British Columbia Discovery Fund Inc. (formerly British Columbia Discovery Fund (VCC) Inc.) Provides Update on Liquidation Proceedings

June 30 2022 - 10:00AM

British Columbia Discovery Fund Inc., (formerly

British Columbia Discovery Fund (VCC) Inc.) (the

“

Fund”), by The Bowra Group Inc. in its capacity

as liquidator of the Fund (the “

Liquidator”),

provides the following update as to the liquidation proceedings of

the Fund.

Pricing Net Asset Value per Class A Common Share

is $1.92 as at May 31, 2022 compared to $2.23 as at February 28,

2022, a decrease of 14%. The principal reason for this change is

the change in the value of the Fund’s investment in publicly traded

Tantalus Systems Holdings Inc. due to a decrease in Tantalus System

Holdings Inc.’s share price. The following is an update of the

Fund’s portfolio companies and the Liquidator’s activities:

- D-Wave Systems

Inc. (“D-Wave”) – D-Wave is a quantum

computing company based in Burnaby, B.C. D-Wave continues to

advance the science used in its products, build its technology, and

build its core business of quantum computing services.Since the

last press release, the Liquidator has not identified any new

material events that would impact the Fund’s investment in

D-Wave.As previously announced, D-Wave entered into a definitive

transaction agreement with DPCM Capital, Inc.

(“DPCM”) (NYSE: XPOA) on February 8, 2022. The

proposed transaction would result in a public listing of D-Wave

upon completion of the transaction.The proposed transaction was

anticipated to close in the second quarter of 2022. As of the date

of this press release the proposed transaction has not closed.

Since the last press release amendments to required disclosure

concerning the proposed transaction have been filed by DPCM with

the Securities and Exchange Commission, the latest amendment being

June 23, 2022.The Liquidator has insufficient information to

comment on the status or anticipated date of closing however notes

that there are several risk factors associated with the proposed

transaction including, but not limited to, general market

conditions, volatility in the capital and debt markets, approval of

respective shareholders, and expiry of the timeline for DPCM to

complete an initial business combination within the required time

period, all of which may delay or prevent closing.Further

information on the amendments filed by DPCM, which include further

detail on the risk factors associated with the proposed

transaction, can be found at:

https://www.dpcmcapital.com/sec-filingsFurther updates and

information about D-Wave can be found at: www.dwavesys.com.The

Liquidator is continuing to monitor the transaction between D-Wave

and DPCM, the potential impact on the Fund’s Net Asset Value, and

review any potential opportunities for liquidity events pursuant to

its mandate.

- Tantalus Systems Holdings

Inc. – (“Tantalus”) – Tantalus is a

technology company which develops and operates smart grid solutions

for utilities based in Burnaby, B.C. Tantalus is currently publicly

listed and trades on the Toronto Stock Exchange under symbol

TSX:GRID.Since the last press release, the Liquidator has not

identified any new material events that would impact the Fund’s

investment in Tantalus however the Liquidator notes that the share

price of Tantalus decreased in the period used to calculate the May

31, 2022 Net Asset Value per Class A Common Share.Due to the

relative value of the Fund’s investment in Tantalus the decrease in

the share price of Tantalus is the primary reason for the decrease

in Net Asset Value per Class A Common Share from the last press

release.Further updates and information about Tantalus can be found

at: www.tantalus.com and SEDAR.The Liquidator is continuing to

monitor Tantalus and assess its strategy for the realization of the

Fund’s position in Tantalus.

- Phemi Systems

Corporation (“Phemi”) – Phemi is a

technology company which provides data management, analysis,

privacy, and security for healthcare based in Vancouver, B.C.Since

the last press release, the Liquidator has not identified any new

material events that would impact the Fund’s investment in

Phemi.Further updates and information about Phemi can be found at:

www.phemi.com.The Liquidator is continuing to monitor Phemi and

review any potential opportunities for liquidity events pursuant to

its mandate.

- 3760073 Canada

Corp. (formerly Navarik Corp.)

(“Navarik”) – Navarik is a technology company

providing software and data solutions for cargo and shipping of

petroleum products based in Vancouver, B.C. Navarik sold all of its

assets to Vela Software Group (“Vela”) in

September 2020. The Fund’s current interest in Navarik is limited

to future distributions Navarik may make to its shareholders

pursuant to the transaction with Vela.Since the last press release,

Navarik has paid a further distribution to the Fund of $0.07 per

share of Navarik held by the Fund for a total of $80,459.75,

pursuant to the sale of its assets to Vela.The Liquidator is

continuing to monitor Navarik and the potential for any future

distributions to the Fund pursuant to the terms of its sale to

Vela.

- MTI Limited

Partnership (acquired as a result of the sale of Mobidia

Technology Inc.) (“MTI LP”) – Mobidia was a Fund

portfolio company that was sold to App Annie in 2015. The Fund’s

current interest in MTI LP is limited to its respective interest in

App Annie shares held by MTI LP exchanged in the sale of Mobidia

transaction.Since the last press release, the Liquidator has not

identified any new material events that would impact the Fund’s

investment in MTI LP.The Liquidator is continuing to monitor MTI LP

and App Annie and review any opportunities for liquidity events

pursuant to its mandate.

The Fund will continue to realize on its

investments in portfolio companies through participation in

liquidity events when possible pursuant to its liquidation mandate

and to address remaining outstanding matters relating to its

liquidation, including tax matters.

At this time, the Fund is not aware of the

anticipated date of any distribution, or the date of its

dissolution.

The Liquidator released the Liquidator’s First

Report on November 30, 2021 and a copy of the Report is available

on the Liquidator’s website under Liquidator – Reports at:

www.bowragroup.com.

Updates and materials related to the Fund’s

liquidation proceedings can be found on the Liquidator’s website

at: www.bowragroup.com. The Liquidator will continue to make

available on its website additional information and updates on the

status of the Fund’s liquidation proceedings and disseminate a news

release on at least a quarterly basis.

Risk Factors and Forward-Looking

Information

This news release may include statements about

expected future events and/or financial results that are

forward-looking in nature and subject to risks and uncertainties.

The issuer cautions that actual performance will be affected by a

number of factors, many of which are beyond the control of the

Liquidator.

Certain risks include, but are not limited to:

the Fund cannot assure its shareholders of the timing or amount of

any liquidation distributions. The timing of liquidation of the

Fund’s portfolio assets depends on the timing of occurrence of

liquidity events in the underlying portfolio companies and the

amount of such distributions depends on the proceeds realized from

such dispositions which in turn will depend on the many factors

that impact the value of the portfolio companies. The Fund will

continue to incur expenses that will reduce the value of any

liquidation distributions; if the Fund fails to retain sufficient

funds to pay the expenses and liabilities actually owed to the

Fund’s creditors, each shareholder receiving liquidation

distributions could be held liable for payment to the Fund’s

creditors, of his, her or its pro rata share of any shortfall, up

to the amount actually distributed to each shareholder; if, at the

time of a distribution to shareholders, the Fund cannot pass

statutory solvency tests, the distribution may be prohibited; there

are no assurances that the Liquidator will achieve the same

financial results that management might achieve if it had continued

as the manager of the Fund; the tax treatment of liquidation

distributions may vary from shareholder to shareholder, and

shareholders should consult their own tax advisors; and the Class A

Shares may, in certain circumstances, cease to be ‘‘qualified

investments’’ for “registered plans” for the purposes of the Income

Tax Act (Canada).

See “Risk Factors” in the information circular

of the Fund dated May 22, 2020 and available on www.sedar.com.

Additional Information

Additional information relating to the Fund’s

liquidation and associated matters is contained in the information

circular of the Fund dated May 22, 2020, which is available on

SEDAR at www.sedar.com.

The Bowra Group is a boutique financial advisory

firm with offices in Vancouver, British Columbia and Edmonton,

Alberta. The Bowra Group specializes in insolvency and

restructuring, and services offered include business

restructurings, business viability and performance improvement

assessments and turnaround management. The Bowra Group is a

Licensed Insolvency Trustee and acts formally as Trustee, Monitor,

Receiver and Liquidator in engagements across a variety of

industries.

Further information about The Bowra Group and

updates to shareholders and information on the liquidation of the

Fund can be found at www.bowragroup.com.

Gordon Brown The Bowra Group Inc. Suite 430 –

505 Burrard Street, Vancouver, B.C. V7M 2C1 Phone: 604-689-8939

Email: info@bowragroup.com

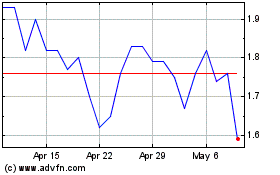

Tantalus Systems (TSX:GRID)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tantalus Systems (TSX:GRID)

Historical Stock Chart

From Nov 2023 to Nov 2024