ISE Alternative Markets to Launch New Auctions Based on ReXX Commercial Property Indices

March 12 2008 - 1:30PM

Business Wire

The International Securities Exchange (ISE) today announced the

upcoming launch of ISE Alternative Markets with the introduction of

derivatives auctions based on the ReXX Commercial Property Indices.

These auctions will enable market participants to take positions on

the total return and changes in rent of commercial property for

individual U.S. cities and an All Market Composite. ISE Alternative

Markets is able to provide liquidity and transparency to the real

estate derivatives market through the use of its patented Longitude

Auction Platform. This pari-mutuel technology pools liquidity

across all orders to allow investors to trade derivatives on asset

classes that lack a liquid underlying market. �We are incredibly

pleased that our first new product offering on the Longitude

Auction Platform is with Rexx Index, LLC, and the ReXX Indices,

which benchmark returns on commercial real estate,� said Mike

Knesevitch, Head of ISE�s Alternative Markets business. �For the

first time, market participants can quickly and efficiently manage

real estate risk through an auction market that offers transparent

pricing and eliminates counterparty risk. The auctions provide

hedging capabilities that range from protecting parties against

increases or decreases in future rent, to enabling investors to

gain immediate exposure to investment-grade commercial real estate

in 15 U.S. cities without the cost of owning or managing a group of

buildings.� �This is an exciting development for all players in the

U.S. commercial real estate market,� said Paul Frischer, Managing

Member of Rexx Index, LLC and founder of the Rexx indices. �The

ReXX indices are the leading indicator of current commercial real

estate market performance, and market participants will now be able

to use our proprietary index values to manage risk and return.

Through our relationship with ISE Alternative Markets, this

valuable tool will enable real estate and financial markets to

adopt strategies in changing real estate market conditions with an

end-to-end solution.� The ReXX Commercial Property Indices are the

first rent-based commercial real estate indices for commercial

property derivatives and represent nearly two billion square feet

of real estate valued at two trillion dollars. Unlike traditional

real estate indices that serve as lagging indicators and are purely

appraisal or transaction-based, ReXX is a leading indicator based

on current market asking rents, lease transactions, inflation and

interest rates. With 15 individual metro markets and the All Market

Composite Index, ReXX provides a granular view of the market as

well as an all encompassing measure of 15 of the largest metro

markets. Real estate performance is location specific, and ReXX

provides important geographic market changes in value not available

in other indices. The first auctions are scheduled for the second

quarter of 2008 and will be based on property in New York Midtown,

Houston, Chicago, San Francisco and the All Market Composite Index,

which is a benchmark that aggregates data from all 15 U.S. metro

regions that ReXX covers. The Options Clearing Corporation (OCC)

will provide central clearing for these products. ISE is finalizing

the regulatory framework for the auctions with the CFTC. For more

information on the ReXX Indices, trading eligibility, auction and

settlement dates, or for information about ISE Alternative Markets,

please visit www.ise.com/alternativemarkets or send an email to

alternativemarkets@ise.com. ISE Background The International

Securities Exchange operates a family of fully electronic trading

platforms, creating efficient markets through innovative technology

and market structure. ISE�s markets portfolio consists of an

options exchange and a stock exchange. As the world�s largest

equity options trading venue, ISE offers options on equities, ETFs,

indices, and FX. The ISE Stock Exchange trades approximately 6,000

products, and is the only fully electronic equities platform that

provides the opportunity for continuous price improvement through

the interaction of its non-displayed liquidity pool, MidPoint

Match, and its displayed stock market. ISE Alternative Markets is

scheduled to launch in 2008 and will offer an events market trading

platform for derivatives auctions. To complement its markets and

enable investors to trade smarter, ISE creates innovative new

products including a portfolio of proprietary indexes and enhanced

market data products for sophisticated investors. ISE is a wholly

owned subsidiary of Eurex, a leading global derivatives exchange.

Eurex itself is jointly owned by Deutsche B�rse AG (Ticker: DB1)

and SWX Swiss Exchange. Together, Eurex and ISE are the global

market leader in individual equity and equity index derivatives.

Rexx Index, LLC The Rexx Commercial Property Index (Rexx Index)

supports origination and execution of real estate property

derivatives. The Rexx Index uses data that includes asking rent,

lease rent, inflation and interest rates to produce quarterly

indices for the US Office market. These indices include individual

market and composite return for: Atlanta, Boston, Chicago, Dallas,

Denver, Houston, Los Angeles, Manhattan, Miami, Phoenix, San

Francisco, Seattle, Washington D.C. Cushman & Wakefield and

Newmark Knight Frank, leaders in the commercial real estate

services industry, each own a minority interest and provide

proprietary information in participation with other sources of

data. For more information about Rexx Index, visit

www.rexxindex.com

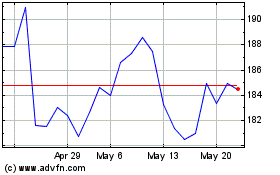

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Feb 2025 to Mar 2025

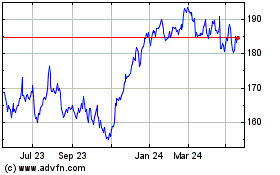

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Mar 2024 to Mar 2025