Third-Quarter Revenue Grows 45% Year on Year

Shopify Now Powers Over One Million Merchants Worldwide

Shopify reports in U.S. dollars and in

accordance with U.S. GAAP

Shopify Inc. (NYSE:SHOP)(TSX:SHOP), a leading global commerce

company, today announced strong financial results for the quarter

ended September 30, 2019.

“More than a million merchants are now building their businesses

on Shopify, as more entrepreneurs around the world reach for

independence,” said Tobi Lütke, Shopify’s CEO. “These merchants

chose Shopify because we’re making entrepreneurship easier, and we

will continue to level the playing field to help merchants

everywhere succeed.”

“Our strong results in the quarter were driven in part by the

success of our international expansion, which is just one of the

many ways we are investing in the platform,” said Amy Shapero,

Shopify’s CFO. “By carefully balancing these multiple opportunities

that have different investment time horizons, we can keep investing

in the innovations that will power merchants in the future while

helping them grow rapidly today.”

Third-Quarter Financial Highlights

- Total revenue in the third quarter was $390.6 million, a 45%

increase from the comparable quarter in 2018.

- Subscription Solutions revenue grew 37% to $165.6 million. This

increase was driven primarily by growth in Monthly Recurring

Revenue1 ("MRR"), largely due to an increase in the number of

merchants joining the Shopify platform.

- Merchant Solutions revenue grew 50%, to $225.0 million, driven

primarily by the growth of Gross Merchandise Volume2 ("GMV").

- MRR as of September 30, 2019 was $50.7 million, up 34% compared

with $37.9 million as of September 30, 2018. Shopify Plus

contributed $13.5 million, or 27%, of MRR compared with 24% of MRR

as of September 30, 2018.

- GMV for the third quarter was $14.8 billion, an increase of

$4.8 billion, or 48%, over the third quarter of 2018. Gross

Payments Volume3 ("GPV") grew to $6.2 billion, which accounted for

42% of GMV processed in the quarter, versus $4.1 billion, or 41%,

for the third quarter of 2018.

- Gross profit dollars grew 45%, to $216.7 million, compared with

$149.7 million recorded for the third quarter of 2018.

- Operating loss for the third quarter of 2019 was $35.7 million,

or 9% of revenue, versus a loss of $31.4 million, or 12% of

revenue, for the comparable period a year ago.

- Adjusted operating income4 for the third quarter of 2019 was 3%

of revenue, or $10.5 million; adjusted operating loss for the third

quarter of 2018 was 1% of revenue, or $2.4 million.

- Net loss for the third quarter of 2019 was $72.8 million, or

$0.64 per share, compared with $23.2 million, or $0.22 per share,

for the third quarter of 2018. Net loss for the third quarter of

2019 includes a tax provision of $48.3 million. This provision is

primarily due to a one-time capital gain triggered by the transfer

of regional relationship and territory rights from our Canadian

entity to regional headquarters, which allows us to develop and

maintain merchant and commercial operations in their respective

regions as we expand internationally.

- Adjusted net loss4 for the third quarter of 2019 was $33.6

million, or $0.29 per share, compared with adjusted net income of

$5.8 million, or $0.05 per share, for the third quarter of

2018.

- At September 30, 2019, Shopify had $2.67 billion in cash, cash

equivalents and marketable securities, compared with $1.97 billion

on December 31, 2018. The increase reflects $688.0 million of net

proceeds from Shopify’s offering of Class A subordinate voting

shares in the third quarter of 2019.

Third-Quarter Business Highlights

In the third quarter, Shopify continued to build for the long

term by lowering the barriers to entry for entrepreneurship,

extending the functionality of the platform for merchants, and

enriching our offering as a global commerce operating system:

- Shopify surpassed one million merchants worldwide on our

platform, hitting a major milestone and reflecting the continued

expansion of Shopify’s global community of entrepreneurs.

- Shopify Fulfillment Network continued to lay the foundation for

timely and affordable direct-to-consumer fulfillment for merchants

that value their brands and customer experience. With strong

interest from merchants, we will continue to add select merchants

and partners as we focus on high performance and optimize for the

merchant experience.

- Shopify announced availability for merchants in most U.S.

states to start selling hemp or hemp-derived cannabidiol (CBD)

products on our platform, both online or in brick-and-mortar retail

locations.

- Shopify launched the Shopify Sustainability Fund, which commits

at least $5 million annually to invest in areas like carbon

sequestration, neutralizing our carbon footprint, sustainable

packaging, and enabling our merchants and their buyers to

participate.

- Shopify launched Shopify Chat, our first native chat function

that allows merchants to have real-time conversations with

customers visiting their stores and provide a better shopping

experience.

- Shopify launched native language capabilities in Turkish,

bringing the total number of languages in which the Shopify Admin

is available to 19.

- Shopify launched Shopify Payments in Italy, expanding the

availability of Shopify Payments to 14 countries.

- Shopify Shipping adoption continued to expand, with

approximately 44% of eligible merchants in the United States and

Canada using Shopify Shipping in the quarter.

- Purchases from merchants’ stores coming from mobile devices

versus desktop continued to climb in the quarter, accounting for

nearly 81% of traffic and 71% of orders for the three months ended

September 30, 2019, versus 77% and 67%, respectively, for the third

quarter of 2018.

- Shopify Capital issued $141.0 million in merchant cash advances

and loans in the third quarter of 2019, an increase of 85% versus

the $76.4 million issued in the third quarter of last year. Shopify

Capital has grown to approximately $768.9 million in cumulative

cash advanced since its launch in April 2016 through the third

quarter of 2019, approximately $166 million of which was

outstanding on September 30, 2019.

Subsequent to the close of our third quarter, Shopify completed

the acquisition of 6 River Systems, Inc., a leading provider of

collaborative warehouse fulfillment solutions.

Financial Outlook

The financial outlook that follows constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control. Please see "Forward-looking Statements"

below.

In addition to the other assumptions and factors described in

this press release, Shopify’s outlook assumes the continuation of

growth trends in our industry, our ability to manage our growth

effectively and the absence of material changes in our industry or

the global economy. The following statements supersede all prior

statements made by Shopify and are based on current expectations.

As these statements are forward-looking, actual results may differ

materially.

These statements do not give effect to the potential impact of

mergers, acquisitions, divestitures or business combinations that

may be announced or closed after the date hereof. All numbers

provided in this section are approximate.

For the full year 2019, Shopify currently expects:

- Revenues in the range of $1.545 billion to $1.555 billion

- GAAP operating loss in the range of $158 million to $168

million

- Adjusted operating income4 in the range of $27 million to $37

million, which excludes stock-based compensation expenses and

related payroll taxes of $180 million, and amortization of acquired

intangibles of $15 million

For the fourth quarter of 2019, Shopify currently expects:

- Revenues in the range of $472 million to $482 million

- GAAP operating loss in the range of $47 million to $57

million

- Adjusted operating income4 in the range of $10 million to $20

million, which excludes stock-based compensation expenses and

related payroll taxes of $57 million, and amortization of acquired

intangibles of $10 million

- Monthly Recurring Revenue, or MRR, is calculated by multiplying

the number of merchants by the average monthly subscription plan

fee in effect on the last day of that period and is used by

management as a directional indicator of subscription solutions

revenue going forward assuming merchants maintain their

subscription plan the following month.

- Gross Merchandise Volume, or GMV, represents the total dollar

value of orders processed on the Shopify platform in the period,

net of refunds, and inclusive of shipping and handling, duty and

value-added taxes.

- Gross Payments Volume, or GPV, is the amount of GMV processed

through Shopify Payments.

- Non-GAAP financial measures exclude the effect of stock-based

compensation expenses and related payroll taxes as well as

amortization of acquired intangibles and related taxes. Please

refer to "Non-GAAP Financial Measures" in this press release for

more information.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss

our third-quarter results today, October 29, 2019, at 8:30 a.m. ET.

The conference call will be webcast on the investor relations

section of Shopify’s website at https://investors.shopify.com/events/Events-Presentations/default.aspx.

An archived replay of the webcast will be available following the

conclusion of the call.

Shopify’s Third-Quarter 2019 Interim Unaudited Condensed

Consolidated Financial Statements and Notes and its Third-Quarter

2019 Management’s Discussion and Analysis are available on

Shopify’s website at www.shopify.com,

and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading global commerce company, providing trusted

tools to start, grow, market, and manage a retail business of any

size. Shopify makes commerce better for everyone with a platform

and services that are engineered for reliability, while delivering

a better shopping experience for consumers everywhere.

Headquartered in Ottawa, Canada, Shopify powers over one million

businesses in more than 175 countries and is trusted by brands such

as Allbirds, Gymshark, PepsiCo, Staples, and many more. For more

information, visit www.shopify.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with United States generally

accepted accounting principles (GAAP), Shopify uses certain

non-GAAP financial measures to provide additional information in

order to assist investors in understanding our financial and

operating performance.

Adjusted operating income (loss), non-GAAP operating expenses,

adjusted net income (loss) and adjusted net income (loss) per share

are non-GAAP financial measures that exclude the effect of

stock-based compensation expenses and related payroll taxes and

amortization of acquired intangibles and related taxes.

Management uses non-GAAP financial measures internally for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Shopify believes that these

non-GAAP measures provide useful information about operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. Non-GAAP financial

measures are not recognized measures for financial statement

presentation under U.S. GAAP and do not have standardized meanings,

and may not be comparable to similar measures presented by other

public companies. Such non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP. See the financial tables below for a reconciliation of

the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of applicable securities laws, including

statements regarding Shopify’s financial outlook and future

financial performance. Words such as "expects", "continue", "keep",

"will", "anticipates" and "intends" or similar expressions are

intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current

projections and expectations about future events and financial

trends that management believes might affect its financial

condition, results of operations, business strategy and financial

needs, and on certain assumptions and analysis made by Shopify in

light of the experience and perception of historical trends,

current conditions and expected future developments and other

factors management believes are appropriate. These projections,

expectations, assumptions and analyses are subject to known and

unknown risks, uncertainties, assumptions and other factors that

could cause actual results, performance, events and achievements to

differ materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

actual results will be consistent with these forward-looking

statements. Actual results could differ materially from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control, including but not limited to: (i) merchant

acquisition and retention; (ii) managing our growth; (iii) our

history of losses; (iv) our limited operating history; (v) our

ability to innovate; (vi) a disruption of service or security

breach; (vii) payments processed through Shopify Payments; (viii)

our reliance on a single supplier to provide the technology we

offer through Shopify Payments; (ix) the security of personal

information we store relating to merchants and their customers, and

consumers with whom we have a direct relationship; (x) evolving

privacy laws and regulations, cross-border data transfer

restrictions, data localization requirements and other domestic or

foreign regulations; (xi) our potential inability to hire, retain

and motivate qualified personnel; (xii) international sales and the

use of our platform in various countries; and (xiii) other one-time

events and other important factors disclosed previously and from

time to time in Shopify’s filings with the U.S. Securities and

Exchange Commission and the securities commissions or similar

securities regulatory authorities in each of the provinces or

territories of Canada. The forward-looking statements contained in

this news release represent Shopify’s expectations as of the date

of this news release, or as of the date they are otherwise stated

to be made, and subsequent events may cause these expectations to

change. Shopify undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law.

Shopify Inc.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended

Nine months ended

September 30, 2019

September 30, 2018

September 30, 2019

September 30, 2018

$

$

$

$

Revenues

Subscription solutions

165,577

120,517

459,075

331,436

Merchant solutions

224,975

149,547

613,938

397,931

390,552

270,064

1,073,013

729,367

Cost of revenues

Subscription solutions

33,263

26,600

90,786

74,284

Merchant solutions

140,593

93,737

380,475

244,559

173,856

120,337

471,261

318,843

Gross profit

216,696

149,727

601,752

410,524

Operating expenses

Sales and marketing

116,546

91,635

340,778

254,906

Research and development

90,387

61,629

252,262

163,650

General and administrative

45,421

27,831

119,780

74,430

Total operating expenses

252,354

181,095

712,820

492,986

Loss from operations

(35,658

)

(31,368

)

(111,068

)

(82,462)

Other income

11,212

8,184

33,793

19,423

Loss before income taxes

(24,446

)

(23,184

)

(77,275

)

(63,039)

Provision for income taxes

48,338

—

48,338

—

Net loss

(72,784

)

(23,184

)

(125,613)

(63,039)

Other comprehensive income

(loss)

(6,097

)

6,101

9,923

(5,131)

Comprehensive loss

(78,881

)

(17,083

)

(115,690

)

(68,170)

Basic and diluted net loss per share

attributable to shareholders

(0.64

)

(0.22

)

(1.12

)

(0.60)

Weighted average shares used to compute

basic and diluted net loss per share attributable to

shareholders

113,086,997

106,647,222

112,015,160

104,976,730

Shopify Inc.

Condensed Consolidated Balance

Sheets

(Expressed in US $000’s except

share amounts, unaudited)

As at

September 30, 2019

December 31, 2018

$

$

Assets

Current assets

Cash and cash equivalents

1,124,529

410,683

Marketable securities

1,542,653

1,558,987

Trade and other receivables, net

46,691

41,347

Merchant cash advances and loans

receivable, net

165,775

91,873

Other current assets

31,184

26,192

2,910,832

2,129,082

Long-term assets

Property and equipment, net

92,141

61,612

Intangible assets, net

24,759

26,072

Right-of-use assets

96,788

—

Deferred tax assets

16,040

—

Goodwill

48,375

38,019

278,103

125,703

Total assets

3,188,935

2,254,785

Liabilities and shareholders’

equity

Current liabilities

Accounts payable and accrued

liabilities

139,330

96,956

Income taxes payable

66,617

—

Deferred revenue

48,368

39,180

Lease liabilities

5,426

2,552

259,741

138,688

Long-term liabilities

Deferred revenue

2,115

1,881

Lease liabilities

105,595

22,316

Deferred tax liability

1,425

1,132

109,135

25,329

Commitments and contingencies

Shareholders’ equity

Common stock, unlimited Class A

subordinate voting shares authorized, 103,106,023 and 98,081,889

issued and outstanding; unlimited Class B multiple voting shares

authorized, 12,237,278 and 12,310,800 issued and outstanding

3,042,555

2,215,936

Additional paid-in capital

84,792

74,805

Accumulated other comprehensive income

(loss)

(2,293

)

(12,216

)

Accumulated deficit

(304,995

)

(187,757

)

Total shareholders’ equity

2,820,059

2,090,768

Total liabilities and shareholders’

equity

3,188,935

2,254,785

Shopify Inc.

Condensed Consolidated

Statements of Cash Flows

(Expressed in US $000’s,

unaudited)

Nine months ended

September 30, 2019

September 30, 2018

$

$

Cash flows from operating

activities

Net loss for the period

(125,613)

(63,039)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Amortization and depreciation

22,950

21,204

Stock-based compensation

110,464

68,301

Provision for uncollectible receivables

related to merchant cash advances and loans receivable

10,967

5,043

Deferred income taxes

(15,295)

—

Unrealized foreign exchange loss

2,404

637

Changes in operating assets and

liabilities:

Trade and other receivables

(25,153)

(22,524)

Merchant cash advances and loans

receivable

(84,869)

(57,460)

Other current assets

(3,139)

(8,255)

Accounts payable and accrued

liabilities

53,885

44,203

Income tax assets and liabilities

61,485

—

Deferred revenue

9,029

6,685

Lease assets and liabilities

612

5,272

Net cash provided by operating

activities

17,727

67

Cash flows from investing

activities

Purchase of marketable securities

(2,003,102)

(1,689,553)

Maturity of marketable securities

2,034,933

1,160,003

Acquisitions of property and equipment

(43,357)

(20,432)

Acquisitions of intangible assets

(5,484)

(12,328)

Acquisition of businesses, net of cash

acquired

(12,476)

(3,718

)

Net cash used by investing activities

(29,486)

(566,028)

Cash flows from financing

activities

Proceeds from the exercise of stock

options

37,301

22,273

Proceeds from public offering, net of

issuance costs

688,014

646,984

Net cash provided by financing

activities

725,315

669,257

Effect of foreign exchange on cash and

cash equivalents

290

(1,552)

Net increase in cash and cash

equivalents

713,846

101,744

Cash and cash equivalents – Beginning

of Period

410,683

141,677

Cash and cash equivalents – End of

Period

1,124,529

243,421

Shopify Inc.Reconciliation from GAAP to Non-GAAP

Results(Expressed in US $000’s, except share and per share

amounts, unaudited)

Three months ended Nine months

ended September 30, 2019 September 30, 2018

September 30, 2019 September 30, 2018

$

$

$

$

GAAP Gross profit

216,696

149,727

601,752

410,524

% of Revenue

55

%

55

%

56

%

56

%

add: stock-based compensation

928

618

2,536

1,628

add: payroll taxes related to stock-based compensation

113

37

345

153

Non-GAAP Gross profit (before adjustment for amortization of

acquired intangibles)

217,737

150,382

604,633

412,305

% of Revenue

56

%

56

%

56

%

57

%

add: amortization of acquired intangibles

1,707

1,241

4,978

3,467

Non-GAAP Gross profit (adjusted for amortization of acquired

intangibles)

219,444

151,623

609,611

415,772

% of Revenue

56

%

56

%

57

%

57

%

GAAP Sales and marketing

116,546

91,635

340,778

254,906

% of Revenue

30

%

34

%

32

%

35

%

less: stock-based compensation

8,707

6,015

23,951

15,775

less: payroll taxes related to stock-based compensation

985

382

2,897

1,640

Non-GAAP Sales and marketing

106,854

85,238

313,930

237,491

% of Revenue

27

%

32

%

29

%

33

%

GAAP Research and development

90,387

61,629

252,262

163,650

% of Revenue

23

%

23

%

24

%

22

%

less: stock-based compensation

23,136

14,719

64,234

39,223

less: payroll taxes related to stock-based compensation

2,777

950

8,050

3,583

Non-GAAP Research and development

64,474

45,960

179,978

120,844

% of Revenue

17

%

17

%

17

%

17

%

GAAP General and administrative

45,421

27,831

119,780

74,430

% of Revenue

12

%

10

%

11

%

10

%

less: stock-based compensation

7,261

4,833

19,743

11,675

less: payroll taxes related to stock-based compensation

592

174

1,585

659

Non-GAAP General and administrative

37,568

22,824

98,452

62,096

% of Revenue

10

%

8

%

9

%

9

%

GAAP Operating expenses

252,354

181,095

712,820

492,986

% of Revenue

65

%

67

%

66

%

68

%

less: stock-based compensation

39,104

25,567

107,928

66,673

less: payroll taxes related to stock-based compensation

4,354

1,506

12,532

5,882

Non-GAAP Operating expenses

208,896

154,022

592,360

420,431

% of Revenue

53

%

57

%

55

%

58

%

GAAP Operating loss

(35,658

)

(31,368

)

(111,068

)

(82,462

)

% of Revenue

(9

)%

(12

)%

(10

)%

(11

)%

add: stock-based compensation

40,032

26,185

110,464

68,301

add: payroll taxes related to stock-based compensation

4,467

1,543

12,877

6,035

Adjusted Operating income (loss) (before adjustment for

amortization of acquired intangibles)

8,841

(3,640

)

12,273

(8,126

)

% of Revenue

2

%

(1

)%

1

%

(1

)%

add: amortization of acquired intangibles

1,707

1,241

4,978

3,467

Adjusted Operating income (loss) (adjusted for amortization of

acquired intangibles)

10,548

(2,399

)

17,251

(4,659

)

% of Revenue

3

%

(1

)%

2

%

(1

)%

GAAP Net loss

(72,784

)

(23,184

)

(125,613

)

(63,039

)

% of Revenue

(19

)%

(9

)%

(12

)%

(9

)%

add: stock-based compensation

40,032

26,185

110,464

68,301

add: payroll taxes related to stock-based compensation

4,467

1,543

12,877

6,035

Adjusted Net income (loss) (before adjustments for amortization of

acquired intangibles and provision for income tax effects)

(28,285

)

4,544

(2,272

)

11,297

% of Revenue

(7

)%

2

%

(0

)%

2

%

add: amortization of acquired intangibles

1,707

1,241

4,978

3,467

add: provision for income tax effects related to non-GAAP

adjustments

(7,018

)

-

(18,471

)

-

Adjusted Net income (loss) (adjusted for amortization of acquired

intangibles and provision for income tax effects)

(33,596

)

5,785

(15,765

)

14,764

% of Revenue

(9

)%

2

%

(1

)%

2

%

GAAP net loss per share attributable to shareholders

(0.64

)

(0.22

)

(1.12

)

(0.60

)

add: stock-based compensation

0.35

0.25

0.99

0.65

add: payroll taxes related to stock-based compensation

0.04

0.01

0.11

0.06

Adjusted net income (loss) per share attributable to shareholders

(before adjustments for amortization of acquired intangibles and

provision for income tax effects)

(0.25

)

0.04

(0.02

)

0.11

add: amortization of acquired intangibles

0.02

0.01

0.04

0.03

add: provision for income tax effects related to non-GAAP

adjustments

(0.06

)

—

(0.16

)

— Adjusted net income (loss) per share attributable to shareholders

(adjusted for amortization of acquired intangibles and provision

for income tax effects)

(0.29

)

0.05

(0.14

)

0.14

Weighted average shares used to compute GAAP and non-GAAP net

income (loss) per share attributable to shareholders

113,086,997

106,647,222

112,015,160

104,976,730

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191029005378/en/

INVESTORS: Katie Keita Senior Director, Investor Relations

613-241-2828 x 1024 IR@shopify.com

MEDIA: Julie Nicholson Director of Communications 416-238-6705 x

302 press@shopify.com

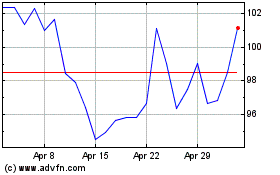

Shopify (TSX:SHOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shopify (TSX:SHOP)

Historical Stock Chart

From Dec 2023 to Dec 2024