Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

February 07 2025 - 10:21AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission February 7, 2025

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Virtus Total

Return Fund Inc.

(Name of Subject Company (Issuer))

Virtus Total

Return Fund Inc.

(Name of Filing Persons (Offeror))

Common Stock, Par Value $0.001 Per Share

(Title of Class of Securities)

92835W107

(CUSIP Number of

Class of Securities)

Kathryn Santoro

Vice President, Chief Legal Officer & Secretary for Registrant

One Financial Plaza

Hartford, CT

06103-2608

866-270-7788

(Name, address and telephone number of person authorized to receive notices and

communications on behalf of filing persons)

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ |

third party tender offer subject to Rule 14d-1. |

| ☒ |

issuer tender offer subject to Rule 13e-4. |

| ☐ |

going-private transaction subject to Rule 13e-3. |

| ☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

INTRODUCTORY STATEMENT

This Amendment No. 1 amends the Tender Offer Statement on Schedule TO originally filed by Virtus Total Return Fund Inc. (the “Fund”) with the

Securities and Exchange Commission (the “Commission”) on January 7, 2025.

|

|

|

| Item 12. |

|

Exhibits. |

|

|

| (a)(1)(i) |

|

Issuer tender offer statement dated January 7, 2025* |

|

|

| (a)(1)(ii) |

|

Form of letter of transmittal to holders of certificated shares* |

|

|

| (a)(1)(iii) |

|

Form of letter of transmittal to holders of non-certificated shares* |

|

|

| (a)(1)(iv) |

|

Form of letter to brokers, dealers, commercial banks, trust companies, and other nominees* |

|

|

| (a)(1)(v) |

|

Form of letter to clients of brokers, dealers, commercial banks, trust companies, and other nominees* |

|

|

| (a)(1)(vi) |

|

Form of letter to stockholders* |

|

|

| (a)(1)(vii) |

|

Form of letter to stockholders holding certificated shares* |

|

|

| (a)(2) |

|

None |

|

|

| (a)(3) |

|

Not applicable |

|

|

| (a)(4) |

|

Not applicable |

|

|

| (a)(5)(i) |

|

Text of press release dated and issued December 2, 2024* |

|

|

| (a)(5)(ii) |

|

Text of press release dated and issued January 7, 2025* |

|

|

| (a)(5)(iii) |

|

Notice of guaranteed delivery* |

|

|

| (a)(5)(iv) |

|

Text of press release dated and issued February 7, 2025 (filed herewith) |

|

|

| (b) |

|

None |

|

|

| (d)(1) |

|

Standstill agreement between Virtus Investment Advisers, Inc. and Bulldog Investors LLP dated March 6, 2024* |

|

|

| (d)(2) |

|

Standstill agreement between Virtus Investment Advisers, Inc. and Yakira Partners L.P. dated March 6, 2024* |

|

|

| (g) |

|

None |

|

|

| (h) |

|

None |

|

|

| 107 |

|

Filing fee table* |

* Previously filed as an exhibit to the Schedule TO filed by the Fund with the Commission on January 7,

2025.

| Item 13. |

Information Required by Schedule 13e-3 |

Not applicable

SIGNATURE

After due

inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete, and correct.

|

| VIRTUS TOTAL RETURN FUND INC. |

|

| /s/ Kathryn L. Santoro |

| Name: Kathryn L. Santoro |

| Title: Secretary |

Dated: February 7, 2025

|

|

|

|

|

|

News Release

|

Virtus Total Return Fund Inc. Announces

Preliminary Results of Tender Offer

HARTFORD, CT, Friday,

February 7, 2025 – Virtus Total Return Fund Inc. (NYSE: ZTR) (the “Fund”) today announced preliminary

results of its previously announced tender offer (“Tender Offer”) to acquire 10% of the Fund’s outstanding shares, which expired on February 6, 2025 at 5 p.m. (Eastern).

Approximately 20,373,789 shares were tendered, including shares tendered pursuant to notices of guaranteed delivery, based on preliminary information.

With the Tender Offer oversubscribed, the relative number of shares that will be purchased from each tendering shareholder will be prorated based on the number of shares properly tendered.

The purchase price of the properly tendered and accepted shares is 98% of the Fund’s net asset value per share as of the close of regular trading on

February 6, 2025, which is equal to $6.4386 per share. The Fund expects to announce the final results of the Tender Offer on or about February 12, 2025.

About the Fund

Virtus Total Return Fund Inc. is a diversified closed-end fund whose investment objective is capital

appreciation, with income as a secondary objective. Virtus Investment Advisers, LLC is the investment adviser and Duff & Phelps Investment Management Co. and Newfleet Asset Management are the subadvisers to the Fund. For more information on the Fund, contact

shareholder services at (866) 270-7788, by email at closedendfunds@virtus.com, or through

the Closed-End Funds section of virtus.com.

Fund Risks

An investment in a fund is subject to risk, including the risk of possible loss of principal. A fund’s shares may be worth less upon their sale than

what an investor paid for them. Shares of closed-end funds may trade at a premium or discount to their NAV. For more information about the Fund’s investment objective and risks, please see the Fund’s

annual report. A copy of the Fund’s most recent annual report may be obtained free of charge by contacting “Shareholder Services” as set forth at the bottom of this press release.

# # #

For Further Information:

Shareholder Services

(866) 270-7788

closedendfunds@virtus.com

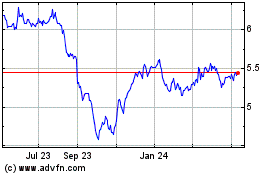

Virtus Total Return (NYSE:ZTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

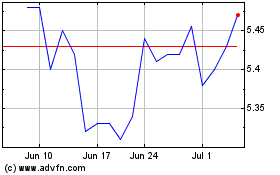

Virtus Total Return (NYSE:ZTR)

Historical Stock Chart

From Feb 2024 to Feb 2025