Xpeng Shares Soar After Volkswagen's $700 Million Investment

July 26 2023 - 10:16PM

Dow Jones News

By Bingyan Wang

Shares of Chinese electric-vehicle maker Xpeng rose sharply

toward an 11-month high after Volkswagen Group purchased a 4.99%

stake in the company, following its "local electrification"

strategy.

Hong Kong-listed XPeng shares advanced as much as 33% on

Thursday morning, putting it on track for the highest close since

August. ADRs closed at $19.46 in U.S. trading overnight, up

27%.

German automaker Volkswagen will take a 4.99% stake totaling

$700 million in XPeng through the purchase of stock at $15 per ADS

to build long-term strategic cooperation, Volkswagen said in a

statement. The partnership includes a technological framework

agreement that provides for the joint development of two VW-branded

EVs for the midsize segment of the Chinese market, slated to be

rolled out in early 2026.

Volkswagen plans to "swiftly tap into new customer and market

segments, thereby systematically leveraging the potential of

China's dynamically growing e-mobility market," it said.

The news fueled investor optimism over the Chinese EV market,

sending Xpeng's rival Nio and Li Auto up 11% and 3.3%,

respectively, in Hong Kong.

Despite Thursday's rally, Citi's analysts assign a high-risk

rating to XPeng's U.S.-listed shares, saying the company is

currently overvalued. They set the target price for Xpeng's

U.S.-listed shares at US$6.28.

Write to Bingyan Wang at bingyan.wang@wsj.com

(END) Dow Jones Newswires

July 26, 2023 23:01 ET (03:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

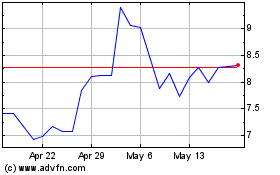

XPeng (NYSE:XPEV)

Historical Stock Chart

From Jun 2024 to Jul 2024

XPeng (NYSE:XPEV)

Historical Stock Chart

From Jul 2023 to Jul 2024