Computer Modelling Group Ltd. (“CMG” or the “Company”) is pleased

to announce its financial results for the fiscal year ended March

31, 2019.

| ANNUAL

PERFORMANCE |

|

|

|

|

($ thousands, unless otherwise stated) |

March 31, 2019 |

|

March 31, 2018 (1) |

|

March 31, 2017 (1) |

|

| |

|

|

|

| Annuity/maintenance licenses |

63,800 |

|

64,679 |

|

65,263 |

|

| Perpetual

licenses |

5,000 |

|

4,164 |

|

4,971 |

|

| Software licenses |

68,800 |

|

68,843 |

|

70,234 |

|

| Professional

services |

6,057 |

|

5,837 |

|

4,863 |

|

| Total revenue |

74,857 |

|

74,680 |

|

75,097 |

|

| Operating profit |

29,554 |

|

28,030 |

|

33,321 |

|

| Operating profit (%) |

39 |

% |

38 |

% |

44 |

% |

| Net income for the year |

22,135 |

|

20,806 |

|

24,269 |

|

| EBITDA(2) |

31,507 |

|

30,027 |

|

34,414 |

|

| Cash dividends declared and paid |

32,090 |

|

32,041 |

|

31,697 |

|

| Funds flow from operations (3) |

25,593 |

|

25,503 |

|

27,560 |

|

| Total assets |

90,305 |

|

97,990 |

|

106,725 |

|

| Total shares outstanding |

80,227 |

|

80,215 |

|

79,482 |

|

| Trading price per share at March 31 |

6.15 |

|

9.29 |

|

10.35 |

|

| Market capitalization

at March 31 |

493,396 |

|

745,194 |

|

822,634 |

|

| Per share amounts - ($/share) |

|

|

|

| Earnings per share - basic |

0.28 |

|

0.26 |

|

0.31 |

|

| Earnings per share - diluted |

0.28 |

|

0.26 |

|

0.31 |

|

| Cash dividends declared and paid |

0.40 |

|

0.40 |

|

0.40 |

|

| Funds flow from

operations per share - basic (3) |

0.32 |

|

0.32 |

|

0.35 |

|

(1) On April 1, 2018, the Company adopted IFRS 15 Revenue from

Contracts with Customers using the cumulative effect method, by

recognizing the cumulative effect of initially applying IFRS 15 as

an adjustment to the opening balance of equity at April 1, 2018.

Accordingly, comparative information is not restated and continues

to be reported under the previous standard(2) EBITDA is defined as

net income before adjusting for depreciation expense, finance

income, finance costs, and income and other taxes. See “Non-IFRS

Financial Measures”.(3) Funds flow from operations is a non-IFRS

financial measure that represents net income adjusted for

depreciation expense, non-cash stock-based compensation expense and

deferred tax expense (recovery). See “Non-IFRS Financial

Measures”.

| Quarterly

Performance |

Fiscal 2018 |

|

|

Fiscal 2019 |

| ($

thousands, unless otherwise stated) |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

| |

|

|

|

|

|

|

|

|

|

Annuity/maintenance licenses |

16,516 |

16,341 |

16,158 |

15,664 |

14,715 |

15,111 |

17,240 |

16,734 |

| Perpetual

licenses |

1,078 |

290 |

743 |

2,053 |

326 |

1,172 |

611 |

2,891 |

|

Software licenses |

17,594 |

16,631 |

16,901 |

17,717 |

15,041 |

16,283 |

17,851 |

19,625 |

|

Professional services |

1,392 |

1,350 |

1,418 |

1,677 |

1,664 |

1,658 |

1,222 |

1,513 |

| Total

revenue |

18,986 |

17,981 |

18,319 |

19,394 |

16,705 |

17,941 |

19,073 |

21,138 |

| Operating

profit |

6,978 |

6,615 |

6,908 |

7,529 |

5,374 |

7,024 |

8,406 |

8,750 |

| Operating profit (%) |

37 |

37 |

38 |

39 |

32 |

39 |

44 |

41 |

| Profit before income and other taxes |

6,930 |

6,253 |

7,151 |

8,547 |

5,980 |

7,104 |

9,406 |

8,400 |

| Income and other taxes |

1,973 |

1,647 |

2,054 |

2,401 |

1,722 |

2,048 |

2,559 |

2,426 |

| Net income for the period |

4,957 |

4,606 |

5,097 |

6,146 |

4,258 |

5,056 |

6,847 |

5,974 |

| EBITDA |

7,447 |

7,090 |

7,400 |

8,090 |

5,837 |

7,505 |

8,915 |

9,250 |

| Cash dividends declared and paid |

7,977 |

8,021 |

8,022 |

8,021 |

8,021 |

8,024 |

8,022 |

8,023 |

| Funds flow from

operations |

6,205 |

5,788 |

6,225 |

7,285 |

5,242 |

5,777 |

7,550 |

7,024 |

| Per share amounts - ($/share) |

|

|

|

|

|

|

|

|

| Earnings per share - basic |

0.06 |

0.06 |

0.06 |

0.08 |

0.05 |

0.06 |

0.09 |

0.07 |

| Earnings per share - diluted |

0.06 |

0.06 |

0.06 |

0.08 |

0.05 |

0.06 |

0.09 |

0.07 |

| Cash dividends declared and paid |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

| Funds flow from

operations per share - basic |

0.08 |

0.07 |

0.08 |

0.09 |

0.07 |

0.07 |

0.09 |

0.09 |

Highlights

During the year ended March 31, 2019, as compared to the

previous fiscal year, CMG’s:

- Net income increased by 6% and basic earnings per share

increased by 8%;

- Total revenue remained consistent;

- Perpetual license revenue grew by 20%;

- Total operating expenses decreased by 3%.

During the year ended March 31, 2019, CMG:

- Achieved EBITDA of 42% of total revenue;

- Realized basic earnings per share of $0.28;

- Generated funds flow from operations of $0.32 per share;

- Declared and paid a regular dividend of $0.40 per share.

Revenue

| Three months

ended March 31, |

2019 |

|

2018 |

|

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Software license revenue |

19,625 |

|

17,717 |

|

1,908 |

|

11 |

% |

| Professional services |

1,513 |

|

1,677 |

|

(164 |

) |

-10 |

% |

|

Total revenue |

21,138 |

|

19,394 |

|

1,744 |

|

9 |

% |

| |

|

|

|

|

| Software license revenue - % of total revenue |

93 |

% |

91 |

% |

|

|

| Professional services

- % of total revenue |

7 |

% |

9 |

% |

|

|

| Year ended

March 31, |

2019 |

|

2018 |

|

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Software license revenue |

68,800 |

|

68,843 |

|

(43 |

) |

0 |

% |

| Professional services |

6,057 |

|

5,837 |

|

220 |

|

4 |

% |

|

Total revenue |

74,857 |

|

74,680 |

|

177 |

|

0 |

% |

| |

|

|

|

|

| Software license revenue - % of total revenue |

92 |

% |

92 |

% |

|

|

| Professional services

- % of total revenue |

8 |

% |

8 |

% |

|

|

CMG’s revenue is comprised of software license sales, which

provide the majority of the Company’s revenue, and fees for

professional services.

Total revenue for the three months ended March 31, 2019

increased by 9%, compared to the same period of the previous fiscal

year, mainly due to an increase in software license revenue. Total

revenue for the year ended March 31, 2019 remained consistent with

the previous fiscal year.

Software License Revenue

| Three months

ended March 31, |

2019 |

|

2018 |

|

$ change |

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Annuity/maintenance license revenue |

16,734 |

|

15,664 |

|

1,070 |

7 |

% |

| Perpetual license revenue |

2,891 |

|

2,053 |

|

838 |

41 |

% |

|

Total software license revenue |

19,625 |

|

17,717 |

|

1,908 |

11 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of total software license

revenue |

85 |

% |

88 |

% |

|

|

| Perpetual as a % of

total software license revenue |

15 |

% |

12 |

% |

|

|

| Year ended

March 31, |

2019 |

|

2018 |

|

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Annuity/maintenance license revenue |

63,800 |

|

64,679 |

|

(879 |

) |

-1 |

% |

| Perpetual license revenue |

5,000 |

|

4,164 |

|

836 |

|

20 |

% |

|

Total software license revenue |

68,800 |

|

68,843 |

|

(43 |

) |

0 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of total software license

revenue |

93 |

% |

94 |

% |

|

|

| Perpetual as a % of

total software license revenue |

7 |

% |

6 |

% |

|

|

Total software license revenue for the three months ended March

31, 2019 increased by 11% compared the same period of the previous

fiscal year, due to increases in both annuity/maintenance license

revenue and perpetual license revenue. Total software license

revenue for the year ended March 31, 2019 remained consistent with

the previous fiscal year, as an increase in perpetual licenses

revenue was offset by a decrease in annuity/maintenance license

revenue.

CMG’s annuity/maintenance license revenue increased by 7% during

the three months ended March 31, 2019, compared to the same period

of the previous fiscal year, primarily due to maintenance

reactivation and increased licensing by a customer in the Eastern

Hemisphere.

CMG’s annuity/maintenance license revenue decreased by 1% during

the year ended March 31, 2019, compared to the previous fiscal

year, mainly due to lower licensing in Canada and South America,

partially offset by increases in the Eastern Hemisphere and the

United States.

Perpetual license revenue increased by 41% for the three months

ended March 31, 2019, compared to the same period of the previous

fiscal year, due to increases in the United States and the Eastern

Hemisphere. On an annual basis, more perpetual sales were realized

in most geographic areas, with the exception of South America,

which resulted in a 20% increase in perpetual license revenue,

compared to the previous fiscal year. Software licensing under

perpetual sales may fluctuate significantly between periods due to

the uncertainty associated with the timing and the location where

sales are generated. For this reason, even though we expect to

achieve a certain level of aggregate perpetual sales on an annual

basis, we expect to observe fluctuations in the quarterly perpetual

revenue amounts throughout the fiscal year.

Software Revenue by Geographic Segment

|

Three months ended March 31, |

2019 |

2018 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

| Annuity/maintenance

license revenue |

|

|

|

|

| Canada |

3,725 |

3,748 |

(23 |

) |

-1 |

% |

| United States |

4,664 |

4,565 |

99 |

|

2 |

% |

| South America |

1,924 |

2,142 |

(218 |

) |

-10 |

% |

| Eastern

Hemisphere(1) |

6,421 |

5,209 |

1,212 |

|

23 |

% |

|

|

16,734 |

15,664 |

1,070 |

|

7 |

% |

| Perpetual license

revenue |

|

|

|

|

| Canada |

- |

- |

- |

|

0 |

% |

| United States |

582 |

107 |

475 |

|

444 |

% |

| South America |

- |

- |

- |

|

0 |

% |

| Eastern Hemisphere |

2,309 |

1,946 |

363 |

|

19 |

% |

|

|

2,891 |

2,053 |

838 |

|

41 |

% |

| Total software license

revenue |

|

|

|

|

| Canada |

3,725 |

3,748 |

(23 |

) |

-1 |

% |

| United States |

5,246 |

4,672 |

574 |

|

12 |

% |

| South America |

1,924 |

2,142 |

(218 |

) |

-10 |

% |

| Eastern Hemisphere |

8,730 |

7,155 |

1,575 |

|

22 |

% |

|

|

19,625 |

17,717 |

1,908 |

|

11 |

% |

|

|

| Year ended March 31, |

2019 |

2018 |

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

| Annuity/maintenance

license revenue |

|

|

|

|

| Canada |

15,151 |

16,754 |

(1,603 |

) |

-10 |

% |

| United States |

18,620 |

18,519 |

101 |

|

1 |

% |

| South America |

8,734 |

9,009 |

(275 |

) |

-3 |

% |

|

Eastern Hemisphere(1) |

21,295 |

20,397 |

898 |

|

4 |

% |

|

|

63,800 |

64,679 |

(879 |

) |

-1 |

% |

| Perpetual license

revenue |

|

|

|

|

| Canada |

156 |

- |

156 |

|

100 |

% |

| United States |

1,096 |

262 |

834 |

|

318 |

% |

| South America |

6 |

394 |

(388 |

) |

-98 |

% |

|

Eastern Hemisphere |

3,742 |

3,508 |

234 |

|

7 |

% |

|

|

5,000 |

4,164 |

836 |

|

20 |

% |

| Total software license

revenue |

|

|

|

|

| Canada |

15,307 |

16,754 |

(1,447 |

) |

-9 |

% |

| United States |

19,716 |

18,781 |

935 |

|

5 |

% |

| South America |

8,740 |

9,403 |

(663 |

) |

-7 |

% |

|

Eastern Hemisphere |

25,037 |

23,905 |

1,132 |

|

5 |

% |

|

|

68,800 |

68,843 |

(43 |

) |

0 |

% |

(1) Includes Europe, Africa, Asia and Australia.

During the three months ended March 31, 2019, on a geographic

basis, total software license revenue increased in the United

States and the Eastern Hemisphere, partially offset by decreases in

South America.

During the year ended March 31, 2019, on a geographic basis,

total software license sales remained flat, as increases in the

United States and the Eastern Hemisphere were offset by decreases

in Canada and South America.

The Canadian market (representing 22% of total annual software

license revenue) remained relatively flat for the three months

ended March 31, 2019, compared to the same period of the previous

fiscal year, representing the first consistent quarter-over-quarter

comparison since fiscal 2015. Canada experienced a decrease of 10%

in annuity/maintenance license revenue during the year ended March

31, 2019, compared to the previous fiscal year, due to reduction in

licensing by some customers. There were no significant perpetual

sales realized in Canada during the three months and year ended

March 31, 2019 or in the comparative periods.

The United States market (representing 29% of total annual

software license revenue) experienced increases of 2% and 1% in

annuity/maintenance license revenue during the three months and

year ended March 31, 2019, respectively, compared to the same

periods of the previous fiscal year, due to increased licensing by

new and existing customers involved in unconventional shale and

tight hydrocarbon recovery processes. The increase in

annuity/maintenance license revenue for the year was partially

offset by the negative impact of IFRS 15 adoption. There were more

perpetual sales realized in the three months and year ended March

31, 2019, compared to the same periods of the previous fiscal year,

primarily contributing to the growth in total U.S. software license

revenue.

South America (representing 13% of total annual software license

revenue) experienced decreases of 10% and 3% in annuity/maintenance

license revenue during the three months and year ended March 31,

2019, compared to the same periods of the previous fiscal year, due

to maintenance reactivation on perpetual licenses included in the

comparative periods. Our revenue in South America can be

significantly impacted by the variability of the amounts recorded

from a long-standing customer and its affiliates for whom revenue

is recognized only when cash is received. We recognized similar

amounts of revenue from this customer in the years ended March 31,

2019 and 2018. There were no significant perpetual license sales in

South America during fiscal 2019.

The Eastern Hemisphere (representing 36% of total annual

software license revenue) experienced increases of 23% and 4% in

annuity/maintenance license revenue during the three months and

year ended March 31, 2019, respectively, compared to the same

periods of the previous fiscal year, mainly due to maintenance

reactivation and increased licensing by a customer in the Middle

East. Eastern Hemisphere perpetual revenue for the three months and

year ended March 31, 2019 was higher by 19% and 7%, respectively,

compared the same periods of the previous fiscal year.

Deferred Revenue

| |

|

Fiscal |

|

Fiscal |

|

|

|

|

|

|

2019 |

|

2018 |

|

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

|

|

|

| Deferred revenue at: |

|

|

|

|

|

|

|

| Q1 (June 30) |

|

29,350 |

(4) |

31,551 |

(1) |

(2,201 |

) |

-7 |

% |

| Q2 (September 30) |

|

23,222 |

(5) |

23,686 |

(2) |

(464 |

) |

-2 |

% |

| Q3 (December 31) |

|

13,782 |

|

17,785 |

|

(4,003 |

) |

-23 |

% |

| Q4 (March 31) |

|

35,015 |

(6) |

34,362 |

(3) |

653 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

(1) Includes current deferred revenue of $30.3 million and

long-term deferred revenue of $1.3 million.(2) Includes current

deferred revenue of $23.0 million and long-term deferred revenue of

$0.6 million.(3) Includes current deferred revenue of $33.4 million

and long-term deferred revenue of $1.0 million.(4) Includes current

deferred revenue of $28.8 million and long-term deferred revenue of

$0.6 million.(5) Includes current deferred revenue of $22.9 million

and long-term deferred revenue of $0.3 million.(6) Includes current

deferred revenue of $34.7 million and long-term deferred revenue of

$0.3 million.

CMG’s deferred revenue consists primarily of amounts for

pre-sold licenses. Our annuity/maintenance revenue is deferred and

recognized on a straight-line basis or according to usage over the

life of the related license period, which is generally one year or

less. Amounts are deferred for licenses that have been provided and

revenue recognition reflects the passage of time.

The above table illustrates the normal trend in the deferred

revenue balance from the beginning of the calendar year (which

corresponds with Q4 of our fiscal year), when most renewals occur,

to the end of the calendar year (which corresponds with Q3 of our

fiscal year). Our fourth quarter corresponds with the beginning of

the fiscal year for most oil and gas companies, representing a time

when they enter a new budget year and sign/renew their

contracts.

Deferred revenue as at Q4 of fiscal 2019 increased by 2%

compared to Q4 of fiscal 2018, primarily due to increased licensing

in the Eastern Hemisphere.

Expenses

| Three months

ended March 31, |

2019 |

2018 |

$ change |

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Sales, marketing and professional services |

5,216 |

5,068 |

148 |

3 |

% |

| Research and development |

5,280 |

5,171 |

109 |

2 |

% |

| General and administrative |

1,892 |

1,626 |

266 |

16 |

% |

|

Total operating expenses |

12,388 |

11,865 |

523 |

4 |

% |

| |

|

|

|

|

| Direct employee costs(1) |

9,237 |

8,877 |

360 |

4 |

% |

| Other corporate costs |

3,151 |

2,988 |

163 |

5 |

% |

|

|

12,388 |

11,865 |

523 |

4 |

% |

| Year ended

March 31, |

2019 |

2018 |

$ change |

|

% change |

|

| ($ thousands) |

|

|

|

|

| |

|

|

|

|

| Sales, marketing and professional services |

18,690 |

19,535 |

(845 |

) |

-4 |

% |

| Research and development |

19,893 |

20,371 |

(478 |

) |

-2 |

% |

| General and administrative |

6,720 |

6,744 |

(24 |

) |

0 |

% |

|

Total operating expenses |

45,303 |

46,650 |

(1,347 |

) |

-3 |

% |

| |

|

|

|

|

| Direct employee costs(1) |

33,481 |

33,959 |

(478 |

) |

-1 |

% |

| Other corporate costs |

11,822 |

12,691 |

(869 |

) |

-7 |

% |

|

|

45,303 |

46,650 |

(1,347 |

) |

-3 |

% |

(1) Includes salaries, bonuses, stock-based compensation,

benefits, commissions, and professional development. See “Non-IFRS

Financial Measures”.

CMG’s total operating expenses increased by 4% for the three

months ended March 31, 2019, compared to the same period of the

previous fiscal year, due to increases in both direct employee

costs and other corporate costs. CMG’s total operating expenses

decreased by 3% for the year ended March 31, 2019, compared to the

previous fiscal year, due to decreases in both direct employee

costs and other corporate costs.

Direct employee costs increased by 4% during the three months

ended March 31, 2019, compared to the same period of the previous

fiscal year, due to higher commissions and a bonus adjustment as a

result of higher billings and revenue achievement during the

quarter. Direct employee costs decreased by 1% during the year

ended March 31, 2019, compared to the previous fiscal year, due to

lower stock-based compensation and a lower headcount during the

year. Other corporate costs increased by 5% during the three months

ended March 31, 2019, compared to the same period of the previous

fiscal year, mainly as a result of increased travel for customer

visits and contract negotiation and a strengthening of the US

dollar compared to the Canadian dollar. Other corporate costs

decreased by 7% during the year ended March 31, 2019, compared to

the same period of the previous fiscal year, mainly because the

comparative year included $0.6 million of non-recurring charges

related to the head office move, which were incurred in the first

quarter of the year.

Outlook

As we exit fiscal 2019, we are very pleased with the financial

performance achieved in the last quarter of the year. During the

fourth quarter, annuity and maintenance revenue increased by 7%,

mainly due to an increase in the Eastern Hemisphere, while

perpetual license sales grew by 41% as a result of increases in

both the United States and the Eastern Hemisphere.

Supported by the strong fourth quarter revenue growth, we

achieved increases in operating profit and EBITDA of 16% and 14%,

respectively, compared to the fourth quarter of the previous fiscal

year.

Our total software revenue for fiscal 2019 remained consistent

with the previous fiscal year as a decrease in annuity and

maintenance revenue was offset by an increase in perpetual sales.

We are very pleased to have achieved $5.0 million in perpetual

sales during fiscal 2019, which represents an increase of 20% over

the previous year.

Annuity and maintenance revenue decreased by 1% during the year,

mainly due to decreased licensing in Canada, as the Canadian oil

and gas industry continued to be under pressure. We are, however,

encouraged by fourth quarter Canadian annuity and maintenance

revenue, which was consistent with the fourth quarter of last year.

The United States region continued to benefit from strong activity

by unconventional customers during fiscal 2019; however, the

revenue growth in that region was partially offset by the negative

impact of adopting the new revenue recognition accounting standard

and the movement in the CAD/USD exchange rate. While South America

saw a slight decrease in annuity and maintenance revenue during

fiscal 2019, the Eastern Hemisphere grew by 5%, mainly due to

revenue growth experienced in the fourth quarter. Another positive

indicator was a 2% increase in deferred revenue as we exited the

year.

Operating expenses decreased by 3% during fiscal 2019.

During fiscal 2019, we maintained strong profitability with

operating profit of 39% of revenue and EBITDA of 42% of revenue,

demonstrating the resilience of our business model and the value of

our products even in the difficult operating environment faced by

the oil and gas sector. One of the notable accomplishments during

the fiscal year was the closing of our first commercial contract

for CoFlow, our newest product, in February for use on an onshore

asset, which was followed by two more contracts, signed in March

and April, with two new customers for short-term use of CoFlow on

specific projects.

We continued to maintain a strong balance sheet and closed the

year with $54.3 million of cash in our bank account and no debt. We

further demonstrated a solid liquidity position by maintaining

annual funds flow from operations at the same level as in the

previous fiscal year, at $0.32 per share.

During fiscal 2019, we paid dividends of $0.40 per share. CMG’s

Board of Directors declared a quarterly dividend of $0.10 per share

to be paid on June 14, 2019, representing the 50th successive

quarter of dividend payments.

For further details on the results, please refer to CMG’s

Management Discussion and Analysis and Consolidated Financial

Statements, which are available on SEDAR at www.sedar.com or on

CMG’s website at www.cmgl.ca.

Non-IFRS Financial

Measures

This press release includes certain measures that have not been

prepared in accordance with IFRS, such as “EBITDA”, “direct

employee costs”, “other corporate costs” and “funds flow from

operations”. Since these measures do not have a standard meaning

prescribed by IFRS, they are unlikely to be comparable to similar

measures presented by other issuers. Management believes that these

indicators nevertheless provide useful measures in evaluating the

Company’s performance.

“Direct employee costs” include salaries, bonuses, stock-based

compensation, benefits, commission expenses, and professional

development. “Other corporate costs” include facility-related

expenses, corporate reporting, professional services, marketing and

promotion, computer expenses, travel, and other office-related

expenses. Direct employee costs and other corporate costs should

not be considered an alternative to total operating expenses as

determined in accordance with IFRS. People-related costs represent

the Company’s largest area of expenditure; hence, management

considers highlighting separately corporate and people-related

costs to be important in evaluating the quantitative impact of cost

management of these two major expenditure pools. See “Expenses”

heading for a reconciliation of direct employee costs and other

corporate costs to total operating expenses.

“EBITDA” refers to net income before adjusting for depreciation

expense, finance income, finance costs, and income and other taxes.

EBITDA should not be construed as an alternative to net income as

determined by IFRS. The Company believes that EBITDA is useful

supplemental information as it provides an indication of the

results generated by the Company’s main business activities prior

to consideration of how those activities are amortized, financed or

taxed.

“Funds flow from operations” is a non-IFRS financial measure

that represents net income adjusted for certain non-cash items,

such as depreciation expense, stock-based compensation expense,

deferred tax expense (recovery) and deferred rent. The Company

considers funds flow from operations a useful measure as it

represents the cash generated during the period, regardless of the

timing of collection of receivables and payment of payables, and

demonstrates the Company’s ability to generate the cash flow

necessary to fund future growth and dividend payments. Funds flow

from operations may not be comparable to similar measures presented

by other companies.

Forward-looking

Information

Certain information included in this press release is

forward-looking. Forward-looking information includes statements

that are not statements of historical fact and which address

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things

as investment objectives and strategy, the development plans and

status of the Company’s software development projects, the

Company’s intentions, results of operations, levels of activity,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), business prospects and

opportunities, research and development timetable, and future

growth and performance. When used in this press release, statements

to the effect that the Company or its management “believes”,

“expects”, “expected”, “plans”, “may”, “will”, “projects”,

“anticipates”, “estimates”, “would”, “could”, “should”,

“endeavours”, “seeks”, “predicts” or “intends” or similar

statements, including “potential”, “opportunity”, “target” or other

variations thereof that are not statements of historical fact

should be construed as forward-looking information. These

statements reflect management’s current beliefs with respect to

future events and are based on information currently available to

management of the Company. The Company believes that the

expectations reflected in such forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking information

should not be unduly relied upon.

Corporate Profile

CMG is a computer software technology company serving the oil

and gas industry. The Company is a leading supplier of advanced

process reservoir modelling software with a blue chip customer base

of international oil companies and technology centers in

approximately 60 countries. The Company also provides professional

services consisting of highly specialized support, consulting,

training, and contract research activities. CMG has sales and

technical support services based in Calgary, Houston, London,

Dubai, Bogota and Kuala Lumpur. CMG’s Common Shares are listed on

the Toronto Stock Exchange (“TSX”) and trade under the symbol

“CMG”.

Consolidated Statements of Financial

Position

|

(thousands of Canadian $) |

March 31, 2019 |

|

March 31, 2018* |

|

| |

|

|

| Assets |

|

|

| Current assets: |

|

|

|

Cash |

54,290 |

|

63,719 |

|

|

Trade and other receivables |

19,220 |

|

16,272 |

|

|

Prepaid expenses |

1,332 |

|

1,415 |

|

|

Prepaid income taxes |

367 |

|

- |

|

|

|

75,209 |

|

81,406 |

|

| Property and equipment |

14,501 |

|

16,062 |

|

| Deferred tax asset |

595 |

|

522 |

|

|

Total assets |

90,305 |

|

97,990 |

|

| |

|

|

| Liabilities and

shareholders’ equity |

|

|

| Current liabilities: |

|

|

|

Trade payables and accrued liabilities |

6,162 |

|

6,550 |

|

|

Income taxes payable |

60 |

|

126 |

|

|

Deferred revenue |

34,653 |

|

33,360 |

|

|

|

40,875 |

|

40,036 |

|

| Deferred revenue |

362 |

|

1,002 |

|

| Deferred rent liability |

1,813 |

|

1,388 |

|

|

Total liabilities |

43,050 |

|

42,426 |

|

| |

|

|

| Shareholders’ equity: |

|

|

|

Share capital |

79,711 |

|

79,598 |

|

|

Contributed surplus |

12,808 |

|

11,775 |

|

|

Deficit |

(45,264 |

) |

(35,809 |

) |

|

Total shareholders' equity |

47,255 |

|

55,564 |

|

| Total liabilities and

shareholders' equity |

90,305 |

|

97,990 |

|

|

|

|

|

Consolidated Statements of Operations

and Comprehensive Income

|

Years ended March 31,(thousands of Canadian $ except per share

amounts) |

2019 |

2018* |

|

|

|

|

|

|

Revenue |

74,857 |

74,680 |

|

|

|

|

|

| Operating

expenses |

|

|

| Sales, marketing and

professional services |

18,690 |

19,535 |

|

| Research and

development |

19,893 |

20,371 |

|

| General and

administrative |

6,720 |

6,744 |

|

|

|

45,303 |

46,650 |

|

| Operating

profit |

29,554 |

28,030 |

|

|

|

|

|

| Finance income |

1,336 |

905 |

|

| Finance costs |

- |

(54 |

) |

|

Profit before income and other taxes |

30,890 |

28,881 |

|

|

Income and other taxes |

8,755 |

8,075 |

|

|

|

|

|

|

Net and total comprehensive income |

22,135 |

20,806 |

|

|

|

|

|

| Earnings Per

Share |

|

|

| Basic |

0.28 |

0.26 |

|

|

Diluted |

0.28 |

0.26 |

|

|

|

|

|

Consolidated Statements of Cash Flows

|

Years ended March 31,(thousands of Canadian $) |

|

|

2019 |

|

2018 |

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

| Net income |

|

|

22,135 |

|

20,806 |

|

| Adjustments for: |

|

|

|

|

| Depreciation |

|

|

1,953 |

|

1,997 |

|

| Income and other taxes |

|

|

8,755 |

|

8,075 |

|

| Stock-based compensation |

|

|

1,154 |

|

2,087 |

|

| Interest income |

|

|

(1,214 |

) |

(905 |

) |

| Deferred rent |

|

|

425 |

|

1,388 |

|

|

|

|

|

33,208 |

|

33,448 |

|

| Changes in non-cash working

capital: |

|

|

|

|

| Trade and other receivables |

|

|

(2,954 |

) |

9,033 |

|

| Trade payables and accrued

liabilities |

|

|

(63 |

) |

35 |

|

| Prepaid expenses |

|

|

83 |

|

(179 |

) |

|

Deferred revenue |

|

|

1,338 |

|

(3,870 |

) |

| Cash provided by operating

activities |

|

|

31,612 |

|

38,467 |

|

| Interest received |

|

|

1,221 |

|

905 |

|

| Income taxes paid |

|

|

(9,447 |

) |

(8,842 |

) |

|

Net cash provided by operating activities |

|

|

23,386 |

|

30,530 |

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

| Proceeds from issue of common

shares |

|

|

17 |

|

6,664 |

|

| Dividends paid |

|

|

(32,090 |

) |

(32,041 |

) |

|

Net cash used in financing activities |

|

|

(32,073 |

) |

(25,377 |

) |

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

| Property and equipment

additions |

|

|

(742 |

) |

(4,673 |

) |

|

(Decrease) increase in cash |

|

|

(9,429 |

) |

480 |

|

|

Cash, beginning of year |

|

|

63,719 |

|

63,239 |

|

| Cash, end of

year |

|

|

54,290 |

|

63,719 |

|

|

|

|

|

|

|

* The Company adopted IFRS 15 effective April 1, 2018 using the

cumulative effect method. Under this method, comparative

information is not restated.

See accompanying notes to consolidated financial statements.

For further information, contact:

| Ryan N. SchneiderPresident &

CEO(403) 531-1300ryan.schneider@cmgl.ca |

or |

Sandra BalicVice President,

Finance & CFO(403) 531-1300sandra.balic@cmgl.ca |

www.cmgl.ca

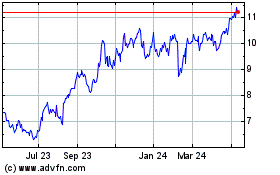

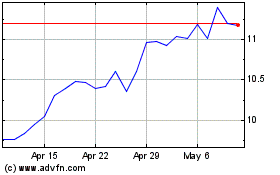

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Apr 2024 to May 2024

Computer Modelling (TSX:CMG)

Historical Stock Chart

From May 2023 to May 2024