STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

announce its financial and operating results for the three and nine

months ended September 30, 2020. The following press release should

be read in conjunction with the unaudited condensed consolidated

interim financial statements and notes thereto as at and for the

three and nine months ended September 30, 2020 (the “Financial

Statements”), the MD&A dated November 3, 2020 and audited

consolidated financial statements as at and for the year ended

December 31, 2019 and related MD&A (the “Annual MD&A”).

Readers should also refer to the “Forward-looking information &

statements” legal advisory and the section regarding “Non-IFRS

Measures” at the end of this press release. All financial amounts

and measures are expressed in Canadian dollars unless otherwise

indicated. Additional information about STEP is available on the

SEDAR website at www.sedar.com including the Company’s Annual

Information Form for the year ended December 31, 2019 dated March

11, 2020 (the “AIF”).

CONSOLIDATED HIGHLIGHTS

FINANCIAL

|

($000s except percentages and per share amounts) |

|

Three months ended September 30, |

|

|

|

|

Nine months ended September 30, |

|

|

|

|

2020 |

|

|

2019 |

|

|

|

|

2020 |

|

|

2019 |

|

|

Consolidated revenue |

$ |

62,363 |

|

$ |

178,745 |

|

|

|

$ |

297,377 |

|

$ |

541,790 |

|

| Net loss attributable to

shareholders |

$ |

(9,762 |

) |

$ |

(112,843 |

) |

|

|

$ |

(102,314 |

) |

$ |

(119,471 |

) |

|

Per share-basic |

$ |

(0.14 |

) |

$ |

(1.69 |

) |

|

|

$ |

(1.52 |

) |

$ |

(1.79 |

) |

|

Per share-diluted |

$ |

(0.15 |

) |

$ |

(1.69 |

) |

|

|

$ |

(1.52 |

) |

$ |

(1.79 |

) |

|

Weighted average shares – basic |

|

67,514,015 |

|

|

66,767,919 |

|

|

|

|

67,232,574 |

|

|

66,733,701 |

|

|

Weighted average shares – diluted |

|

66,523,901 |

|

|

66,767,919 |

|

|

|

|

67,232,574 |

|

|

66,733,701 |

|

| Adjusted EBITDA (1) |

$ |

9,098 |

|

$ |

22,690 |

|

|

|

$ |

28,434 |

|

$ |

69,644 |

|

|

Adjusted EBITDA % (1) |

|

15% |

|

|

13% |

|

|

|

|

10% |

|

|

13% |

|

(1) See Non-IFRS Measures. “Adjusted EBITDA” is

a financial measure not presented in accordance with IFRS and is

equal to net (loss) income before finance costs, depreciation and

amortization, loss (gain) on disposal of property and equipment,

current and deferred income tax provisions and recoveries,

share-based compensation, transaction costs, foreign exchange

forward contract (gain) loss, foreign exchange (gain) loss, and

impairment losses. “Adjusted EBITDA %” is calculated as Adjusted

EBITDA divided by revenue.

|

($000s except shares) |

September 30, |

|

December 31, |

|

|

|

2020 |

|

|

2019 |

|

Cash and cash equivalents |

$ |

8,233 |

|

$ |

7,267 |

|

Working capital (including cash and cash equivalents) (2) |

$ |

54,750 |

|

$ |

72,156 |

|

Total assets |

$ |

502,421 |

|

$ |

686,039 |

|

Total long-term financial liabilities (2) |

$ |

220,114 |

|

$ |

247,481 |

| Net

debt (2) |

$ |

206,767 |

|

$ |

232,552 |

|

Shares outstanding |

|

67,525,666 |

|

|

66,942,830 |

(2) See Non-IFRS Measures. “Working capital”,

“Total long-term financial liabilities” and “Net debt” are

financial measures not presented in accordance with IFRS. “Working

capital” is equal to total current assets less total current

liabilities. “Total long-term financial liabilities” is comprised

of Loans and borrowings, Long-term lease obligations and Other

liabilities. “Net debt” is equal to loans and borrowings before

deferred financing charges less cash and cash equivalents.

OVERVIEW AND LIQUIDITY Activity

levels for the third quarter of 2020 were significantly lower than

the prior year due to the historic demand destruction that occurred

earlier in 2020. Canada’s rig count was 75 during the week of

October 2, 2020 compared to 144 during the week of October 4, 2019,

a decline of 48%. The U.S. rig count was 266 versus 855 for the

same week representing a decline of 69%. The spot price for West

Texas Intermediate crude oil (“WTI”) at September 30, 2020 was USD

$40 per barrel compared to USD $54 per barrel at September 30,

2019, 26% lower year over year.

During the third quarter, commodity prices

stabilized relative to volatility earlier in the year and WTI crude

prices averaged USD $41 per barrel compared to an average of USD

$28 in second quarter of 2020. WTI crude prices ranged from a low

of USD $37 per barrel to a high of USD $43 per barrel, during the

third quarter 2020. The U.S. rig count remained flat in the third

quarter of 2020 with 263 rigs the week of July 2, 2020 compared to

266 rigs the week of October 2, 2020. The Canadian rig count

increased from 18 the week of July 2, 2020 compared to 75 rigs the

week of October 2, 2020. Natural gas prices continue to be

resilient and have increased to approximately CAD $3/1 million

British thermal units (“mmbtu”) by the end of the third

quarter.

Volatile market conditions related to the impact

of COVID-19 have created significant uncertainty for our clients.

Our clients have responded to these historical disruptions by

materially reducing their capital programs and re-evaluating near

term spending. During the third quarter 2020, our clients

cautiously restarted some of their drilling and completion programs

but at much lower levels than was expected earlier in the year. As

a result, STEP’s revenues decreased.

In reaction to challenging market conditions in

both Canada and the U.S., management focused on elements within the

Company’s control. STEP re-sized its operations and focused on

liquidity. STEP believes the measures we have undertaken to reduce

our cost structure and maximize cash preservation have enhanced our

financial resilience. These measures included reducing manned

equipment, reducing capital spend proportionate with the reduced

equipment, reducing Board of Director compensation, reducing

headcount, reducing compensation for all employees, eliminating

discretionary management bonuses, negotiating better pricing with

our vendors, and reducing general and administrative expenses.

The current environment has created

uncertainties with respect to counterparty credit risk, liquidity

and the valuation of long-lived assets, inventory and right-of-use

assets. At September 30, 2020, management has incorporated the

anticipated impact of COVID-19 in estimates and judgments in the

preparation of its unaudited condensed consolidated interim

statements to the extent known at September 30, 2020. Outcomes that

are different from assumptions used in estimates could be

materially different as additional information becomes known.

FINANCIAL HIGHLIGHTS – THIRD QUARTER AND

YEAR TO DATE SEPTEMBER 30

- Consolidated revenue was $62.4

million and $297.4 million for the three and nine months ended

September 30, 2020, compared to $178.7 million and $541.8 million

in the same periods of the prior year. A decrease of 65% for the

three months ended September 30, 2020 and a decrease of 45% for the

nine months ended September 30, 2020.

- Net loss for the three and nine

months ended September 30, 2020 was $9.8 million and $102.3

million, respectively, compared to net loss of $112.8 million and

$119.5 million for the same periods in 2019.

- For the three and nine months ended

September 30, 2020, Adjusted EBITDA was $9.1 million and $28.4

million compared to $22.7 million and $69.6 million in the same

periods of prior year.

- STEP recorded severance of $0.4

million and $3.8 million for the three and nine months ended

September 30, 2020.

- During the three and nine months

ended September 30, 2020, we have received $4.5 million and $7.6

million, respectively, in benefit from the assistance of the

Canadian Emergency Wage Subsidy (“CEWS”) program. The grants were

recorded as a reduction of associated wage expense.

- STEP continues to make progress on

debt reduction and year to date the Company made net repayments on

loans and borrowings of $25.4 million. As at September 30, 2020,

STEP’s net debt is $206.8 million compared to $232.6 million at

December 31, 2019.

- STEP recorded bad debt expense of

$1.0 million and $3.5 million for the three and nine months ended

September 30, 2020.

- On August 13, 2020, STEP entered

into a Second Amended and Restated Credit Agreement with its

syndicate of lenders; which includes a Canadian $215.0 million term

facility, a Canadian $30.0 million revolving facility, a Canadian

$10.0 million operating facility and a USD $15.0 million operating

facility (“the Credit Facilities”). Subsequent to September 30,

2020, the Company requested and received a one quarter extension of

the covenant relief period to September 30, 2021.

- STEP was compliant with all

covenants under its Credit Facilities at September 30, 2020.

- No impairments were recorded during

the third quarter of 2020.

- During the second quarter of 2020,

the Company recorded a non-cash impairment charge with respect to

property and equipment in its U.S. fracturing Cash Generating Unit

(“CGU”) of $13.1 million. During the first quarter of 2020, the

Company recorded a non-cash impairment charge with respect to

property and equipment in its Canadian fracturing CGU of $58.8

million. During the third quarter of 2019, the Company recorded a

non-cash impairment charge with respect to goodwill and intangibles

of $113.5 million in its US fracturing CGU.

FINANCIAL HIGHLIGHTS – SEQUENTIAL

QUARTERS

- Consolidated revenue increased from

$40.6 million in second quarter 2020 to $62.4 million in third

quarter 2020, an increase of 53%. Activity in third quarter as

evidenced by increased rig counts, stable oil prices and continued

relative strength in natural gas prices resulted in some clients

reactivating programs.

- Consolidated Adjusted EBITDA

increased by $12.6 million from the second quarter of 2020 to the

third quarter of 2020.

- Consolidated net loss was $9.8

million for the three months ended September 30, 2020 compared to

$40.3 million in the second quarter. The second quarter net loss

included an impairment charge against the US fracturing CGU of

$13.1 million and an associated deferred tax recovery of $2.8

million.

INDUSTRY CONDITIONS &

OUTLOOK

During the third quarter, WTI crude prices

stabilized at approximately USD $41 per barrel, an improvement from

the volatile crude prices experienced from late March 2020 until

the end of June 2020. Additionally, natural gas prices saw an

improvement to approximately CAD $3/mmbtu by the end of the third

quarter. Activity, as indicated by rig counts, has increased with

the re-opening of the global economies. With increased Canadian

client activity in third quarter, the Company staffed an additional

two fracturing spreads for a total of three spreads, however

activity in 2020 continues to lag activity in the same period of

2019.

We expect that we will see budget exhaustion in

the fourth quarter of 2020, as our clients near completion of their

revised 2020 programs. The Company expects this will result in

lower demand for our services in the fourth quarter compared to

third quarter, however activity may be somewhat augmented by

clients getting an early start to 2021 programs by bringing work

forward into the fourth quarter. Utilization in first quarter 2021

is expected to be high; however, many client work programs are

under consideration with full visibility not expected until later

in fourth quarter. Pricing pressure in the U.S. continues to

negatively affect both coil and fracturing financial results and is

expected to continue to impact results in Q4 and into 2021. STEP is

encouraged by the increased requests for proposals and bids for

2021 work in both Canada and the US but expects the current

competitive market conditions to persist.

The overall global economy and the energy

industry continue to face an uncertain and potentially volatile

economic outlook. A return to more stable demand and supply for

crude oil will partially depend upon actions taken by health and

government authorities and individual responses to these measures,

as we deal with COVID-19. Geopolitical tensions and the ability of

the Organization of Petroleum Exporting Countries and certain other

countries (“OPEC+”) to maintain production targets will also affect

the supply of crude oil. The results of the U.S. Presidential

election may also introduce additional industry volatility.

STEP will continue to monitor industry

conditions and adjust our business accordingly.

CAPITAL UPDATEEarlier in the

year, as a result of the pronounced impact of COVID-19, and the

anticipated material impact on near term demand for our services,

management adopted a cautious outlook for the balance of 2020. As a

result, the capital budget was reduced to $15.5 million, with an

emphasis on providing the necessary maintenance capital for the

expected operating fleet. Activity levels, particularly in our

Canadian fracturing operations, have exceeded our expectations

which has resulted in higher activity and improved financial

results. Due to increased activity in the third quarter and

expected in the fourth quarter, STEP has increased its maintenance

capital budget by $2 million from the previously announced $15.5

million to $17.5 million. Management will continue to evaluate and

balance the capital program with market conditions and demand for

STEP’s services.

RESPONDING TO COVID-19

The World Health Organization declared COVID-19

a pandemic March 2020. Measures taken by public health officials

and governments around the world varied but primarily included

shelter in place orders followed by phased re-openings. At the

present time, a second wave of the COVID-19 virus is spreading

through the world with public health officials and government

measures again varying. The measures taken to address COVID-19

resulted in and continue to result in a significant slowdown in the

global economy and in turn increased uncertainty and market

volatility.

Compounding the COVID-19 effect for the oil and

gas industry is oversupply concerns related to the OPEC+ continued

ability to agree on production capacity limits and continued

geopolitical uncertainty that did and could continue to increase

global supplies of oil. The demand destruction from COVID-19 and

oversupply concerns have caused a significant deterioration in

economic conditions and increased uncertainty for the oil and gas

industry and have materially reduced client spending and demand for

STEP services.

STEP places the health and safety of our

employees, and the clients and communities we serve among our

highest priorities. COVID-19 protocols for field employees working

on STEP sites and client sites continue to be followed, including

quarantine procedures upon suspected or actual exposure to

COVID-19. Following all public health and government authorities’

directives, the Company has completed a phased approach to bring

employees back to our offices and service centers.

The Canadian provincial and federal governments

have recognized the serious economic impacts of the spread of

COVID-19 and have taken steps to provide various programs to

individuals and businesses, such as the CEWS.

CANADIAN OPERATIONS REVIEW

STEP has a fleet of 16 coiled tubing units in

the Western Canadian Sedimentary Basin (“WCSB”). The Company’s

coiled tubing units were designed to service the deepest wells in

the WCSB. STEP’s fracturing business primarily focuses on the

deeper, more technically challenging plays in Alberta and northeast

British Columbia. STEP has 282,500 horsepower (“HP”), of which

15,000 HP will require capital for refurbishment. Approximately

132,500 HP of the available HP has dual fuel capabilities. The

Company deploys or idles coiled tubing units or fracturing

horsepower as dictated by the market’s ability to support targeted

utilization and economic returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Fracturing |

$ |

29,425 |

|

$ |

65,754 |

|

$ |

116,374 |

|

$ |

201,329 |

|

|

Coiled tubing |

|

15,424 |

|

|

32,080 |

|

|

51,112 |

|

|

80,836 |

|

|

|

|

44,849 |

|

|

97,834 |

|

|

167,486 |

|

|

282,165 |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

36,443 |

|

|

84,149 |

|

|

159,950 |

|

|

257,581 |

|

|

Selling, general and administrative |

|

1,306 |

|

|

2,453 |

|

|

4,260 |

|

|

7,238 |

|

|

Results from operating activities |

$ |

7,100 |

|

$ |

11,232 |

|

$ |

3,276 |

|

$ |

17,346 |

|

| Add non-cash items: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

9,770 |

|

|

11,319 |

|

|

35,234 |

|

|

37,057 |

|

|

Share-based compensation |

|

318 |

|

|

534 |

|

|

541 |

|

|

1,409 |

|

|

Adjusted EBITDA (1) |

$ |

17,188 |

|

$ |

23,085 |

|

$ |

39,051 |

|

$ |

55,812 |

|

|

Adjusted EBITDA % (1) |

|

38% |

|

|

24% |

|

|

23% |

|

|

20% |

|

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

|

|

Fracturing |

|

66% |

|

|

67% |

|

|

69% |

|

|

71% |

|

|

Coiled tubing |

|

34% |

|

|

33% |

|

|

31% |

|

|

29% |

|

|

Fracturing services |

|

|

|

|

|

|

|

|

|

Fracturing revenue per operating day(1) |

$ |

186,234 |

|

$ |

186,272 |

|

$ |

205,608 |

|

$ |

198,942 |

|

|

Number of fracturing operating days (2) |

|

158 |

|

|

353 |

|

|

566 |

|

|

1,012 |

|

|

Proppant pumped (tonnes) |

|

251,000 |

|

|

255,000 |

|

|

642,000 |

|

|

676,000 |

|

|

Stages completed |

|

1,703 |

|

|

3,768 |

|

|

6,360 |

|

|

9,360 |

|

|

Horsepower |

|

|

|

|

|

|

|

|

|

Active pumping HP, end of period |

|

150,000 |

|

|

225,000 |

|

|

150,000 |

|

|

225,000 |

|

|

Idle pumping HP, end of period |

|

132,500 |

|

|

72,500 |

|

|

132,500 |

|

|

72,500 |

|

|

Total pumping HP, end of period (3) |

|

282,500 |

|

|

297,500 |

|

|

282,500 |

|

|

297,500 |

|

| Coiled tubing services |

|

|

|

|

|

|

|

|

|

Coiled tubing revenue per operating day(1) |

$ |

48,351 |

|

$ |

53,916 |

|

$ |

46,550 |

|

$ |

51,259 |

|

|

Number of coiled tubing operating days (2) |

|

319 |

|

|

595 |

|

|

1,098 |

|

|

1,577 |

|

|

Active coiled tubing units, end of period |

|

5 |

|

|

9 |

|

|

5 |

|

|

9 |

|

|

Idle coiled tubing units, end of period |

|

11 |

|

|

7 |

|

|

11 |

|

|

7 |

|

|

Total coiled tubing units, end of period |

|

16 |

|

|

16 |

|

|

16 |

|

|

16 |

|

(1) See Non-IFRS Measures.(2) An operating day

is defined as any coiled tubing and fracturing work that is

performed in a 24-hour period, exclusive of support equipment. (3)

Represents total owned HP in Canada, of which 150,000 HP is

currently deployed and 15,000 of the remainder requires certain

refurbishment.

FINANCIAL AND OPERATIONAL HIGHLIGHTS –

THIRD QUARTERDuring the third quarter of 2020, fracturing

operating days were 158 compared to 353 operating days in third

quarter 2019. STEP’s coiled tubing units had 319 operating days

during third quarter 2020 compared to 595 operating days in the

third quarter of 2019. STEP deployed three fracturing spreads and

five coiled tubing units in third quarter of 2020 compared to six

fracturing spreads and nine coiled tubing units in the same period

of 2019. Revenue for the three months ended September 30, 2020 was

$44.8 million as compared to $97.8 million in the same period of

prior year. Adjusted EBITDA for the three months ended September

30, 2020 was $17.2 million or 38% of revenue versus $23.1 million

or 24% of revenue for the three months ended September 30,

2019.

As discussed above, STEP was able to access the

federal government’s CEWS program and its Canadian operations

recorded $4.1 million for the three months ended September 30,

2020. STEP also incurred an additional $0.1 million in severance

during third quarter of 2020. Revenue decreased by 54% and Adjusted

EBITDA decreased by $5.9 million or 6% third quarter 2020 versus

third quarter 2019. The maintenance of margins was the result of

STEP maintaining approximately the same equipment utilization

percentages by deploying approximately 50% less equipment, the

benefits received under the CEWS program and STEP’s sustained focus

on cost controls.

The actions taken earlier in the year to manage

the unprecedented negative economic and market conditions continued

throughout the third quarter. Wages were reduced by up to 20%

including a temporary one day per week furlough that was suspended

at the end of the third quarter with the increase in activity.

Field employees were recalled when we had visibility to sustained

work. STEP also undertook to retain its most senior field staff to

provide the ability to scale up operations. All discretionary

expenses such as travel, and meals and entertainment continued to

be reduced or eliminated.

FINANCIAL AND OPERATIONAL HIGHLIGHTS –

YEAR TO DATE SEPTEMBER 30For the nine months ended

September 30, 2020, STEP completed 566 fracturing operating days

compared to 1,012 operating days for the same period in 2019. STEP

completed 1,098 coiled tubing operating days for the nine months

ended September 30, 2020 compared to 1,577 in the same period of

2019. Revenue for the nine months ended September 30, 2020 was

$167.5 million compared to $282.2 million for the nine months ended

September 30, 2019. Adjusted EBITDA for the nine months ended

September 30, 2020 was $39.1 million or 23% of revenue compared to

$55.8 million or 20% of revenue for the nine months ended September

30, 2019.

During the nine months ended September 30, 2020,

STEP incurred $3.2 million in severance costs in its Canadian

operations and recorded $6.9 million of benefit from the CEWS

program. The maintenance of margins with a 41% decrease in revenue

was achieved by maintaining higher utilization percentages with

less equipment, the benefits received under the CEWS program and a

sustained focus on cost savings.

FINANCIAL AND OPERATIONAL HIGHLIGHTS -

SEQUENTIAL QUARTERSTEP generated $44.8 million of revenue

during the third quarter of 2020 versus $13.9 million of revenue in

second quarter of 2020. Adjusted EBITDA for third quarter 2020 was

$17.2 million or 38% of revenue versus $1.0 million or 7% of

revenue in second quarter of 2020. Both fracturing and coiled

tubing saw an increase in operating days. Fracturing operating days

improved by 144 while coiled tubing operating days increased by 117

relative to the second quarter. The second quarter in Canada is

typically slower due to spring break up conditions that make it

difficult to move heavy equipment. However, reductions in activity

were amplified due to COVID-19 and instability in crude oil pricing

and demand. During the second quarter of 2020, the Company received

the benefit of $2.8 million in CEWS and incurred severance of $1.3

million.

STEP capitalizes fluid ends when their estimated

useful life exceeds 12 months. Fluid ends are capitalized in Canada

based on a review of usage history. However, had the Company

expensed fluid ends, the operating expenses for the three and nine

months ended September 30, 2020 would have increased by

approximately $1.0 million and $3.8 million, respectively.

UNITED STATES OPERATIONS

REVIEW

STEP’s U.S. business commenced operations in

2015 with coiled tubing services. STEP has a fleet of 13 coiled

tubing units in the Permian and Eagle Ford basins in Texas and the

Bakken shale in North Dakota. STEP entered the U.S. fracturing

business in April 2018. The U.S. fracturing business has 207,500

HP, which primarily operates in the Permian and Eagle Ford basins

in Texas. Management continues to adjust capacity and regional

deployment to optimize utilization, efficiency and returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Fracturing |

$ |

9,363 |

|

$ |

56,835 |

|

$ |

90,287 |

|

$ |

182,228 |

|

|

Coiled tubing |

|

8,151 |

|

|

24,076 |

|

|

39,604 |

|

|

77,397 |

|

|

|

|

17,514 |

|

|

80,911 |

|

|

129,891 |

|

|

259,625 |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

30,739 |

|

|

86,576 |

|

|

156,366 |

|

|

262,102 |

|

|

Selling, general and administrative |

|

1,555 |

|

|

2,946 |

|

|

5,508 |

|

|

8,449 |

|

|

Results from operating activities |

$ |

(14,780 |

) |

$ |

(8,611 |

) |

$ |

(31,983 |

) |

$ |

(10,926 |

) |

| Add non-cash items: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

9,926 |

|

|

11,859 |

|

|

32,966 |

|

|

35,599 |

|

|

Share-based compensation |

|

55 |

|

|

521 |

|

|

(212 |

) |

|

1,730 |

|

|

Adjusted EBITDA (1) |

$ |

(4,799 |

) |

$ |

3,769 |

|

$ |

771 |

|

$ |

26,403 |

|

|

Adjusted EBITDA % (1) |

|

(27% |

) |

|

5% |

|

|

1% |

|

|

10% |

|

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

|

|

Fracturing |

|

53% |

|

|

70% |

|

|

70% |

|

|

70% |

|

|

Coiled tubing |

|

47% |

|

|

30% |

|

|

30% |

|

|

30% |

|

|

Fracturing services |

|

|

|

|

|

|

|

|

|

Fracturing revenue per operating day (1) |

$ |

240,077 |

|

$ |

336,302 |

|

$ |

298,964 |

|

$ |

375,728 |

|

|

Number of fracturing operating days (2) |

|

39 |

|

|

169 |

|

|

302 |

|

|

485 |

|

|

Proppant pumped (tonnes) |

|

32,278 |

|

|

171,000 |

|

|

415,670 |

|

|

489,000 |

|

|

Stages completed |

|

182 |

|

|

994 |

|

|

1,992 |

|

|

2,605 |

|

|

Horsepower |

|

|

|

|

|

|

|

|

|

Active pumping HP, end of period |

|

50,000 |

|

|

142,500 |

|

|

50,000 |

|

|

142,500 |

|

|

Idle pumping HP, end of period |

|

157,500 |

|

|

50,000 |

|

|

157,500 |

|

|

50,000 |

|

|

Total pumping HP, end of period (3) |

|

207,500 |

|

|

192,500 |

|

|

207,500 |

|

|

192,500 |

|

| Coiled tubing services |

|

|

|

|

|

|

|

|

|

Coiled tubing revenue per operating day(1) |

$ |

37,736 |

|

$ |

44,585 |

|

$ |

43,142 |

|

$ |

48,132 |

|

|

Number of coiled tubing operating days (2) |

|

216 |

|

|

540 |

|

|

918 |

|

|

1,608 |

|

|

Active coiled tubing units, end of period |

|

5 |

|

|

8 |

|

|

5 |

|

|

8 |

|

|

Idle coiled tubing units, end of period |

|

8 |

|

|

5 |

|

|

8 |

|

|

5 |

|

|

Total coiled tubing units, end of period |

|

13 |

|

|

13 |

|

|

13 |

|

|

13 |

|

(1) See Non-IFRS Measures.(2) An operating day

is defined as any coiled tubing and fracturing work that is

performed in a 24-hour period, exclusive of support equipment. (3)

Represents total owned HP in the U.S.

FINANCIAL AND OPERATIONAL HIGHLIGHTS –

THIRD QUARTERU.S. fracturing operated one spread

throughout the third quarter of 2020 compared to three spreads in

the same period of 2019. U.S. fracturing was active for 39

operating days compared to 169 operating days in third quarter of

2019. U.S. coiled tubing operated five coiled tubing units in third

quarter 2020 compared to 8 coiled tubing units in the same period

of 2020. STEP’s U.S. coiled tubing units completed 216 operating

days during the third quarter of 2020 compared to 540 operating

days in the third quarter of 2019. Revenue for the three months

ended September 30, 2020 was $17.5 million compared to $80.9

million during the same period of 2019. Adjusted EBITDA was a loss

of $4.8 million or negative 27% of revenue for the three months

ended September 30, 2020 versus Adjusted EBITDA of $3.8 million or

5% of revenue for the three months ended September 30, 2019. Both

the fracturing and coiled tubing business continue to experience

significant price pressure and increased competition.

STEP continues to monitor financial assistance

programs implemented in the U.S. to assist with the effects of

COVID-19 but to date has not received any benefit.

FINANCIAL AND OPERATIONAL HIGHLIGHTS –

YEAR TO DATE SEPTEMBER 30For the nine months ended

September 30, 2020, STEP U.S. fracturing completed 302 fracturing

operating days compared to 485 operating days for the same period

of 2019. STEP U.S. coiled tubing completed 918 coiled tubing

operating days for the nine months ended September 30, 2020

compared to 1,608 in the same period of 2019. Revenue for the nine

months ended September 30, 2020 was $129.9 million compared to

$259.6 million for the nine months ended September 30, 2019.

Adjusted EBITDA for the nine months ended September 30, 2020 was

$0.8 million or 1% of revenue compared to $26.4 million or 10% of

revenue for the nine months ended September 30, 2019.

STEP continues to manage expenses by right

sizing staff to levels commensurate to activity levels and

minimizing or eliminating all discretionary expenses. Repair and

maintenance expenses have decreased in proportion to the reduction

in active equipment. Capital spend has been limited to maintenance

capital. STEP has also combined its Midland, Texas coiled tubing

and fracturing field locations into one location and its coiled

tubing and fracturing corporate functions were consolidated in San

Antonio, Texas.

FINANCIAL AND OPERATIONAL HIGHLIGHTS -

SEQUENTIAL QUARTERIn the U.S., seasonality is generally

not a factor. Revenue decreased by $9.3 million from $26.8 million

in second quarter of 2020 to $17.5 million in third quarter of 2020

and the third quarter 2020 Adjusted EBITDA loss increased to a loss

of $4.8 million from a loss of $2.4 million in second quarter of

2020, as the environment in the U.S. remained challenging with high

levels of competition for available work. Fracturing operating days

decreased by 20 relative to the second quarter, while coiled tubing

operating days increased by 68.

STEP capitalizes fluid ends when it is

determined they have an estimated useful life that exceeds 12

months. Based on a review of usage history in the U.S. fluid ends

are expensed. U.S. fracturing expensed fluid ends for the three and

nine months ended September 30, 2020 of $0.1 million and $3.9

million, respectively.

CORPORATE

REVIEW

The Company’s corporate activities are separated

from Canadian and U.S. operations. Corporate operating expenses

include expenses related to asset reliability, maintenance and

optimization teams. Corporate SG&A costs include costs

associated with the executive team, the Board of Directors, public

company costs and other activities that benefit Canadian and U.S.

operating segments collectively.

|

($000’s) |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

Operating expenses |

$ |

119 |

|

$ |

666 |

|

$ |

892 |

|

$ |

1,865 |

|

|

Selling, general and administrative |

|

3,907 |

|

|

4,478 |

|

|

12,754 |

|

|

14,074 |

|

|

Results from operating activities |

|

(4,026 |

) |

|

(5,144 |

) |

|

(13,646 |

) |

|

(15,939 |

) |

| Add non-cash items: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

187 |

|

|

270 |

|

|

599 |

|

|

897 |

|

|

Share-based compensation |

|

548 |

|

|

710 |

|

|

1,659 |

|

|

2,471 |

|

|

Adjusted EBITDA (1) |

$ |

(3,291 |

) |

$ |

(4,164 |

) |

$ |

(11,388 |

) |

$ |

(12,571 |

) |

|

Adjusted EBITDA % (1,2) |

|

(5% |

) |

|

(2% |

) |

|

(4% |

) |

|

(2% |

) |

(1) See Non-IFRS Measures. (2) Adjusted EBITDA

percentage calculated using the consolidated revenue for the

period.

FINANCIAL HIGHLIGHTS – THIRD

QUARTERExpenses from corporate activities, excluding

depreciation and share-based compensation related to corporate

assets and employees, were $3.3 million for the third quarter of

2020 compared to $4.2 million for the third quarter of 2019.

Severance of $0.3 million was incurred in the third quarter of 2020

and STEP obtained $0.4 million of benefit from the CEWS program for

corporate employees. In light of the extent of disruption and

uncertainty brought about by COVID-19, STEP also recorded $1.0

million of bad debt expense in the quarter. Adjusting corporate

expenses for severance, CEWS and the additional bad debt expense

results in corporate expenses of $2.4 million compared to $4.2

million in the prior year, a decrease of 43%.

With the onset of market volatility from

COVID-19 and the decline of crude oil prices, STEP implemented a

number of measures to minimize expenses. Headcount was reduced and

discretionary management bonuses were eliminated. Other measures

included reduced or eliminated discretionary expenses such as

travel, meals and entertainment and vehicle allowances.

FINANCIAL HIGHLIGHTS – YEAR TO DATE

SEPTEMBER 30Expenses from corporate activities, excluding

depreciation and share-based compensation related to corporate

assets and employees, were $11.4 million for the nine months ended

September 30, 2020 compared to $12.6 million in the same period of

the prior year, a decrease of $1.2 million. The expenses for the

nine months ended September 30, 2020 included $0.6 million in

severance which was offset by $0.7 million from the CEWS program

for corporate employees. STEP also recorded $3.5 million in bad

debt expense for the nine months ended September 30, 2020 in

recognition of the current operating environment and the increased

counterparty risk.

FINANCIAL HIGHLIGHTS – SEQUENTIAL

QUARTERCorporate expenses, excluding depreciation and

share based compensation, for third quarter of 2020 were $3.3

million compared to $2.0 million in the second quarter 2020. Third

quarter 2020 corporate expenses included severance of $0.3 million,

benefits from the CEWS program of $0.4 million and bad debt expense

of $1.0 million. Second quarter 2020 expenses included severance of

$0.1 million and benefits from the CEWS program of $0.3

million.

NON‐IFRS MEASURES Please see

the discussion in the Non‐IFRS Measures section of the MD&A for

the reconciliation of non‐IFRS items to IFRS measures.

FORWARD‐LOOKING

information & STATEMENTS

Certain statements contained in this Press

Release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipate”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”,

“propose”, “might”, “may”, “will”, “shall”, “project”, “should”,

“could”, “would”, “believe”, “predict”, “forecast”, “pursue”,

“potential”, “objective” and “capable” and similar expressions are

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. While the

Company believes the expectations reflected in the forward-looking

statements included in this Press Release are reasonable, such

statements are not guarantees of future performance or outcomes and

may prove to be incorrect and should not be unduly relied upon.

In particular, but without limitation, this

Press Release contains forward-looking statements pertaining to:

COVID-19 and its impact on energy demand and the Company’s

financial position and business plans; 2020 and 2021 industry

conditions and outlook, including potential deferral or

cancellation of client work programs and near term spending and the

impact thereof on the Company’s performance, revenue and cash

flows; supply and demand for oilfield services and industry

activity levels, including completions activity and utilization

levels; the Company’s ability to obtain covenant relief; the

Company’s ability to meet all financial commitments including

interest payments over the next twelve months; market uncertainty,

and its effect on commodity prices; relaxation of COVID-19 related

restrictions, the potential for a second wave of COVID-19

infections, and the resulting impact on crude oil demand and the

Company’s operations; the Company’s anticipated business strategies

and expected success; including changes to cost structures and cash

preservation measures; the Company’s ability to manage its capital

structure; pricing received for the Company’s services; the

Company’s capital program in 2020 and management’s continued

evaluation thereof; planned utilization of government financial

support and economic stimulus programs; expected profitability;

expected income tax liabilities; adequacy of resources to funds

operations, financial obligations and planned capital expenditures

in 2020; planned deployment and staffing levels for the Company’s

equipment; the Company’s ability to retain its senior field staff

and existing clients; the monitoring of industry demand, client

capital budgets and market conditions; client credit risk,

including the Company’s ability to set credit limits, monitor

client payment patterns, and to apply liens; and the Company’s

expected compliance with covenants under its Credit Facilities, its

ability to continue as a going concern, satisfy its financial

commitments and obtain relief from the lenders under its Credit

Facilities; and the impact of litigation, including the Calfrac

litigation, on the Company.

The forward-looking information and statements

contained in this Press Release reflect several material factors

and expectations and assumptions of the Company including, without

limitation: the Company will continue to conduct its operations in

a manner consistent with past operations; the Company will continue

as a going concern; the Company’s ability to manage the effect of

the COVID-19 pandemic, OPEC or OPEC+ related market uncertainty on

its operations and industry uncertainty caused by the U.S.

Presidential election; the general continuance of current or, where

applicable, assumed industry conditions; pricing of the Company’s

services; the Company’s ability to market successfully to current

and new clients; the Company’s ability to utilize its equipment;

the Company’s ability to collect on trade and other receivables;

the Company’s ability to obtain and retain qualified staff and

equipment in a timely and cost effective manner; levels of

deployable equipment; future capital expenditures to be made by the

Company; future funding sources for the Company’s capital program;

the Company’s future debt levels; the availability of unused credit

capacity on the Company’s credit lines; the impact of competition

on the Company; the Company’s ability to obtain financing on

acceptable terms; the Company’s continued compliance with financial

covenants; the amount of available equipment in the marketplace;

and client activity levels. The Company believes the material

factors, expectations and assumptions reflected in the

forward-looking information and statements are reasonable but no

assurance can be given that these factors, expectations and

assumptions will prove correct.

Actual results could differ materially from

those anticipated in these forward-looking statements due to the

risk factors set forth below and elsewhere in this MD&A:

volatility of the oil and natural gas industry; global or national

health concerns such as the COVID-19 pandemic and their impact on

demand and pricing for the Company’s services, the Company’s supply

chain, the continuity of the Company’s operations and the health of

the Company’s workforce; competition in the oilfield services

industry; restrictions on access to capital; reliance on suppliers

of raw materials, diesel fuel and component parts; reliance on

equipment suppliers and fabricators; direct and indirect exposure

to volatile credit markets; fluctuations in currency exchange

rates; fluctuations in interest rates on floating rate loans and

borrowings; merger and acquisition activity among the Company’s

clients; reduction in the Company’s clients’ cash flows or ability

to source debt or equity; federal, provincial or state legislative

and regulatory initiatives that could result in increased costs and

additional operating restrictions or delays; health, safety and

environment laws and regulations may require the Company to make

substantial expenditures or cause it to incur substantial

liabilities; changes to government financial support and economic

stimulus programs implemented to mitigate economic impacts of

COVID-19; loss of a significant client could cause the Company’s

revenue to decline substantially; negative cash flows from

operating activities; third party credit risk; hazards inherent in

the oilfield services industry which may not be covered to the full

extent by the Company’s insurance policies; difficulty in

retaining, replacing or adding personnel; seasonal volatility due

to adverse weather conditions; reliance on a few key employees;

legal proceedings involving the Company; failure to maintain the

Company’s safety standards and record; failure to continuously

improve operating equipment and proprietary fluid chemistries;

actual results differing materially from management estimates and

assumptions; market uncertainties; and the risk factors set forth

under the heading “Risk Factors” in the AIF and under the heading “

Risk Factors and Risk Management” in the Company’s November 3, 2020

MD&A and the Annual MD&A.

Any financial outlook or future orientated

financial information contained in this Press Release regarding

prospective financial performance, financial position or cash flows

is based on the assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information, including the Company’s capital

program, contains forward looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company’s operations will likely vary from the amounts set

forth in these projections and such variations may be material.

Readers are cautioned that any such financial outlook and future

oriented financial information contains herein should not be used

for purposes other than those for which it is disclosed herein.

The forward-looking information and statements

contained in this Press Release speak only as of the date of the

document, and none of the Company or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. The reader is cautioned not to place undue reliance on

forward-looking information.

About STEPSTEP is an oilfield

service company that provides stand-alone and fully integrated

fracturing, coiled tubing and wireline solutions. Our combination

of modern equipment along with our commitment to safety and quality

execution has differentiated STEP in plays where wells are deeper,

have longer laterals and higher pressures.

Founded in 2011 as a specialized deep capacity

coiled tubing company, STEP now provides an integrated solution for

deep capacity coiled tubing and fracturing services to exploration

and production (“E&P”) companies in Canada and the United

States (“U.S.”). Our Canadian services are focused in the WCSB,

while in the U.S., our services are focused in the Permian and

Eagle Ford in Texas and the Bakken in North Dakota.

Our four core values; Safety,

Trust, Execution and

Possibilities inspire our team of professionals to

provide differentiated levels of service, with a goal of flawless

execution and an unwavering focus on safety.

For more information please contact:

|

Regan DavisPresident & Chief Executive Officer |

|

Michael KellyExecutive Vice President & Chief Financial

Officer |

| Telephone: 403-457-1772 |

|

Telephone: 403-457-1772 |

Email: investor_relations@step-es.comWeb:

www.stepenergyservices.com

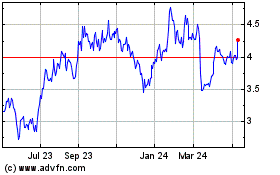

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Dec 2024 to Jan 2025

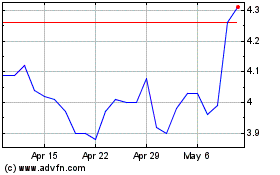

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Jan 2024 to Jan 2025