HEALWELL AI Inc. (f/k/a MCI Onehealth Technologies Inc.)

("

HEALWELL" or the "

Company")

(TSX: AIDX), a healthcare technology and data science company

focused on preventative care, is pleased to announce that it has

successfully completed the strategic transaction with WELL Health

Technologies Corp. ("

WELL") that was first

announced on July 20, 2023 (the "

Transaction").

The Transaction comprised, among other things, a private placement

offering of convertible debenture units for gross proceeds of $10

million, a sale of the Company's clinical assets1 in Ontario to

WELL, and the satisfaction and discharge of the outstanding secured

debt of the Company and a number of its subsidiaries.

With the closing of this Transaction, HEALWELL

positions itself as a healthcare technology and data science

company focused on preventative care, with a vision to improve

healthcare and save lives through early identification and

detection of disease. HEALWELL leverages AI to empower patients and

doctors to deliver increased access, reduce healthcare costs, and

improve patient outcomes. The Company has been re-named from its

former name, MCI Onehealth Technologies Inc., to HEALWELL AI Inc.,

to better reflect this renewed vision and focus. In addition,

HEALWELL has entered into a strategic alliance agreement with WELL

that positions the Company for newfound growth and expansion

opportunities as an emerging artificial intelligence (AI) enabled

healthcare technology company.

Dr. Alexander

Dobranowski, CEO of HEALWELL, commented, “We are very

pleased to announce the successful completion of this critical

strategic transaction with WELL Health, one of the leading

technology-enabled healthcare companies in North America, and a

place where our providers will thrive as they continue to serve

patients in our communities. Furthermore, the strategic partnership

and alliance with WELL Health will position HEALWELL with the

necessary resources and clinical access to maximize our ability to

execute against our mission, both in Canada and the USA."

Hamed Shahbazi, CEO of WELL

Health, commented, “I am pleased to be joining the board of

HEALWELL and helping further this very important strategic

alliance. WELL is on a mission to tech-enable healthcare providers

and we can’t think of a more important goal for the company than to

make sure we are leading in the field of AI-enabled preventative

health and the support it can provide our providers and their

patients. We are making a significant long-term commitment and are

looking forward to helping build a world-class company that will

benefit both HEALWELL and WELL shareholders given our status as the

largest investor in HEALWELL after completing this important round

of funding.”

Mr.

Brian Paes-Braga, Managing Partner of SAF,

commented, “I am very pleased to be personally joining the HEALWELL

AI corporate journey as a major investor in this round, alongside

our partners at WELL Health, resulting in the strengthening and

re-capitalization of the HEALWELL balance sheet. I believe HEALWELL

has the potential to not just be a first mover and leader in AI,

healthcare technology, and data science in Canada, but also the

foundation for a platform to expand globally. What excites me most

about this initiative is the laser focus from management and WELL

on delivering on the promise of AI-enabled preventative health,

ensuring that this generational opportunity in technology, value

creation, and health is stewarded thoughtfully.”

Strategic Alliance

Agreement

The Company has entered into a strategic

alliance agreement with WELL to accelerate the growth and

development of its AI-enabled healthcare technologies and to

leverage those technologies for the benefit of WELL’s care

providers and their patients. The strategic alliance agreement sets

up a framework under which both companies plan to co-develop and

roll out AI based decision support tools to WELL’s newly expanded

network of clinics and providers which will now include the clinics

previously owned by MCI.

The strategic alliance agreement establishes a

unique relationship between the two companies to harness their

collective resources and expertise to drive growth and enhance the

experience of doctors and patients in WELL’s clinics. It is also

expected that the companies will collaborate on capital allocation

opportunities within the AI enabled digital health marketplace

particularly as it relates to helping doctors detect and diagnose

diseases as early as possible.

New Directors and

Management

The Company is excited to announce that it has

appointed two new directors to the board of the Company, Mr. Hamed

Shahbazi and Mr. Erik Danudjaja, both from WELL. The Company has

also expanded its management team, adding Mr. Blake Corbet as SVP

of Corporate Development. Additional information on the new

appointees is set out below:

Hamed Shahbazi, Board Director

Mr. Shahbazi is the Founder, Chief Executive

Officer and Chairman of WELL and has over 25 years of experience as

a technology focused operator and executive. Over the past five

years Mr. Shahbazi has led WELL to become the dominant digital

healthcare company in Canada with over $750 million in annual

revenue. Previously, he founded TIO Networks a multi-channel

payment solution provider, specializing in bill payment and other

financial services, which was acquired by PayPal in July 2017 for

CAD$304 million. Over his career, Mr. Shahbazi has gained extensive

experience in strategic mergers & acquisitions, both as an

operator and board member with more than 70 successful

transactions.

Erik Danudjaja, Board Director

Mr. Danudjaja is the Senior Associate of

Corporate Development & Strategy at WELL. Since joining in

2021, he has been a key contributor to WELL’s capital allocation

and M&A program helping WELL complete more than a dozen

transactions. Before his tenure at WELL, Erik served as an

investment analyst at Burgundy Asset Management, focusing on US

small and mid-cap equities.

Blake Corbet, SVP of Corporate Development

Mr. Corbet has over 25 years of experience

working as an investment banker in London, Toronto and Vancouver

involving financing, advisory and acquisition transactions in a

variety of international markets. Most recently, Mr. Corbet

ran the Corporate Development group at BBTV Holdings Inc.

(TSX: BBTV) joining shortly after that company completed its IPO,

and prior to that was co-head of investment banking at PI Financial

Corp. As the SVP of Corporate Development at HEALWELL, Mr.

Corbet is responsible for Corporate Development activities

including acquisitions, divestitures and partnerships.

The Company also announces that Dr. Robert

Francis and Mr. Anthony Lacavera have resigned as directors of the

Company, effective October 1, 2023, to facilitate onboarding the

WELL nominee directors. Each has been a valued member of the board

and the Company would like to thank them both for their services

and wish them all the best in their future endeavors.

With the above changes, the Company’s board

continues to be comprised of five directors.

Liquidity Update

The Company has faced significant financial

challenges and liquidity constraints since the beginning of the

year. With the closing of the Transaction, these challenges have

been addressed, and the Company believes that it once again has

sufficient capital to continue to operate its business and drive

its growth objectives.

Transaction Highlights

Convertible Debenture Financing

The Company completed a private placement of

convertible debenture units for aggregate gross proceeds of $10

million. WELL participated in the financing as lead investor, and

subscribed for $4.0 million of the total financing. Members of the

SAF Group, a Canadian based global alternative capital provider,

were key investors alongside WELL in this financing.

Each $1,000 convertible debenture unit consisted

of a convertible debenture in the principal amount of $1,000

(“Debentures”) and 5,000 warrants to acquire a

Class A Subordinate Voting Share of the Company

(“Warrants”). The Debentures are unsecured

obligations of the Company, mature 5 years from the closing date of

the offering, and bear interest at a rate of 10% per annum, which

will be payable at maturity. The principal and interest outstanding

under the Debentures will be convertible into Class A Subordinate

Voting Shares of the Company at any time, at the option of the

holder, at a conversion price of $0.20 per Class A Subordinate

Voting Share. The Warrants are also exercisable at a price of

$0.20/share and expire five years from the closing date of the

offering.

The Debentures and Warrants, if fully converted

and exercised immediately following the closing of the Transaction,

would result in the issuance of 100,000,000 new Class A Subordinate

Voting Shares, which would leave existing Class A Subordinate

Voting Shareholders holding approximately 35% of the Class A

Subordinate Voting Shares.

In connection with the Transaction, the Company

will pay a transaction fee of $100,000 to its former financial

advisor.

Sale of Ontario Clinics and Corporate Health

Division

The Company has sold to WELL, under an asset

purchase agreement between their respective subsidiaries, twelve of

its fourteen medical clinics in Ontario, along with other related

assets, for an aggregate purchase price of approximately $1.5

million.

The acquired clinics will join WELL’s extensive

and efficiently run network of clinics, the largest owned and

operated network in Canada, ensuring stability and continued

quality of care for patients and healthcare professionals.

The Company, through a wholly-owned subsidiary,

has also sold to Medworks Inc. ("Medworks") a

number of assets relating to its Corporate Health Services division

for a purchase price of $100,000.

In connection with each of the asset purchase

transactions, the Company has given customary representations,

warranties and indemnities that will survive the closing for a

period of 1-2.5 years.

Secured Debt Resolution

In connection with the Transaction, the Company

and a number of its subsidiaries have fully satisfied and

discharged their outstanding secured credit facilities with TD

Bank, The First Canadian Wellness Co. Inc. (the

"Lender"), a related party to the Company, and

WELL. In total, more than $11 million in principal and accrued fees

and interest have been satisfied as follows:

- The Company’s

$3.1 million secured promissory note from WELL and its $1.5 million

facility with TD Bank have been repaid;

- The Company has

been and is continuing to deliver certain non-core assets

consisting of debt and equity securities in four private healthcare

technologies companies to the Lender in full satisfaction of the

$1.5 million facility that was made available to the Company by the

Lender on May 18, 2023 (the "New Facility"). The

transfer of the non-core assets is being completed in stages, with

the first transfer having been completed on August 4, 2023 and the

last stage expected to be completed within a short period

post-closing.

- The Company will

pay $600,000 to the Lender to partially satisfy the balance of the

Company’s outstanding obligations to the Lender.

- WELL has

purchased the remainder of the secured credit facility from the

Lender and, at closing of the Transaction, discharged the

obligations of the Company and a number of its subsidiaries under

that facility.

Please refer to the Company’s press release

dated July 20, 2023 and its amended and restated material change

report dated August 31, 2023 for more detail on the New Facility

and its repayment.

Call Option

WELL has acquired a call option from Dr. Sven

Grail and Dr. George Christodoulou, control persons of the Company,

which gives WELL the right to acquire up to 30.8 million Class A

Subordinate Voting Shares and 30.8 million Class B Multiple Voting

Shares of the Company, representing an aggregate of approximately

93% of the votes attributable to all issued and outstanding shares

of the Company (prior to the conversion or exercise of any

Debentures or Warrants and after the surrender of certain Class B

Multiple Voting Shares as described below).

The exercise of the option is conditional on the

achievement by the Company of a number of performance milestones

designed to demonstrate improvements in the Company’s financial and

capital markets performance. The option can only be exercised in

pairs, such that WELL must concurrently acquire a Class A

Subordinate Voting Share and a Class B Multiple Voting Share, and

is exercisable for 36 months post-closing. The exercise of the call

option is expected to proceed under the private agreement exemption

in National Instrument 62-104 – Take-over Bids and Issuer Bids

("NI 62-104"), such that the price of the call

option would not be permitted to exceed 115% of the market price of

the Class A Subordinate Voting Shares at the time of exercise. If

at the time of exercise, the exercise price would exceed 115% of

the market price of the Class A Subordinate Voting Shares, the

exercise would be subject to the standard rules and procedures

applicable to take-over bids under NI 62-104.

Surrender of Class B Shares

On closing of the Transaction an aggregate of

5.2 million Class B Multiple Voting Shares were surrendered to the

Company for no consideration and have been cancelled. Following the

surrender, the only outstanding Class B Multiple Voting Shares are

those subject to the Call Option.

Investor Rights Agreement

On closing of the Transaction, the Company

entered into an investor rights agreement with WELL providing WELL

with, among other things (a) the right to nominate up to (i) 2

directors or non-voting board observers of the Company, or (ii) a

majority of the directors or non-voting board observers of the

Company in the event that WELL becomes a control person of the

Company having more than 20% of the voting rights attached to all

outstanding voting securities of the Company; (b) pre-emptive

rights in respect of future issuances of securities of the Company,

and (c) qualification and registration rights, in each case subject

to standard terms and conditions.

Equity Incentive Reorganization

In connection with the completion of the

Transaction and the renewed vision of the Company, the board of

directors of the Company has approved a reorganization of its

equity incentive strategy to better align the interests of its

board, management, employees and consultants with the new strategic

direction of the Company.

The board has approved the grant of a total of

233,187 deferred share units ("DSUs"), 950,000

restricted share units ("RSUs") and 950,000

performance share units (“PSUs, and together with

the DSUs and the RSUs, the "Equity Incentives") to

acquire Class A Subordinate Voting Shares. The Equity Incentives

were granted pursuant to the Company's long-term omnibus equity

incentive plan dated December 22, 2020 (the

"Plan"). In addition to the Equity Incentive

grants, the board has also approved the amendment of the

outstanding options for Class A Subordinate Voting Shares

previously granted to certain employees, consultants and senior

officers of the Company who will continue to serve the Company

following completion of the Transaction. The amendments consisted

of changing (a) the exercise price of each option to $0.69/share,

(b) the expiry date of each option to October 1, 2028, and (c) the

vesting terms for any unvested options to vest in annual increments

of 25% over the 4 years following the closing of the

Transaction.

The grants were fixed by the Human Resources and

Compensation Committee of the Company after due consideration of

the anticipated role of each recipient in the go-forward business,

the dilutive effect of the Offering and comparable compensation

offered by other similarly positioned businesses. The amendments to

the options held by insiders were overwhelmingly approved by the

shareholders of the Company at its recent shareholder meeting on

September 21, 2023.

The grant of Equity Incentives to the directors

and senior officers of the Company, and the amendment of certain

options held by senior officers of the Company, were “related party

transactions” within the meaning of Multilateral Instrument 61-101

– Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). In total, 500,000 RSUs and PSUs

were granted to Alexander Dobranowski, the CEO of the Company,

150,000 RSUs and PSUs were granted to Scott Nirenberski, the CFO

off the Company, 88,405 DSUs were granted to Kingsley Ward, the

Chairman of the Company, 79,710 DSUs were granted to Bashar

Al-Rehany, a Director of the Company, and 55,072 DSUs were granted

to Anthony Lacavera, a former Director of the Company. Among the

options amended were 973,333 options held by Alexander Dobranowski,

the CEO of the Company, and 486,667 options held by Scott

Nirenberski, the CFO of the Company.

The Company did not file a material change

report 21 days or more in advance of the grants and amendments. The

Company believes this is reasonable, as the final details of the

grants and amendments had not been finalized until recently and

were tied to completion of the Transaction.

Other Information

Owens Wright LLP acted as legal counsel to

HEALWELL and Clark Wilson LLP acted as legal counsel to WELL in

connection with the Transaction.

Eight Capital acted as financial advisor to WELL

Health in connection with the Transaction.

For more details on the Transaction please refer

to the Company's press releases dated July 20, 2023, July 27, 2023

and September 21, 2023, as well as the Company’s material change

reports dated July 28, 2023 and August 31, 2023, and its management

information circular dated August 21, 2023, all of which are

available for review on the Company’s SEDAR+ page at

www.sedarplus.ca. Copies of the definitive agreements for the

Transaction will also be made available for review on the Company’s

SEDAR+ page in due course.

About HEALWELL

AI Inc.

HEALWELL AI is a

healthcare technology company focused on AI and data science for

preventative care. Our mission is to improve healthcare and save

lives through early identification and detection of disease. As a

physician led organization with a proven management team

of experienced executives, HEALWELL AI is executing a strategy

centered around developing and acquiring technology and clinical

sciences capabilities that complement the company’s roadmap.

HEALWELL is publicly traded on the Toronto Stock Exchange under the

symbol “AIDX”. For more information, visit

www.HEALWELL.ai.

About WELL

Health Technologies Corp.

WELL’s mission is to tech-enable healthcare

providers. WELL does this by developing the best technologies,

services, and support available, which ensures healthcare providers

are empowered to positively impact patient outcomes. WELL’s

comprehensive healthcare and digital platform includes extensive

front and back-office management software applications that help

physicians run and secure their practices. WELL’s solutions enable

more than 28,000 healthcare providers between the US and Canada and

power the largest owned and operated healthcare ecosystem in Canada

with more than 130 clinics supporting primary care, specialized

care and diagnostic services. In the United States WELL’s solutions

are focused on specialized markets such as the gastrointestinal

market, women’s health, primary care, and mental health. WELL is

publicly traded on the Toronto Stock Exchange under the symbol

"WELL" and on the OTC Exchange under the symbol "WHTCF". To learn

more about the Company, please visit: www.well.company

For media enquiries please contact:

Alexander DobranowskiChief Executive Officer416-440-4040

x.201ir@healwell.ai

Forward Looking Statements

Certain statements in this press release,

constitute "forward-looking information" and "forward looking

statements" (collectively, "forward looking statements") within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements include

statements with respect to the go-forward business of the Company

following completion of the strategic transaction, the strategic

alliance between the Company and WELL, the intention for the

Company to white label new AI-enabled healthcare technologies, and

the statements regarding the Company having sufficient working

capital for future operations. The words "to become", "improve",

"growth", "ensuring", "continue", "anticipated", "expect",

"proceed", "potential", "future", "consider", "result in",

"increase", "deliver", "emerging", "is conditional", "plan",

"position", "opportunities", "expansion", "exercise", "ensure",

"achieve", "acquire", "complete", "satisfy", "entitle", "subject

to" or variations of such words and phrases or statements that

certain future conditions, actions, events or results "will",

"may", "could", "would", "should", "might" or "can", or negative

versions thereof, "occur", or "be achieved", and other similar

expressions, identify forward-looking statements. Forward-looking

statements are necessarily based upon management’s perceptions of

historical trends, current conditions and expected future

developments, as well as a number of specific factors and

assumptions that, while considered reasonable by HEALWELL as of the

date of such statements, are outside of HEALWELL's control and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies which could result in

the forward-looking statements ultimately being entirely or

partially incorrect or untrue. Forward looking statements contained

in this press release are based on various assumptions, including,

but not limited to, the following: HEALWELL’s ability to maintain

its relationships and to successfully implement its strategic

alliance with WELL; HEALWELL’s future access to debt and equity

financing; HEALWELL’s plans for future cost reduction; the

availability of working capital and sources of liquidity;

HEALWELL’s ability to achieve its growth and revenue strategies;

the demand for HEALWELL's products and fluctuations in future

revenues; the availability of future business ventures, commercial

arrangements and acquisition targets or opportunities and

HEALWELL’s ability to consummate them and to effectively integrate

future acquisition targets into its platform; the effects of

competition in the industry; the requirement for increasingly

innovative product solutions and service offerings; trends in

customer growth; the stability of general economic and market

conditions; currency exchange rates and interest rates; HEALWELL's

ability to comply with applicable laws and regulations; HEALWELL's

continued compliance with third party intellectual property rights;

and that the risk factors noted below, collectively, do not have a

material impact on HEALWELL's business, operations, revenues and/or

results. By their nature, forward-looking statements are subject to

inherent risks and uncertainties that may be general or specific

and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove

to be accurate, that assumptions may not be correct, and that

objectives, strategic goals and priorities will not be

achieved.

Known and unknown risk factors, many of which

are beyond the control of HEALWELL, could cause the actual results

of HEALWELL to differ materially from the results, performance,

achievements or developments expressed or implied by such

forward-looking statements. Such risk factors include but are not

limited to those factors which are discussed under the section

entitled "Risk Factors" in HEALWELL's annual information form dated

March 31, 2023, which is available under HEALWELL's SEDAR+ profile

at www.sedarplus.ca. The risk factors are not intended to represent

a complete list of the factors that could affect HEALWELL and the

reader is cautioned to consider these and other factors,

uncertainties and potential events carefully and not to put undue

reliance on forward-looking statements. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management’s expectations and plans relating to the future.

HEALWELL disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise, or to explain any material

difference between subsequent actual events and such

forward-looking statements, except to the extent required by

applicable law. All of the forward-looking statements contained in

this press release are qualified by these cautionary

statements.

1 HEALWELL retained one clinic – known as Polyclinic

– following the Transaction, where the Company has revenue from

Patient Services as well as Technology & Research revenue.

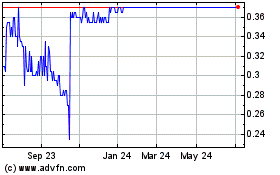

BBTV (TSX:BBTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

BBTV (TSX:BBTV)

Historical Stock Chart

From Apr 2023 to Apr 2024