Blackstone, Thomson Reuters Consortium Cashes in 43 Million LSEG Shares

September 07 2023 - 2:47AM

Dow Jones News

By Michael Susin

Goldman Sachs said a consortium including Blackstone and Thomson

Reuters has cashed in 43.1 million of the shares it holds in the

London Stock Exchange Group through a placing, directed buyback and

sale of call options.

The bank on Thursday said the York Entities consortium has also

sold 25.5 million ordinary LSEG shares at 7,950 pence a

share--worth a total of 2.02 billion pounds ($2.53 billion) in a

placing to institutional investors. This represents a 3.8% discount

to Thursday's closing price of 8,264 pence prior to the

announcement.

In a separate statement, the LSEG said it conducted an

off-market purchase of nearly 750 million pounds ($938 million)

worth of limited-voting ordinary shares in parallel with the

consortium's placing at a price of 7,894 pence a share. This

represents a discount of 4.5% to Thursday's closing price.

York Entities has sold call options over around 8.2 million

extra voting shares to Barclays Bank, Goldman Sachs, BofA

Securities and Morgan Stanley. These represent an around 1.5%

economic interest and a 1.6% voting interest in the company. They

are also selling around 2.7 million additional voting shares to

allow them to establish the initial hedge for the call option

transaction through a concurrent placing to institutional

investors.

Shares in LSEG at 0702 GMT were down 184 pence, or 2.2%, at

8,080 pence.

Dow Jones competes with Thomson Reuters in financial news and

information services.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

September 07, 2023 03:32 ET (07:32 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

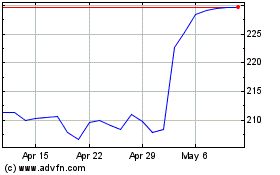

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From Apr 2024 to May 2024

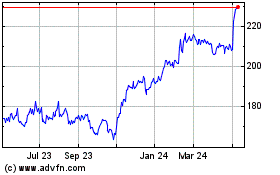

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From May 2023 to May 2024