Sprott Physical Uranium Trust Provides Update on Application for U.S. Stock Exchange Listing

April 27 2022 - 4:04PM

Sprott Asset Management LP (“

Sprott Asset

Management”), on behalf of the Sprott Physical Uranium

Trust (TSX: U.UN and U.U) (the “

Trust” or

“

SPUT”), announced today that it has been informed

that the U.S. Securities and Exchange Commission

(“

SEC”) has declined to consider the application

submitted earlier this year in respect of a U.S. stock exchange

listing for the units of the Trust.

“Unfortunately, we have been informed that the

SEC has rejected the application to list the units of SPUT on the

NYSE Arca at this time. We understand the rejection was based on

the Trust not meeting the applicable NYSE Arca listing standards

due to the structure of the Trust and the nature of the physical

uranium market. While we are disappointed by this outcome, the

Trust has grown to $3.0 billion in net assets since its inception

which confirms our belief that SPUT provides enormous value and

transparency to its investors. SPUT has also played an integral

role in helping to improve price discovery, liquidity and activity

in the spot uranium market. We will continue to operate the Trust

in the best interests of unitholders and provide market-leading

disclosure and transparency. The Trust allows investors from around

the world to invest in the uranium market through our U.S. and

Canadian dollar denominated listings on the Toronto Stock Exchange,

as well as trading on the OTCQX Best Market. SPUT will continue to

play a positive role in the evolution of the physical uranium

market for the benefit of our unitholders,” said John Ciampaglia,

Chief Executive Officer of Sprott Asset Management.

The rejection of the application to list the

Trust units follows a robust and involved process by Sprott Asset

Management, as SPUT’s manager, over the past nine months to seek a

listing of the units of the Trust on the NYSE Arca. As required

under the Trust’s management agreement, Sprott Asset Management has

paid the out-of-pocket costs incurred by SPUT in connection with

the foregoing. Given the outcome, the Trust does not currently

intend to further pursue a listing of its units on a U.S. stock

exchange in the near term.

About Sprott Asset Management and the

TrustSprott Asset Management, a subsidiary of Sprott Inc.,

is the investment manager to the Trust. Important information about

the Trust, including its investment objectives and strategies,

applicable management fees, and expenses can be found on

www.sprott.com/uranium and on www.sedar.com. Commissions,

management fees, or other charges and expenses may be associated

with investing in the Trust. The performance of the Trust is not

guaranteed, its value changes frequently and past performance is

not an indication of future results.

To learn more about the Trust, please visit

www.sprott.com/uranium.

Caution Regarding Forward-Looking

Information This news release contains “forward-looking

information” within the meaning of applicable securities laws.

Often, but not always, forward-looking statements can be identified

by the use of words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or variations (including negative

variations) of such words and phrases, or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved. Forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Trust to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Forward-looking statements contained

herein are made as of the date of this news release and each of

Sprott Asset Management and the Trust disclaim any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Neither of

Sprott Asset Management nor the Trust undertakes any obligation to

update forward-looking statements if circumstances, management’s

estimates or opinions should change, except as required by

securities legislation. Accordingly, the reader is cautioned not to

place undue reliance on forward-looking statements. Forward-looking

information includes information that relates to, among other

things, the future pursuit of listing of units of the Trust on a

U.S. stock exchange and SPUT’s role in the uranium market.

For more information:

Glen WilliamsManaging Director, Investor and

Institutional Client RelationsTel: 416.943.4394Email:

gwilliams@sprott.com

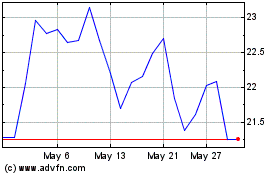

Sprott Physical Uranium (TSX:U.U)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sprott Physical Uranium (TSX:U.U)

Historical Stock Chart

From Feb 2024 to Feb 2025