.0

$

0.44

Amortization of intangibles

43.0

—

—

43.0

0.11

Non-GAAP Adjusted

$

325.0

$

47.0

$

66.0

$

212.0

$

0.55

Diluted Shares (in millions)

384.6

Full Year 2024

Operating profit

(loss)

Interest expense,

net

Change in

Warrant

Liability

Income tax

expense

Net income

(loss)

Diluted EPS (3)

GAAP

$

1,174.0

$

173.0

$

177.0

$

278.0

$

546.0

$

1.41

Amortization of intangibles

176.0

—

—

—

176.0

0.45

Change in warrant liability

—

—

(177.0

)

—

177.0

0.46

Non-GAAP Adjusted

$

1,350.0

$

173.0

$

—

$

278.0

$

899.0

$

2.32

Diluted Shares (in millions)

387.9

(1)

Information reconciling certain

forward-looking GAAP measures to non-GAAP measures related to FY

2024 guidance, including organic net sales growth, adjusted

operating margin and adjusted free cash flow, is not available

without unreasonable effort due to high variability, complexity and

uncertainty with respect to forecasting and quantifying certain

amounts that are necessary for such reconciliations. For the same

reasons, we are unable to compute the probable significance of the

unavailable information, which could have a potentially

unpredictable, and potentially significant, impact on our future

GAAP financial results.

(2)

Diluted EPS and adjusted diluted

EPS based on 384.6 million shares (includes 374.6 million basic

shares and a weighted average 10.0 million potential dilutive stock

options and restricted stock units).

(3)

Diluted EPS and adjusted diluted

EPS based on 387.9 million shares (includes 377.4 million basic

shares and a weighted average 10.5 million potential dilutive stock

options and restricted stock units).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423045499/en/

For investor inquiries, please contact: Lynne Maxeiner

Vice President, Global Treasury & Investor Relations Vertiv T

+1 614-841-6776 E: lynne.maxeiner@vertiv.com

For media inquiries, please contact: Peter Poulos

FleishmanHillard for Vertiv T +1 646-284-4991 E:

peter.poulos@fleishman.com

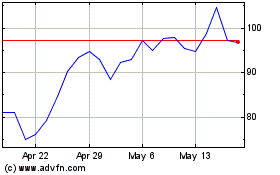

Vertiv (NYSE:VRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vertiv (NYSE:VRT)

Historical Stock Chart

From Jan 2024 to Jan 2025