Progress Energy Announces 2012 Budget

October 30 2011 - 1:23AM

PR Newswire (Canada)

Capital investment focused on North Montney growth CALGARY, Oct.

31, 2011 /CNW/ - - Progress Energy Resources Corp. ("Progress" or

the "Company") announced, in advance of its Annual Investor Day,

that it plans to invest approximately $465 million in 2012 to

continue the development of its North Montney resource base,

initiate the first phases of development on its joint venture lands

with PETRONAS, and pursue its light oil opportunities in the Deep

Basin. "In 2011 we executed on a number of key initiatives that

have strengthened our balance sheet while attracting a strong joint

venture partner, PETRONAS, to accelerate development of our North

Montney assets and provide expertise in LNG development and market

access," said Michael Culbert, President and Chief Executive

Officer of Progress. "The focus of our 2012 capital program

will continue to be on our North Montney resource base and

expansion of our light oil play in the Deep Basin." 2012 Capital

Program For 2012, Progress will have a capital investment program

of approximately $800 million including the North Montney Joint

Venture ("NMJV") or $465 million net to the Company.

Approximately $380 million will be invested in Progress' North

Montney program, $50 million in the NMJV, including capital for the

detailed feasibility study of the LNG project, and $35 million in

the Deep Basin targeting the Company's Dunvegan light oil

play. The Company anticipates drilling approximately 35 to 40

horizontals on existing development pods with another six to eight

wells targeting delineation drilling on its vast North Montney land

holdings. Approximately 25 to 30 gross wells are planned for the

Company's NMJV lands. In the Company's emerging Dunvegan light oil

play, six to eight wells are expected to be drilled. Ten Montney

Development Pods -- Town South - The 50 million cubic feet per day

("mmcf") facility is operating at capacity and enters into its

maintenance phase heading into 2012. The last of the Gundy area

wells, which were feeding into this facility, will be directed to

the new Gundy facility and a further seven to nine wells will be

drilled in 2012 at Town South; -- Kobes - An expansion of the

Progress operated gas processing facility will be undertaken in

2012 to bring capacity to 50 mmcf per day. Four to five wells are

planned for 2012; -- Town North - An additional two wells are

planned for 2012 to fill the existing 25 mmcf per day processing

facility; -- Gundy - The gas processing facility is being expanded

to 50 mmcf per day and eight to eleven wells are planned for 2012;

-- West Gundy - The Company's newest pod development is on a 20

section, 100 percent working interest block of land adjacent to

Progress' Kobes pod. Plans for 2102 are to drill eight to twelve

wells in this area and construct a 25 mmcf per day facility in the

first quarter.; -- Caribou - The third horizontal in this area will

be completed with plans to move to full development in 2013; -- Nig

- This partner operated pod development is 25 kilometers to the

east of Town and currently has one tested horizontal with three

additional wells to be completed by the first quarter of 2012; and,

-- North Montney Joint Venture - 25 to 30 wells will be drilled at

Altares, Lily and Kahta in 2012. Production Targets Progress

expects to average 50,000 to 52,000 boe per day for 2012 and exit

at approximately 58,000 to 60,000 boe per day, implying growth of

approximately 15 to 20 percent on a per share basis. Building

Long-term Underlying Value Over the past 10 years, we have

established an enviable asset base in two of the premier natural

gas plays in North America. We have amassed large contiguous land

blocks in both the Foothills and Deep Basin regions, both capable

of generating strong returns on invested capital in the current

natural gas price environment. As we have built our asset

position, we have concentrated on maintaining high working

interests and operatorship which allow us to control the cost and

the pace of development. As well, our balance sheet has

strengthened substantially over the past year providing the

flexibility to advance our resource opportunities and add long-term

value for shareholders. Investor Day Progress Energy will be

hosting its Annual Investor Day on Tuesday, November 1, 2011

in Calgary and on Wednesday, November 2, 2011 in Toronto. The

Calgary event will be webcast and interested investors may listen

in using the following link to the slides and presentations.

Presentations will begin each day at 8:30 a.m. local time. Event

URL:

http://event.on24.com/r.htm?e=374091&s=1&k=B88CC7438A5C8FAC6E71B08D126B5923

Progress is a Calgary based, energy company primarily focused on

natural gas exploration, development and production in northwest

Alberta and northeast British Columbia. Common shares of Progress

are listed on the Toronto Stock Exchange under the symbol PRQ.

Forward Looking Statement Advisory This press release and financial

highlights table (collectively the "press release") contains

forward-looking statements and forward-looking information within

the meaning of applicable securities laws. The use of any of the

words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans",

"intends", "implies", and similar expressions are intended to

identify forward-looking information or statements. In

particular, forward looking statements in this press release

include, but are not limited to, statements with respect the effect

of the development pods on the Company's natural gas production and

reserve base over the next five years; the pace of capital

investment; the focus of capital expenditures, the timing of

capital spending and the results therefrom; the focus of the

Company's exploration and development efforts; expected capital

spending program; potential capital investment opportunities;

potential drilling inventory; test rates; expected sources of

funding for capital program in the first half of 2011; Progress'

planned asset disposition program including the timing thereof and

the use of proceeds received therefrom; Prog2012,estimated 2011

exit production rate, 2012 average and exit rate production;

potential drilling credits and the advantages to be received

therefrom; effect of capital expenditures on production; growth

potential and rates of return of Progress' assets; pace of

development; projections of future land holdings; and future

drilling plans and programs, the timing thereof and the results

therefrom. The forward-looking statements and information are

based on certain key expectations and assumptions made by Progress,

including expectations and assumptions concerning prevailing

commodity prices and exchange rates, applicable credits, royalty

rates and tax laws; future well production rates; test rates and

reserve and resource volumes; the performance of existing wells;

the success obtained in drilling new wells; the sufficiency of

budgeted capital expenditures in carrying out planned activities;

and the availability and cost of labour and services and future

operating costs. Although Progress believes that the

expectations and assumptions on which such forward-looking

statements and information are based are reasonable, undue reliance

should not be placed on the forward looking statements and

information because Progress can give no assurance that they will

prove to be correct. Since forward-looking statements and

information address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, the risks associated with the oil and gas industry in

general such as operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve and resource estimates; the uncertainty of estimates and

projections relating to test rates, reserves, resources,

production, costs and expenses; health, safety and environmental

risks; commodity price and exchange rate fluctuations; marketing

and transportation; loss of markets; environmental risks;

competition; incorrect assessment of the value of acquisitions;

failure to realize the anticipated benefits of acquisitions;

ability to access sufficient capital from internal and external

sources; changes in legislation, including but not limited to tax

laws, royalties and environmental regulations. Management has

included the above summary of assumptions and risks related to

forward-looking information provided in this press release in order

to provide security holders with a more complete perspective on the

Company's future operations and such information may not be

appropriate for other purposes. The Company's actual results,

performance or achievement could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that the Company will

derive there from. Readers are cautioned that the foregoing

lists of factors are not exhaustive. These forward-looking

statements are made as of the date of this press release and the

company disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by

applicable securities laws. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect the operations or

financial results of Progress are included in reports on file with

applicable securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com). The

forward-looking statements and information contained in this press

release are made as of the date hereof and Progress undertakes no

obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws. Barrels of Oil Equivalent "Boe" means barrel of

oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural

gas. Boe's may be misleading, particularly if used in isolation. A

boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Progress Energy Resources Corp.

CONTACT: Contacts:Greg KistVice President, Marketing, Corporate

& Government Relations403-539-1809

gkist@progressenergy.com.Kurtis BarrettAnalyst, Investor

Relations403-539-1843 kbarrett@progressenergy.com

Copyright

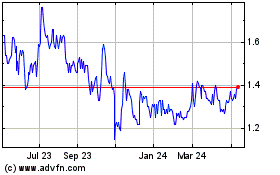

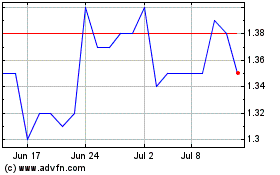

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Feb 2024 to Feb 2025