Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

provides 2023 operational guidance as well as a 5-year production

outlook for the Morelos Complex, which includes production from the

ELG Mine Complex (“ELG”) and from the Media Luna Project (“Media

Luna”).

TABLE 1: 2023 OPERATIONAL

GUIDANCE

|

|

2023 Guidance |

2022 Guidance1 |

|

Gold Production |

oz |

440,000 to 470,000 |

430,000 to 470,000 |

|

Total Cash Costs2a |

$/oz sold |

$740 to $780 |

$695 to $735 |

|

All-in Sustaining Costs2b |

$/oz sold |

$1,080 to $1,130 |

$980 to $1,030 |

|

Sustaining Capital Expenditures2c |

|

|

|

|

Capitalized Stripping |

M$ |

$55 to $65 |

$50 to $60 |

|

ELG Sustaining |

M$ |

$60 to $70 |

$35 to $45 |

|

Total Sustaining |

M$ |

$115 to $135 |

$85 to $105 |

|

Non-Sustaining Capital Expenditures2d |

|

|

|

|

Media Luna Project |

M$ |

$390 to $440 |

$120 to $150 |

|

Media Luna Infill Drilling |

M$ |

$20 |

$20 |

|

ELG Non-Sustaining |

M$ |

$2 |

$15 to $20 |

|

Total Non-Sustaining |

M$ |

$412 to $462 |

$155 to $190 |

| 1) |

|

2022 guidance was updated during last year to

reflect lower non-sustaining capital expenditures for Media

Luna. |

| 2) |

|

Refer to “Non-GAAP Financial Performance Measures”

in the Company’s September 30, 2022 MD&A for further

information and a detailed reconciliation. See also the Cautionary

Notes to this press release. |

| |

|

|

a) |

|

Total cash

costs in 2022 have averaged $736 per ounce gold sold through

Q3. |

| |

|

|

b) |

|

All-in sustaining costs in 2022 have averaged $999 per ounce

gold sold through Q3. |

| |

|

|

c) |

|

Sustaining capital expenditures in 2022 have totaled $70.6

million (including $40.6 million of capitalized waste) through

Q3. |

| |

|

|

d) |

|

Non-sustaining capital expenditures in 2022 have totaled $112.8

million (including $80.6 million of capital expenditures for Media

Luna) through Q3. |

| 3) |

|

2023 guidance assumes a realized gold price of

$1,750 per ounce, MXN:USD of 20.0, and a diesel price of $20.50 per

litre. |

Jody Kuzenko, President and CEO of Torex,

stated:

“We expect 2023 to be pivotal in the evolution

of Torex Gold as we continue to execute on several key strategic

initiatives, including advancing and de-risking Media Luna,

optimizing and extending ELG, as well as growing reserves and

resources. With more than $590 million of available liquidity at

the end of the third quarter, and robust forecast cash flow from

ELG, we are well positioned to fund these value-enhancing

initiatives as we continue to maximize the potential of our Morelos

Property.

“Guided gold production in 2023 is consistent

with 2022 and slightly higher than outlined in our previous

multi-year outlook. All-in sustaining costs in 2023 are expected to

be $100 per ounce higher than guided in 2022 given ongoing

inflationary pressures related to key consumables and increased

capitalized stripping. The additional costs are also attributable

to one-time costs associated with developing a new 8.7 megawatt

(MW) solar plant and upgrading electrical infrastructure to support

an increased power draw from the grid required for the growth at

the Morelos Complex.

“Non-sustaining capital expenditures are

expected to increase significantly as procurement, construction and

development activities at Media Luna continue to ramp-up, with 2023

expected to be the peak year of spend on the project.

“The 5-year production outlook released today

also demonstrates our ongoing work to increase and optimize

production from ELG during the development and ramp up of Media

Luna, with modestly higher production now forecast through 2025

than previously anticipated. The improved production outlook is a

direct result of optimizing and extending the life of the El Limón

open pits and continuing to increase mining rates within the

higher-grade ELG Underground.

“Overall, we expect to deliver another year of

safe, reliable, and profitable production in 2023, while continuing

to advance Media Luna towards first production in late-2024 on

schedule and on budget.”

2023 PRODUCTION GUIDANCEGold

production in 2023 is expected to be between 440,000 ounces and

470,000 ounces. The guided range is consistent with 2022 guidance;

however, narrowed at the low end given the history of performance

stability. The 2023 guided range is also slightly higher than the

420,000 to 460,000 ounces outlined in the Company’s 3-year outlook

released in March 2022.

Gold production is expected to be relatively

balanced throughout the year, with quarter-over-quarter variances

primarily attributable to processed grades inherent in mining a

skarn style deposit.

The strip ratio for 2023 is expected to average

10.7:1 compared to 8.9:1 in 2022 given additional laybacks within

the El Limón and El Limón Sur open pits. Based on the current mine

plan, a higher portion of waste is expected to be mined in the

second and third quarters compared with the first and fourth

quarters. During these quarters, the mill is expected to process a

greater proportion of higher-grade stockpiled material.

2023 COST GUIDANCETotal cash

costs are guided at $740 to $780 per ounce of gold sold in 2023.

The $45 per ounce increase in costs relative to 2022 guidance is

due to ongoing inflationary pressures, primarily related to key

consumables (cyanide, metabisulphite, explosives, and cement) as

well as labour. Total cash costs for full year 2022 are expected to

be at the upper end of the 2022 guided range ($695 to $735 per

ounce).

All-in sustaining costs are guided at $1,080 to

$1,130 per ounce of gold sold in 2023. The $100 per ounce increase

relative to 2022 guidance reflects higher total cash costs, a

greater amount of capitalized stripping related to additional

laybacks, higher level of underground development classified as

sustaining capital expenditures, and energy-related projects, which

are non-recurring in nature. All-in sustaining costs for full year

2022 are expected to be at the middle of the 2022 guided range

($980 to $1,030 per ounce sold).

2023 CAPITAL EXPENDITURE

GUIDANCESustaining capital expenditures in 2023 are guided

at $115 to $135 million, including $55 to $65 million of

capitalized stripping.

The year-over-year increase in capitalized

stripping is directly related to the additional laybacks in the El

Limón and El Limón Sur open pits, which have extended the life of

both pits in an effort to ensure a smooth transition from ELG to

Media Luna. The level of capitalized stripping is expected to

decline post 2023 given the anticipated depletion of the Guajes pit

in mid-2023, El Limón Sur pit in late-2024, and El Limón pit in

mid-2025.

ELG sustaining capital expenditures are guided

at $60 to $70 million in 2023, $25 million higher than guided in

2022 due to power-related projects and increased spend associated

with underground development. Power-related projects are earmarked

at $10 million in 2023 and include the development of an 8.7 MW

solar plant as well as upgrades to existing infrastructure to

support the increased power draw at site (45 MW from 25 MW). Total

ELG underground development is earmarked at $35 million in 2023,

which includes $15 million in development that in prior years was

classified as non-sustaining capital expenditures. Underground

development in 2023 is primarily focused on opening up existing

mining fronts, while in previous years the development was

associated with opening up new mining fronts. Excluding capitalized

stripping, total capital expenditures for ELG are guided at $62 to

$72 million compared to $50 to $65 million guided in 2022.

Non-sustaining capital expenditures in 2023 are

guided at $412 to $462 million, which includes $390 to $440 million

of expenditures related to procurement, development and

construction activities at Media Luna. Expenditures on Media Luna

are expected to remain relatively consistent through H1 2024,

before declining as development activities wind down ahead of

commercial production anticipated in early 2025.

2023 EXPLORATION PLANSThe

Company plans to invest approximately $39 million in exploration

and drilling in 2023, with the goal of increasing the overall

resource and reserve base of the Morelos Property and delivering on

the Company’s objective of filling the mill post 2027. Details of

the planned exploration programs are as follows:

- Media Luna:

Approximately $20 million is budgeted for drilling within the

broader Media Luna Cluster (55,000 metres). At EPO, 25,000 metres

of drilling is planned with 40% focused on infill drilling and the

remaining on expansionary drilling. The Company plans to carry-out

an initial drill program at Media Luna West, which will include

26,000 metres of wide-spaced drilling to test the mineralized

potential of this highly prospective target. In addition, 4,000

metres of condemnation drilling is planned. Program costs are

included in the non-sustaining capital expenditure guidance.

- ELG Underground:

Approximately $6 million is budgeted for infill and step-out

drilling within the ELG Underground (30,000 metres). Drilling is

targeting to both upgrade and expand resources within Sub-Sill,

Sub-Sill South, ELD and El Limón Sur Deep deposits. Of the program

costs, $4 million (22,000 metres) has been included in sustaining

capital expenditure guidance and $2 million (8,000 metres) has been

included in non-sustaining capital expenditure guidance.

- Near Mine and

regional: Approximately $8 million is budgeted to conduct

exploration across the broader land package, including near mine

drilling (27,000 metres of drilling) on early-stage exploration

targets. The program expenditures will be classified as exploration

expenses.

- Definition and grade

control drilling: Approximately $5 million of definition

and grade control drilling in 2023. These costs are classified as

an expense in cost of goods sold and as such are included in total

cash cost guidance.

FIVE-YEAR PRODUCTION OUTLOOK (2023 –

2027)Ongoing efforts to further improve the near-term

production profile for the Morelos Complex continue to bear fruit

with higher production forecast through 2025 than was previously

envisioned in the 2022 Technical Report (“Technical Report”). The

improved near-term production outlook is directly related to

ongoing efforts to extend and optimize production from ELG.

During 2022, drilling was successful in

identifying additional mineralization along the boundary of the El

Limón open pit, which is expected to extend the life of the deposit

to mid-2025. In addition, drilling within the El Limón Sur open pit

has extended the life of the deposit to late-2024.

In addition to the drilling success at the open

pits, efforts to enhance the contribution from the ELG Underground

have also been successful. Following an average record mining rate

of 1,523 tonnes per day in 2022, the Company is targeting to exit

2023 at a mining rate of 1,800 tonnes per day and 2024 at a rate of

2,000 tonnes per day. The forecast rates compare favourably to the

1,400 tonnes per day outlined in the most recent Technical

Report.

TABLE 2: FIVE-YEAR PRODUCTION OUTLOOK

FOR THE MORELOS COMPLEX

|

Production(koz)1 |

Actual |

Outlook2021 |

Outlook2022 |

Outlook2023 |

2022 TechnicalReport |

|

2021 (Au) |

468.2 |

430 to 470 |

|

|

|

|

2022 (Au) |

474.0 |

430 to 470 |

430 to 470 |

|

|

|

2023 (Au) |

|

400 to 450 |

420 to 460 |

440 to 470 |

435.7 |

|

2024 (AuEq) |

|

300 to 350 (Au) |

385 to 425 |

400 to 450 |

405.5 |

|

2025 (AuEq) |

|

|

415 to 455 |

425 to 475 |

433.8 |

|

2026 (AuEq) |

|

|

|

425 to 475 |

457.1 |

|

2027 (AuEq) |

|

|

|

450 to 500 |

480.0 |

|

1) |

|

Payable gold

production (Au) disclosed for 2023 and prior periods. Payable gold

equivalent production (AuEq) disclosed for 2024 and beyond given

increased contribution from copper and silver with the forecast

start-up of Media Luna in Q4 2024. For more information on AuEq,

see Tables 3 and 4 below. |

The modest dip in 2024 production is associated

with the current tie-in schedule for the copper and iron flotation

circuits at the processing plant in late 2024. This year, a focus

will be on further optimizing the existing tie in schedule with a

view to minimizing associated down time.

Given the development stage nature of Media

Luna, the contribution from Media Luna during the 5-year outlook

period remains unchanged from the mine physicals outlined in the

Technical Report.

A breakdown of Torex’s Mineral Reserves and

Resources as at December 31, 2021 can be found in Tables 3 and 4 at

the end of this press release.

CASH FLOW SEASONALITYCash flow

from operations in Q1 will be impacted by the payment of the

Mexican-based Mining Tax (accrued throughout the year and paid out

the following March) and Corporate Income Tax owing at year-end.

Taxes paid will be reflected in cash flow from operations prior to

changes in non-cash working capital. In Q2, cash flow from

operations after changes in non-cash working capital will be

impacted by the employee profit sharing payment (“PTU”), which is

accrued throughout the year and paid out in full in May of the

following year.

ADDITIONAL GOLD PRICE PROTECTION SECURED

FOR 2024As part of the Company’s work to reduce price risk

during the build-out of Media Luna, Torex has entered into forward

sales contracts covering 27,000 ounces per quarter through all of

2024 at an average gold price of $1,939 per ounce. These forward

sales are in addition to the Company’s existing forward sales of

27,000 ounces of gold per quarter through all of 2023 at an average

price of $1,924 per ounce. These forward sales cover approximately

25% of forecast production through 2024.

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to extend and optimize production from the ELG

Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

|

TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan Rollins |

| President and CEO |

Senior Vice President, Corporate

Development & Investor Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

QUALIFIED PERSONThe technical

and scientific information in this press release, with respect to

the Company’s 2023 production outlook and strip ratio as well as

five-year production outlook, has been reviewed and approved by

Dave Stefanuto, P. Eng, Executive Vice President, Technical

Services and Capital Projects of the Company, and a qualified

person under National Instrument 43-101.

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTS

NON-GAAP FINANCIAL PERFORMANCE MEASURESTotal

cash costs per oz of gold sold (“TCC”), and all-in sustaining costs

per ounce of gold sold (“AISC”), sustaining capital expenditures,

non-sustaining capital expenditures and realized gold price are

financial performance measures with no standard meaning under

Generally Accepted Accounting Principles (“GAAP”) and might not be

comparable to similar financial measures disclosed by other

issuers. Please refer to the “Non-GAAP Financial Performance

Measures” section (the “MD&A Information”) in the Company’s

management’s discussion and analysis (the “MD&A”) for the

quarter ended September 30, 2022, dated November 8, 2022, available

on the Company’s SEDAR profile at www.sedar.com for further

information with respect to TCC, AISC, sustaining capital

expenditures, non-sustaining capital expenditures and realized gold

price and a detailed reconciliation of these non-GAAP financial

performance measures the most directly comparable measure under

IFRS. The MD&A Information is incorporated by reference into

this press release.

FORWARD LOOKING INFORMATIONThis press release

contains "forward-looking statements" and "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the 2023 operational guidance for 2023 including gold

production, total cash costs per oz of gold sold (“TCC”), all-in

sustaining costs per ounce of gold sold (“AISC”), sustaining

capital expenditures and non-sustaining capital expenditures and

the five year production outlook; the expected continuation of

executing on several key strategic initiatives, including advancing

and de-risking Media Luna, optimizing and extending ELG, as well as

growing reserves and resources; with the available liquidity at the

end of the third quarter, and robust forecast cash flow from ELG,

the Company’s positioning to fund these value-enhancing initiatives

as the Company continues to maximize the potential of its Morelos

Property; the guided gold production in 2023 through to 2027;

expected all-in sustaining costs in 2023 to be $100 per ounce

higher than guided in 2022 given ongoing inflationary pressures

related to key consumables and increased capitalized stripping;

expected non-sustaining capital expenditures to increase

significantly as procurement, construction and development

activities at Media Luna continue to ramp-up, with 2023 expected to

be the peak year of spend on the project; the 5-year production

outlook with modestly higher production now forecast through 2025

than previously anticipated; overall, expectation of another year

of safe, reliable, and profitable production in 2023, while

continuing to advance Media Luna towards first production in

late-2024 on schedule and on budget; the expected relatively

balanced gold production throughout the year, with

quarter-over-quarter variances primarily attributable to processed

grades inherent in mining a skarn style deposit; the expected strip

ratio for 2023 and timing on the mining of waste over the year;

expectation of processing higher-grade stockpiled material during

periods of higher mining of waste material; expected TCC for 2023;

expected TCC for full year 2022 to be at the upper end of the 2022

guided range; expected AISC for 2023; AISC for full year 2022 are

expected to be at the middle of the 2022 guided range; expected

sustaining capital expenditures for 2023; the expected decline in

the level of capitalized stripping post 2023 given the anticipated

depletion of the Guajes pit in mid-2023, El Limón Sur pit in

late-2024, and El Limón pit in mid-2025; the expected ELG

sustaining capital expenditures for 2023; expected expenditures of

power-related projects of $10 million in 2023 including

expenditures for the development of an 8.7 MW solar plant as well

as upgrades to existing infrastructure to support the increased

power draw at site (45 MW from 25 MW); expected expenditures for

total ELG underground development of $35 million in 2023; excluding

capitalized stripping, expected total capital expenditures for ELG

of $62 to $72 million in 2023; expected non-sustaining capital

expenditures in 2023 of $412 to $462 million, which includes $390

to $440 million of expenditures related to procurement, development

and construction activities at Media Luna; expectation that

expenditures on Media Luna will remain relatively consistent

through H1 2024, before declining as development activities wind

down ahead of commercial production anticipated in early 2025;

amounts of planned investment in exploration programs and the

objective or goal of each program as described in this press

release and the overall goal of filling the mill beyond 2027; the

expectation that additional mineralization identified during 2022

will extend the life of the El Limón open pit deposit to mid-2025

and the expected extension of the life of the El Limón Sur open pit

deposit to late-2024; the target to exit 2023 at an ELG underground

mining rate of 1,800 tonnes per day and 2024 at a rate of 2,000

tonnes per day; the expected modest dip in 2024 production

associated with the current tie-in schedule for the copper and iron

flotation circuits at the processing plant in late 2024; the focus

in 2023 on further optimizing the existing tie in schedule with a

view to minimizing associated down time and Torex’s key strategic

objectives are to extend and optimize production from the ELG

Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “expects”, “planned”, “guided”,

“strategy”, “target”, “goal”, “objective” or variations of such

words and phrases or statements that certain actions, events or

results “will”, or “is expected to” occur. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

and uncertainties identified in the Company’s technical report (the

“Technical Report”) released on March 31, 2022, entitled “NI 43-101

Technical Report ELG Mine Complex Life of Mine Plan and Media Luna

Feasibility Study”, which has an effective date of March 16, 2022,

Company’s annual information form (“AIF”) and management’s

discussion and analysis (“MD&A”) or other unknown but

potentially significant impacts. Forward-looking information is

based on the reasonable assumptions, estimates, analyses and

opinions of management made in light of its experience and

perception of trends, current conditions and expected developments,

and other factors that management believes are relevant and

reasonable in the circumstances at the date such statements are

made. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in the forward-looking information, there may be

other factors that cause results not to be as anticipated. There

can be no assurance that such information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company does not undertake to update any

forward-looking information, whether as a result of new information

or future events or otherwise, except as may be required by

applicable securities laws. The Technical Report, AIF and MD&A

are available under the Company’s profile on SEDAR at www.sedar.com

and on the Company’s website at www.torexgold.com.

TABLE 3: MORELOS COMPLEX – MINERAL

RESERVES (DECEMBER 31, 2021)

| |

|

|

|

|

|

|

|

|

|

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(g/t) |

(g/t) |

(%) |

(koz) |

(koz) |

(Mlb) |

(g/t) |

(koz) |

|

El Limón Guajes Open Pit (ELG OP) |

|

|

|

|

|

|

|

|

|

|

Proven |

4,900 |

3.95 |

4.6 |

0.14 |

623 |

719 |

15 |

4.00 |

630 |

|

Probable |

5,471 |

2.35 |

4.5 |

0.12 |

414 |

784 |

15 |

2.39 |

421 |

|

Proven & Probable |

10,371 |

3.11 |

4.5 |

0.13 |

1,037 |

1,503 |

30 |

3.15 |

1,051 |

|

El Limón Guajes Underground (ELG UG) |

|

|

|

|

|

|

|

|

|

Proven |

110 |

7.23 |

10.5 |

0.59 |

25 |

37 |

1 |

7.38 |

26 |

|

Probable |

2,566 |

5.68 |

5.7 |

0.22 |

469 |

474 |

13 |

5.74 |

474 |

|

Proven & Probable |

2,675 |

5.74 |

5.9 |

0.24 |

494 |

511 |

14 |

5.81 |

500 |

|

Media Luna Underground (ML UG) |

|

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

Proven & Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

Surface Stockpiles |

|

|

|

|

|

|

|

|

|

|

Proven |

4,808 |

1.35 |

3.1 |

0.07 |

209 |

484 |

7 |

1.38 |

213 |

|

Probable |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Proven & Probable |

4,808 |

1.35 |

3.1 |

0.07 |

209 |

484 |

7 |

1.38 |

213 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Proven |

9,817 |

2.72 |

3.9 |

0.11 |

858 |

1,240 |

23 |

2.75 |

869 |

|

Probable |

31,054 |

2.96 |

20.2 |

0.69 |

2,959 |

20,202 |

472 |

4.26 |

4,254 |

|

Proven & Probable |

40,871 |

2.90 |

16.3 |

0.55 |

3,817 |

21,442 |

495 |

3.90 |

5,123 |

| Notes to accompany summary Mineral Reserve

Table: |

| |

1. |

|

Mineral

Reserves were developed in accordance with CIM (2014)

guidelines. |

| |

2. |

|

Rounding may result in apparent summation differences between

tonnes, grade, and contained metal content Surface Stockpile

mineral reserves are estimated using production and survey data and

apply the same AuEq formula as ELG Open Pits and ELG

Underground. |

| |

3. |

|

AuEq of Total Reserves is established from combined

contributions of the various deposits. |

| |

4. |

|

The qualified person for the mineral reserve estimate is

Johannes (Gertjan) Bekkers, P. Eng., Director of Mine Technical

Services. |

| |

5. |

|

The qualified person is not aware of mining, metallurgical,

infrastructure, permitting, or other factors that materially affect

the Mineral Reserve estimates. |

| |

|

|

|

| Notes to accompany the ELG Open Pit Mineral

Reserves: |

| |

6. |

|

Mineral Reserves are founded on Measured and Indicated Mineral

Resources, with an effective date of December 31, 2021, for ELG

Open Pits (including El Limón, El Limón Sur and Guajes

deposits). |

| |

7. |

|

ELG Open Pit Mineral Reserves are reported above a diluted

cut-off grade of 1.1 g/t Au. |

| |

8. |

|

ELG Low Grade Mineral Reserves are reported above a diluted

cut-off grade of 1.0 g/t Au. |

| |

9. |

|

It is planned that ELG Low Grade Mineral Reserves within the

designed pits will be stockpiled during pit operation and processed

during pit closure. |

| |

10. |

|

Mineral Reserves within the designed pits include assumed

estimates for dilution and ore losses. |

| |

11. |

|

Cut-off grades and designed pits are considered appropriate for

a metal price of $1,400/oz Au and metal recovery of 89% Au. |

| |

12. |

|

Mineral Reserves are reported using a gold price of

US$1,400/oz, silver price of US$17/oz, and copper price of

US$3.25/lb. |

| |

13. |

|

Average metallurgical recoveries of 89% for gold and 30% for

silver and 10% for copper |

| |

14. |

|

ELG AuEq = Au (g/t) + Ag (g/t) * (0.0041) + Cu (%) * (0.1789),

accounting for metal prices and metallurgical recoveries. |

| |

|

|

|

| Notes to accompany the ELG Underground Mineral

Reserves: |

| |

15. |

|

Mineral Reserves are founded on Measured and Indicated Mineral

Resources, with an effective date of December 31, 2021, for ELG

Underground (including Sub-Sill and ELD deposits). |

| |

16. |

|

Mineral Reserves were developed in accordance with CIM

guidelines. |

| |

17. |

|

El Limón Underground mineral reserves are reported above an

in-situ ore cut-off grade of 3.58 g/t Au and an in-situ incremental

cut-off grade of 1.04 g/t Au |

| |

18. |

|

Cut-off grades and mining shapes are considered appropriate for

a metal price of $1,400/oz Au and metal recovery of 89% Au. |

| |

19. |

|

Mineral Reserves within designed mine shapes assume mechanized

cut and fill mining method and include estimates for dilution and

mining losses. |

| |

20. |

|

Mineral Reserves are reported using a gold price of

US$1,400/oz, silver price of US$17/oz, and copper price of

US$3.25/lb |

| |

21. |

|

Average metallurgical recoveries of 89% for gold and 30% for

silver and 10% for copper |

| |

22. |

|

ELG AuEq = Au (g/t) + Ag (g/t) * (0.0041) + Cu (%) * (0.1789),

accounting for metal prices and metallurgical recoveries. |

| |

| Notes to accompany the ML Underground Mineral

Reserves: |

| |

23. |

|

Mineral Reserves are based on Media Luna Indicated Mineral

Resources with an effective date of October 31st, 2021. |

| |

24. |

|

Media Luna Underground Mineral Reserves are reported above a

diluted ore cut-off grade of 2.2 g/t AuEq |

| |

25. |

|

Media Luna Underground cut-off grades and mining shapes are

considered appropriate for a metal price of $1,400/oz Au, $17/oz Ag

and $3.25/lb Cu and metal recoveries of 85% Au, 79% Ag, and 91%

Cu. |

| |

26. |

|

Mineral Reserves within designed mine shapes assume long-hole

open stoping, supplemented with mechanized cut-and-fill mining and

includes estimates for dilution and mining losses. |

| |

27. |

|

Media Luna AuEq = Au (g/t) + Ag (g/t) * (0.011188) + Cu (%) *

(1.694580), accounting for metal prices and metallurgical

recoveries |

TABLE 4: MORELOS COMPLEX – MINERAL

RESOURCES (DECEMBER 31, 2021)

| |

|

|

|

|

|

|

|

|

|

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(g/t) |

(g/t) |

(%) |

(koz) |

(koz) |

(Mlb) |

(g/t) |

(koz) |

|

El Limón Guajes Open Pit (ELG OP) |

|

|

|

|

|

|

|

|

|

|

Measured |

5,727 |

3.89 |

5.0 |

0.13 |

716 |

919 |

17 |

3.93 |

724 |

|

Indicated |

11,027 |

2.37 |

4.7 |

0.12 |

842 |

1,660 |

28 |

2.41 |

856 |

|

Measured & Indicated |

16,754 |

2.89 |

4.8 |

0.12 |

1,557 |

2,579 |

45 |

2.93 |

1,580 |

|

Inferred |

812 |

1.80 |

3.5 |

0.08 |

47 |

90 |

1 |

1.83 |

48 |

|

El Limón Guajes Underground (ELG UG) |

|

|

|

|

|

|

|

|

|

Measured |

584 |

7.24 |

10.0 |

0.52 |

136 |

187 |

7 |

7.37 |

138 |

|

Indicated |

3,968 |

6.11 |

7.1 |

0.27 |

779 |

900 |

23 |

6.18 |

789 |

|

Measured & Indicated |

4,551 |

6.25 |

7.4 |

0.30 |

915 |

1,088 |

30 |

6.34 |

927 |

|

Inferred |

1,380 |

4.88 |

6.2 |

0.25 |

217 |

275 |

8 |

4.95 |

220 |

|

Media Luna Underground (ML UG) |

|

|

|

|

|

|

|

|

|

|

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

25,380 |

3.24 |

31.5 |

1.08 |

2,642 |

25,706 |

602 |

5.38 |

4,394 |

|

Measured & Indicated |

25,380 |

3.24 |

31.5 |

1.08 |

2,642 |

25,706 |

602 |

5.38 |

4,394 |

|

Inferred |

5,991 |

2.47 |

20.8 |

0.81 |

476 |

3,998 |

106 |

4.05 |

780 |

|

EPO |

|

|

|

|

|

|

|

|

|

|

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Measured & Indicated |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Inferred |

8,019 |

1.52 |

34.6 |

1.27 |

391 |

8,908 |

225 |

3.97 |

1,024 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Measured |

6,311 |

4.20 |

5.5 |

0.17 |

852 |

1,106 |

24 |

4.25 |

862 |

|

Indicated |

40,375 |

3.28 |

21.8 |

0.73 |

4,263 |

28,266 |

653 |

4.65 |

6,039 |

|

Measured & Indicated |

46,685 |

3.41 |

19.6 |

0.66 |

5,114 |

29,373 |

677 |

4.60 |

6,901 |

|

Inferred |

16,202 |

2.17 |

25.5 |

0.95 |

1,131 |

13,271 |

340 |

3.98 |

2,071 |

| Notes to accompany summary Mineral Resource

Table: |

| |

1. |

|

CIM (2014)

definitions were followed for Mineral Resources. |

| |

2. |

|

Mineral Resources are depleted above a mining surface or to the

as-mined solids as of December 31, 2021. |

| |

3. |

|

Mineral Resources are reported using a gold price of

US$1,550/oz, silver price of US$20/oz, and copper price of

US$3.50/lb. |

| |

4. |

|

AuEq of total Mineral Resources is established from combined

contributions of the various deposits. |

| |

5. |

|

Mineral Resources are inclusive of Mineral Reserves. |

| |

6. |

|

Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. |

| |

7. |

|

Numbers may not add due to rounding. |

| |

8. |

|

The estimate was prepared by Mr. John Makin, MAIG, a consultant

with SLR Consulting (Canada) Ltd. Mr. Makin is independent of the

company and is a “Qualified Person” under NI 43-101. |

| |

|

|

|

| Notes to accompany the ELG Mineral Resources: |

| |

9. |

|

The effective date of the estimate is December 31, 2021. |

| |

10. |

|

Average metallurgical recoveries are 89% for gold, 30% for

silver and 10% for copper. |

| |

11. |

|

ELG AuEq = Au (g/t) + (Ag (g/t) * 0.0043) + (Cu (%) * 0.1740).

AuEq calculations consider both metal prices and metallurgical

recoveries. |

| |

|

|

|

| Notes to accompany the ELG Open Pit Mineral

Resources |

| |

12. |

|

Mineral resources are reported above a cut-off grade of 0.9 g/t

Au. |

| |

13. |

|

Mineral Resources are reported inside an optimized pit shell,

underground mineral reserves at ELD within the El Limón shell have

been excluded from the open pit Mineral Resources. |

| |

|

|

|

| Notes to accompany the ELG Underground Mineral

Resources: |

| |

14. |

|

Mineral Resources are reported above a cut-off grade of 2.6 g/t

Au. |

| |

15. |

|

The assumed mining method is underground cut and fill. |

| |

16. |

|

Mineral Resources from ELD that are contained within the El

Limón pit optimization and that are not underground Mineral

Reserves have been excluded from the underground Mineral

Resources. |

| |

|

|

|

| Notes to accompany the ML Mineral Resources: |

| |

17. |

|

The effective date of the estimate is October 31, 2021. |

| |

18. |

|

Mineral Resources are reported above a 2.0 g/t AuEq cut-off

grade. |

| |

19. |

|

Metallurgical recoveries at Media Luna (excluding EPO) average

85% for gold, 79% for silver, and 91% for copper. Metallurgical

recoveries at EPO average 85% for gold, 75% for silver, and 89% for

copper. |

| |

20. |

|

Media Luna (excluding EPO) AuEq = Au (g/t) + (Ag (g/t) *

0.011889) + (Cu (%) * 1.648326). EPO AuEq = Au (g/t) + Ag (g/t) *

(0.011385) + Cu % * (1.621237). AuEq calculations consider both

metal prices and metallurgical recoveries. |

| |

21. |

|

The assumed mining method is from underground methods, using a

combination of long hole stoping and, cut and fill. |

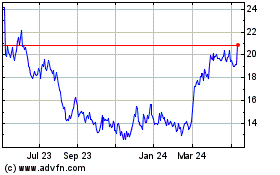

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

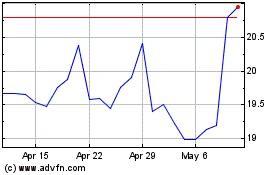

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024