Cardinal Energy Ltd. Announces Notice of Redemption of 8.00% Convertible Debentures

February 04 2021 - 7:26PM

Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX: CJ; CJ.DB.A) is pleased to

announce that it is issuing a notice of redemption to holders of

its currently outstanding $28,207,000 8.00% Convertible Unsecured

Subordinated Debentures due December 31, 2022 (the

"

Debentures"). The Debentures are not subject to a

pre-payment penalty.

As set out in the notice of redemption, Cardinal

will redeem, as of March 11, 2021 ("Redemption

Date"), all of the aggregate principal amount of the

Debentures for cash. On the Redemption Date, Cardinal will pay the

aggregate principal amount of the Debentures (being $1,000 for each

Debenture) plus all accrued and unpaid interest thereon to but

excluding the Redemption Date (less any tax required to be

deducted) (collectively, the "Redemption Price").

The Debentures are listed on the Toronto Stock Exchange (the

"TSX") under the symbol "CJ.DB.A" (CUSIP

14150GAB9).

Holders of the Debentures have the right to

convert their Debentures, at their option, into common shares of

Cardinal ("Cardinal Shares") at a conversion price

of $1.25 per Cardinal Share at any time prior 5:00 p.m. Toronto

time on March 10, 2021. A holder electing to convert the principal

amount of their Debentures will receive approximately 800 Cardinal

Shares per $1,000 principal amount of Debentures converted plus a

cash payment for accrued unpaid interest up to, but excluding, the

date of conversion (less any tax required to be deducted). No

fractional shares will be issued on conversion but, in lieu

thereof, the Company will pay the cash equivalent thereof

determined on the basis of the Current Market Price (as defined in

the Indenture governing the Debentures) of the Cardinal Shares on

the date of conversion. As all of the Debentures were issued in

"book-entry only" form and are held by CDS Clearing and Depository

Services Inc., beneficial holders of Debentures must contact their

broker, dealer, bank, trust company or other nominee to exercise

their right to convert their Debentures.

The redemption of the Debentures will be funded

in whole or in part through the issuance of up to $26,884,423

principal amount of unsecured subordinated non-convertible notes

(the "Notes") which will be issued at a 0.5%

discount to the face value based on the maximum financing size for

total maximum net proceeds of up to $26,750,000 (the

"Redemption Financing"). The amount of Notes to be

issued will be dependent on the actual principal amount of

Debentures outstanding on the Redemption Date, after giving effect

to conversions, if any, occurring prior to the Redemption Date. The

Notes will bear interest at 8% per annum from funding until

September 30, 2021, and increasing to 9% per annum on October 1,

2021, to 10% per annum on April 1, 2022 and to 12% per annum on

September 30, 2022 (all interest will accrue quarterly in arrears

and be payable on the first business day following the last day of

each fiscal quarter). The Notes will not be subject to a

pre-payment penalty except in the case of a change of control. The

closing of the Redemption Financing is expected to occur on or

about the Redemption Date, and is subject to the approval of the

TSX and certain other funding conditions.

The Redemption Financing is being provided

solely by certain insiders (or companies controlled by them) of the

Company, some of whom also hold an aggregate of $720,000 principal

amount of Debentures. Insider participation in the Redemption

Financing will be "related party transactions" within the meaning

of Multilateral Instrument 61-101 - Protection of Minority Security

Holders in a Special Transaction ("MI 61-101").

The Redemption Financing is not subject to the formal valuation

requirements of MI 61-101 and is exempt from the minority approval

requirements pursuant to sections 5.7(1)(a) and (f) of MI

61-101.

Forward Looking Information

Certain statements contained in this press

release constitute forward-looking information including, without

limitation, anticipated timing of the Redemption Date, anticipated

completion of the Redemption Financing on the terms and timing

contemplated and the amount of and anticipated use of proceeds. The

use of any of the words "anticipate", "continue", "expect",

"intend", "may", "will", "project", "should", "believe" and

"confident" and similar expressions are intended to identify

forward-looking information. These statements involve known and

unknown risks, uncertainties and other factors including the risk

that the conditions to closing will not be satisfied and that that

closing will not occur which may cause actual results or events to

differ materially from those anticipated in such forward-looking

information.

Cardinal believes that the expectations

reflected in such forward-looking information are reasonable but no

assurance can be given that these expectations will prove to be

correct and such forward-looking information included in this press

release should not be unduly relied upon. These statements speak

only as of the date of this press release. Cardinal undertakes no

obligation to publicly update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as expressly required by applicable securities

laws.

About Cardinal Energy Ltd.

One of Cardinal's goals is to continually

improve our Environmental, Safety and Governance mandate and

operate our assets in a responsible and environmentally sensitive

manner. As part of this mandate, Cardinal injects and conserves

more carbon than it emits making us one of the few Canadian energy

companies to have a negative carbon footprint.

Cardinal is a Canadian oil focused company with

operations focused on low decline light, medium and heavy quality

oil in Western Canada.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.ca Phone: (403) 234-8681

Website: www.cardinalenergy.ca

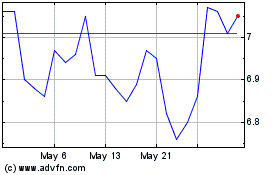

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

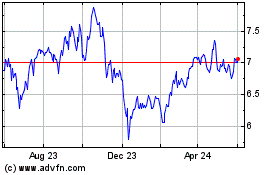

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jan 2024 to Jan 2025