TORONTO, Nov. 10, 2011 /CNW/ - Sprott Inc. ("Sprott" or the

"Company") today announced its financial results for the three and

nine month periods ended September 30, 2011. Q3 2011 Highlights --

Assets Under Management ("AUM") were $9.9 billion as at September

30, 2011, compared to $6.5 billion as at September 30, 2010 and

$9.3 billion as at June 30, 2011 -- Management Fees were $40.4

million, an increase of 63.4% compared with the third quarter of

2010 -- Base EBITDA was $18.3 million ($0.11 per share), compared

with $10.4 million ($0.07 per share) in the third quarter of 2010,

an increase of 76.6% -- EBITDA was $17.4 million ($0.10 per share),

compared with $13.8 million ($0.09 per share) in the third quarter

of 2010, an increase of 26.5% -- Net income increased by 4.1% to

$10.4 million ($0.06 per share), from $10.0 million ($0.07 per

share) in the third quarter of 2010 -- Sprott Strategic Fixed

Income Fund completed $220 million Initial Public Offering --

Sprott Physical Gold Trust completed US$306 million follow-on

offering -- Paul Meehl named CEO of Global Resource Investments,

Ltd. -- J.D Rothstein named Senior Vice President and National

Sales Manager of Sprott Asset Management Subsequent events: --

Introduced new Sprott USA (formerly Terra Resource Investment

Management) managed accounts platform -- Launched Sprott Corporate

Class Inc. "During the third quarter, we continued to build and

diversify our organization to offer our clients a broader range of

investment opportunities," said Peter Grosskopf, CEO of Sprott Inc.

"In October, we launched our first Sprott-branded products through

Sprott USA, with the introduction of a new managed accounts

platform that offers US investors access to the combined expertise

of Rick Rule, Eric Sprott and the Sprott investment team." "The

ongoing climate of global economic uncertainty has taken a toll on

the markets, with most major indices in negative territory for the

year," added Mr. Grosskopf. "While we have positioned our

portfolios defensively, in line with our well-stated views on the

weaknesses inherent in the financial system, we were disappointed

not to have delivered better performance through the recent

turmoil. We remain confident in our physical metals positions and

believe the current market environment presents unique

opportunities to invest in precious metals-related equities, many

of which are trading at historically wide spreads to bullion

prices."

_____________________________________________________________________

| | For the | | | | | | three |For the three|For the nine |For the

nine | | $ millions |months ended|months ended |months ended |

monthsended | | | September |September 30,|September 30,|September

30,| | | 30, | 2010 | 2011 | 2010 | | | 2011 | | | |

|______________|____________|_____________|_____________|_____________|

|AUM, beginning| 9,292| 5,546| 8,545| 4,774| |of period | | | | |

|______________|____________|_____________|_____________|_____________|

|Net sales | 655| 354| 1,480| 875|

|______________|____________|_____________|_____________|_____________|

|Business | —| —| 695| —| |acquisition | | | | |

|______________|____________|_____________|_____________|_____________|

|Market value | | | | | |appreciation | (66)| 613| (839)| 864|

|(depreciation)| | | | | |of portfolios | | | | |

|______________|____________|_____________|_____________|_____________|

|AUM, end of | 9,881| 6,513| 9,881| 6,513| |period | | | | |

|______________|____________|_____________|_____________|_____________|

Assets Under Management At September 30, 2011, AUM increased by

51.7% to $9.9 billion, from $6.5 billion at September 30,

2010. When compared to AUM of $9.3 billion at June 30, 2011,

AUM increased by 6.3% during the third quarter. The $0.6 billion

increase in AUM at the end of the third quarter of 2011, when

compared to the second quarter of 2011, resulted from $0.7 billion

in net sales, offset by $0.1 billion in market depreciation of

portfolios. The majority of the net sales for the quarter came from

the launch of the Sprott Strategic Fixed Income Fund, which raised

net proceeds of $213 million, and the completion of a $281 million

(net) follow-on offering of Sprott Physical Gold Trust Units.

During the quarter, market value depreciation from most Mutual

Funds and Managed Accounts, more than offset the positive

investment performance of the Domestic Hedge Funds, Offshore Funds

and Bullion Funds. Average AUM for the quarter ended September 30,

2011 was $10.4 billion, compared with $5.7 billion for the third

quarter of last year. Income Statement Total revenue for the

quarter ended September 30, 2011 increased by 52.4% to $44.3

million, from $29.1 million in the third quarter of 2010. For the

nine months ended September 30, 2011, total revenue increased by

51.2% to $123.1 million from $81.4 million in the first nine months

of 2011. Management fees increased by 63.4% during the quarter to

$40.4 million, from $24.7 million in the third quarter of 2011, as

average AUM increased by approximately 82.4% over the same period

last year. Management fee margins fell to 1.6% from 1.7% in the

third quarter of 2010. The decrease is mainly due to the

significant growth in bullion funds, which have a lower management

fee than the majority of the other Sprott Funds. For the first nine

months of 2011, management fees increased by 56.8% to $113.1

million from $72.1 million in the first three quarters of 2011.

Losses from proprietary investments, which include investments in

funds that Sprott manages, an investment in Sprott Resource Lending

Corp, certain other resource-related stocks and warrants, and gold

and silver bullion, totaled $2.4 million for the third quarter of

2011, compared with a gain of $2.9 million in the third quarter of

2011. For the nine months ended September 30, 2011, losses from

proprietary investments totaled $6.0 million, compared with a gain

of $3.4 million during the first nine months of 2010. Commission

revenue for the quarter ended September 30, 2011, was $3.4 million

compared to $0.3 million during the prior year period. In the third

quarter of 2011, commission revenue was mainly due to commissions

generated by Global Resource Investments, Ltd. ("GRIL") and, to a

lesser extent, Sprott Private Wealth LP. For the nine months ended

September 30, 2011, commission revenue increased by $8.0 million to

$11.3 million from $3.3 million during the prior year period,

primarily due to the addition of GRIL in February 2011. Other

income decreased by $0.5 million in the third quarter of 2011 to

$1.0 million from $0.5 million for the third quarter of 2010. For

the nine months ended September 30, 2011, other income increased by

$0.3 million to $2.0 million from $1.7 million during the prior

year period. Total expenses for the quarter ended September 30,

2011 were $30.3 million, an increase of $14.5 million or 92.1%,

compared with $15.8 million for the third quarter of 2010. Total

expenses for the first nine months of 2011 were $83.0 million, an

increase of 72.8% from $48.0 million in the nine months ended

September 30, 2010. The increase during the quarter and nine months

of 2011 is primarily due to the acquisition of the Global Group of

Companies (including the amortization of the related intangible

assets and earn out shares) and higher costs associated with the

growth of the business, including higher compensation and benefits

expenses. Base EBITDA, which excludes the impact of income taxes

and certain non-cash expenses and gains or losses on proprietary

investments, increased by 76.6% to $18.3 million ($0.11 per share)

for the third quarter of 2011, compared with $10.4 million ($0.07

per share) in the third quarter of 2010. For the nine months ended

September 30, 2011, Base EBITDA increased by 72.2% to $53.3 million

from $31.0 million in the first nine months of 2010. Net income for

the quarter ended September 30, 2011 increased 4.1% to $10.4

million ($0.06 per share) from $10.0 million ($0.07 per share) in

the third quarter of 2010. During the quarter, despite an increase

in net income, net income per share decreased by $0.01, compared to

the third quarter of 2010. The decrease resulted primarily from the

issuance of common shares in relation to the acquisition of the

Global Companies. For the first nine months of 2011, net income was

$28.4 million ($0.17 per share), a 17.7% increase over the $24.1

million ($0.16 per share) earned during the first nine months of

2010. Dividends On August 9, 2011, a dividend of $0.03 per common

share was declared for the quarter ended June 30, 2011. This

dividend was paid on September 2, 2011 to shareholders of record at

the close of business on August 18, 2011. In November 2011, a

dividend of $0.03 per common share was declared for the quarter

ended September 30, 2011. Conference Call and Webcast A conference

call and webcast will be held today, Thursday November 10, 2011, at

10:00am ET to discuss the Company's financial results. To access

the call, please dial 647-427-7450 or 1-888-231-8191 ten minutes

prior to the scheduled start of the call. A taped replay of the

conference call will be available until Thursday, November 17, 2011

by calling 416-849-0833 or 1-855-859-2056, reference number

24801373. The conference call will also be webcast live at

www.sprottinc.com and www.newswire.ca. An archived replay of the

webcast will be available for 365 days. *Non-IFRS Financial

Measures This press release includes financial terms (including

AUM, EBITDA, Base EBITDA, Cash Flow from Operations and net sales)

that the Company utilizes to assess the financial performance of

its business that are not measures recognized under International

Financial Reporting Standards ("IFRS"). These non-IFRS measures

should not be considered alternatives to performance measures

determined in accordance with IFRS and may not be comparable to

similar measures presented by other issuers. For additional

information regarding the Company's use of non-IFRS measures,

including the calculation of these measures, please refer to the

"Non-IFRS Financial Measures" section of the Company's Management's

Discussion and Analysis and its financial statements available on

the Company's website at www.sprottinc.com and on SEDAR at

www.sedar.com. Forward-Looking Statements This release contains

"forward-looking statements" which reflect the current expectations

of the Company. These statements reflect management's current

beliefs with respect to future events and are based on information

currently available to management. Forward-looking statements

involve significant known and unknown risks, uncertainties and

assumptions. Many factors could cause actual results, performance

or achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements including, without limitation,

those listed under the heading "Risk Factors" in the Company's

annual information form dated March 22, 2011. Should one or more of

these risks or uncertainties materialize, or should assumptions

underlying the forward-looking statements prove incorrect, actual

results, performance or achievements could vary materially from

those expressed or implied by the forward-looking statements

contained in this release. Although the forward-looking statements

contained in this release are based upon what the Company believes

to be reasonable assumptions, the Company cannot assure investors

that actual results, performance or achievements will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this release and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances. About Sprott Inc. Sprott Inc. is a

leading independent asset manager dedicated to achieving superior

returns for its clients over the long term. The Company currently

operates through four business units: Sprott Asset Management LP,

Sprott Private Wealth LP, Sprott Consulting LP, and Sprott U.S.

Holdings Inc. Sprott Asset Management is the investment

manager of the Sprott family of mutual funds and hedge funds and

discretionary managed accounts; Sprott Private Wealth provides

wealth management services to high net worth individuals; and

Sprott Consulting provides management, administrative and

consulting services to other companies, including Sprott Resource

Corp. , Sprott Resource Lending Corp. and Sprott Power Corp. .

Sprott U.S. Holdings Inc. includes Global Resource Investments Ltd,

Sprott Asset Management USA Inc., and Resource Capital Investments

Corporation. Sprott Inc. is headquartered in Toronto, Canada, and

is listed on the Toronto Stock Exchange under the symbol "SII". For

more information on Sprott Inc., please visit www.sprottinc.com.

Sprott Inc. CONTACT: Investor contact information: (416) 203-2310

or 1 (877) 403-2310or ir@sprott.com.

Copyright

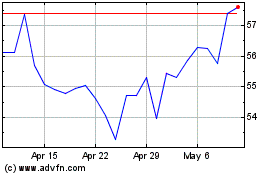

Sprott (TSX:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

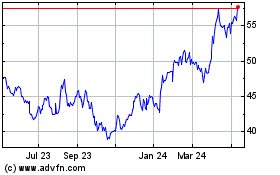

Sprott (TSX:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024