all amounts are in US dollars

Nutrien Ltd. (“Nutrien”)(NYSE, TSX: NTR), Agrium Inc. (“Agrium”)

and Potash Corporation of Saskatchewan Inc. (“PotashCorp”), each

wholly-owned subsidiaries of Nutrien (together, the “Company”)

today announced the early tender results as of the Early Tender

Time (as defined below) of their previously announced cash tender

offer to purchase up to $300 million (the “Tender Cap”) in

aggregate purchase price (the “Offer”) of their respective debt

securities listed in the table below (collectively, the “Notes”,

and each, a “series” of Notes).

On November 16, 2021, the Company commenced the Offer in

accordance with the terms and conditions set forth in the offer to

purchase, dated November 16, 2021 (the “Offer to Purchase”), sent

to holders of the Notes.

As of 5:00 p.m., New York City time, on November 30, 2021 (the

“Early Tender Time”), $703,871,000 aggregate principal amount of

the Notes were validly tendered and not validly withdrawn pursuant

to the Offer, as set forth in the table below:

Title of Security

Issuer

CUSIP / ISIN Numbers

Principal Amount

Outstanding

Acceptance Priority

Level

Principal Amount Tendered as

of the Early Tender Time

7.800% Debentures due 2027

Agrium

008916 AC2/ US008916AC28

$125,000,000

1

$5,064,000

7.125% Debentures due 2036

Agrium

008916 AG3/ US008916AG32

$7,089,000

2

$0

6.125% Debentures due 2041

Agrium

008916 AJ7/ US008916AJ70

$2,874,000

3

$190,000

5.250% Debentures due 2045

Agrium

008916 AN8/ US0089AN82

$34,450,000

4

$16,000

7.125% Senior Notes due 2036

Nutrien

67077M AP3/ US67077MAP32

$292,911,000

5

$87,697,000

6.125% Senior Notes due 2041

Nutrien

67077M AQ1/ US67077MAQ15

$497,126,000

6

$99,035,000

5.250% Senior Notes due 2045

Nutrien

67077M AS7/ US67077MAS70

$465,550,000

7

$244,469,000

5.875% Notes due 2036

PotashCorp

73755L AD9/ US73755LAD91

$18,848,000

8

$2,499,000

5.875% Senior Notes due 2036

Nutrien

67077M AF5/ US67077MAF59

$481,152,000

9

$117,647,000

5.625% Notes due 2040

PotashCorp

73755L AK3/ US73755LAK35

$47,927,000

10

$7,510,000

5.625% Senior Notes due 2040

Nutrien

67077M AG3/ US67077MAG33

$452,073,000

11

$139,744,000

Pursuant to the terms of the Offer, following the Expiration

Time (as defined below), the Company will accept for purchase Notes

that have been validly tendered and not validly withdrawn up to the

Tender Cap and in accordance with the Acceptance Priority Levels

set forth in the table above and subject to proration as described

in the Offer to Purchase. Because the tender offer was fully

subscribed as of the Early Tender Time, no Notes of any series

tendered after the Early Tender Time (regardless of acceptance

priority level) will be accepted for purchase, as described in the

Offer to Purchase.

As set forth in the Offer to Purchase, subject to the Tender

Cap, Acceptance Priority Levels and proration, holders who validly

tendered and did not validly withdraw their Notes at or prior to

the Early Tender Time are eligible to receive the Full Tender Offer

Consideration, which will be determined at 11:00 a.m., New York

City time, on December 1, 2021. In addition, holders that validly

tendered Notes that are accepted for purchase by the Company will

receive accrued and unpaid interest from, and including, the last

interest payment date for their tendered Notes to, but not

including, the Settlement Date (which is currently expected to be

December 16, 2021), rounded to the nearest cent.

The Withdrawal Deadline for the Offer was 5:00 p.m., New York

City time, on November 30, 2021, and has not been extended for any

series of Notes. The Offer will expire at 11:59 p.m., New York City

time, on December 14, 2021, unless extended or earlier terminated

by the Company (such date and time with respect to the Offer, as

the same may be extended or earlier terminated, with respect to any

or all series, the “Expiration Time”).

The Offer is subject to the satisfaction or waiver of certain

conditions specified in the Offer to Purchase.

Capitalized terms used in this press release and not defined

herein have the meanings given to them in the Offer to

Purchase.

BMO Capital Markets Corp. and Wells Fargo Securities, LLC are

acting as joint dealer managers for the Offer. For additional

information regarding the terms of the Offer, please contact: BMO

Capital Markets Corp. toll-free at (833) 418-0762 or collect at

(212) 702-1840 or Wells Fargo Securities, LLC toll-free at (866)

309-6316 or collect at (704) 410-4756. Requests for the Offer to

Purchase may be directed to D.F. King & Co., Inc., which is

acting as the Tender Agent and Information Agent for the Offer, at

+1(800) 676-7437 (toll-free) or by email at nutrien@dfking.com. The

Offer to Purchase can be accessed at the following web address:

www.dfking.com/nutrien.

Advisory

THIS PRESS RELEASE IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT

AN OFFER OR SOLICITATION TO PURCHASE NOTES. THE OFFER IS BEING MADE

SOLELY PURSUANT TO THE OFFER TO PURCHASE, WHICH SETS FORTH THE

COMPLETE TERMS OF THE OFFER THAT HOLDERS OF THE NOTES SHOULD

CAREFULLY READ PRIOR TO MAKING ANY DECISION.

THE OFFER TO PURCHASE DOES NOT CONSTITUTE AN OFFER OR

SOLICITATION TO PURCHASE NOTES IN ANY JURISDICTION IN WHICH, OR TO

OR FROM ANY PERSON TO OR FROM WHOM, IT IS UNLAWFUL TO MAKE SUCH

OFFER OR SOLICITATION UNDER APPLICABLE SECURITIES OR BLUE SKY LAWS.

IN ANY JURISDICTION IN WHICH THE SECURITIES, BLUE SKY OR OTHER LAWS

REQUIRE THE OFFER TO BE MADE BY A LICENSED BROKER OR DEALER, THE

OFFER WILL BE DEEMED TO BE MADE ON BEHALF OF THE COMPANY BY ONE OR

MORE OF THE JOINT DEALER MANAGERS, IF ANY OF THE JOINT DEALER

MANAGERS ARE LICENSED BROKERS OR DEALERS UNDER THE LAWS OF SUCH

JURISDICTION, OR BY ONE OR MORE REGISTERED BROKERS OR DEALERS THAT

ARE LICENSED UNDER THE LAWS OF SUCH JURISDICTION.

About Nutrien

Nutrien is the world’s largest provider of crop inputs and

services, playing a critical role in helping growers increase food

production in a sustainable manner. We produce and distribute

approximately 27 million tonnes of potash, nitrogen and phosphate

products world-wide. With this capability and our leading

agriculture retail network, we are well positioned to supply the

needs of our customers. We operate with a long-term view and are

committed to working with our stakeholders as we address our

economic, environmental and social priorities. The scale and

diversity of our integrated portfolio provides a stable earnings

base, multiple avenues for growth and the opportunity to return

capital to shareholders.

Forward-Looking Statements

Certain statements and other information included in this press

release constitute "forward-looking information" or

"forward-looking statements" (collectively, "forward-looking

statements") under applicable securities laws (such statements are

often accompanied by words such as "“anticipate”, “forecast”,

“expect”, “believe”, “may”, “will”, “should”, “estimate”, “intend”

or other similar words). All statements in this press release,

other than those relating to historical information or current

conditions, are forward-looking statements, including, but not

limited to the principal amount of debt securities of any series to

be purchased in the Offer and the timing of the Settlement Date.

Forward-looking statements in this press release are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond our control, which could cause actual results to differ

materially from such forward-looking statements. The key risks and

uncertainties are set forth in the Offer to Purchase, in the

relevant documents incorporated by reference in the Offer to

Purchase, and in Nutrien reports filed with the Canadian securities

regulatory authorities and the United States Securities and

Exchange Commission. As such, undue reliance should not be placed

on these forward-looking statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements in this press release as a

result of new information or future events, except as may be

required under applicable U.S. federal securities laws or

applicable Canadian securities legislation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211130006166/en/

Investor Relations: Jeff Holzman Vice President, Investor

Relations (306) 933-8545 investors@nutrien.com Tim Mizuno Director,

Investor Relations (306) 933-8548 Media Relations: Megan

Fielding Vice President, Brand & Culture Communications (403)

797-3015 Contact us at: www.nutrien.com

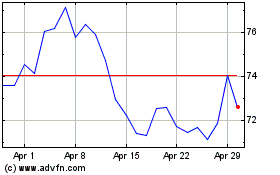

Nutrien (TSX:NTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nutrien (TSX:NTR)

Historical Stock Chart

From Dec 2023 to Dec 2024