Petrus Resources Announces Automatic Share Purchase Plan

February 22 2024 - 4:45PM

Petrus Resources Ltd. ("

Petrus" or the

"

Company") (TSX: PRQ) is pleased to announce that,

as part of its previously announced normal course issuer bid

(“NCIB”) to buy back common shares of the Company (“common

shares”), it has established an automatic share purchase plan

(“ASPP”) with a designated broker. This ASPP has received clearance

from the Toronto Stock Exchange (the “TSX”) and is scheduled to go

into effect on February 27, 2024.

The ASPP is designed to aid in the repurchasing

of common shares during periods under the NCIB when the Company

would typically be restricted from making purchases due to

regulatory constraints or customary self-imposed blackout periods.

Prior to the onset of any specific trading blackout period, Petrus

may, at its discretion, instruct its designated broker to acquire

common shares under the NCIB during the subsequent blackout period

in line with the terms of the ASPP. Such acquisitions will be

determined by the designated broker independently, based on

purchasing criteria set by Petrus in compliance with TSX

regulations, relevant securities laws, and the terms of the

ASPP.

The ASPP will terminate on the earliest of the

following dates: (a) when the maximum annual purchase limit under

the NCIB is reached; (b) upon the expiration of the NCIB; or (c) if

Petrus decides to terminate the ASPP according to its conditions.

The ASPP is considered an “automatic securities purchase plan”

under applicable Canadian securities legislation.

Outside of predefined blackout periods, common

shares may be bought under the NCIB at the discretion of

management, in accordance with TSX regulations and applicable

securities laws. The Company’s NCIB began on December 14, 2023, and

will continue until December 13, 2024, or an earlier date if the

NCIB is completed or terminated by the Company. All common shares

acquired under the ASPP will be counted towards the total number of

common shares repurchased under the NCIB.

Since the initiation of the NCIB, the Company

has bought back 293,000 common shares at a weighted average price

per share of $1.29, totaling $378,000. All common shares

repurchased under the NCIB have been canceled.

ABOUT PETRUSPetrus is a public

Canadian oil and gas company focused on property exploitation,

strategic acquisitions and risk-managed exploration in Alberta.

For further information, please contact:

Ken GrayPresident and Chief Executive OfficerT: 403-930-0889E:

kgray@petrusresources.com

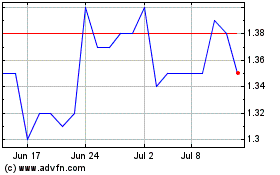

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

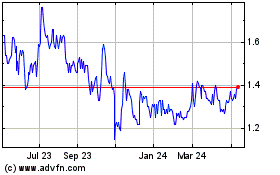

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Feb 2024 to Feb 2025