Aberdeen International Inc. (TSX: AAB, FR: A8H, OTC: AABVF) Reports 2021 Q1 Results With Net Income of $0.02 Per Share and Sh...

June 14 2021 - 1:00AM

Aberdeen International Inc. (“

Aberdeen” or the

“

Company”) (TSX: AAB F: A8H, OTC: AABVF) is

pleased to announce that it has released its financial results for

the first quarter ended April 30, 2021.

For the three months ended April 30, 2021,

Aberdeen reported net income of $3.3 million or $0.02 per basic

share on total revenue of $4.0 million. Revenue was comprised of

$3.9 million from net investment gains and $0.1 million from

interest income. For the three months ending April 30, 2020,

Aberdeen reported net income of $1.6 million or $0.02 per basic

share on total revenue of $1.8 million ($1.7 million from net

investment gains and $0.1 million from interest income and advisory

fees).

The Company’s investment portfolio incurred a

net investment gain of $3.9 million on the back of Flora Growth

Corp’s successful Nasdaq IPO. Furthermore, the Company’s recent

investment in AMMPower Corp. – a green ammonia technology company –

coupled with Brazil Potash’s successful closing of a new round of

financing at US$4.00 per common share, contributed to the positive

growth of the Company’s investment portfolio.

“We’re pleased to deliver another quarter of

earnings growth, building on the strength of last year’s results.

The quarter is reflective of the quality of our portfolio and the

hard work that our investees’ management teams have put into

driving value for shareholders. We are excited about the growing

momentum in clean energy and continue to position the portfolio to

capitalize on exciting opportunities in the space.”, said Chris

Younger, CEO of Aberdeen International.

The Company continues to transition its

investment strategy to a larger focus on clean energy, with

particular interest in the hydrogen sector. The recent investment

in AES-100 Inc. underscores the Company’s belief that hydrogen is

on the verge of a breakthrough, driven by ever greater pressure on

energy, industrial and transportation sector decarbonization and

hydrogen’s viability as a mass-market low-carbon fuel. Hydrogen's

high energy to mass ratio makes it particularly suitable for

heavy-duty, long-distance road freight, maritime and aviation

applications.

ABOUT ABERDEEN INTERNATIONAL

INC.

Aberdeen International is a global resource

investment company and merchant bank focused on small

capitalization companies in the rare metals and renewable energy

sectors. AES-100 Inc., an Aberdeen portfolio investment, owns the

exclusive rights and all intellectual property pertaining to the

Advanced Electrolyzer System (AES-100) for the production of

hydrogen from dilute syngas.

For additional information, please visit our

website at www.aberdeen.green

For further information, please contact:

Chris Younger Chief Executive Officer Aberdeen

International Inc. Chris.Younger@ABERDEENINTERNATIONAL.CA(416)

861-1685

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the investment portfolio of the

Company; the renewable energies sector and the Company’s future

plans. Forward-looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward-looking information, including risks inherent in

the mining industry and risks described in the public disclosure of

the Company which is available under the profile of the Company on

SEDAR at www.sedar.com and on the Company's website at

www.aberdeen.green/. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

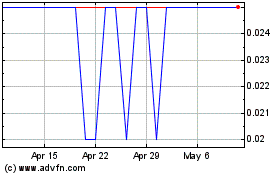

Aberdeen (TSX:AAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

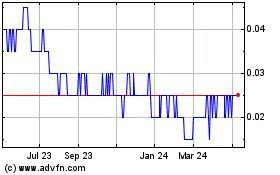

Aberdeen (TSX:AAB)

Historical Stock Chart

From Dec 2023 to Dec 2024