Improved Production for

Second

Quarter of

2023

Serabi Gold plc (AIM:SRB, TSX:SBI), the

Brazilian-focused gold mining and development company,

is pleased to report

operational results for the

second quarter of

2023 and provide

a review of its development and exploration

activities.

HIGHLIGHTS

- Second quarter

gold production totalled 8,518 ounces, a 6% improvement on the

first quarter in 2023.

- Mined grades

were 6.94 g/t gold, the highest since the third quarter of 2021.

Mined grades at Palito averaged 6.68 g/t gold.

- Coringa mine

development continued to progress well with mined grades of 7.83

g/t gold. The development ore transported to Palito plant

contributed over 2,000 ounces of gold production for the

quarter.

- The Vale

Exploration Alliance is progressing well with 7 diamond drillholes

for 3,200 metres completed at the Matilda prospect. A number of

other regional targets have also tested with total drilling

exceeding 5,500 metres. Assay results from Matilda and the other

targets are anticipated within the coming weeks.

- Cash held at 30

June 2023 was US$13.3 million (US$12.3 million net of cash held

under the Vale Exploration Alliance) compared to US$7.2 million at

31 December 2022.

Mike Hodgson, CEO of Serabi,

commented:

“An excellent second quarter to follow the first

quarter production of 8,005 ounces, keeps the company on course to

meet its guidance for this year of between 33,500 to 35,000

ounces.

“The quarter saw improved grades coming from

Palito, along with continued high grade development ore from

Coringa, which resulted in a plant feed grade of 6.84g/t gold,

which we have not achieved since the third quarter of 2021.

“Mine development at Coringa continued to be

very successful. The payability of the development is quite

remarkable, with very limited low-grade or waste zones being

encountered as the orebody is developed. The mine is still in

development and only operating under the GUIA trial mining license.

Even so, the small volumes of ore that are being extracted and

transported to the Palito plant are proving to be very beneficial,

with over 2,000 ounces of gold production attributed to Coringa in

the second quarter.

“On the exploration front, the relationship with

Vale is working well and the first phase of drilling was completed

on the Matilda copper porphyry prospect with seven holes now

drilled. Samples have gone for multi-element external assaying, and

we eagerly await the results. With three rigs on site, the focus

has shifted to other regional targets with a second round of

drilling planned at Matilda when the assays from phase 1 have been

received and the geological picture updated.

“Management remains hopeful that we are entering

the final stages of satisfying the requests of the court and public

prosecutor regarding the future licencing of Coringa and in

particular that the project presents minimal impact to the

environment and communities that live nearby. The indigenous study

report (“ECI”) was completed in April. It has been circulated

through the technical committees of the Indigenous communities with

comments received and being incorporated into a revised draft. In

parallel, independent consultations have been carried out with the

indigenous communities to seek project support, which have

progressed very well. With the demands fulfilled, this should

result in a cancellation of the court decision and open the door

for SEMAS, the environmental agency, to issue the installation

License (“LI”) shortly thereafter.”

OPERATIONAL

RESULTS

Total production for the second quarter of 2023

was 8,518 ounces. Coringa contributed 2,186 ounces to this total.

Total ore mined from the Palito Complex during

the quarter was 31,652 tonnes at 6.68 g/t compared to 29,691 tonnes

at 6.33 g/t of gold for the first quarter of 2023. Development

mining operations at Coringa generated a total of 9,370 tonnes at

7.83 g/t in the quarter.

41,116 tonnes of ROM ore was processed through

the Palito plant during the quarter, with an average grade of 6.84

g/t of gold, compared with 39,004 tonnes at 6.75 g/t in the first

quarter of 2023. This included 9,215 tonnes of Coringa ore at a

feed grade of 7.59 g/t gold.

A total of 2,469 metres of horizontal

development has been completed at Palito during the quarter, of

which 1,619 metres was ore development. The balance is the ramp,

cross cuts and stope preparation development. Horizontal

development at Coringa totalled 508 metres, of which 304 metres was

in ore.

|

|

SUMMARY PRODUCTION STATISTICS FOR 2023 AND

2022 |

|

|

|

Qtr 1 |

Qtr 2 |

YTD |

Qtr 1 |

Qtr 2 |

Qtr 3 |

Qtr 4 |

Full Year |

|

2023 |

2023 |

2023 |

2022 |

2022 |

2022 |

2022 |

2022 |

|

Group |

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

8,005 |

8,518 |

16,524 |

7,062 |

8,418 |

8,542 |

7,798 |

31,819 |

| Mined

ore |

Tonnes |

41,546 |

41,022 |

82,568 |

40,606 |

44,008 |

46,863 |

42,264 |

173,741 |

|

|

Gold grade (g/t) |

6.49 |

6.94 |

6.71 |

5.95 |

6.26 |

6.22 |

6.01 |

6.12 |

| Milled

ore |

Tonnes |

39,004 |

41,116 |

80,120 |

41,357 |

43,488 |

44,867 |

42,692 |

172,404 |

|

|

Gold

grade (g/t) |

6.75 |

6.84 |

6.80 |

5.72 |

6.43 |

6.34 |

6.05 |

6.14 |

|

Palito Complex |

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

5,776 |

6,632 |

12,108 |

7,062 |

8,418 |

7,972 |

7,355 |

30,807 |

| Mined

ore |

Tonnes |

31,705 |

31,901 |

63,357 |

40,606 |

44,008 |

43,180 |

38,293 |

166,087 |

|

|

Gold grade (g/t) |

6.14 |

6.68 |

6.41 |

5.84 |

6.26 |

6.28 |

6.20 |

6.15 |

| Milled

ore |

Tonnes |

31,273 |

31,901 |

63,174 |

41,357 |

43,488 |

42,257 |

39,573 |

166,675 |

|

|

Gold grade (g/t) |

6.14 |

6.63 |

6.38 |

5.72 |

6.43 |

6.30 |

6.17 |

6.16 |

|

Horizontal development |

Metres |

2,010 |

2,469 |

4,480 |

2,938 |

3,353 |

2,458 |

2,245 |

10,994 |

|

Coringa |

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

2,229 |

2,186 |

4,415 |

|

|

570 |

443 |

1,013 |

| Mined

ore |

Tonnes |

9,841 |

9,370 |

19,211 |

|

|

3,683 |

3,971 |

7,654 |

|

|

Gold grade (g/t) |

7.63 |

7.83 |

7.73 |

|

|

5.46 |

4.15 |

4.78 |

| Milled

ore |

Tonnes |

7,731 |

9,215 |

16,496 |

|

|

2,610 |

3,119 |

5,729 |

|

|

Gold grade (g/t) |

9.22 |

7.59 |

8.33 |

|

|

7.00 |

4.58 |

5.68 |

|

Horizontal development |

Metres |

452 |

508 |

960 |

212 |

302 |

632 |

645 |

1,791 |

(1) The

table may not sum due to rounding.

(2) Production

numbers are subject to change pending final assay analysis from

refineries.

EXPLORATION UPDATE

The Vale Exploration Alliance, signed in May

2023, is progressing well with exploration activity across a number

of key target areas of the Palito tenement package. This activity

includes:

- Three contractor diamond drill rigs

in operation having completed a total of 21 holes, 7 of which were

testing the Matilda copper porphyry target. The total metres

drilled now exceeds 5,500 metres of the planned 15,000 metres

programme.

- Samples have been sent to an

independent laboratory for multi-element assays with the initial

results from Matilda expected within the coming weeks.

- Systematic soil sampling and auger

drilling is being undertaken on areas not previously tested. Soils

are being initially tested with a hand-held XRF (X-ray

fluorescence) and delivering some interesting results. Following

the receipt of results from the external laboratory, further

mapping activities and a drilling programme will be

considered.

The initial phase of drilling at Matilda was

designed to test the footprint of the target. Logging of the core

suggests that a number of the holes intersected mineralisation

similar to that identified in the 2022 programme. Other holes

appear to be more weakly mineralised whilst two holes returned

broad zones with what visually appears to be higher grade

mineralisation, comparable with the highest grade zones from the

2022 programme where grades of 0.4% to 0.7% copper equivalent were

intersected (see press release dated 5 July 2022). Assay results

from an independent laboratory are awaited and will be announced in

due course. Following full geological analysis of these assay

results, a second phase of drilling will commence at Matilda. This

will also be guided by a ground geophysics survey that has been

programmed to support further geological interpretation.

The drill rigs have moved to other targets

including:

- Barbara and Maria Loura which are

potential extensions of or parallel structures to the Sao Chico ore

body.

- Cinderella which is the site of

major historic artisanal activity and has a strong gold-in-soil

anomaly over a broad area.

- Calico, which is a target of

comparable size to Matilda with a strong gold-in-soil anomaly but

no historic drilling.

The regional exploration effort of soil sampling

and auger drilling has been successful in identifying a number of

new high priority targets using a hand-held XRF device to generate

preliminary results while external assays are pending. These

targets include a significant copper-in-soil anomaly to the north

of Matilda that will require follow-up mapping and potentially

drilling later in the programme. With 1,450 soil samples collected

and 308 auger drillholes completed, these programmes are 53% and

72% completed respectively.

FINANCE UPDATE

Cash balances at the end of June 2023 were

US$13.3 million which includes US$0.94 million of funds held for

the Vale Exploration Alliance. This compares with a cash balance of

US$7.2 million at the end of December 2022 and US$13.9 million at

31 March 2023, which included a US$5.0 million loan for a 12 month

period from Santander Bank in Brazil received at the end of

February 2023. During May 2023, the Group repaid the US$5.0

million loan facility that it had taken out with Itau BBA bank in

May 2022. Net cash attributable to the Group has increased by

US$5.1 million during the first six months of the year.

The person who arranged for the release of this

announcement on behalf of the Company was Clive Line, Director.

Enquiries

SERABI GOLD plcMichael

Hodgson t

+44 (0)20 7246 6830Chief

Executive m

+44 (0)7799 473621

Clive

Line t

+44 (0)20 7246 6830Finance

Director m

+44 (0)7710 151692

e

contact@serabigold.com

www.serabigold.com

BEAUMONT CORNISH

LimitedNominated Adviser & Financial

AdviserRoland Cornish / Michael

Cornish t

+44 (0)20 7628 3396

PEEL HUNT LLPJoint UK

BrokerRoss

Allister t

+44 (0)20 7418 9000

TAMESIS PARTNERS LLPJoint

UK BrokerCharlie Bendon/ Richard

Greenfield t

+44 (0)20 3882 2868

CAMARCOFinancial PRGordon

Poole / Emily

Hall t

+44 (0)20 3757 4980

Copies of this announcement are available from

the Company's website at www.serabigold.com.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

GLOSSARY OF TERMS

The following is a glossary of technical

terms:

|

“Ag” |

means silver. |

|

“Au” |

means gold. |

|

“assay” |

in economic geology, means to analyse the proportions of metal in a

rock or overburden sample; to test an ore or mineral for

composition, purity, weight or other properties of commercial

interest. |

|

“CIM” |

means the Canadian Institute of Mining, Metallurgy and

Petroleum. |

|

“chalcopyrite” |

is a sulphide of copper and iron. |

|

“Cu” |

means copper. |

|

“cut-off grade” |

the lowest grade of mineralised material that qualifies as ore in a

given deposit; rock of the lowest assay included in an ore

estimate. |

|

“dacite porphyry

intrusive” |

a silica-rich igneous rock with larger phenocrysts (crystals)

within a fine-grained matrixi |

|

“deposit” |

is a mineralised body which has been physically delineated by

sufficient drilling, trenching, and/or underground work, and found

to contain a sufficient average grade of metal or metals to warrant

further exploration and/or development expenditures; such a deposit

does not qualify as a commercially mineable ore body or as

containing ore reserves, until final legal, technical, and economic

factors have been resolved. |

|

“electromagnetics” |

is a geophysical technique tool measuring the magnetic field

generated by subjecting the sub-surface to electrical

currents. |

|

“garimpo” |

is a local artisanal mining operation |

|

“garimpeiro” |

is a local artisanal miner. |

|

“geochemical” |

refers to geological information using measurements derived from

chemical analysis. |

|

“geophysical” |

refers to geological information using measurements derived from

the use of magnetic and electrical readings. |

|

“geophysical techniques” |

include the exploration of an area by exploiting differences in

physical properties of different rock types. Geophysical methods

include seismic, magnetic, gravity, induced polarisation and other

techniques; geophysical surveys can be undertaken from the ground

or from the air. |

|

“gossan” |

is an iron-bearing weathered product that overlies a sulphide

deposit. |

|

“grade” |

is the concentration of mineral within the host rock typically

quoted as grams per tonne (g/t), parts per million (ppm) or parts

per billion (ppb). |

|

“g/t” |

means grams per tonne. |

|

“granodiorite” |

is an igneous intrusive rock similar to granite. |

|

“hectare” or a “ha” |

is a unit of measurement equal to 10,000 square metres. |

|

“igneous” |

is a rock that has solidified from molten material or magma. |

|

“IP” |

refers to induced polarisation, a geophysical technique whereby an

electric current is induced into the sub-surface and the

conductivity of the sub-surface is recorded. |

|

“intrusive” |

is a body of rock that invades older rocks. |

|

“mineralisation” |

the concentration of metals and their chemical compounds within a

body of rock. |

|

“mineralised” |

refers to rock which contains minerals e.g. iron, copper,

gold. |

|

“Mo-Bi-As-Te-W-Sn” |

Molybdenum-Bismuth-Arsenic-Tellurium-Tungsten-Tin |

|

“monzogranite” |

a biotite rich granite, often part of the later-stage emplacement

of a larger granite body. |

|

“mt” |

means million tonnes. |

|

“ore” |

means a metal or mineral or a combination of these of sufficient

value as to quality and quantity to enable it to be mined at a

profit. |

|

“oxides” |

are near surface bed-rock which has been weathered and oxidised by

long term exposure to the effects of water and air. |

|

“ppm” |

means parts per million. |

|

“saprolite” |

is a weathered or decomposed clay-rich rock. |

|

“sulphide” |

refers to minerals consisting of a chemical combination of sulphur

with a metal. |

|

“vein” |

is a generic term to describe an occurrence of mineralised rock

within an area of non-mineralised rock. |

|

“VTEM” |

refers to versa time domain electromagnetic, a particular variant

of time-domain electromagnetic geophysical survey to prospect for

conductive bodies below surface. |

|

“XRF” |

X-ray Fluorescence (XRF) is a spectrometric technique used to

perform elemental analysis non-destructively on samples |

Assay ResultsAssay results reported within this

release include those provided by the Company's own on-site

laboratory facilities at Palito and have not yet been independently

verified. Serabi closely monitors the performance of its own

facility against results from independent laboratory analysis for

quality control purpose. As a matter of normal practice, the

Company sends duplicate samples derived from a variety of the

Company's activities to accredited laboratory facilities for

independent verification. Since mid-2019, over 10,000 exploration

drill core samples have been assayed at both the Palito laboratory

and certified external laboratory, in most cases the ALS laboratory

in Belo Horizonte, Brazil. When comparing significant assays with

grades exceeding 1 g/t gold, comparison between Palito versus

external results record an average over-estimation by the Palito

laboratory of 6.7% over this period. Based on the results of this

work, the Company's management are satisfied that the Company's own

facility shows sufficiently good correlation with independent

laboratory facilities for exploration drill samples. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a

recognised standard, the independent authors of such a statement

would not use Palito assay results without sufficient duplicates

from an appropriately certificated laboratory.

Forward-looking statementsCertain statements in

this announcement are, or may be deemed to be, forward looking

statements. Forward looking statements are identified by their use

of terms and phrases such as ‘‘believe’’, ‘‘could’’, “should”

‘‘envisage’’, ‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’

or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors’ current expectations and assumptions regarding the

Company’s future growth, results of operations, performance, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements reflect

the Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

Qualified Persons StatementThe scientific and

technical information contained within this announcement has been

reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

30 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognizing him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release

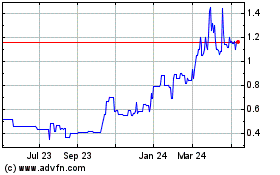

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

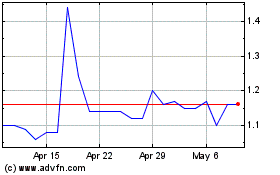

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025