NuVista Energy Ltd. ("NuVista") (TSX:NVA) is pleased to announce results for the

three months ended March 31, 2014 and provide an update on its future business

plans. The first quarter has been an active one with record exploration and

development spending for NuVista, and one where our key objectives have been

advanced materially. Our first quarter drilling was focused mainly upon

development of the condensate-rich Bilbo (South) block in preparation for the

upcoming production capacity ramp which will be created by the startup of our

new Bilbo block compressor station and the associated pipelines to the Keyera

Simonette plant. In addition, we have continued our successful delineation and

land expiry management program in the Wapiti area, improved corporate netbacks

and prudently managed our balance sheet. Financially, we also benefited

tremendously from strong natural gas and condensate prices during the quarter.

We have positioned the company to provide strong long-term profitable growth in

a $3.00 to $3.50/GJ AECO natural gas price environment due to the material and

growing high value condensate production and also due to the continuous

improvement of our capital and operating efficiencies. The fiscal environment

has improved significantly due to the recent gas price increase in late 2013 and

early 2014 and there is a reasonable probability this strength will continue

throughout 2014 due to very low gas storage levels driven by the cold winter

across North America. As a result of the recent price strength, we have

increased our commodity hedge positions to ensure a strong baseline price

underpinning our capital plans and economic threshold. For the remainder of 2014

approximately 60% of our gas production is hedged with floor prices above

$3.70/Mcf and approximately 50% of production has a ceiling price of C$3.82/Mcf.

For 2015, close to 30% of our gas production is hedged with floor prices above

$4.00/Mcf. Beyond 2014, we expect natural gas prices could moderate somewhat

over today's price but are confident there should be a higher base price

compared to the environment of 2012 and 2013. In this scenario, NuVista

continues to be in an excellent position to deliver growth and profitability.

Significant highlights for the first quarter of 2014 include:

-- Continued to reach IP30's on additional wells since our last

announcement on March 6, 2014 including a Northeast Wapiti Montney

delineation well and an uphole sweet cretaceous Falher horizontal well

as shown in the following table. We have seven additional Wapiti Montney

wells which have now been completed with results as expected. They are

ready for production but have yet to be brought on line to achieve

IP30's as they await the startup of our Bilbo block facilities;

New Well IP30 Results(i)

----------------------------------------------------------------------------

Liquid CGR

Well Raw Gas Hydrocarbons Total Sales C5+/Raw

----------------------------------------------------------------------------

(MMcf/d) (Bbls/d) (Boe/d) (Bbls/MMcf)

----------------------------------------------------------------------------

Average Wapiti Montney 261

delineation well typecurve 5.8 Condensate 1,222 45

----------------------------------------------------------------------------

Well 19 (Northeast

Delineation) 397

Location: 16-19-67-6 W6M 6.8 Condensate 1,527 58

----------------------------------------------------------------------------

Average Falher horizontal 390

well typecurve 6.5 NGL's 1,330 N/A

----------------------------------------------------------------------------

New 9-19-65-6W6 Falher well

(choked downhole for 385

restricted rate) 6.3(ii) NGL's 1,265 N/A

----------------------------------------------------------------------------

(i) Well numbering for the Montney refers to the numbered wells in our

corporate presentation available on our website. They are effectively in

chronological order since our inception in the play. All numbers shown are

based on field estimate data.

(ii) This well has now entered month three of production at 7.7 MMcf/d raw

and 1,550 Boe/d after removal of the downhole choke.

-- Achieved first quarter 2014 production of 17,823 Boe/d after entering

2014 at approximately 16,500 Boe/d, an increase of over 8%. This

compares to 14,903 Boe/d for the first quarter of 2013, an increase of

20% before taking account of the 2013 divestitures of 2,300 Boe/d. After

accounting for the effect of divestitures the growth rate is 41%;

-- Increased our Wapiti Montney production to 8,057 Boe/d in the first

quarter of 2014 compared to 6,292 Boe/d in the fourth quarter of 2013

and 1,830 Boe/d in the first quarter of 2013;

-- Our recently announced well in the North block (well 16) which had an

IP30 of 2,115 Boe/d has now been on production for just over 4 months

and has already achieved impressive cumulative raw gas production of 1

Bcf, a record initial cumulative rate for NuVista. The well will reach

payout this month, achieving a total payout period of less than 6

months;

-- Achieved funds from operations of $30.9 million ($0.23/share, basic) for

the three months ended March 31, 2014, a 166% increase from $11.6

million ($0.10/share, basic) for the three months ended March 31, 2013

despite fourth quarter 2013 dispositions. The increase in funds from

operations is largely due to an increased contribution of higher netback

Wapiti Montney volumes and stronger commodity pricing;

-- Achieved corporate netbacks for the three months ended March 31, 2014 of

$19.26/Boe as compared to $8.67/Boe for the same period in 2013, and

$12.99/Boe for the preceding quarter. Montney operating netbacks

achieved in the first quarter of 2014 were $38.28/Boe. Corporate

netbacks are expected to continue to rise assuming a flat commodity

price environment as the higher netback Wapiti Montney production

increasingly dominates our corporate production;

-- Successfully executed a total capital program of $126.6 million in the

quarter. Drilled 9 wells (9 net), 8 in our Montney condensate rich

resource play and one sweet Falher zone horizontal cretaceous well for

100% success rate while completing spending on our Bilbo (South) block

compressor station and trunk pipelines;

-- Managed net debt to $146.5 million, including working capital deficiency

for a ratio of net debt to annualized first quarter funds from

operations of 1.2x; and

-- Updated the Borrowing Base under our credit facility to $240 million

versus bank debt at the close of the first quarter of 2014 of $87

million.

Wapiti Montney Progress

NuVista's Wapiti Montney play and key corporate goals were progressed

significantly through the first quarter of 2014. In addition to exceeding our

original internal targets for first quarter production and cash flow, we have

added seven wells to date which are now behind pipe awaiting the startup of our

new Bilbo (South) compressor station and the downstream third party facilities.

Our policy is to release only IP30 data and not test rates but all wells that

were tested performed at least as anticipated and as such we are confident that

our production rates will meet or exceed original internal expectations upon

startup of these facilities. Drilling activity has continued through spring

breakup for two of our three rigs as a result of proactive pad drilling and

nearby access to high-grade roads. Completions for wells drilled in April and

May will resume post break-up. In addition, we are pleased with the gradual

continuation of our land consolidation and swap process in the Wapiti area.

The newest IP30 (Well #19) is another exciting result for NuVista given the

significant distance from existing development. Gas rates and liquid yields met

our typecurve expectations. The well, which is located between the Bilbo and

Elmworth development blocks, provides continued encouragement toward material

expansion of development drilling areas which will underpin even longer-term

development certainty than we currently have. We plan to follow this delineation

success with another horizontal test in 2014.

Our new Bilbo (South) compressor station continues on budget and on schedule for

startup late in the second quarter of 2014. The Keyera liquids and gas pipelines

to Simonette Gas Plant are behind schedule due to contractor and spring breakup

related weather issues, with startup now anticipated in the third quarter

depending on weather conditions. However, we still anticipate startup of our new

Bilbo compressor station on time due to the benefit of various third party

pipeline interconnections and the availability of processing capacity at other

gas plants in the area.

2014 Production Guidance Re-Affirmed

The second quarter of 2014 brings facility outages for work previously planned

at the Keyera Simonette and SemCams K3 plants and pipelines, and an unplanned

outage at Pembina Pipelines. During this period, we will continue to build new

volumes behind pipe to be brought on-stream upon the resumption of facility

capacity being available. Due to uncertainty in the outages noted above, we

anticipate a production range of 13,000 to 14,000 Boe/d after accounting for an

expected total outage impact of 5,000 to 6,000 Boe/d in the quarter. Production

will ramp up considerably in the third quarter following the startup of these

facilities. Since the majority of the 2014 facility outages were anticipated, we

remain confident in our previously released annual production and cash flow

guidance of 17,500 to 18,500 Boe/d for the full year of 2014 with cash flow of

approximately $130 to $140 million. Based on our confidence in recent well

results, production for the fourth quarter of 2014 is still anticipated to

average 20,000 to 21,000 Boe/d despite the minor delay in the major pipeline

construction.

2014 Capital Guidance and 2015 Production Guidance Increased

As a result of our successful first quarter drilling program and favorable

commodity pricing through spring breakup thus far, we are modestly increasing

our capital spending for 2014 to a range of $300 to $315 million, increasing our

expected new well count by three wells including two additional delineation/land

expiry locations. Within this range we have also made provisions for an

increased land budget and the pre-ordering of long lead facility equipment

targeting additional future projects. We currently have 19 Montney wells on

production, and we anticipate having approximately 35 total wells on production

by the end of 2014. All facets of our Bilbo compressor station and the Keyera

Simonette projects are expected to be operational by 2015, and as a result we

are increasing our prior guidance from 23,000 to a range of 23,500 to 25,000

Boe/d for 2015.

With corporate netbacks and production rising quickly, and efficiencies

continuing to build in every aspect of our Wapiti Montney play, NuVista is

confident to continue accelerating the pace of activity in the future. We will

continue to work with area midstream companies to provide incremental facility

capacity to underpin long-term profitable growth. We would like to thank our

shareholders for their continued support, and our dedicated and talented staff

for their significant contributions to the bright future we are delivering

together.

Please refer to the corporate presentation on our website which will be updated

on or before May 14, 2014 to include further details and context regarding the

information in this press release.

Corporate Highlights Three months ended March 31

----------------------------------------------------------------------------

($ thousands, except per share) 2014 2013

----------------------------------------------------------------------------

Financial

Oil and natural gas revenue 68,897 41,748

Funds from operations(1) 30,893 11,629

Per basic share 0.23 0.10

Per diluted share 0.23 0.10

Net earnings (loss) (4,358) (4,061)

Per basic share (0.03) (0.03)

Per diluted share (0.03) (0.03)

Adjusted net earnings (loss)(1) 2,667 (8,621)

Per basic share 0.02 (0.07)

Per diluted share 0.02 (0.07)

Total assets 1,017,837 926,852

Long-term debt, net of adjusted working

capital(1) 146,503 79,556

Capital expenditures 126,569 68,789

Dispositions - 12,596

Weighted average common shares outstanding

(thousands):

Basic 135,135 118,620

Diluted 135,135 118,620

----------------------------------------------------------------------------

Operating

Production

Natural gas (MMcf/d) 70.4 62.8

Condensate (Bbls/d) 2,803 990

Butane (Bbls/d) 577 370

Propane (Bbls/d) 983 586

Ethane (Bbls/d) 859 760

Oil (Bbls/d) 866 1,732

Total oil equivalent (Boe/d) 17,823 14,903

Average product prices (2)

Natural gas ($/Mcf) 4.50 3.24

Condensate ($/Bbl) 95.29 103.28

Butane ($/Bbl) 59.54 63.19

Propane ($/Bbl) 57.46 25.07

Ethane ($/Bbl) 15.61 5.59

Oil ($/Bbl) 89.28 66.65

Operating expenses

Natural gas and natural gas liquids ($/Mcfe) 1.74 1.86

Oil ($/Bbl) 19.48 20.12

Total oil equivalent ($/Boe) 10.87 12.20

Operating netback ($/Boe) 24.60 14.02

Funds from operations netback ($/Boe)(1) 19.26 8.67

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NOTES:

(1) Funds from operations, revenue, funds from operations per share, funds

from operations netback, operating netback, adjusted net earnings,

adjusted net earnings per share and adjusted working capital are not

defined by GAAP in Canada and are referred to as non-GAAP measures.

Funds from operations are based on cash flow from operating activities

as per the statement of cash flows before changes in non-cash working

capital and asset retirement expenditures. Funds from operations per

share is calculated based on the weighted average number of common

shares outstanding consistent with the calculation of net earnings

(loss) per share. Funds from operations netback equals the total of

revenues including realized commodity derivative gains/losses less

royalties, transportation, operating, general and administrative,

restricted stock units, interest expenses and cash taxes calculated on

a Boe basis. Adjusted net earnings equals net earnings excluding after

tax unrealized gains (losses) on commodity derivatives, impairments,

impairment reversals, goodwill impairments and gains (losses) on

property divestments. Operating netback equals the total of revenues

including realized commodity derivative gains/losses less royalties,

transportation and operating expenses calculated on a Boe basis.

Adjusted working capital excludes the current portions of the

commodity derivative asset or liability. Total Boe is calculated by

multiplying the daily production by the number of days in the period.

For more details on non-GAAP measures, including reconciliation to

GAAP measures refer to NuVista's "Management's Discussion and

Analysis".

(2) Product prices exclude realized gains/losses on commodity derivatives.

CONSOLIDATED FINANCIAL STATEMENTS AND MD&A

First quarter 2014 condensed interim consolidated financial statements and notes

to the consolidated financial statements and Management's Discussion and

Analysis for NuVista Energy Ltd. have been filed on SEDAR (www.sedar.com) under

NuVista Energy Ltd. and can also be accessed on NuVista's website at

www.nuvistaenergy.com.

ADVISORY REGARDING OIL AND GAS INFORMATION

This news release contains the terms barrels of oil equivalent ("Boe"), millions

of barrels of oil equivalent ("MMBoe") and thousand cubic feet equivalent

("Mcfe") and trillion cubic feet equivalent ("Tcfe"). Natural gas is converted

to a Boe using six thousand cubic feet of gas to one barrel of oil. In certain

circumstances natural gas liquid volumes have been converted to a Mcfe on the

basis of one barrel of natural gas liquids to six thousand cubic feet of gas.

Boes, MMBoes, Mcfes and Tcfes may be misleading, particularly if used in

isolation. The foregoing conversion ratios are based on an energy equivalency

conversion method primarily applicable at the burner tip and does not represent

a value equivalency at the wellhead. As well, given than the value ratio based

on the current price of crude oil to natural gas is significantly different from

the 6:1 energy equivalency ratio, using a conversion ratio on a 6:1 basis may be

misleading as an indication of value.

ADVISORY REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

This press release contains forward-looking statements and forward-looking

information (collectively, "forward-looking statements") within the meaning of

applicable securities laws. The use of any of the words "will", "expects",

"believe", "plans", "potential" and similar expressions are intended to identify

forward-looking statements. More particularly and without limitation, this press

release contains forward looking statements, including management's assessment

of: NuVista's future strategy, plans, focus, opportunities, growth initiatives

and operations; plans and expectations regarding facility construction and

infrastructure development, the timing thereof and the benefits to be obtained

therefrom; plans relating to future access to processing facilities,

transportation and markets; expectations of future results, including long-term

profitable growth, cash flow, production, production mix, netbacks, continued

improvement of our capital and operating efficiencies, drilling, development,

completion and tie-in plans, expectations regarding well performance and

economics; anticipated production capacity of a new compressor station; planned

and unplanned facility outages; the amount, timing, allocation and efficiency of

NuVista's capital program and the results therefrom; targeted debt levels.

NuVista's risk management strategy; expectations regarding future commodity

prices and netbacks; industry conditions and the timing of release of future

results. By their nature, forward-looking statements are based upon certain

assumptions and are subject to numerous risks and uncertainties, some of which

are beyond NuVista's control, including the impact of general economic

conditions, industry conditions, current and future commodity prices, currency

and interest rates, anticipated production rates, borrowing, operating and other

costs and funds from operations, the timing, allocation and amount of capital

expenditures and the results therefrom, anticipated reserves and the imprecision

of reserve estimates, the performance of existing wells, the success obtained in

drilling new wells, the sufficiency of budgeted capital expenditures in carrying

out planned activities, access to infrastructure and markets, competition from

other industry participants, availability of qualified personnel or services and

drilling and related equipment, stock market volatility, effects of regulation

by governmental agencies including changes in environmental regulations, tax

laws and royalties, the ability to access sufficient capital from internal

sources and bank and equity markets; and including, without limitation, those

risks considered under "Risk Factors" in our Annual Information Form. Readers

are cautioned that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on forward-looking

statements. NuVista's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these forward-looking

statements, or if any of them do so, what benefits NuVista will derive

therefrom. NuVista has included the forward-looking statements in this press

release in order to provide readers with a more complete perspective on

NuVista's future operations and such information may not be appropriate for

other purposes. NuVista disclaims any intention or obligation to update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

NuVista Energy Ltd.

Jonathan A. Wright

President and CEO

(403) 538-8501

NuVista Energy Ltd.

Robert F. Froese

VP, Finance and CFO

(403) 538-8530

www.nuvistaenergy.com

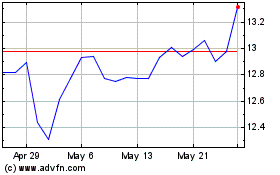

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Nov 2023 to Nov 2024