Imperial Announces Normal Course Issuer Bid

April 27 2020 - 8:00AM

Imperial Metals Corporation (the “Company”)

(TSX:III) announces the Toronto Stock Exchange (the “TSX”) has

accepted the Company’s Notice of Intention to make a Normal Course

Issuer Bid (the “Bid”) to be transacted through the facilities of

the TSX or alternative Canadian market places.

Pursuant to the Bid, the Company may purchase up

to 642,451 common shares, which represents 0.50% of the total

128,490,174 common shares of the Company issued and outstanding as

of April 24, 2020. Purchases will be made, at the discretion of the

Company at prevailing market prices, commencing April 29, 2020 and

ending no later than April 28, 2021. Pursuant to TSX policies,

daily purchases made by the Company will not exceed 9,087 common

shares or 25% of the Company’s average daily trading volume of

36,351 common shares on the TSX, subject to certain prescribed

exceptions.

The shares acquired under the Bid will be used

to satisfy the Company’s obligations under its Non-Management

Directors’ Plan and Share Purchase Plan (the “Plans”). The funding

for any purchase pursuant to the Bid will be financed out of the

working capital of the Company. In the previous 12 months, the

Company has repurchased 189,081 of its outstanding common shares at

the average price per share of $1.78. The maximum number of common

shares sought and approved by the TSX under the terms of the

previous Bid was 635,552. The common shares have or will be

allocated to satisfy the Company’s obligations under the Plans. A

copy of the Company’s Notice filed with the TSX may be obtained, by

any shareholder without charge, by contacting the Company’s Chief

Financial Officer.

About Imperial

Imperial is a Vancouver exploration, mine

development and operating company. The Company, through its

subsidiaries, owns a 30% interest in the Red Chris mine, and a 100%

interest in both the Mount Polley and Huckleberry copper mines in

British Columbia. Imperial also holds a 45.3% interest in the

Ruddock Creek lead/zinc property.

Company Contacts

Brian Kynoch | President |

604.669.8959Andre Deepwell | Chief Financial

Officer | 604.488.2666Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

information or forward-looking statements within the meaning of

Canadian and United States Securities Laws, which we will refer to

as “forward-looking information”. Except for statements of

historical fact relating to the Company, certain information

contained herein constitutes forward-looking information, including

the Company’s intentions with respect to the Bid, the purchases and

funding of such purchases thereunder and the use of any shares

acquired under the Bid.

With respect to forward-looking information

contained in this news release, the Company has made assumptions

regarding, among other things, that the Company will complete

purchases of common shares pursuant to the Bid. The Company’s

actual actions may differ materially from those anticipated in its

forward-looking information as a result of the risk factors set

forth above, along with the risks that are set out in the Company’s

current Management’s Discussion & Analysis filed on SEDAR at

www.sedar.com.

The forward-looking information contained in

this news release is expressly qualified in its entirety by this

cautionary statement. Such information is given only as of the date

of this news release. The Company does not assume any obligation to

update its forward-looking information to reflect new information,

subsequent events or otherwise, except as required by law.

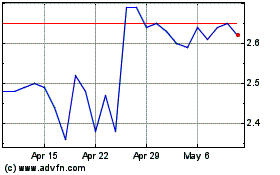

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

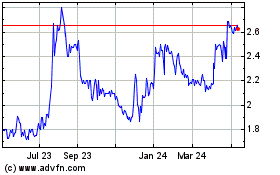

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025