Brookfield Oaktree Wealth Solutions Survey Highlights Investor Demand for Alternative Investments and Critical Role of Financial Advisors

October 08 2024 - 7:00AM

Brookfield Oaktree Wealth Solutions, a leading provider of

alternative investments to financial advisors and their clients

globally, today revealed key findings from its new survey of

high-net-worth investors and financial advisors. Conducted by

independent research organization CoreData, “The Alts Institute”

Alternative Investing Survey surveyed high-net-worth (HNW)

investors in the U.S. and Canada with at least US $2.5 million in

household investable assets and financial advisors with an average

of US $633 million in practice assets under management.

Key findings among HNW

investors:

- Those who are already invested in

alts want more:

- 88% of alts users are open to

investing more into alternatives.

- 78% of alts users would like to

invest in a greater variety of investments beyond what they already

own.

- 81% believe that having an

alternatives allocation will drive stronger long-term outcomes than

a traditional portfolio.

- More than half would be comfortable

with a 20%+ allocation to alternatives if their advisor recommended

it.

- Those who are not alts investors

(yet) are very open to them:

- 72% would begin investing in

alternatives if they better understood the available options.

- 70% say they would begin investing

in alternatives if their financial advisor recommended it.

Key findings among financial

advisors:

- Nearly 72% of advisors say

alternative investment expertise will be a meaningful driver in

growing their book of business and a broad range of benefits

including enhancing absolute returns, client satisfaction, and

smoothing revenue volatility.

- 85% believe that alternative

investments have enhanced their client conversations about

portfolio construction.

- 86% believe that greater individual

investor access to alternative investments will drive more reliance

on professional advice.

- 91% say that building a strong

working knowledge of alternative investments is a commitment worth

making. This finding is reinforced by the fact that 41% of HNW

investors, regardless of whether they have alts holdings, have

moved or considered moving to a new advisor to better access

high-quality alternatives.

John Sweeney, Chief Executive Officer of

Brookfield Oaktree Wealth Solutions, said, “Demand for alternative

investment products among high-net-worth investors is growing

exponentially, and our proprietary research highlights how deeply

investors want their advisors to lead the way. This underscores

just how vital having access to alternatives can be for advisors

looking to retain and grow their client relationships.”

He continued, “By developing and leveraging

their alternatives expertise, advisors can differentiate their

practice in the market, recruit new prospects, and deliver

significant value by helping their clients maximize the

opportunities ahead. We look forward to supporting advisors with

partnership and practice management as they continue to navigate

the alternatives landscape.”

The Alts Institute by Brookfield Oaktree

Wealth Solutions offers financial advisors a comprehensive

platform that empowers them with client-friendly resources,

advanced asset allocation strategies, and best practices to fully

unlock the potential of alternative investments. Through in-depth

research, The Alts Institute deepens its understanding of the

alternatives market, aiming to better serve both financial advisors

and investors. Additionally, it sheds light on current and emerging

trends within the industry, making it an invaluable resource for

staying ahead in the evolving investment landscape.

The Alts Institute also surveyed HNW investors

in Hong Kong, Singapore and Taiwan on their views on alternatives.

To learn more about how investors in Asia are thinking about

alternative investments, see additional results here.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE:

BAM, TSX: BAM) is a leading global alternative asset manager with

approximately $1 trillion of assets under management across

renewable power and transition, infrastructure, private equity,

real estate, and credit. We invest client capital for the long-term

with a focus on real assets and essential service businesses that

form the backbone of the global economy. We offer a range of

alternative investment products to investors around the world —

including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors. We draw on

Brookfield’s heritage as an owner and operator to invest for value

and generate strong returns for our clients, across economic

cycles.

For more information, please visit our website

at www.bam.brookfield.com.

About Brookfield Oaktree Wealth Solutions

Brookfield Oaktree Wealth Solutions is a leading

provider of alternative investments to advisors and their clients

globally, helping them meet their overall financial goals. The

global scale and multi-decade track records of our parent

companies, Brookfield and Oaktree, place us among the leaders in

alternative investing. For more information, please visit our

website at www.brookfieldoaktree.com. Brookfield Oaktree Wealth

Solutions is registered as a broker-dealer with the U.S. Securities

& Exchange Commission (“SEC”) and is a member of Financial

Industry Regulatory Authority, Inc.) (“FINRA”) and the Securities

Investor Protection Corporation (“SIPC”).

Advisors interested in learning more about

Brookfield Oaktree Wealth Solutions should call +1 (855) 777-8001

or email info@brookfieldoaktree.com.

Contact information:

Media:

Rachel Wood

Tel: (212)

613-3490

Email:

rachel.wood@brookfield.com

Investor Relations: Brookfield Oaktree

Wealth Solutions Tel: (855) 777-8001 Email:

ir@brookfieldoaktree.com

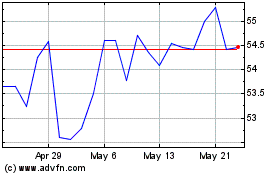

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

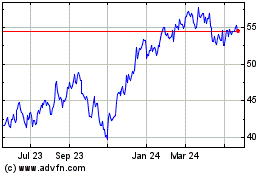

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Dec 2023 to Dec 2024