Parex Resources Inc. (“Parex” or the "Company") (TSX:PXT) is

pleased to announce the results of its annual independent reserves

assessment as at December 31, 2021, as well as provide an

operational update. The Company also announces the declaration of a

first quarter 2022 regular dividend of CAD$0.14 per common share to

be paid on March 30, 2022 to shareholders of record on March 15,

2022, representing a 12% increase from the Company's fourth quarter

2021 regular dividend. Also, in 2022, the Company expects to

purchase the maximum allowable common shares pursuant to its normal

course issuer bid program (“NCIB”). Parex has purchased the maximum

allowable common shares under its NCIBs for the previous three

years.

The financial and operational information

contained below is based on the Company’s unaudited estimated

results for the year ended December 31, 2021. All currency

amounts are in United States dollars, unless otherwise stated.

2021 Year-End Corporate Reserves Report:

Highlights

“With an industry-leading balance sheet, a plan

to return meaningful capital to shareholders, and a reserve life

index exceeding 10 years, Parex is extremely well-positioned to

generate shareholder value in 2022 and over the long term,”

commented Imad Mohsen, President and Chief Executive Officer.

For the year ended December 31, 2021, Parex:

- Added 25.3

million barrels of oil equivalent ("MMboe") proved developed

producing reserves (“PDP”) and 21.5 MMboe proved plus probable

("2P") reserves, replacing respectively 148% and 125% of total 2021

production (approximately 17.15 MMboe);

- Increased PDP

and 2P reserves per share by 22% and 11%, respectively, with

exploration activities complimented by the 2021 NCIB;

- Added 2P

reserves of 7.8 MMboe at Arauca, which is a block that is new to

Parex and located in the Northern Llanos basin, as well as added 2P

reserves of 4.3 MMboe at Capachos;

- Realized

estimated PDP finding, development & acquisition (“FD&A”)

costs of $10.71/boe, resulting in a 3.4 times PDP FD&A recycle

ratio (using estimated Q4 2021 funds flow from operations of

$36.76/boe);

- Achieved

estimated 2P FD&A costs of $18.35/boe, resulting in a 2.0 times

2P FD&A recycle ratio (using estimated Q4 2021 funds flow from

operations of $36.76/boe);

- Realized an

after tax proved (“1P”) net asset value (“NAV”) per share of

C$29.03 and 2P NAV of C$38.51 per share, discounted at 10% and

using the GLJ 2021 Report price forecast, and includes estimated

December 31, 2021 working capital of $325 million.

This press release contains Forward-Looking

Information and references to Non-GAAP and Other Financial

Measures.

Significant related assumptions and risk

factors, and reconciliations are described under the Non-GAAP and

Other Financial Measures and Forward-Looking Statements sections of

this press release, respectively.2021 Year-End Corporate

Reserves Report: Discussion of Reserves

The following tables summarize information

contained in the independent reserves report prepared by GLJ Ltd.

(“GLJ”) dated February 3, 2022 with an effective date of

December 31, 2021 (the "GLJ 2021 Report"), with comparatives

to the independent reserves report prepared by GLJ dated

February 4, 2021 with an effective date of December 31,

2020 (the "GLJ 2020 Report"), and the independent reserves report

prepared by GLJ dated February 5, 2020 with an effective date

of December 31, 2019 ("GLJ 2019 Report", and collectively with

the GLJ 2021 Report and the GLJ 2020 Report, the "GLJ Reports").

Each GLJ Report was prepared in accordance with definitions,

standards and procedures contained in the Canadian Oil and Gas

Evaluation Handbook ("COGE Handbook") and National Instrument

51-101 - Standards of Disclosure for Oil and Gas Activities ("NI

51-101"). Additional reserve information as required under NI

51-101 will be included in the Company's Annual Information Form

for the 2021 fiscal year which will be filed on SEDAR by March 31,

2022. Consistent with the Company’s reporting currency, all amounts

are in United States dollars unless otherwise noted.

The recovery and reserve estimates provided in

this news release are estimates only, and there is no guarantee

that the estimated reserves will be recovered. Actual reserves may

eventually prove to be greater than, or less than, the estimates

provided herein. In certain of the tables set forth below, the

columns may not add due to rounding.

All December 31, 2021 reserves presented

are based on GLJ's forecast pricing effective January 1, 2022; all

December 31, 2020 reserves presented are based on GLJ's

forecast pricing effective January 1, 2021 and all

December 31, 2019 reserves presented are based on GLJ's

forecast pricing effective January 1, 2020.

Parex’s reserves are located in the Llanos and

Magdalena basins in the country of Colombia.

Five-Year Crude Oil Price Forecast – GLJ Report (January

2021 and 2022)

|

|

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

ICE Brent (US$/bbl) - January 1, 2021 |

50.75 |

55.00 |

58.50 |

61.79 |

62.95 |

64.13 |

|

ICE Brent (US$/bbl) - January 1, 2022 |

70.95(1) |

76.00 |

72.51 |

71.24 |

72.66 |

74.12 |

(1) Actual 2021 ICE Brent average price.

2021 Year-End Gross Reserves

Volumes

|

|

|

Dec. 31 |

Change over Dec. 31, |

| |

|

2019 |

2020 |

2021 |

|

Reserve Category |

|

Mboe(1) |

Mboe(1) |

Mboe(1)(2) |

2020 |

|

Proved Developed Producing (PDP) |

|

70,946 |

72,373 |

80,559 |

11% |

| Proved Developed

Non-Producing |

|

6,699 |

15,087 |

9,685 |

(36%) |

| Proved

Undeveloped |

|

61,180 |

40,623 |

35,022 |

(14%) |

|

Proved (1P) |

|

138,825 |

128,083 |

125,266 |

(2%) |

|

Probable |

|

59,599 |

66,408 |

73,559 |

11% |

|

Proved + Probable (2P) |

|

198,423 |

194,491 |

198,825 |

2% |

|

Possible(3) |

|

62,661 |

85,995 |

88,102 |

2% |

|

Proved + Probable + Possible (3P) |

|

261,085 |

280,486 |

286,927 |

2% |

(1) Mboe is defined as thousand barrels of oil

equivalent.(2) All reserves are presented as Parex working interest

before royalties. 2021 net reserves after royalties are: PDP 68,703

Mboe, proved developed non-producing 8,336 Mboe, proved undeveloped

29,727 Mboe, 1P 106,765 Mboe, 2P 165,781 Mboe and 3P 238,441

Mboe.(3) Please refer to the “Reserve Advisory” section for a

description of each reserve category. Possible reserves are those

additional reserves that are less certain to be recovered than

probable reserves. There is a 10% probability that the quantities

recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

2021 Year-End Gross Reserves Volumes Per

Share

|

|

|

Dec. 31 |

Change over Dec. 31, 2019 |

Change over Dec. 31, 2020 |

|

|

|

2019 |

2020 |

2021(1) |

|

Year-End Basic Outstanding Shares (000s) |

|

143.3 |

130.9 |

120.3 |

(16%) |

(8%) |

|

Proved Developed Producing (PDP) (boe/share) |

|

0.50 |

0.55 |

0.67 |

34% |

22% |

| Proved (1P) (boe/share) |

|

0.97 |

0.98 |

1.04 |

7% |

6% |

| Proved + Probable (2P)

(boe/share) |

|

1.38 |

1.49 |

1.65 |

20% |

11% |

| Proved

+ Probable + Possible (3P)(2) (boe/share) |

|

1.82 |

2.14 |

2.39 |

31% |

12% |

(1) All reserves are presented as Parex working

interest before royalties. 2021 net reserves after royalties are:

PDP 68,703 Mboe, proved developed non-producing 8,336 Mboe, proved

undeveloped 29,727 Mboe, 1P 106,765 Mboe, 2P 165,781 Mboe and 3P

238,441 Mboe.(2) Please refer to the “Reserve Advisory” section for

a description of each reserve category. Possible reserves are those

additional reserves that are less certain to be recovered than

probable reserves. There is a 10% probability that the quantities

recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

2021 Gross Reserves by Area

|

|

|

Proved |

Proved + Probable |

Proved + Probable + Possible |

|

Area |

|

Mboe(1) |

Mboe(1) |

Mboe(1) |

|

LLA-34 |

|

80,243 |

119,724 |

160,096 |

| Southern Llanos - Cabrestero,

LLA-32 |

|

19,477 |

28,306 |

38,187 |

| Northern Llanos - Capachos,

Arauca |

|

11,462 |

21,597 |

28,223 |

| Magdalena - VIM-1,

Fortuna |

|

8,439 |

20,507 |

43,423 |

| Other

Areas |

|

5,645 |

8,691 |

16,998 |

|

Total |

|

125,266 |

198,825 |

286,927 |

(1) All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserve Advisory”

section for a description of each reserve category. Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves. The estimates of reserves and

future net revenue for individual properties may not reflect the

same confidence level as estimates of reserves and future net

revenue for all properties, due to the effects of aggregation.

2021 Gross Year-End Reserves Volumes by

Product Type(1)

|

Product Type |

|

Proved Developed Producing |

Total Proved |

Total Proved + Probable |

Total Proved + Probable + Possible |

|

Light & Medium Crude Oil (Mbbl)(2) |

|

7,428 |

21,693 |

43,282 |

74,541 |

| Heavy Crude Oil (Mbbl) |

|

68,860 |

97,739 |

143,321 |

190,009 |

| Natural Gas Liquids

(Mbbl) |

|

189 |

531 |

773 |

1,086 |

|

Conventional Natural Gas (MMcf)(3) |

|

24,492 |

31,817 |

68,703 |

127,749 |

|

Oil Equivalent (Mboe)(4) |

|

80,559 |

125,266 |

198,825 |

286,927 |

(1) All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserve Advisory”

section for a description of each reserve category. Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves.(2) Mbbl is defined as

thousands of barrels.(3) MMcf is defined as one million cubic

feet.(4) Columns may not add due to rounding.

Summary of Reserve Metrics – Company

Gross(1)

|

|

2021 |

3-Year |

|

USD$ |

Proved Developed Producing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

| F&D Costs ($/boe) |

10.71 |

25.71 |

23.76 |

11.47 |

| FD&A Costs ($/boe) |

10.71 |

24.46 |

18.35 |

11.17 |

|

Recycle Ratio - F&D |

3.4 x |

1.4 x |

1.5 x |

2.4 x |

| Recycle

Ratio - FD&A |

3.4 x |

1.5 x |

2.0 x |

2.4 x |

(1) Please refer to “Unaudited Financial Information” and

“Non-GAAP Terms”. All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserve Advisory”

section for a description of each reserve category.

Reserve Life Index ("RLI")

|

|

|

Dec. 31, 2019(1) |

Dec. 31, 2020(2) |

Dec. 31, 2021(3) |

|

Proved Developed Producing (PDP) |

|

3.6 years |

4.3 years |

4.4 years |

| Proved (1P) |

|

7.0 years |

7.5 years |

6.9 years |

| Proved

Plus Probable (2P) |

|

10.0 years |

11.4 years |

10.9 years |

(1) Calculated by dividing the amount of the

relevant reserves category by average Q4 2019 production of 54,221

boe/d annualized (consisting of 8,346 bbl/d of light crude oil and

medium crude oil, 44,740 bbl/d of heavy crude oil and 6,810 mcf/d

of conventional natural gas).(2) Calculated by dividing the amount

of the relevant reserves category by average Q4 2020 production of

46,642 boe/d annualized (consisting of 6,637 bbl/d of light crude

oil and medium crude oil, 38,332 bbl/d of heavy crude oil and

10,038 mcf/d of conventional natural gas).(3) Calculated by

dividing the amount of the relevant reserves category by estimated

average Q4 2021 production of 49,779 boe/d annualized (consisting

of 6,376 bbl/d of light crude oil and medium crude oil, 41,534

bbl/d of heavy crude oil and 11,214 mcf/d of conventional natural

gas).

Future Development Capital (“FDC”) (000s) – GLJ 2021

Report(1)

|

Reserve Category |

|

2022 |

|

2023 |

|

2024 |

|

2025 |

2026+ |

Total FDC |

Total FDC/boe |

|

PDP |

$ |

5,930 |

$ |

8,807 |

$ |

— |

$ |

— |

$ |

— |

$ |

14,737 |

$ |

0.18 |

|

1P |

$ |

205,933 |

$ |

89,852 |

$ |

39,299 |

$ |

241 |

$ |

36,705 |

$ |

372,030 |

$ |

2.97 |

|

2P |

$ |

243,886 |

$ |

140,173 |

$ |

66,638 |

$ |

65,862 |

$ |

23,270 |

$ |

539,829 |

$ |

2.72 |

(1) FDC are stated in USD, undiscounted and based on GLJ January

1, 2022 price forecasts.

Reserves Net Present Value After Tax Summary – GLJ Brent

Forecast(1)(2)

|

|

|

NPV10 |

NPV10 |

NAV |

CAD/sh Change over |

| |

|

December 31, |

December 31, |

December 31, |

| |

|

2020 |

2021 |

2021 |

Dec. 31, |

|

Reserve Category |

|

(000s)(2) |

(000s)(2) |

(CAD/sh)(3) |

2020 |

|

Proved Developed Producing (PDP) |

|

$ |

1,261,769 |

$ |

1,801,167 |

$ |

22.42 |

46% |

| Proved Developed

Non-Producing |

|

|

171,766 |

|

174,419 |

|

|

| Proved

Undeveloped |

|

|

395,908 |

|

452,933 |

|

|

|

Proved (1P) |

|

$ |

1,829,443 |

$ |

2,428,519 |

$ |

29.03 |

39% |

|

Probable |

|

|

669,994 |

|

899,434 |

|

|

|

Proved + Probable (2P) |

|

$ |

2,499,437 |

$ |

3,327,953 |

$ |

38.51 |

40% |

|

Possible(4) |

|

|

882,572 |

|

1,096,001 |

|

|

|

Proved + Probable + Possible (3P) |

|

$ |

3,382,009 |

$ |

4,423,954 |

$ |

50.06 |

39% |

(1) Net present values are stated in USD and are

discounted at 10 percent. All reserves are presented as Parex

working interest before royalties. Please refer to the “Reserve

Advisory” section for a description of each reserve category. The

forecast prices used in the calculation of the present value of

future net revenue are based on the GLJ January 1, 2021 and GLJ

January 1, 2022 price forecasts, respectively. The GLJ January 1,

2022 price forecast will be included in the Company's Annual

Information Form for the 2021 fiscal year.(2) Includes FDC as at

December 31, 2020 of $21 million for PDP, $299 million for 1P,

$423 million for 2P and $542 million for 3P and FDC as at

December 31, 2021 of $15 million for PDP, $372 million for 1P,

$540 million for 2P and $658 million for 3P. (3) NAV is calculated,

as at December 31, 2021, as after tax NPV10 plus estimated

working capital of USD$325 million (converted at USDCAD=1.2678),

divided by 120 million basic shares outstanding as at

December 31, 2021. NAV per share is a Non-GAAP ratio, refer to

“Non-GAAP Terms” section below for further details. (4) Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves.

2021 Year-End Gross Reserves Reconciliation

Company

|

|

|

Total Proved |

Total Proved + Probable |

Total Proved + Probable + Possible |

|

|

|

Mboe |

Mboe |

Mboe |

|

December 31, 2020 |

|

128,083 |

194,491 |

280,486 |

| Technical Revisions(1) |

|

4,205 |

(1,240) |

(2,543) |

| Extensions(2) |

|

7,886 |

14,914 |

17,102 |

| Acquisitions(3) |

|

2,246 |

7,814 |

9,036 |

|

Production |

|

(17,154) |

(17,154) |

(17,154) |

|

December 31, 2021(4) |

|

125,266 |

198,825 |

286,927 |

(1) Reserves technical revisions are associated

with the evaluation of additions on the Bacano on the Cabrestero

block, La Belleza on the VIM-1 block and Capachos block offset by

negative revisions in Tigana on the LLA-34 block.(2) Reserve

extensions are associated with the evaluations of LLA-34 and

Capachos blocks.(3) Reserve acquisitions are associated with the

evaluations of the Arauca block.(4) Subject to final reconciliation

adjustments. All reserves are presented as Parex working interest

before royalties. Please refer to the “Reserve Advisory” section

for a description of each reserve category. Possible reserves are

those additional reserves that are less certain to be recovered

than probable reserves. There is a 10% probability that the

quantities recovered will equal or exceed the sum of proved plus

probable plus possible reserves. The estimates of reserves and

future net revenue for individual properties may not reflect the

same confidence level as estimates of reserves and future net

revenue for all properties, due to the effects of aggregation.

Operational Update

2021 Gross Q4 & Year-End Production Volumes by

Product Type

|

|

|

For the three months ended Dec. 31 |

|

For the year endedDec. 31 |

|

|

|

|

Product Type |

|

2021(1) |

2020 |

|

2021(1) |

2020 |

|

Light & Medium Crude Oil (bbl/d) |

|

6,376 |

6,637 |

|

6,831 |

6,021 |

| Heavy Crude Oil (bbl/d) |

|

41,534 |

38,332 |

|

38,449 |

39,197 |

|

Conventional Natural Gas (mcf/d) |

|

11,214 |

10,038 |

|

10,308 |

7,800 |

|

Oil Equivalent (boe/d) |

|

49,779 |

46,642 |

|

46,998 |

46,518 |

(1) Production volumes for the three months ended

December 31, 2021 and for the year ended December 31,

2021 are estimated.

- FY 2021

Production: Estimated to be approximately 46,998 boe/d

(consisting of 6,831 bbl/d of light crude oil and medium crude oil,

38,449 bbl/d of heavy crude oil and 10,308 mcf/d of conventional

natural gas).

- Q4 2021

Production: Estimated to be approximately 49,779 boe/d

(consisting of 6,376 bbl/d of light crude oil and medium crude oil,

41,534 bbl/d of heavy crude oil and 11,214 mcf/d of conventional

natural gas), up approximately 7% from fourth quarter 2020.

- January

2022 Production: Estimated to be approximately 51,500

boe/d, which is an approximately 14% increase over January 2021

production.

-

Hedging: Parex production remains 100% unhedged

and is benefiting from recent increases in global oil prices.

- Southern

Llanos (Cabrestero Block): Executed a robust recompletions

and delineation program that has doubled production from

approximately 5,500 bbl/d of oil in January 2021 to approximately

11,000 bbl/d of oil in January 2022.

- Southern

Llanos (LLA-34 Block): Continued focus on field

delineation and development drilling; January 2022 production was

approximately 32,200 bbl/d of oil, compared to January 2021

production of approximately 29,600 bbl/d of oil.

- Northern

Llanos (Arauca Block): The first well of a four-well

program is expected to spud in the first half of 2022 (full

program subject to partner approval).

- Northern

Llanos (Capachos Block): The first well of a six-well

program is expected to spud in the first half of 2022 (full program

subject to partner approval). Additionally, electric turbines that

are expected to increase capacity by debottlenecking the facility

are scheduled to be operational in the second half of 2022.

-

Magdalena (Fortuna Block): Drilled two of three

wells that targeted two of four zones and are currently in the

testing phase of operations; following the completion of the

three-well program, the Company will continue the appraisal of the

other two zones.

-

Magdalena (VIM-1 Block):

- Production from

La Belleza started in November 2021 with gross rates of

approximately 2,400 boe/d (consisting of 1,400 bbl/d of light crude

oil per day and 6,000 mcf/d of conventional natural gas), which is

in line with previous guidance.

- The Planadas-1

exploration well, located 6.3 kilometers west of the La Belleza-1

discovery, was drilled with partner participation and yielded no

hydrocarbons. Parex, at sole risk, proceeded with a sidetracking

operation to investigate a nearby updip target; drilling

difficulties during sidetrack operations were encountered and at

this time the well has been suspended.

-

Successful Colombia Bid Round in December 2021 with

Procurement of 18 Blocks in Core Basins: Acquisition was

comprised of 13 blocks in the Llanos and 5 blocks in the Magdalena

basins, adding over 4.3 million acres to the Company’s land

position and improving the depth and quality of its prospect

inventory.

- Increased

Parex’s land position in Colombia to approximately 5.9 million net

acres, which is 3.7 times greater than the 1.6 million net acres

had as at year end 2020.

- The 18-block

addition demonstrates Parex’s commitment to Colombia as well as

strategic growth; of the 18 blocks acquired, 16 were nominated by

Parex in areas specifically targeted by the Company.

- Commitments from

the bid round are expected to be approximately $100 million at a

base royalty rate of 9%; such commitments are not incremental to

the Company’s current exploration capital plans.

-

Inaugural Task Force on Climate-Related Financial

Disclosures (“TCFD”) Report: Released in December 2021 and

fulfills a key corporate milestone to align the Company’s ESG

reporting with the recommendations of the TCFD.

- Further enhances

prior disclosures on the Company’s climate-related governance and

management practices in the 2021 CDP climate change response, for

which Parex received a B score that compares to an average score in

the oil & gas exploration and production activity group of

C.

- To see the full

report, please see Parex’s corporate website at:

www.parexresources.com

Q1 2022 Regular Dividend Increased by

12%

Parex’s Board of Directors has declared a first

quarter 2022 regular dividend of CAD$0.14 per common share to be

paid on March 30, 2022 to shareholders of record on March 15, 2022,

representing a 12% increase from the Company’s fourth quarter 2021

regular dividend. This quarterly dividend payment to shareholders

is designated as an “eligible dividend” for purposes of the Income

Tax Act (Canada).

Normal Course Issuer Bid – Expect to

Purchase Maximum Allowable Shares in 2022

Over the past three years Parex has purchased

the maximum number of common shares it is authorized to purchase

pursuant to its NCIBs. From 2017 to January 31, 2022, Parex has

repurchased an aggregate of 46 million common shares and returned

over CAD$900 million to shareholders through share

repurchases.

During 2021, Parex purchased 12.9 million of the

Company’s common shares for a total cost of CAD$273 million at an

average price of CAD$21.25 per share. As at December 31, 2021,

Parex had 120.3 million basic common shares outstanding.

Under the current NCIB, Parex anticipates

purchasing the maximum allowable shares of 11.8 million in 2022.

Year to date 2022, Parex has purchased for cancellation 1,350,000

of its common shares at an average cost of C$24.35. As at January

31, 2022, Parex had 119.2 million basic common shares

outstanding.

President & Chief Executive Officer

Perspective

For information on the Company’s 2021

accomplishments and 2022 outlook, please see the following video

for the perspective of Imad Mohsen, President & Chief Executive

Officer.

2021 Year-End Results Conference Call &

Webcast

We anticipate holding a conference call and

webcast for investors, analysts and other interested parties on

Wednesday, March 2, 2022 at 9:30 am MT (11:30 am ET),

conditional on the 2021 fourth quarter and year-end results being

released on Tuesday, March 1, 2022 following the close of

markets. To participate in the conference call or webcast, please

see access information below:

|

Toll-free dial number (Canada/US) |

1-800-952-5114 |

| International dial-in

numbers |

Click to access the dial-in

number of your location |

| Passcode |

3997132 # |

| Webcast |

https://edge.media-server.com/mmc/p/jezv2otm |

| |

|

For more information, please contact:

Mike KruchtenSr. Vice President, Capital

Markets & Corporate PlanningParex Resources

Inc.403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations &

Communications AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

This news release does not constitute an offer to sell

securities, nor is it a solicitation of an offer to buy securities,

in any jurisdiction.

Not for distribution or for dissemination in the United

States.

Reserve Advisory

The recovery and reserve estimates of crude oil

reserves provided in this news release are estimates only, and

there is no guarantee that the estimated reserves will be

recovered. Actual crude oil reserves may eventually prove to be

greater than, or less than, the estimates provided herein. All

December 31, 2021 reserves presented are based on GLJ's

forecast pricing effective January 1, 2022. All December 31,

2020 reserves presented are based on GLJ's forecast pricing

effective January 1, 2021. All December 31, 2019 reserves

presented are based on GLJ's forecast pricing effective January 1,

2020.

It should not be assumed that the estimates of

future net revenues presented herein represent the fair market

value of the reserves. There are numerous uncertainties inherent in

estimating quantities of crude oil, reserves and the future cash

flows attributed to such reserves.

“Proved Developed Producing Reserves" are those

reserves that are expected to be recovered from completion

intervals open at the time of the estimate. These reserves may be

currently producing or, if shut-in, they must have previously been

on production, and the date of resumption of production must be

known with reasonable certainty.

"Proved Developed Non-Producing Reserves" are

those reserves that either have not been on production or have

previously been on production but are shut-in and the date of

resumption of production is unknown.

"Proved Undeveloped Reserves" are those reserves

expected to be recovered from known accumulations where a

significant expenditure (e.g. when compared to the cost of drilling

a well) is required to render them capable of production. They must

fully meet the requirements of the reserves category (proved,

probable, possible) to which they are assigned.

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than proved

reserves. It is equally likely that the actual remaining quantities

recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

“Possible” reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10 percent probability that the quantities

actually recovered will equal or exceed the sum of proved plus

probable plus possible reserves. It is unlikely that the actual

remaining quantities recovered will exceed the sum of the estimated

proved plus probable plus possible reserves.

The term "Boe" means a barrel of oil equivalent

on the basis of 6 Mcf of natural gas to 1 barrel of oil ("bbl").

Boe’s may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6:1, utilizing a conversion ratio at 6:1 may be

misleading as an indication of value.

Light crude oil is crude oil with a relative

density greater than 31.1 degrees API gravity, medium crude oil is

crude oil with a relative density greater than 22.3 degrees API

gravity and less than or equal to 31.1 degrees API gravity, and

heavy crude oil is crude oil with a relative density greater than

10 degrees API gravity and less than or equal to 22.3 degrees API

gravity.

With respect to F&D costs, the aggregate of

the exploration and development costs incurred in the most recent

financial year and the change during that year in estimated future

development costs generally will not reflect total F&D costs

related to reserve additions for that year.

The estimates of reserves and future net revenue

for individual properties may not reflect the same confidence level

as estimates of reserves and future net revenue for all properties,

due to the effects of aggregation.

This press release contains several oil and gas

metrics, including reserve replacement and RLI. In addition, the

following non-GAAP financial measures and non-GAAP ratios, as

described below under "Non-GAAP and Other Financial Measures", can

be considered to be oil and gas metrics: F&D costs, FD&A

costs, FD&A funds flow from operations netback recycle ratio,

F&D funds flow from operations netback recycle ratio, reserve

replacement, reserve additions including acquisitions and NAV. Such

oil and gas metrics have been prepared by management and do not

have standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metric should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes. A summary of the calculations of reserve

replacement and RLI are as follows, with the other oil and gas

metrics referred to above being described herein under "Non-GAAP

and Other Financial Measures":

- Reserve replacement is calculated by dividing the annual

reserve additions by the annual production.

- RLI is calculated by dividing the applicable reserves category

by the annualized fourth quarter production.

Unaudited Financial

Information

Certain financial and operating results included

in this news release, including capital expenditures, production

information, funds flow from operations and operating costs are

based on unaudited estimated results. These estimated results are

subject to change upon completion of the Company’s audited

financial statements for the year ended December 31, 2021, and any

changes could be material. Parex anticipates filing its audited

financial statements and related management’s discussion and

analysis for the year ended December 31, 2021 on SEDAR on or before

March 31, 2022.

The information contained in this press release

in respect of the Company's expected capital expenditures, working

capital and funds flow from operations for 2021 may contain future

oriented financial information ("FOFI") within the meaning of

applicable securities laws. The FOFI has been prepared by

management to provide an outlook of the Company's activities and

results and may not be appropriate for other purposes. The FOFI has

been prepared based on a number of assumptions including the

assumptions discussed in this press release. The actual results of

operations of the Company and the resulting financial results may

vary from the amounts set forth herein, and such variations may be

material. The Company and management believe that the FOFI has been

prepared on a reasonable basis, reflecting management's best

estimates and judgments. FOFI contained in this press release was

made as of the date of this press release and Parex disclaims any

intention or obligation to update or revise any FOFI, whether as a

result of new information, future events or otherwise, unless

required pursuant to applicable law.

Non-GAAP and Other Financial

Measures

This press release uses various “non-GAAP

financial measures”, “non-GAAP ratios”, “supplementary financial

measures” and “capital management measures” (as such terms are

defined in NI 52-112), which are described in further detail

below.

These measures facilitate management’s

comparisons to the Company’s historical operating results in

assessing its results and strategic and operational decision-making

and may be used by financial analysts and others in the oil and

natural gas industry to evaluate the Company’s performance.

Further, management believes that such financial measures are

useful supplemental information to analyze operating performance

and provide an indication of the results generated by the Company's

principal business activities.

Non-GAAP Financial Measures

NI 52-112 defines a non-GAAP financial measure

as a financial measure that: (i) depicts the historical or expected

future financial performance, financial position or cash flow of an

entity; (ii) with respect to its composition, excludes an amount

that is included in, or includes an amount that is excluded from,

the composition of the most directly comparable financial measure

disclosed in the primary financial statements of the entity; (iii)

is not disclosed in the financial statements of the entity; and

(iv) is not a ratio, fraction, percentage or similar

representation.

The non-GAAP financial measures used in this

press release are not standardized financial measures under GAAP

and might not be comparable to similar measures presented by other

companies. Investors are cautioned that non-GAAP financial measures

should not be construed as alternatives to or more meaningful than

the most directly comparable GAAP measures as indicators of Parex'

performance. Set forth below is a description of the non-GAAP

financial measures used in this press release.

Non-GAAP Terms

This report contains financial terms that are

not considered measures under GAAP such as funds flow provided by

operations, funds flow netback per boe, capital expenditures,

working capital, F&D costs, FD&A costs, and F&D and

FD&A recycle ratios that do not have any standardized meaning

under IFRS and may not be comparable to similar measures presented

by other companies. Management uses these non-GAAP measures for its

own performance measurement and to provide shareholders and

investors with additional measurements of the Company’s efficiency

and its ability to fund a portion of its future capital

expenditures.

Funds Flow Provided by

Operations, is a non-GAAP financial measure that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital.

|

|

For the three months ended December 31, |

|

For the year endedDecember 31, |

|

($000s) |

2021 (estimate, unaudited) |

|

|

2020 |

|

|

2021 (estimate, unaudited) |

|

|

2020 |

|

Cash provided by operating activities |

$ |

176,070 |

|

|

$ |

86,988 |

|

|

$ |

534,368 |

|

$ |

290,018 |

|

Net change in non-cash working capital |

|

(6,170 |

) |

|

|

(5,421 |

) |

|

|

44,816 |

|

|

7,023 |

|

Funds flow provided by operations |

$ |

169,900 |

|

|

$ |

81,567 |

|

|

$ |

579,184 |

|

$ |

297,041 |

Funds Flow Provided by Operations per

boe or Funds Flow Netback per boe, is a non-GAAP ratio

that includes all cash generated from operating activities and is

calculated before changes in non-cash working capital, divided by

produced oil and natural gas sales volumes. The Company considers

funds flow netback to be a key measure as it demonstrates Parex’

profitability after all cash costs relative to current commodity

prices and is calculated as follows:

|

|

For the three months ended December 31, |

|

For the year endedDecember 31, |

|

($000s) |

2021 (estimate, unaudited) |

|

|

2020 |

|

2021 (estimate, unaudited) |

|

|

2020 |

|

Funds flow provided by operations |

$ |

169,900 |

|

$ |

81,567 |

|

$ |

579,184 |

|

$ |

297,041 |

|

|

|

|

|

|

|

|

|

|

Company produced oil and natural gas sales in

period |

|

4,621,528 |

|

|

4,279,656 |

|

|

17,207,142 |

|

|

16,954,264 |

|

Funds flow provided by operations per boe |

$ |

36.76 |

|

$ |

19.06 |

|

$ |

33.66 |

|

$ |

17.52 |

Capital Expenditures, is a

non-GAAP financial measure which the Company uses to describe its

capital costs associated with Oil and Gas expenditures. The measure

considers both Property, Plant and Equipment expenditures and

Exploration and Evaluation asset expenditures which are items in

the Company’s statement of Cash Flows for the period.

|

|

For the three months ended December 31, |

|

For the year endedDecember 31, |

|

($000s) |

2021 (estimate, unaudited) |

|

|

2020 |

|

2021 (estimate, unaudited) |

|

|

2020 |

|

Property, plant and equipment expenditures |

$ |

76,454 |

|

$ |

34,893 |

|

$ |

212,153 |

|

$ |

116,915 |

|

Exploration and evaluation expenditures |

|

42,053 |

|

|

12,039 |

|

|

65,082 |

|

|

24,349 |

|

Capital expenditures |

$ |

118,507 |

|

$ |

46,932 |

|

$ |

277,235 |

|

$ |

141,264 |

Working Capital, is a non-GAAP

capital measure which the Company uses to describe its liquidity

position and ability to meet its short-term liabilities. Working

Capital is defined as current assets less current liabilities.

|

|

For the three months ended December 31, |

|

For the year endedDecember 31, |

|

($000s) |

2021 (estimate, unaudited) |

|

|

2020 |

|

2021 (estimate, unaudited) |

|

|

2020 |

|

Current Assets |

$ |

574,038 |

|

$ |

442,636 |

|

$ |

574,038 |

|

$ |

442,636 |

| Current

Liabilities |

|

248,869 |

|

|

122,481 |

|

|

248,869 |

|

|

122,481 |

|

Working Capital |

$ |

325,169 |

|

$ |

320,155 |

|

$ |

325,169 |

|

$ |

320,155 |

Finding & Development Costs (F&D

costs) and Finding, Development and Acquisition Costs (FD&A

costs), is a non-GAAP ratio that helps to explain the cost

of finding and developing additional oil and gas reserves. F&D

costs are determined by dividing capital expenditures plus the

change in FDC in the period divided by BOE reserve additions in the

period. FD&A costs are determined by dividing capital

expenditures in the period plus the change in FDC plus acquisition

costs divided by BOE reserve additions in the period.

|

|

2021 |

3-Year |

|

USD$(‘000) |

Proved Developed Producing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

| Capital Expenditures(1) |

277,235 |

277,235 |

277,235 |

626,695 |

| Capital

Expenditures - change in FDC |

(5,782) |

33,662 |

47,605 |

58,613 |

|

Total Capital |

271,453 |

310,897 |

324,840 |

685,308 |

| |

|

|

|

|

| Net Acquisitions |

— |

— |

— |

— |

| Net

Acquisitions - change in FDC |

— |

39,800 |

69,482 |

69,482 |

|

Total Net Acquisitions |

— |

39,800 |

69,482 |

69,482 |

|

|

|

|

|

|

|

Total Capital including Acquisitions |

271,453 |

350,697 |

394,322 |

754,790 |

|

|

|

|

|

|

| Reserve Additions |

25,340 |

12,091 |

13,674 |

59,748 |

| Net

Acquisitions Reserve Additions |

— |

2,246 |

7,814 |

7,814 |

|

Reserve Additions including

Acquisitions(2)

(Mboe) |

25,340 |

14,337 |

21,488 |

67,562 |

|

|

|

|

|

|

| F&D Costs

($/boe) |

10.71 |

25.71 |

23.76 |

11.47 |

|

FD&A Costs ($/boe) |

10.71 |

24.46 |

18.35 |

11.17 |

(1) Calculated using unaudited estimated capital

expenditures for the period ended December 31, 2021. All

reserves are presented as Parex working interest before royalties.

Please refer to the “Reserve Advisory” section for a description of

each reserve category.

Recycle ratio, is a non-GAAP

ratio that measures the profit per barrel of oil to the cost of

finding and developing that barrel of oil. The recycle ratio is

determined by dividing the fourth quarter funds flow from

operations per boe by the F&D costs and FD&A costs in the

period.

|

|

2021 |

3-Year |

|

USD$ |

Proved Developed Producing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

|

Estimated 2021 Q4 funds flow per boe ($/boe) |

36.76 |

36.76 |

36.76 |

27.08 |

|

|

|

|

|

|

| F&D Costs(2) ($/boe) |

10.71 |

25.71 |

23.76 |

11.47 |

|

FD&A Costs(2) ($/boe) |

10.71 |

24.46 |

18.35 |

11.17 |

|

|

|

|

|

|

| Recycle Ratio -

F&D(1) |

3.4 x |

1.4 x |

1.5 x |

2.4 x |

|

Recycle Ratio - FD&A(1) |

3.4 x |

1.5 x |

2.0 x |

2.4 x |

(1) Recycle ratio is calculated as funds flow

from operations per boe divided by F&D or FD&A as

applicable. Three-year funds flow from operations on a per boe

basis is calculated using weighted average sales volumes.

Net Asset Value Per Share, is a

non-GAAP ratio that combines the 51-101 NPV10 value after tax with

the Company’s estimated working capital at the period end date

divided by common shares outstanding at the period end date. The

Company uses the Net Asset Value per share as a way to reflect the

Company’s value considering both existing working capital on hand

plus the NPV10 after tax value on Oil and Gas Reserves. NAV per

share is stated in CAD dollars using an exchange rate of

USDCAD=1.2678.

Dividend Advisory

Future dividend payments, if any, and the level

thereof is uncertain. The Company's dividend policy and any

decision to pay further dividends on the common shares, including

any special dividends, will be subject to the discretion of the

Board and may depend on a variety of factors, including, without

limitation the Company's business performance, financial condition,

financial requirements, growth plans, expected capital requirements

and other conditions existing at such future time including,

without limitation, contractual restrictions and satisfaction of

the solvency tests imposed on the Company under applicable

corporate law. The actual amount, the declaration date, the record

date and the payment date of any dividend are subject to the

discretion of the Board. There can be no assurance that dividends

will be paid at the intended rate or at any rate in the future.

Advisory on Forward Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions

"may" or "will" occur are intended to identify forward-looking

statements. Such statements represent Parex' internal projections,

estimates or beliefs concerning, among other things: the Company’s

strategy, plans and focus; the Company's anticipated results of

operations, production, business prospects and opportunities; terms

of the dividends payable on March 30, 2022; the Company's

expectation that Parex will purchase the maximum allowable shares

under its NCIB; the Company's plan to return meaningful capital to

its shareholders; the Company's estimated reserve life balance;

that Parex is well positioned to generate shareholder value in 2022

and over the long term; anticipated future crude oil prices and

future development capital; expectations that the first well of a

four-well program in Arauca and the first well in a six-well

program in Capachos, will each spud in the first half of 2022;

expectations that the Company's electric turbines will facilitate

increased capacity and the anticipated timing thereof; the

Company's plans to move to a new well pad in Fortuna and the

anticipated timing thereof; expected commitments from the bid

round; and that the Company will hold a conference call and webcast

for investors, analysts and other interested parties and the

anticipated timing thereof. These statements are only predictions

and actual events, or results may differ materially. Although the

Company’s management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex' actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In addition, forward-looking statements

contained in this document include, statements relating to

"reserves", which are by their nature forward-looking statements,

as they involve the implied assessment, based on certain estimates

and assumptions that the reserves described can be profitably

produced in the future. The recovery and reserve estimates of

Parex' reserves provided herein are estimates only and there is no

guarantee that the estimated reserves will be recovered.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

industry conditions including changes in laws and regulations

including adoption of new environmental laws and regulations, and

changes in how they are interpreted and enforced, in Canada and

Colombia; impact of the COVID-19 pandemic and the ability of the

Company to carry on its operations as currently contemplated in

light of the COVID-19 pandemic; determinations by OPEC and other

countries as to production levels; prolonged volatility in

commodity prices; risk of delay in completing or non-competition of

required transfers of the applicable operating and environmental

permits; failure of counterparties to perform under contracts;

competition; lack of availability of qualified personnel; the

results of exploration and development drilling and related

activities; obtaining required approvals of regulatory authorities,

in Canada and Colombia; risks associated with negotiating with

foreign governments as well as country risk associated with

conducting international activities; volatility in market prices

for oil; fluctuations in foreign exchange or interest rates;

environmental risks; changes in income tax laws or changes in tax

laws and incentive programs relating to the oil industry; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under the terms of their

contracts; risk that Parex does not have sufficient financial

resources in the future to pay a divided; risk that the Board does

not declare dividends in the future or that Parex' dividend policy

changes; that Parex will not purchase the maximum allowable shares

under its NCIB; that Parex will not generate shareholder value in

2022 or over the long term; that the first wells in Arauca and

Capachos will not spud when anticipated; that the Company's

electric turbines will not facilitate increased capacity; that

commitments from the bid round will at less favorable terms than

anticipated; and other factors, many of which are beyond the

control of the Company. Readers are cautioned that the foregoing

list of factors is not exhaustive. Additional information on these

and other factors that could affect Parex' operations and financial

results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding: current commodity prices and royalty regimes; the impact

(and the duration thereof) that COVID-19 pandemic will have on the

demand for crude oil and natural gas, Parex’ supply chain and

Parex’ ability to produce, transport and sell Parex’ crude oil and

natural gas; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil; the

impact of increasing competition; conditions in general economic

and financial markets; availability of drilling and related

equipment; effects of regulation by governmental agencies; royalty

rates; future operating costs; effects of regulation by

governmental agencies; uninterrupted access to areas of Parex'

operations and infrastructure; recoverability of reserves and

future production rates; the status of litigation; timing of

drilling and completion of wells; that Parex will have sufficient

cash flow, debt or equity sources or other financial resources

required to fund its capital and operating expenditures and

requirements as needed; that Parex' conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that the estimates of

Parex' reserves volumes and the assumptions related thereto

(including commodity prices and development costs) are accurate in

all material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources in the future to pay a dividend; that the Board will

declare dividends in the future; that Parex will have sufficient

financial resources to purchase the maximum allowable shares under

its NCIB; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations

and such information may not be appropriate for other purposes.

Parex' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

PDF

available: http://ml.globenewswire.com/Resource/Download/d2b152e5-564e-40c6-983a-cda7db14b15a

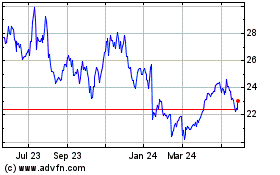

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

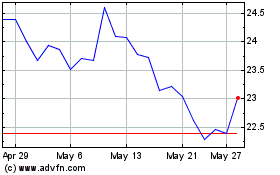

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025