Euro Sun Mining Inc. (TSX: ESM) (“Euro Sun” or the

“Company”) is pleased to announce that it has entered into a

convertible security funding agreement (the “Agreement”) with Lind

Global Fund II, LP, an investment entity managed by The Lind

Partners, a New York based institutional fund manager (together

“Lind”), providing for a principal amount $1.5 million (the “Loan

Amount”) convertible security (the “Convertible Security”) due two

years from the date of issuance. All amounts are in Canadian

dollars unless otherwise indicated.

Euro Sun intends to use the funding for

development expenditures at its Rovina Valley Project and for

general and corporate working capital purposes.

Under the terms of the Agreement, the drawn Loan

Amount will accrue simple interest at a rate of 10% per annum. At

closing, the Company will receive $1.5 million less a closing fee

of $60,000. The Company will issue to Lind a Convertible Security

with a face value of $1.8 million (the “Initial Loan Face Value”),

which includes pre-paid interest of $300,000, as set out in the

Agreement.

Lind will have the option to convert the

Convertible Security into common shares of Euro Sun (“Shares”) at a

price per Share equal to 85% of the five-day volume weighted

average share price (“VWAP”) immediately prior to each conversion

(the “Conversion Price”). Subject to certain conditions, Lind will

be entitled to convert up to 1/24th of the Initial Loan Face Value

per month into Shares.

In the event that the Conversion Price is below

the Company’s chosen floor price of $0.10, the Company will have

the option to repay that conversion in cash (plus a 5% premium), in

lieu of issuing Shares.

Euro Sun has the right to buy-back the

outstanding face value of the Loan Amount at any time with no

penalty. If Euro Sun elects to exercise its buy-back rights, Lind

will have the option to convert up to 33% of such face value into

Shares.

Concurrently with the funding of the Loan

Amount, Lind will be issued 12,711,864 warrants of the Company (the

“Warrants”). The Warrants will be exercisable for 48 months from

the date of their issuance, subject to acceleration, with a warrant

exercise price equal to $0.1357, being 115% of the 20-day VWAP of

the Shares, immediately prior to execution of the Agreement.

The Convertible Security will be (i) secured

against all of the assets and property of the Company pursuant to a

general security agreement and (ii) guaranteed by SAMAX Romania

Limited, a wholly-owned subsidiary of the Company organized under

the laws of Cyprus, which will also provide a share pledge

agreement in favour of Lind.

The Toronto Stock Exchange

(“TSX”) has conditionally approved the listing of

the common shares underlying the Convertible Securities and the

Warrants on the TSX. The listing is subject to the Company

fulfilling all of the requirements of the TSX on or before August

8, 2022. Funding of the Loan Amount is expected to be completed on

or before July 15, 2022.

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange listed

mining company focused on the exploration and development of its

100%-owned Rovina Valley gold and copper project located in

west-central Romania, which hosts the second largest gold deposit

in Europe.

For further information about Euro Sun Mining,

or the contents of this press release, please contact Investor

Relations at info@eurosunmining.com.

About The Lind Partners

The Lind Partners manages institutional funds

that are leaders in providing growth capital to small- and mid-cap

companies publicly traded in the US, Canada, Australia and the UK.

Lind’s funds make direct investments ranging from US$1 to US$30

million, invest in syndicated equity offerings and selectively buy

on market. Having completed more than 100 direct investments

totaling over US$1 Billion in transaction value, Lind’s funds have

been flexible and supportive capital partners to investee companies

since 2011.

www.thelindpartners.com

Caution regarding forward-looking

information:

This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of the Company

with respect to future business activities and operating

performance. Forward-looking information is often identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions and includes information regarding the Company’s

proposed use of proceeds, the ability of the Company to secure the

Loan Amount, the ability of the Company to obtain final approval of

the TSX and the timing for closing.

Investors are cautioned that forward-looking

information is not based on historical facts but instead reflect

management’s expectations, estimates or projections concerning

future results or events based on the opinions, assumptions and

estimates of management considered reasonable at the date the

statements are made. Although the Company believes that the

expectations reflected in such forward-looking information are

reasonable, such information involves risks and uncertainties, and

undue reliance should not be placed on such information, as unknown

or unpredictable factors could have material adverse effects on

future results, performance or achievements of the Company. This

forward-looking information may be affected by risks and

uncertainties in the combined business of the Company and market

conditions, including (1) a significant change in

market price; (2) there being no significant disruptions affecting

the Company’s operations whether due to extreme weather events and

other or related natural disasters, labor disruptions, supply

disruptions, power disruptions, damage to equipment or otherwise;

(3) permitting, development, operations and production for the

Rovina Valley Project being consistent with the Company’s

expectations; (4) political and legal developments in Romania being

consistent with current expectations; (5) certain price assumptions

for gold and copper; (6) prices for diesel, electricity and other

key supplies being approximately consistent with current levels;

(7) the accuracy of the Company’s mineral reserve and mineral

resource estimates; and (8) labor and materials costs increasing on

a basis consistent with the Company’s current expectations. This

information is qualified in its entirety by cautionary statements

and risk factor disclosure contained in filings made by the Company

with the Canadian securities regulators, including the Company’s

annual information form, financial statements and related MD&A

for the financial year ended December 31, 2020 filed with the

securities regulatory authorities in certain provinces of Canada

and available at www.sedar.com.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and do not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

The TSX does not accept responsibility for the

adequacy or accuracy of this news release.

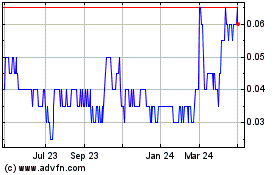

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Oct 2024 to Nov 2024

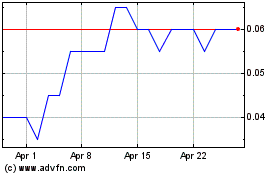

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Nov 2023 to Nov 2024