Tidewater Midstream Announces Upsize to Convertible Debenture Underwritten Offering to $87 Million

May 29 2024 - 8:31AM

Tidewater Midstream and Infrastructure Ltd. (“Tidewater” or the

“Company”) (TSX: TWM) announced that the Company has agreed with

the syndicate of underwriters led by National Bank Financial

Markets (the “Underwriters”) to increase the size of its previously

announced convertible debenture offering. The Underwriters have

agreed to purchase, on a “bought deal” basis, $87 million principal

amount of convertible unsecured subordinated debentures (the

“Debentures”), at a price of $1,000 per Debenture, with an interest

rate of 8.00% per annum, payable semi-annually on the last day of

June and December, commencing on December 31, 2024 (the

“Offering”). The Debentures will mature on June 30, 2029.

Tidewater has also granted the Underwriters the

option to purchase up to $13.0 million principal amount of

additional Debentures, at a price of $1,000 per Debenture, to cover

over-allotments, if any, and for market stabilization purposes,

exercisable in whole or in part at any time until 30 days after the

closing of the Offering.

In all other respects, the terms of the Offering

and the use of proceeds therefrom will remain as previously

disclosed in the original press release dated May 28, 2024.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. The press

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any offer, solicitation or sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

ABOUT TIDEWATER MIDSTREAM

Tidewater is traded on the TSX under the symbol

“TWM”. Tidewater’s business objective is to profitably grow and

create shareholder value in the North American natural gas, natural

gas liquids, crude oil, refined product, and renewable energy value

chain. Its operations include downstream facilities, natural gas

processing facilities, natural gas liquids infrastructure,

pipelines, storage, and various renewable initiatives. To

complement its infrastructure asset base, the Company also markets

crude, refined product, natural gas, natural gas liquids and

renewable products and services to customers across North America.

Tidewater is a majority shareholder of Tidewater Renewables.

Additional information relating to Tidewater is available on SEDAR+

at www.sedarplus.ca and at https://www.tidewatermidstream.com.

For further information please

contact:

| Michael

GracherManager, Investor

RelationsTidewater Midstream and Infrastructure Ltd.Phone:

(403) 200-9142 |

Aaron

AmesInterim Chief Financial

OfficerTidewater Midstream and Infrastructure Ltd.Phone:

(403) 542-7205 |

| |

|

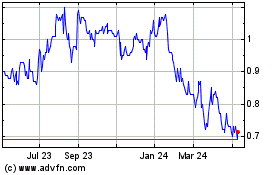

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

From Jan 2025 to Feb 2025

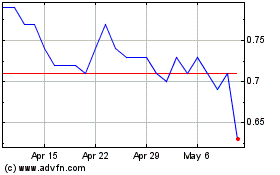

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

From Feb 2024 to Feb 2025