Announces Revised 2023 Guidance

- Reported second-quarter 2023 Net income attributable to limited

partners of $247.1 million, generating second-quarter Adjusted

EBITDA(1) of $488.3 million.

- Reported second-quarter 2023 Cash flows provided by operating

activities of $490.8 million, generating second-quarter Free cash

flow(1) of $340.1 million.

- Announced a second-quarter Base Distribution of $0.5625 per

unit, or $2.25 on an annualized basis, which represents a

12.5-percent increase to the prior-quarter’s Base

Distribution.

- Repurchased $117.6 million of near-term senior notes at

approximately 94-percent of par during the second quarter, and

subsequent to quarter end, repurchased an additional $159.1 million

of senior notes.

- Revised 2023 Adjusted EBITDA(2) guidance to range between

$1.950 billion and $2.050 billion, a reduction of approximately

5-percent at the midpoint.

- Revised 2023 Free cash flow(2) guidance to range between $900.0

million and $1.000 billion as a result of revised Adjusted EBITDA

guidance.

Today Western Midstream Partners, LP (NYSE: WES) (“WES” or the

“Partnership”) announced second-quarter 2023 financial and

operating results. Net income (loss) attributable to limited

partners for the second quarter of 2023 totaled $247.1 million, or

$0.64 per common unit (diluted), with second-quarter 2023 Adjusted

EBITDA(1) totaling $488.3 million. Second-quarter 2023 Cash flows

provided by operating activities totaled $490.8 million, and

second-quarter 2023 Free cash flow(1) totaled $340.1 million.

RECENT HIGHLIGHTS

- Achieved record Delaware Basin natural-gas throughput of 1.59

Bcf/d for the second quarter, representing a 1-percent

sequential-quarter increase.

- Gathered record Delaware Basin crude-oil and NGLs throughput of

208 MBbls/d for the second quarter, representing a 1-percent

sequential-quarter increase.

- Announced a new 250 MMcf/d cryogenic processing plant in the

North Loving area of our West Texas complex (“North Loving Plant”)

underpinned by previously announced commercial agreements

containing significant minimum-volume commitments.

- Obtained full investment-grade ratings after receiving an

upgrade to BBB- from Fitch in May.

On August 14, 2023, WES will pay its second-quarter 2023

per-unit Base Distribution of $0.5625, representing a 12.5-percent

sequential-quarter increase to the Partnership’s first-quarter Base

Distribution. Second-quarter 2023 Free cash flow(1) after

distributions, which included the payment of our first Enhanced

Distribution, totaled $3.1 million. Second-quarter 2023 and

year-to-date capital expenditures(3) totaled $184.3 million and

$363.6 million, respectively.

Second-quarter 2023 natural-gas throughput(4) averaged 4.3

Bcf/d, representing a 4-percent sequential-quarter increase.

Second-quarter 2023 throughput for crude-oil and NGLs assets(4)

averaged 626 MBbls/d, representing a 2-percent sequential-quarter

increase. Second-quarter 2023 throughput for produced-water

assets(4) averaged 943 MBbls/d, representing a 1-percent

sequential-quarter decrease.

“Once again, we experienced record natural-gas and crude-oil and

NGLs throughput in the Delaware Basin,” said Michael Ure, President

and Chief Executive Officer. “Additionally, second-quarter

throughput from our Utah and Wyoming assets increased as inclement

weather experienced during the first quarter subsided, driving an

overall increase in our natural-gas and crude-oil volumes.”

Mr. Ure continued, “Despite these throughput increases,

second-quarter Adjusted EBITDA declined on a sequential-quarter

basis primarily due to an expected seasonal increase in operation

and maintenance expense and normalized property and other

taxes.”

“We still anticipate year-over-year throughput growth across all

three products. However, producer operational challenges appeared

during the second quarter when new wells came online and

outperformed expectations leading to challenges across the

production chain. Based on discussions with our producers and after

analyzing their revised forecasts, we expect these challenges to be

temporary in nature. However, we do expect these challenges to

continue into the second half of 2023, causing year-over-year

growth to be at a slower pace than our initial expectations.”

“These throughput changes, specifically in the Delaware Basin,

have caused us to revise our 2023 Adjusted EBITDA guidance range to

$1.950 billion to $2.050 billion, a reduction of approximately

5-percent at the midpoint. With that said, we continue to believe

that our producers will meet their volume expectations over the

long-run, and the outperformance from the most recent wells further

support our belief that our assets service the best rock in the

Delaware Basin.”

“While we are disappointed in the new outlook for the second

half of 2023, we are confident in the protections that our stable,

long-term contract structures provide. In situations such as these,

when current year cash flow expectations decline due to volumetric

changes, the protections included in our cost-of-service contracts

should benefit WES in future periods, allowing us to still earn our

stated rate of return over the life of the contract.”

“Subsequent to quarter end, we announced a 12.5-percent increase

in the quarterly Base Distribution to $0.5625 per unit. Our ability

to significantly reduce leverage, coupled with numerous commercial

successes, supported this distribution increase. Additionally,

while our growth may be more weighted towards 2024 than originally

anticipated, our confidence in our underlying business and contract

structures reaffirms our decision regarding the Base Distribution

increase and our view that the long-term trajectory of WES remains

strong. Furthermore, our investment-grade balance sheet and strong

financial position continue to provide optionality and allow us to

continue generating long-term value for our stakeholders.”

“WES remains committed to executing on its balanced approach of

returning capital to our stakeholders. During the second quarter,

we utilized a portion of the net proceeds from our $750 million

senior notes issuance in mid-March to repurchase $117.6 million of

near-term maturity senior notes at approximately 94-percent of par.

These activities have continued into the third quarter, and we have

now repurchased a total of $276.7 million of senior notes to date

since the beginning of the second quarter.”

“Moving to operations, in May, we announced the sanctioning of

the 250 MMcf/d North Loving Plant to support our producers’

long-term throughput growth needs in the Delaware Basin. This new

plant is supported by long-term commercial agreements with

significant minimum-volume commitments, and is expected to be

online by the end of 2024, or early 2025. Together with Mentone

Train III, we are growing our Delaware Basin processing capacity by

approximately 36-percent, securing our position as one of the

leading natural-gas processors in the Delaware Basin,” concluded

Mr. Ure.

REVISED 2023 GUIDANCE

Based on the most current production forecast information from

our producer customers, WES is providing revised 2023 guidance as

follows:

- Adjusted EBITDA(2) between $1.950 billion and $2.050

billion.

- Total capital expenditures(3) between $700.0 million to $800.0

million, which is unchanged since our May 2023 North Loving Plant

announcement.

- Free cash flow(2) between $900.0 million and $1.000 billion, in

line with the decrease in Adjusted EBITDA guidance.

- Full-year 2023 Base Distribution of at least $2.1875 per

unit(5), which is unchanged since our July 2023 Base Distribution

increase announcement, excludes the impact of a potential Enhanced

Distribution.

CONFERENCE CALL TOMORROW AT 1:00 P.M. CT

WES will host a conference call on Wednesday, August 9, 2023, at

1:00 p.m. Central Time (2:00 p.m. Eastern Time) to discuss its

second-quarter 2023 results. To participate, individuals should

dial 888-770-7129 (Domestic) or 929-203-2109 (International) ten to

fifteen minutes before the scheduled conference call time and enter

the participant access code 2187921. To access the live audio

webcast of the conference call, please visit the investor relations

section of the Partnership’s website at www.westernmidstream.com. A

replay of the conference call also will be available on the website

following the call.

For additional details on WES’s financial and operational

performance, please refer to the earnings slides and updated

investor presentation available at www.westernmidstream.com.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a Delaware master

limited partnership formed to acquire, own, develop, and operate

midstream assets. With midstream assets located in Texas, New

Mexico, Colorado, Utah, Wyoming, and Pennsylvania, WES is engaged

in the business of gathering, compressing, treating, processing,

and transporting natural gas; gathering, stabilizing, and

transporting condensate, natural-gas liquids, and crude oil; and

gathering and disposing of produced water for its customers. In its

capacity as a natural-gas processor, WES also buys and sells

natural gas, natural-gas liquids, and condensate on behalf of

itself and as an agent for its customers under certain

contracts.

For more information about Western Midstream Partners, LP,

please visit www.westernmidstream.com.

This news release contains forward-looking statements. WES’s

management believes that its expectations are based on reasonable

assumptions. No assurance, however, can be given that such

expectations will prove correct. A number of factors could cause

actual results to differ materially from the projections,

anticipated results, or other expectations expressed in this news

release. These factors include our ability to meet financial

guidance or distribution expectations; our ability to safely and

efficiently operate WES’s assets; the supply of, demand for, and

price of oil, natural gas, NGLs, and related products or services;

our ability to meet projected in-service dates for capital-growth

projects; construction costs or capital expenditures exceeding

estimated or budgeted costs or expenditures; and the other factors

described in the “Risk Factors” section of WES’s most-recent Form

10-K filed with the Securities and Exchange Commission and other

public filings and press releases. WES undertakes no obligation to

publicly update or revise any forward-looking statements.

_______________________________________

(1)

Please see the definitions of the

Partnership’s non-GAAP measures at the end of this release and

reconciliation of GAAP to non-GAAP measures.

(2)

A reconciliation of the Adjusted EBITDA

range to net cash provided by operating activities and net income

(loss), and a reconciliation of the Free cash flow range to net

cash provided by operating activities, is not provided because the

items necessary to estimate such amounts are not reasonably

estimable at this time. These items, net of tax, may include, but

are not limited to, impairments of assets and other charges,

divestiture costs, acquisition costs, or changes in accounting

principles. All of these items could significantly impact such

financial measures. At this time, WES is not able to estimate the

aggregate impact, if any, of these items on future period reported

earnings. Accordingly, WES is not able to provide a corresponding

GAAP equivalent for the Adjusted EBITDA or Free cash flow

ranges.

(3)

Accrual-based, includes equity

investments, excludes capitalized interest, and excludes capital

expenditures associated with the 25% third-party interest in

Chipeta.

(4)

Represents total throughput attributable

to WES, which excludes (i) the 2.0% limited partner interest in WES

Operating owned by an Occidental subsidiary and (ii) for

natural-gas throughput, the 25% third-party interest in Chipeta,

which collectively represent WES’s noncontrolling interests.

(5)

Subject to Board review and approval on a

quarterly basis based on the needs of the business.

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

thousands except per-unit amounts

2023

2022

2023

2022

Revenues and other

Service revenues – fee based

$

661,506

$

655,952

$

1,309,373

$

1,287,550

Service revenues – product based

46,956

70,498

93,766

111,365

Product sales

29,659

149,736

68,684

235,325

Other

152

233

432

476

Total revenues and other

738,273

876,419

1,472,255

1,634,716

Equity income, net – related

parties

42,324

48,464

81,345

98,071

Operating expenses

Cost of product

44,746

148,556

96,205

221,404

Operation and maintenance

183,431

168,153

357,670

297,129

General and administrative

53,405

47,848

104,522

96,450

Property and other taxes

18,547

22,662

25,378

41,104

Depreciation and amortization

143,492

139,036

288,118

273,618

Long-lived asset and other impairments

234

90

52,635

90

Total operating expenses

443,855

526,345

924,528

929,795

Gain (loss) on divestiture and other,

net

(70

)

(1,150

)

(2,188

)

(780

)

Operating income (loss)

336,672

397,388

626,884

802,212

Interest expense

(86,182

)

(80,772

)

(167,852

)

(166,227

)

Gain (loss) on early extinguishment of

debt

6,813

91

6,813

91

Other income (expense), net

2,872

(45

)

4,087

61

Income (loss) before income

taxes

260,175

316,662

469,932

636,137

Income tax expense (benefit)

659

1,491

2,075

3,296

Net income (loss)

259,516

315,171

467,857

632,841

Net income (loss) attributable to

noncontrolling interests

6,595

8,854

11,291

17,807

Net income (loss) attributable to

Western Midstream Partners, LP

$

252,921

$

306,317

$

456,566

$

615,034

Limited partners’ interest in net

income (loss):

Net income (loss) attributable to Western

Midstream Partners, LP

$

252,921

$

306,317

$

456,566

$

615,034

General partner interest in net (income)

loss

(5,821

)

(6,767

)

(10,507

)

(13,550

)

Limited partners’ interest in net income

(loss)

$

247,100

$

299,550

$

446,059

$

601,484

Net income (loss) per common unit –

basic

$

0.64

$

0.74

$

1.16

$

1.49

Net income (loss) per common unit –

diluted

$

0.64

$

0.74

$

1.16

$

1.49

Weighted-average common units

outstanding – basic

384,614

403,027

384,542

403,140

Weighted-average common units

outstanding – diluted

385,510

404,162

385,665

404,280

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

thousands except number of units

June 30, 2023

December 31,

2022

Total current assets

$

797,203

$

900,425

Net property, plant, and equipment

8,600,970

8,541,600

Other assets

1,820,777

1,829,603

Total assets

$

11,218,950

$

11,271,628

Total current liabilities

$

621,544

$

903,857

Long-term debt

6,824,214

6,569,582

Asset retirement obligations

301,975

290,021

Other liabilities

449,054

400,053

Total liabilities

8,196,787

8,163,513

Equity and partners’ capital

Common units (384,613,934 and 384,070,984

units issued and outstanding at June 30, 2023, and December 31,

2022, respectively)

2,888,745

2,969,604

General partner units (9,060,641 units

issued and outstanding at June 30, 2023, and December 31, 2022)

322

2,105

Noncontrolling interests

133,096

136,406

Total liabilities, equity, and

partners’ capital

$

11,218,950

$

11,271,628

Western Midstream Partners,

LP

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Six Months Ended June

30,

thousands

2023

2022

Cash flows from operating

activities

Net income (loss)

$

467,857

$

632,841

Adjustments to reconcile net income (loss)

to net cash provided by operating activities and changes in assets

and liabilities:

Depreciation and amortization

288,118

273,618

Long-lived asset and other impairments

52,635

90

(Gain) loss on divestiture and other,

net

2,188

780

(Gain) loss on early extinguishment of

debt

(6,813

)

(91

)

Change in other items, net

(10,738

)

(163,799

)

Net cash provided by operating

activities

$

793,247

$

743,439

Cash flows from investing

activities

Capital expenditures

$

(334,570

)

$

(191,357

)

Contributions to equity investments -

related parties

(132

)

(5,040

)

Distributions from equity investments in

excess of cumulative earnings – related parties

23,179

25,407

Proceeds from the sale of assets to third

parties

—

1,096

(Increase) decrease in materials and

supplies inventory and other

(19,145

)

(1,053

)

Net cash used in investing activities

$

(330,668

)

$

(170,947

)

Cash flows from financing

activities

Borrowings, net of debt issuance costs

$

956,225

$

634,010

Repayments of debt

(918,332

)

(883,548

)

Increase (decrease) in outstanding

checks

(2,951

)

13,038

Distributions to Partnership

unitholders

(533,556

)

(340,946

)

Distributions to Chipeta noncontrolling

interest owner

(3,470

)

(3,182

)

Distributions to noncontrolling interest

owner of WES Operating

(11,131

)

(8,812

)

Net contributions from (distributions to)

related parties

—

784

Unit repurchases

(7,102

)

(79,217

)

Other

(14,965

)

(9,184

)

Net cash provided by (used in) financing

activities

$

(535,282

)

$

(677,057

)

Net increase (decrease) in cash and

cash equivalents

$

(72,703

)

$

(104,565

)

Cash and cash equivalents at beginning

of period

286,656

201,999

Cash and cash equivalents at end of

period

$

213,953

$

97,434

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

WES defines Adjusted gross margin attributable to Western

Midstream Partners, LP (“Adjusted gross margin”) as total revenues

and other (less reimbursements for electricity-related expenses

recorded as revenue), less cost of product, plus distributions from

equity investments, and excluding the noncontrolling interest

owners’ proportionate share of revenues and cost of product.

WES defines Adjusted EBITDA as net income (loss), plus (i)

distributions from equity investments, (ii) non-cash equity-based

compensation expense, (iii) interest expense, (iv) income tax

expense, (v) depreciation and amortization, (vi) impairments, and

(vii) other expense (including lower of cost or market inventory

adjustments recorded in cost of product), less (i) gain (loss) on

divestiture and other, net, (ii) gain (loss) on early

extinguishment of debt, (iii) income from equity investments, (iv)

interest income, (v) income tax benefit, (vi) other income, and

(vii) the noncontrolling interest owners’ proportionate share of

revenues and expenses.

WES defines Free cash flow as net cash provided by operating

activities less total capital expenditures and contributions to

equity investments, plus distributions from equity investments in

excess of cumulative earnings. Management considers Free cash flow

an appropriate metric for assessing capital discipline, cost

efficiency, and balance-sheet strength. Although Free cash flow is

the metric used to assess WES’s ability to make distributions to

unitholders, this measure should not be viewed as indicative of the

actual amount of cash that is available for distributions or

planned for distributions for a given period. Instead, Free cash

flow should be considered indicative of the amount of cash that is

available for distributions, debt repayments, and other general

partnership purposes.

Below are reconciliations of (i) gross margin (GAAP) to Adjusted

gross margin (non-GAAP), (ii) net income (loss) (GAAP) and net cash

provided by operating activities (GAAP) to Adjusted EBITDA

(non-GAAP), and (iii) net cash provided by operating activities

(GAAP) to Free cash flow (non-GAAP), as required under Regulation G

of the Securities Exchange Act of 1934. Management believes that

Adjusted gross margin, Adjusted EBITDA, and Free cash flow are

widely accepted financial indicators of WES’s financial performance

compared to other publicly traded partnerships and are useful in

assessing WES’s ability to incur and service debt, fund capital

expenditures, and make distributions. Adjusted gross margin,

Adjusted EBITDA, and Free cash flow as defined by WES, may not be

comparable to similarly titled measures used by other companies.

Therefore, WES’s Adjusted gross margin, Adjusted EBITDA, and Free

cash flow should be considered in conjunction with net income

(loss) attributable to Western Midstream Partners, LP and other

applicable performance measures, such as gross margin or cash flows

provided by operating activities.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted Gross Margin

Three Months Ended

thousands

June 30, 2023

March 31, 2023

Reconciliation of Gross margin to

Adjusted gross margin

Total revenues and other

$

738,273

$

733,982

Less:

Cost of product

44,746

51,459

Depreciation and amortization

143,492

144,626

Gross margin

550,035

537,897

Add:

Distributions from equity investments

54,075

51,975

Depreciation and amortization

143,492

144,626

Less:

Reimbursed electricity-related charges

recorded as revenues

23,286

23,569

Adjusted gross margin attributable to

noncontrolling interests (1)

16,914

15,774

Adjusted gross margin

$

707,402

$

695,155

Gross margin

Gross margin for natural-gas assets

(2)

$

409,634

$

393,673

Gross margin for crude-oil and NGLs

assets (2)

88,024

89,281

Gross margin for produced-water

assets (2)

59,130

59,549

Adjusted gross margin

Adjusted gross margin for natural-gas

assets

$

489,476

$

480,009

Adjusted gross margin for crude-oil and

NGLs assets

147,036

145,577

Adjusted gross margin for produced-water

assets

70,890

69,569

(1)

For all periods presented, includes (i)

the 25% third-party interest in Chipeta and (ii) the 2.0% limited

partner interest in WES Operating owned by an Occidental

subsidiary, which collectively represent WES’s noncontrolling

interests.

(2)

Excludes corporate-level depreciation and

amortization.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted EBITDA

Three Months Ended

thousands

June 30, 2023

March 31, 2023

Reconciliation of Net income (loss) to

Adjusted EBITDA

Net income (loss)

$

259,516

$

208,341

Add:

Distributions from equity investments

54,075

51,975

Non-cash equity-based compensation

expense

7,665

7,199

Interest expense

86,182

81,670

Income tax expense

659

1,416

Depreciation and amortization

143,492

144,626

Impairments

234

52,401

Other expense

199

200

Less:

Gain (loss) on divestiture and other,

net

(70

)

(2,118

)

Gain (loss) on early extinguishment of

debt

6,813

—

Equity income, net – related parties

42,324

39,021

Other income

2,872

1,215

Adjusted EBITDA attributable to

noncontrolling interests (1)

11,737

11,015

Adjusted EBITDA

$

488,346

$

498,695

Reconciliation of Net cash provided by

operating activities to Adjusted EBITDA

Net cash provided by operating

activities

$

490,823

$

302,424

Interest (income) expense, net

86,182

81,670

Accretion and amortization of long-term

obligations, net

(2,403

)

(1,692

)

Current income tax expense (benefit)

728

492

Other (income) expense, net

(2,872

)

(1,215

)

Distributions from equity investments in

excess of cumulative earnings – related parties

10,813

12,366

Changes in assets and liabilities:

Accounts receivable, net

(4,078

)

4,037

Accounts and imbalance payables and

accrued liabilities, net

(36,885

)

136,460

Other items, net

(42,225

)

(24,832

)

Adjusted EBITDA attributable to

noncontrolling interests (1)

(11,737

)

(11,015

)

Adjusted EBITDA

$

488,346

$

498,695

Cash flow information

Net cash provided by operating

activities

$

490,823

$

302,424

Net cash used in investing activities

(151,490

)

(179,178

)

Net cash provided by (used in) financing

activities

(238,025

)

(297,257

)

(1)

For all periods presented, includes (i)

the 25% third-party interest in Chipeta and (ii) the 2.0% limited

partner interest in WES Operating owned by an Occidental

subsidiary, which collectively represent WES’s noncontrolling

interests.

Western Midstream Partners,

LP

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Free Cash Flow

Three Months Ended

thousands

June 30, 2023

March 31, 2023

Reconciliation of Net cash provided by

operating activities to Free cash flow

Net cash provided by operating

activities

$

490,823

$

302,424

Less:

Capital expenditures

161,482

173,088

Contributions to equity investments –

related parties

22

110

Add:

Distributions from equity investments in

excess of cumulative earnings – related parties

10,813

12,366

Free cash flow

$

340,132

$

141,592

Cash flow information

Net cash provided by operating

activities

$

490,823

$

302,424

Net cash used in investing activities

(151,490

)

(179,178

)

Net cash provided by (used in) financing

activities

(238,025

)

(297,257

)

Western Midstream Partners,

LP

OPERATING STATISTICS

(Unaudited)

Three Months Ended

June 30, 2023

March 31, 2023

Throughput for natural-gas assets

(MMcf/d)

Gathering, treating, and

transportation

395

369

Processing

3,567

3,454

Equity investments (1)

454

423

Total throughput

4,416

4,246

Throughput attributable to noncontrolling

interests (2)

162

139

Total throughput attributable to WES for

natural-gas assets

4,254

4,107

Throughput for crude-oil and NGLs

assets (MBbls/d)

Gathering, treating, and

transportation

316

309

Equity investments (1)

323

314

Total throughput

639

623

Throughput attributable to noncontrolling

interests (2)

13

12

Total throughput attributable to WES for

crude-oil and NGLs assets

626

611

Throughput for produced-water assets

(MBbls/d)

Gathering and disposal

963

977

Throughput attributable to noncontrolling

interests (2)

20

20

Total throughput attributable to WES for

produced-water assets

943

957

Per-Mcf Gross margin for

natural-gas assets (3)

$

1.02

$

1.03

Per-Bbl Gross margin for

crude-oil and NGLs assets (3)

1.51

1.59

Per-Bbl Gross margin for

produced-water assets (3)

0.68

0.68

Per-Mcf Adjusted gross margin for

natural-gas assets (4)

$

1.26

$

1.30

Per-Bbl Adjusted gross margin for

crude-oil and NGLs assets (4)

2.58

2.65

Per-Bbl Adjusted gross margin for

produced-water assets (4)

0.83

0.81

(1)

Represents our share of average throughput

for investments accounted for under the equity method of

accounting.

(2)

For all periods presented, includes (i)

the 2.0% limited partner interest in WES Operating owned by an

Occidental subsidiary and (ii) for natural-gas assets, the 25%

third-party interest in Chipeta, which collectively represent WES’s

noncontrolling interests.

(3)

Average for period. Calculated as Gross

margin for natural-gas assets, crude-oil and NGLs

assets, or produced-water assets, divided by the respective

total throughput (MMcf or MBbls) for natural-gas assets,

crude-oil and NGLs assets, or produced-water

assets.

(4)

Average for period. Calculated as Adjusted

gross margin for natural-gas assets, crude-oil and

NGLs assets, or produced-water assets, divided by the

respective total throughput (MMcf or MBbls) attributable to WES for

natural-gas assets, crude-oil and NGLs assets, or

produced-water assets.

Western Midstream Partners,

LP

OPERATING STATISTICS

(CONTINUED)

(Unaudited)

Three Months Ended

June 30, 2023

March 31, 2023

Throughput for natural-gas assets

(MMcf/d)

Delaware Basin

1,592

1,569

DJ Basin

1,309

1,306

Equity investments

454

423

Other

1,061

948

Total throughput for natural-gas

assets

4,416

4,246

Throughput for crude-oil and NGLs

assets (MBbls/d)

Delaware Basin

208

205

DJ Basin

66

69

Equity investments

323

314

Other

42

35

Total throughput for crude-oil and NGLs

assets

639

623

Throughput for produced-water assets

(MBbls/d)

Delaware Basin

963

977

Total throughput for produced-water

assets

963

977

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808469408/en/

Daniel Jenkins Director, Investor Relations

Investors@westernmidstream.com 866.512.3523 Rhianna Disch Manager,

Investor Relations Investors@westernmidstream.com 866.512.3523

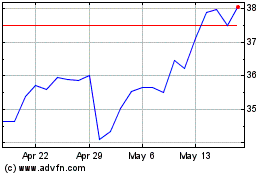

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Feb 2025 to Mar 2025

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Mar 2024 to Mar 2025