China Gold International Reports 2019 Second Quarter and First Half Financial Results

August 14 2019 - 9:15PM

China Gold International Resources Corp. Ltd. (TSX: CGG; HKEx:

2099) (the “

Company” or “

China Gold

International Resources”) reports on the Company’s

financial and operational results for the three months

(“

Q2”, or “

second quarter 2019”)

and six months (“

first half” or “

six

months 2019”) ended June 30, 2019. This news release

should be read in conjunction with the Company’s Financial

Statements, Notes to the Financial Statements and Management’s

Discussion and Analysis.

Selected Production and Financial

Highlights: Q2 2019 Compared to Q2 2018

- Revenue increased by 15% to

US$163.2 million from US$142.1 million for the same period in

2018.

- Mine operating earnings decreased

by 80% to US$7.3 million from US$35.8 million for the same period

in 2018.

- Net profit after tax decreased from

US$0.4 million for the 2018 period to a net loss after income taxes

of US$23.0 million for the same period in 2019.

- The Company’s total production was

55,503 ounces of gold and 16,126 tonnes (approximately 35.6 million

pounds) of copper.

- Gold production from the CSH Mine

increased by 18% to 39,875 ounces from 33,880 ounces for the same

period in 2018.

- The total production cost of gold

for the three months ended June 30, 2019 increased to US$1,329 per

ounce compared to US$1,097 for the three month 2018 period. The

increase in production cost is attributed to the difference between

recoverable gold placed on pad which increased by approximately

112% and gold production which increased by 18% for the three

months ended June 30, 2019. As the CSH Mine uses a heap leaching

(leach pad) process, there are periods in which there is a timing

difference in the volume of ore mined and placed on pad compared to

volume of gold production. On average, the heap leaching process

will take several years from when the ore is first mined and placed

on pad until the point of gold production. Higher volumes of gold

production also contributed to approximately a 33% increase in

amortization of mine development costs. The cash production cost of

gold for the three months ended June 30, 2019 remained consistent

compared with the same period in 2018.

|

|

|

|

CSH Mine |

Three months ended June 30, |

|

|

2019 |

2018 |

|

Total production cost (US$ per ounce) |

1,329 |

1,097 |

|

Cash production cost(1) (US$ per ounce) |

805 |

806 |

|

(1) Non-IFRS measure. |

|

|

- Copper production from the Jiama

Mine increased by 17% to 16,126 tonnes (approximately 35.6 million

pounds) from 13,738 tonnes (approximately 30.3 million pounds) and

gold produced was 15,628 ounces compared to 20,497 ounces for the

same period in 2018.

- In the second quarter of 2019, both

total production cost of copper per pound after by-products and

cash production cost of copper per pound after by-product increased

as compared to the same period in 2018 due to lower grades of ores

produced from the use of open-pit mine. The Jiama Mine is currently

developing a new section of the underground mine which is expected

to have higher grade ore, with anticipated completion by the end of

2020.

|

|

|

|

Jiama Mine |

Three months ended June 30, |

|

|

2019 |

2018 |

|

Total production cost(1) (US$) of copper per pound after

by-products credits(2) |

2.39 |

2.07 |

|

Cash production cost(3) (US$) of copper per pound after by-products

credits(2) |

1.70 |

1.37 |

|

(1) Production costs include expenditures incurred at the mine

sites for the activities related to production including mining,

processing, mine site G&A and royalties

etc.(2) By-products credit refers to the sales of gold and

silver during the corresponding period.(3) Non-IFRS

measure. |

|

|

Selected Production and Financial

Highlights: First Half 2019 Compared to First Half

2018

- Revenue increased by 24% to

US$308.8 million from US$248.8 million for the same period in

2018.

- Mine operating earnings decreased

by 47% to US$22.6 million from US$42.3 million for the same period

in 2018.

- Net loss after taxes of US$27.5

million, a decrease by US$29.9 million from a net income of US$2.4

million for the same period in 2018.

- The Company’s total production was

99,527 ounces of gold and 30,959 tonnes (approximately 68.3 million

pounds) of copper.

- Gold production from the CSH Mine

decreased to 68,502 ounces from 69,922 ounces for the same period

in 2018.

- Copper production from the Jiama

Mine increased to 30,959 tonnes (approximately 68.3 million pounds)

from 20,799 tonnes (approximately 45.9 million pounds) for the same

period in 2018. Gold produced was 31,025 ounces compared to

30,720ounces for the same period in 2018.

Mr. Liangyou Jiang, the CEO and Executive

Director of the Company, stated, “We delivered a quarter with

really strong operating cash flow sufficient to cover the next

twelve months. We are making considerable efforts to position

ourselves and adapt to the current market conditions and the

opportunities ahead of us.”

Analysts, investors, media and general public

are encouraged to visit the Company’s website at

www.chinagoldintl.com, The Stock Exchange of Hong Kong Limited’s

website at www.hkex.com.hk or SEDAR at www.sedar.com to view

the complete set of the financial statements and MD&A or

contact the Company with any questions.

About China Gold International

ResourcesChina Gold International Resources Corp. Ltd. is

based in Vancouver, BC, Canada and operates both profitable and

growing mines, the CSH Gold Mine in Inner Mongolia, and the Jiama

Copper-Polymetallic Mine in Tibet Autonomous Region of the People’s

Republic of China. The Company’s objective is to continue to build

shareholder value by growing production at its current mining

operations, expanding its resource base, and aggressively acquiring

and developing new projects internationally. The Company is listed

on the Toronto Stock Exchange (TSX: CGG) and the Main Board of The

Stock Exchange of Hong Kong Limited (HKEx: 2099).

For further information on the Company, please

refer to its SEDAR profile at www.sedar.com or: Telephone:

604-609-0598, Email: info@chinagoldintl.com, Website:

www.chinagoldintl.com.

Cautionary Note About Forward-Looking

StatementsCertain information regarding China Gold

International Resources contained herein may constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Although China

Gold International Resources believes that the expectations

reflected in such forward-looking statements are reasonable, it can

give no assurance that such expectations will prove to have been

correct. China Gold International Resources cautions that actual

performance will be affected by a number of factors, most of which

are beyond its control, and that future events and results may vary

substantially from what China Gold International Resources

currently foresees. Factors that could cause actual results to

differ materially from those in forward-looking statements include

market prices, exploitation and exploration results, continued

availability of capital and financing and general economic, market

or business conditions. The forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

The information contained herein is stated as of the current date

and subject to change after that date.

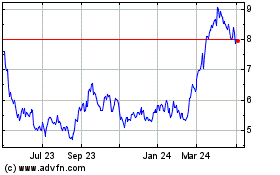

China Gold International... (TSX:CGG)

Historical Stock Chart

From Nov 2024 to Dec 2024

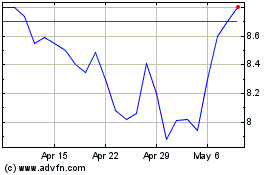

China Gold International... (TSX:CGG)

Historical Stock Chart

From Dec 2023 to Dec 2024