Aptose Biosciences Inc. (“Aptose” or the “Company”) (NASDAQ:APTO)

(TSX:APS), a clinical-stage company developing highly

differentiated therapeutics that target the underlying mechanisms

of cancer, today announced financial results for the three months

ended June 30, 2017 and reported on corporate developments. Unless

specified otherwise, all amounts are in Canadian dollars.

The net loss for the quarter ended June 30, 2017

was $3.2 million ($0.15 per share) compared with $5.6 million

($0.46 per share) in the quarter ended June 30, 2016. Total cash

and cash equivalents and investments as of June 30, 2017 were $14.2

million (or $10.9 million US dollars) which, based on information

currently available and current expected cash burn, provides the

Company with sufficient resources to fund research and development

and operations into Q3 2018.

“We have made tremendous progress with

both of our hematology product candidates, CG’806 and APTO-253,

during the second quarter of this year,” said William G. Rice,

Ph.D., Chairman, President and Chief Executive Officer. “CG’806 is

an oral first-in-class pan-FLT3/BTK multi-kinase inhibitor that we

are developing for patients with acute myeloid leukemia (AML) and

certain B-cell malignancies. Importantly, we’ve developed a

scalable manufacturing process and have selected the formulation

that we intend to advance into clinical trials in 2018. For

APTO-253, a clinical-stage compound that inhibits expression of the

c-Myc oncogene, we generated preliminary data that point to the

root cause of the manufacturing and stability setbacks with the

drug product. Formal root cause studies are underway and may allow

us to bring APTO-253 back into the clinic as a potential treatment

for acute myeloid leukemia.”

Corporate Highlights

- CG’806 preclinical data presented publicly –

In May 2017, the company presented preclinical data for its

pan-FLT3/BTK multi-kinase inhibitor CG’806 in two separate posters

at the 2017 American Association for Cancer Research (AACR)

Conference for Hematologic Malignancies in Boston, MA. Aptose

scientists, along with researchers from the Knight Cancer Institute

at Oregon Health & Science University (OHSU), presented data

relating to the potency of CG’806 against specimens derived from

patients with various hematologic malignancies. In a separate

presentation, Aptose scientists, with researchers from the MD

Anderson Cancer Center, presented data demonstrating potency of

CG’806 against AML cells harboring wild type or specific mutant

forms of FLT3.

- CG’806 manufacturing and preclinical progress

– Aptose has developed a scalable synthetic route for the

manufacture of bulk quantities of CG’806 and has selected an oral

formulation that we plan to take into first-in-human clinical

trials. Preclinical studies with various types of AML and B cell

malignancy cells demonstrated differential actions on distinct

kinases and pathways in different genetic backgrounds, leading to

unanticipated potency against a wide range of these cancer cells.

In addition, we solved the x-ray crystal structures of CG’806 with

the BTK enzyme, which further elucidated the molecule’s strong

interaction with the BTK active site and explains why CG’806

continues to inhibit the C481S mutant form of BTK. Together, the

data support development of CG’806 for various forms of AML and for

patients who i) have relapsed, ii) are refractory or iii) are

intolerant to ibrutinib or other BTK inhibitors with B cell

malignancies that may continue to be sensitive to CG’806.

- Intellectual Property Protection – On August

4th, 2017 we received a notice from the USPTO stating that our U.S.

Patent Application for CG’806 has been allowed for issuance as a

patent. The application claims numerous compounds, including

the CG’806 compound, pharmaceutical compositions comprising the

CG’806 compound, and methods of treating various diseases. It

is important to note that the notice of allowance is not a grant of

patent rights and although it is uncommon, the USPTO can withdraw

the allowed application from issuance.

- APTO-253 root cause analysis update –

Preliminary root cause analyses studies have provided preliminary

data that could point to the identification of the reason for the

manufacturing and stability issues that resulted in a clinical hold

of the Phase lb clinical trial of APTO-253. If the ongoing

studies confirm these data, Aptose will bring these findings to the

FDA with the hope of returning APTO-253 to a state that it can be

reintroduced into the clinical trial. APTO-253, which effectively

inhibits expression of the c-Myc oncogene, is a potential treatment

for AML, and we now have identified a cellular target that can

explain the means by which APTO-253 inhibits the c-Myc gene

expression and induces other cellular sequelae.

- ASH abstracts submitted – Aptose has submitted

five abstracts for CG’806 and two abstracts for APTO-253 for

presentation at the American Society of Hematology (ASH) Annual

Meeting in December. CG’806 has been shown to be a

multi-targeted pan-FLT3/BTK inhibitor, but it also impacts other

relevant oncogenic targets. APTO-253 has demonstrated activity as a

c-Myc inhibitor though the interaction with a specific cellular

target and can result in a synthetic lethal when cancer cells house

specific mutations. This research and other mechanistic findings

for both molecules are highlighted and expanded upon in the

abstracts.

Financial Results

Net loss for the three months ended June 30,

2017 was $3.2 million ($0.15 per share) compared with $5.6 million

($0.46 per share) during the three months ended June 30, 2016. Our

net loss for the six months ended June 30th, 2017 was $7.6 million

($0.39 per share) compared with a loss of $10.7 million ($0.88 per

share) during the six months ended June 30, 2017.

The decrease in the net loss during the three

and six months ended June 30, 2017 compared with the three and six

months ended June 30, 2016 is primarily related to the $1.3 million

option fee paid to CrystalGenomics for its CG’806 technology in

June of 2016, the cancellation of the LALS/Moffitt collaboration,

and lower costs associated with the APTO-253 program, offset by

development activities related to the CG’806 development program

which started in the second half of fiscal 2016.

Aptose utilized cash of $3.6 million in

operating activities in the three months ended June 30, 2017

compared with $4.6 million in the three months ended June 30,

2016. The decrease in cash used in operating activities in

the current period is due mostly to lower operating expenses in the

current period, offset by decrease in accounts payable and accrual

balances during the three months ended June 30, 2017. For the

six months ended June 30, 2017, Aptose utilized cash of $7.1

million compared with $9.2 million in the six months ended June 30,

2016. The decrease in cash used in operations is due mostly

to lower operating expenses in the current period.

Research and DevelopmentResearch and

development expenses totaled $1.5 million in the three months ended

June 30, 2017 compared with $3.3 million in the three months ended

June 30, 2016. Research and development expenses totaled $3.8

million in the six months ended June 30, 2017 compared with $5.6

million in the six months ended June 30, 2016. Research and

development costs consist of the following:

Components of research and development

expenses:

|

|

|

Three months ended |

Six months ended |

|

|

|

June 30, |

|

June 30, |

June 30, |

|

June 30, |

|

(in thousands) |

|

2017 |

|

2016 |

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| CrystalGenomics Option

Fee |

|

|

- |

|

|

1,294 |

|

- |

|

|

1,294 |

| Program costs – CG

‘806 |

|

|

479 |

|

|

19 |

|

1,019 |

|

|

19 |

| Program costs –

APTO-253 |

|

|

451 |

|

|

834 |

|

1,553 |

|

|

1,874 |

| Program costs –

LALS/Moffitt |

|

|

- |

|

|

464 |

|

- |

|

|

949 |

| Salaries |

|

|

422 |

|

|

562 |

|

988 |

|

|

1,284 |

| Stock based

compensation |

|

|

98 |

|

|

109 |

|

166 |

|

|

165 |

|

Depreciation of equipment |

|

|

12 |

|

|

11 |

|

31 |

|

|

23 |

|

|

|

$ |

1,462 |

|

$ |

3,293 |

$ |

3,757 |

|

$ |

5,608 |

Expenditures for the three and six months ended

June 30, 2017 were lower than the expenses incurred in the three

and six months ended June 30, 2016 mostly related to the US$1.0

million option fee paid to CrystalGenomics in June of 2016 and

savings on the APTO-253 program as the Company’s decision to

reprioritize its resources towards its CG’806 program.

Higher program costs associated with the Company’s CG’806 program

were offset by savings that resulted from the decision made in

December 2016 to cancel the LALS/Moffitt collaboration.

The changes in research and development expenses

resulted from the following:

- In the comparative period, the Company paid US$1.0 million

($1.3 million) to CrystalGenomics for an option fee related to the

CG’806 technology and in that period began research and development

activities for this program.

- Research and development activities, including formulation

studies and PK studies, related to CG’806 development program;

- Reduced expenditures on the APTO-253 program. In the

current three and six month periods, the Company was conducting

root cause analysis to determine the cause of the manufacturing

issues. In the comparative periods the Company was actively

manufacturing a new clinical batch.

- Lower salaries expense mostly related to severance payments

made in the three months ended March 31, 2016 when research

headcount was reduced and savings resulting from the reduced

headcount.

- Savings from cancellation of the LALS/Moffitt collaboration

which was active in the three and six months ended June 30, 2016.

There are no costs related to this program in the current

period.

General and AdministrativeGeneral and

administrative expenses totaled $1.8 million in the three months

ended June 30, 2017, compared to $2.3 million in the three months

ended June 30, 2016. For the six month period ended June 30, 2017,

general and administrative expenses totaled $3.9 million compared

with $5.0 million in the same period in the prior year. General and

administrative costs consist of the following:

Components of general and administrative

expenses:

|

|

|

Three months ended |

Six months ended |

|

|

|

June 30, |

|

June 30, |

June 30, |

|

June 30, |

|

(in thousands) |

|

2017 |

|

2016 |

2017 |

|

2016 |

|

|

|

|

|

|

|

|

|

| General and

administrative excluding salaries |

|

$ |

755 |

|

$ |

822 |

$ |

1,697 |

|

$ |

1,955 |

|

Salaries |

|

|

596 |

|

|

823 |

|

1,731 |

|

|

1,798 |

|

Stock-based compensation |

|

|

463 |

|

|

677 |

|

476 |

|

|

1,156 |

|

Depreciation of equipment |

|

|

19 |

|

|

21 |

|

30 |

|

|

42 |

|

|

|

$ |

1,833 |

|

$ |

2,343 |

$ |

3,934 |

|

$ |

4,951 |

General and administrative expenses, excluding

salaries, decreased in the three months ended June 30, 2017,

compared with the three months ended June 30, 2016. The decrease is

mostly the result of lower travel, consulting and rent costs in the

current year related to cost containment initiatives taken in the

prior fiscal year. Salary expenses in the three months ended June

30, 2017, decreased in comparison with the three months ended June

30, 2016, mostly due to reduced headcount.

General and administrative expenses excluding

salaries, decreased in the six months ended June 30, 2017, compared

with the six months ended June 30, 2016. The decrease is mostly the

result of lower travel, consulting and rent costs in the current

year related to cost containment initiatives taken in the prior

fiscal year. Salaries expense for the six months ended June

30, 2017 is comparable to the salaries expense in the six months

ended June 30, 2016. Severance and separation costs incurred

in the three months ended March 31, 2017 are offset by savings in

the three months ended June 30, 2017 as a result of the lower

headcount.

Stock-based compensation decreased in the three

and six months ended June 30, 2017, compared with the three and six

months ended June 30, 2016, due to large forfeitures in the three

months ended March 31, 2017 and also due to grants in prior periods

having a greater fair value than the grants issued in the three

months ended June 30, 2017, and therefore contributing to higher

stock-based compensation in the three and six months period ended

June 30, 2016.

| |

|

|

|

|

|

|

| Aptose

Biosciences Inc. |

|

|

|

|

|

|

| Condensed Consolidated Interim Statements of Loss and

Comprehensive Loss |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three |

Three |

Six |

Six |

|

| |

|

months ended |

months ended |

months ended |

months ended |

|

| (amounts in 000's of

Canadian Dollars except for per common share data) |

|

June 30, 2017 |

June 30, 2016 |

June 30, 2017 |

June 30, 2016 |

|

|

REVENUE |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

| Research and

development |

|

|

1,462 |

|

|

3,293 |

|

|

3,757 |

|

|

5,608 |

|

|

| General

and administrative |

|

|

1,833 |

|

|

2,343 |

|

|

3,934 |

|

|

4,951 |

|

|

| Operating

expenses |

|

|

3,295 |

|

|

5,636 |

|

|

7,691 |

|

|

10,559 |

|

|

| Finance expense |

|

|

- |

|

|

9 |

|

|

- |

|

|

205 |

|

|

| Finance

income |

|

|

(54 |

) |

|

(33 |

) |

|

(95 |

) |

|

(80 |

) |

|

|

Net financing income |

|

|

(54 |

) |

|

(24 |

) |

|

(95 |

) |

|

125 |

|

|

|

Net loss for the period |

|

|

3,241 |

|

|

5,612 |

|

|

7,596 |

|

|

10,684 |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss |

|

|

|

|

|

|

| Items

that may subsequently be reclassified to earnings: |

|

|

|

|

|

|

|

Foreign currency translation loss |

|

|

365 |

|

|

- |

|

|

488 |

|

|

- |

|

|

|

Comprehensive loss for the period |

|

|

3,606 |

|

|

5,612 |

|

|

8,084 |

|

|

10,684 |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share |

|

$ |

0.15 |

|

$ |

0.46 |

|

$ |

0.39 |

|

$ |

0.88 |

|

|

|

|

|

|

|

|

|

|

The press release, the financial statements and

the management’s discussion and analysis for the quarter ended June

30, 2017 will be available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.shtml

Conference Call and

Webcast

Aptose will host a conference call to discuss

results for the three months ended June 30, 2017 today, Tuesday,

August 8, 2017 at 5:00 p.m. EDT. Participants can access the

conference call by dialing (844) 882-7834 (North American toll free

number) and (574) 990-9707 (International) and using passcode

58912011. The conference call can also be accessed

at here and will also be available through a link on the

Investor Relations section of Aptose’s website at

ir.aptose.com. An archived version of the webcast along with

a transcript will be available on the Company’s website for 30

days. An audio replay of the webcast will be available

approximately two hours after the conclusion of the call for seven

days by dialing (855) 859-2056, using the passcode 58912011.

Note

The information contained in this news release

is unaudited.

About Aptose

Aptose Biosciences is a clinical-stage

biotechnology company committed to developing personalized

therapies addressing unmet medical needs in oncology. Aptose is

advancing new therapeutics focused on novel cellular targets on the

leading edge of cancer. The Company's small molecule cancer

therapeutics pipeline includes products designed to provide single

agent efficacy and to enhance the efficacy of other anti-cancer

therapies and regimens without overlapping toxicities. For further

information, please visit www.aptose.com.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Canadian and U.S. securities laws,

including, but not limited to, statements relating to the expected

cash runway of the Company, the clinical potential and favorable

properties of CG’806, the clinical trials for CG’806 and their

expected timing, the potential intellectual property assets

generated by the Company’s activities, the clinical development of

APTO-253 and its expected return to the clinic, and statements

relating to the Company’s plans, objectives, expectations and

intentions and other statements including words such as “continue”,

“expect”, “intend”, “will”, “should”, “would”, “may”, and other

similar expressions. Such statements reflect our current views with

respect to future events and are subject to risks and uncertainties

and are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by us are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements described in this press release. Such factors could

include, among others: our ability to obtain the capital required

for research and operations; the inherent risks in early stage drug

development including demonstrating efficacy; development time/cost

and the regulatory approval process; the progress of our clinical

trials; our ability to find and enter into agreements with

potential partners; our ability to attract and retain key

personnel; changing market and economic conditions; inability of

new manufacturers to produce acceptable batches of GMP in

sufficient quantities; unexpected manufacturing defects; and other

risks detailed from time-to-time in our ongoing quarterly filings,

annual information forms, annual reports and annual filings with

Canadian securities regulators and the United States Securities and

Exchange Commission.

Should one or more of these risks or

uncertainties materialize, or should the assumptions set out in the

section entitled "Risk Factors" in our filings with Canadian

securities regulators and the United States Securities and Exchange

Commission underlying those forward-looking statements prove

incorrect, actual results may vary materially from those described

herein. These forward-looking statements are made as of the date of

this press release and we do not intend, and do not assume any

obligation, to update these forward-looking statements, except as

required by law. We cannot assure you that such statements will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Investors are cautioned that forward-looking statements are not

guarantees of future performance and accordingly investors are

cautioned not to put undue reliance on forward-looking statements

due to the inherent uncertainty therein.

For further information, please contact:

Aptose Biosciences

Greg Chow, CFO

647-479-9828

gchow@aptose.com

SMP Communications

Susan Pietropaolo

201-923-2049

susan@smpcommunications.com

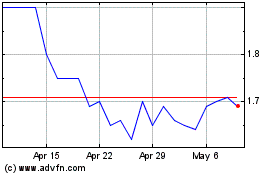

Aptose Biosciences (TSX:APS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aptose Biosciences (TSX:APS)

Historical Stock Chart

From Jan 2024 to Jan 2025