Nutrien Prices Offering of an Aggregate of US$1.5 Billion of 3-Year, 10-Year and 30-Year Senior Notes

May 11 2020 - 5:26PM

Business Wire

Nutrien Ltd. (NYSE, TSX:NTR) today announced the pricing of

US$500 million aggregate principal amount of 1.900 percent senior

notes due May 13, 2023, US$500 million aggregate principal amount

of 2.950 percent senior notes due May 13, 2030 and US$500 million

aggregate principal amount of 3.950 percent senior notes due May

13, 2050 (together, the “senior notes”). The offering is expected

to close on or about May 13, 2020, subject to customary closing

conditions. The senior notes, registered under the

multi-jurisdictional disclosure system in Canada and the United

States, will not be offered in Canada or to any resident of

Canada.

Nutrien intends to use the net proceeds from this offering to

reduce its short-term indebtedness, for general corporate purposes,

to finance its capital expenditures and to fund recent growth

initiatives. The senior notes will be unsecured and rank equally

with Nutrien's existing senior unsecured debt. The joint

book-running managers for the offering are Barclays Capital Inc.,

CIBC World Markets Corp., Citigroup Global Markets Inc., HSBC

Securities (USA) Inc. and TD Securities (USA) LLC.

The offering will be made by way of a prospectus supplement

dated May 11, 2020, to Nutrien's short form base shelf prospectus

dated March 16, 2020, filed with the securities regulatory

authorities in each of the provinces of Canada, which forms a part

of and is included in Nutrien’s registration statement on Form

F-10, filed in the United States with the Securities and Exchange

Commission (the “SEC”) under the multijurisdictional disclosure

system. A final prospectus supplement in respect of the offering of

the senior notes will be filed with the same regulatory authorities

in Canada and the SEC.

About Nutrien

Nutrien is the world’s largest provider of crop inputs and

services, playing a critical role in helping growers increase food

production in a sustainable manner. We produce and distribute 25

million tonnes of potash, nitrogen and phosphate products

world-wide. With this capability and our leading agriculture retail

network, we are well positioned to supply the needs of our

customers. We operate with a long-term view and are committed to

working with our stakeholders as we address our economic,

environmental and social priorities. The scale and diversity of our

integrated portfolio provides a stable earnings base, multiple

avenues for growth and the opportunity to return capital to

shareholders.

Advisory

The senior notes are being offered in the United States pursuant

to an effective registration statement (including a base shelf

prospectus) filed with the SEC. Nutrien has filed a preliminary

prospectus supplement related to the offering of the senior notes.

Before you invest, you should read the preliminary prospectus

supplement, the accompanying base shelf prospectus and other

documents that are incorporated by reference therein for more

complete information about Nutrien and this offering.

The preliminary prospectus supplement and the accompanying base

shelf prospectus are available for free on the SEC website at

www.sec.gov. Alternatively, the documents may be obtained by

contacting Barclays Capital Inc. toll free at 1 (888) 603-5847,

CIBC World Markets Corp. toll free at 1 (800) 282-0822, Citigroup

Global Markets Inc. toll free at 1 (800) 831-9146, HSBC Securities

(USA) Inc. toll-free at 1 (866) 811-8049 or TD Securities USA LLC

toll-free at 1 (855) 495-9846.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

senior notes in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of such jurisdiction.

Forward-Looking Statements

Certain statements and other information included in this press

release constitute "forward-looking information" within the meaning

of applicable Canadian securities legislation or constitute

"forward-looking statements" within the meaning of applicable U.S.

securities legislation (together, "forward-looking statements").

All statements in this press release, other than those relating to

historical information or current conditions, are forward-looking

statements, including, but not limited to, forecasts and statements

as to management's expectations with respect to, among other

things, the intended use of proceeds of the offering and the timing

of closing of the offering. Such forward-looking statements involve

known and unknown risks and uncertainties, many of which are beyond

our control, as well as various assumptions and business

sensitivities, including the impact of extraordinary external

events, such as the current pandemic health event resulting from

the novel 2019 coronavirus disease (COVID-19), and their collateral

consequences, including extended disruption of economic activity in

our markets, as well as those risk factors referred to in the

preliminary prospectus supplement referenced in this press release

and those referred to under the heading "Risk Factors" in Nutrien's

annual information form for the year ended December 31, 2019 and

under the heading "Enterprise Risk Management" in Nutrien's

management's discussion and analysis for the year ended December

31, 2019 and under the heading “Risk Factors” in Nutrien’s

management’s discussion and analysis for the quarter ended March

31, 2020, which may cause actual results, performance or

achievements of Nutrien, which includes the offering being delayed

or not completed, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Nutrien disclaims any intention or

obligation to update or revise any forward-looking statements in

this press release as a result of new information or future events,

except as may be required under applicable Canadian securities

legislation or applicable U.S. federal securities law. These

forward-looking statements are based on certain assumptions and

analyses made by us in light of our experience and perception of

historical trends, current conditions and expected future

developments as well as other factors we believe are appropriate in

the circumstances. All of the forward-looking statements contained

herein are qualified by these cautionary statements and by the

assumptions that are stated or inherent in such forward-looking

statements. Although we believe these assumptions are reasonable,

undue reliance should not be placed on these assumptions and such

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200511005969/en/

Investor Relations: Richard Downey Vice President,

Investor Relations (403) 225-7357 investors@nutrien.com

Tim Mizuno Senior Manager, Investor Relations (306) 933-8548

Media Relations: Will Tigley Manager, Communications, CEO

and Corporate Functions (403) 225-7310

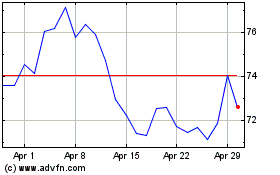

Nutrien (TSX:NTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nutrien (TSX:NTR)

Historical Stock Chart

From Mar 2024 to Mar 2025