Aberdeen Acquires Securities in Jourdan

September 22 2020 - 4:00PM

ABERDEEN INTERNATIONAL INC. (“Aberdeen” or the “Company”)

(TSX: AAB) has acquired 5,000,000 units of Jourdan

Resources Inc. (“

Jourdan”)

(

TSX-V: JOR) in a non-brokered

private placement financing of Jourdan at a price of $0.015 per

unit for a total subscription price of

$75,000. Each unit is comprised of one

Jourdan common share and one Jourdan common share purchase

warrant. Each common share purchase warrant is

exercisable for one common share of Jourdan at a price of $0.05 for

a period of 24 months.

Prior to this transaction, Aberdeen owned

8,333,333 common shares of Jourdan, representing approximately

14.2% of the then issued and outstanding shares on a non-diluted

basis. As a result of this transaction, Aberdeen owns 13,333,333

Jourdan shares and 5,000,000 Jourdan common share purchase

warrants, which represents 12.3% of Jourdan on an issued and

outstanding basis or 16.1% on a partially diluted basis.

Aberdeen completed this private placement for

investment purposes and may buy or sell Jourdan securities in the

future.

ABOUT ABERDEEN INTERNATIONAL

INC.

Aberdeen International is a global resource

investment company and merchant bank focused on small

capitalization companies in the mining and metals sector.

For additional information, including to obtain

a copy of either of Aberdeen’s related early warning reports,

please visit our website at www.aberdeeninternational.ca

or contact:

Ryan PtolemyChief Financial OfficerAberdeen

International Inc.65 Queen Street West, Suite 800Toronto, Canada

M5H 2M5ryanp@fmfinancialgroup.com+1 416-861-2267

Cautionary Notes

This press release contains "forward looking

information" within the meaning of applicable Canadian securities

legislation. Forward looking information includes, but is not

limited to, statements with respect to the future financial or

operating performance of the Company, Aberdeen’s possible future

trading and intentions, valuations of investments, proposed

transactions and investments, investment philosophy and liabilities

and commitments. Generally, forward looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: financing not being available at desired prices;

general business, economic, competitive, political and social

uncertainties; and other general risks of the mining and investment

industries. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

THE TSX VENTURE EXCHANGE HAS

NOT REVIEWED AND DOES NOT ACCEPT

RESPONSIBILITY FOR THE ACCURACY OF THIS

RELEASE

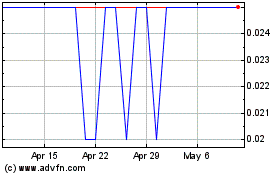

Aberdeen (TSX:AAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

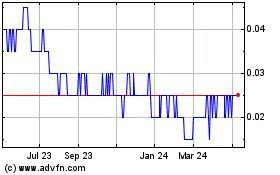

Aberdeen (TSX:AAB)

Historical Stock Chart

From Dec 2023 to Dec 2024