Amazon Mining Holding Plc (TSX VENTURE: AMZ) ("Amazon" or the

"Company"), is pleased to announce the receipt of a positive

Preliminary Economic Assessment ("PEA" or the "Scoping Study") from

SRK Consulting ("SRK") and ECM S/A Projetos Industriais ("ECM") on

Amazon's wholly-owned Cerrado Verde project ("Cerrado Verde" or the

"Project") located in Minas Gerais, Brazil. The PEA evaluated the

technical and the financial aspects of the mine operation and

beneficiation facility. The Scoping Study assumed open pit mining

and pyrometallurgy process for the production of ThermoPotash

product.

The Study supports Amazon's positive outlook on Cerrado Verde's

value and represents a significant milestone toward full

development of the Project. Amazon took a conservative base case

approach to the Scoping Study, limiting the production rate to 1.1

Mt per year of ThermoPotash at 8.34% K2O. ECM estimates that with a

production rate of 1.1 Mt per year and the inferred resource base

of 105 million tonnes at 10.3% K2O determined by Coffey Mining, the

Project has a projected life of around 100 years, 40 years was

assumed for the analysis. Amazon also evaluated a second scenario

with a production rate of 2.2 Mt per year.

The results of the study for the 1.1Mt production rate scenario include:

-- Estimated Project Capital Cost of US$155.3 million, plus $23.3 million

in contingency and $18.2 million of pre-construction costs

-- Estimated Operating Cost (including production, work force, and variable

costs) of US$37.01 per tonne plus estimated marketing and administrative

costs of US$4.79 per tonne for a total cost of US$41.80 per tonne of

ThermoPotash

-- Net Present Value of US$455.4 million at a 10% discount rate

-- Net Present Value of US$339.1 million at a 12% discount rate

-- Estimated after-tax and royalty Internal Rate of Return (IRR) of 32.9%

-- Payback of the initial Capital Expenditure: 2.38 years

The results of the study for the 2.2Mt production rate scenario include:

-- Estimated Project Capital Cost of US$218.4 million, plus $32.8 million

in contingency and $18.2 million of pre-construction costs

-- Estimated Operating Costs (including production, work force, and

variable costs) of US$32.12 per tonne plus estimated marketing and

administrative cost of US$4.24 per tonne for a total cost of US$36.36

per tonne of ThermoPotash

-- Net Present Value of US$858.1 million at a 10% discount rate

-- Net Present Value of US$652.6 million at a 12% discount rate

-- Estimated after-tax and royalty Internal Rate of Return (IRR) of 40.2%

-- Payback of the initial Capital Expenditure: 1.87 years

The Scoping Study assumed a constant US Dollar-Brazilian Real

exchange rate of $1USD=$1.8BRL and constant petroleum coke and

limestone pricing of R$310 per ton and R$15 per ton, respectively.

Also, the cash flow projections exclude the cost of financing. Mine

life was assumed at 40 years. Income tax calculations did not

include any loss carry forwards.

The Scoping Study utilized the weighted average

delivery-adjusted sales prices of US$151.82/t and $133.23/t for the

1.1 and 2.2Mt, respectively, based on the independent market study

conducted by Agroconsult Consultoria & Marketing. (Please refer

to the news release on October 26, 2010.) The Marketing Study

assumed an FOB Vancouver potash (KCl) price of $400/t long

term.

With the encouraging results of the Scoping Study, the Company

will continue to study the feasibility of the Project led by Mr.

Pedro Ladeira, Vice President of Engineering and Mr. Mauricio

Sampaio, Vice President of Operations. President & CEO,

Cristiano Veloso, said "We are very pleased with the results of the

study. Based on cement production cost estimates, we had previously

estimated the operating costs before marketing and administrative

costs to be approximately $53 per tonne. This study lowers the

estimates by 30% to $37 per tonne. Also, the total capital

expenditure associated with the development of the Project is well

within the range of our expectations and is significantly lower

than other potash projects under development." Mr. Sampaio added,

"Our strategy to incorporate ThermoPotash in NPK removes much of

the adoption risk, as 90% of all fertilizer in Brazil is sold as an

NPK formulation. The Study's projected low operating costs combined

with the strong ThermoPotash prices estimated by Agroconsult should

secure future profitability with first production slated for early

2013."

The Company will file a NI 43-101 PEA report of the Study on the

Cerrado Verde project with Canadian securities regulators within 45

days of this release. The PEA will be available on SEDAR at

www.sedar.com, and also on the Company's website.

Conference Call

A conference call to discuss the results of the Scoping Study

has been scheduled for Wednesday, November 3, 2010 at 10:00 am ET

(7:00 am PT). Conference Call details can be found below:

Toll-free US / Canada +1 (800) 200-6965

Brazil 0800 891 1814

United Kingdom 0800 032 3502

Rest of the World +1 (646) 216-7221

Participant Code 978133#

Qualified Persons

Neal Rigby of SRK Consulting is the Principal author of the

Technical Report and incorporated the results of the Resource

Estimate prepared by Porfirio Cabaleiro Rodrigues of Coffey Mining.

All persons are Qualified Persons, independent of Amazon Mining

within the meaning of section 1.4 of NI 43-101, SRK Consulting has

reviewed and approved the technical information within this news

release.

The preliminary assessment includes inferred mineral resources

that are considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be categorized as mineral reserves, and there is no certainty that

the preliminary assessment will be realized. Mineral resources that

are not mineral reserves do not have demonstrated economic

viability.

About SRK Consulting

SRK Consulting is an independent, international consulting

practice that provides focused advice and solutions to clients,

mainly from earth and water resource industries. For mining

projects, SRK offers services from exploration through feasibility,

mine planning, and production to mine closure. Formed in 1974, SRK

now employs more than 1,000 professionals internationally in 38

permanent staffed offices on 6 continents.

About ECM

ECM, founded in 1984, is a Brazilian engineering company with

extensive experience in developing multidisciplinary industrial

projects of all sizes, including project design for the minerals

and mining industry, from feasibility studies to plant

commissioning. ECM has about 550 employees and has been involved in

significant mining projects over the past decade in Brazil.

About Amazon

Amazon Mining is a mineral exploration and development company

founded by Brazilians in 2005. The company is focused on the

development of the Cerrado Verde project. Cerrado Verde is a source

of potash rich rock from which Amazon plans to produce a

slow-release, non-chloride, multi-nutrient, fertilizer product.

Amazon Mining is a UK public company with shares listed on the TSX

Venture Exchange since November 2007.

On behalf of the Board of Directors of Amazon Mining Holding

Plc, Jed Richardson, Vice President of Corporate Development.

Cautionary Language and Forward Looking Statements

THIS PRESS RELEASE CONTAINS CERTAIN "FORWARD LOOKING

STATEMENTS", WHICH INCLUDE BUT IS NOT LIMITED TO, STATEMENTS WITH

RESPECT TO THE FUTURE FINANCIAL OR OPERATING PERFORMANCE OF THE

COMPANY, ITS SUBSIDIARIES AND ITS PROJECTS, STATEMENTS REGARDING

USE OF PROCEEDS, EXPLORATION PROSPECTS, IDENTIFICATION OF MINERAL

RESERVES, COSTS OF AND CAPITAL FOR EXPLORATION PROJECTS,

EXPLORATION EXPENDITURES, TIMING OF FUTURE EXPLORATION AND

PERMITTING, REQUIREMENTS FOR ADDITIONAL CAPITAL, GOVERNMENT

REGULATIONS OF MINING OPERATIONS, ENVIRONMENTAL RISKS, RECLAMATION

EXPENSES, TITLE DISPUTES OR CLAIMS, AND LIMITATIONS OF INSURANCE

COVERAGE. FORWARD LOOKING STATEMENTS CAN GENERALLY BE IDENTIFIED BY

THE USE OF WORDS SUCH AS "PLANS", "EXPECTS", OR "DOES NOT EXPECT"

OR "IS EXPECTED", "ANTICIPATES" OR "DOES NOT ANTICIPATE", OR

"BELIEVES", "INTENDS", "FORECASTS", "BUDGET", "SCHEDULED",

"ESTIMATES" OR VARIATIONS OF SUCH WORDS OR PHRASES OR STATE THAT

CERTAIN ACTIONS, EVENT, OR RESULTS "MAY", "COULD", "WOULD",

"MIGHT", OR "WILL BE TAKEN", "OCCUR" OR "BE ACHIEVED". FORWARD

LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES

AND OTHER FACTORS WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE

OR ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM ANY

FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY

SAID STATEMENTS. THERE CAN BE NO ASSURANCES THAT FORWARD-LOOKING

STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND FUTURE

EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SAID

STATEMENTS. ACCORDINGLY, READERS SHOULD NOT PLACE UNDUE RELIANCE ON

FORWARD-LOOKING STATEMENTS.

Readers are cautioned not to rely solely on the summary of such

information contained in this release and are directed to the

complete set of drill results posted on Amazon's website

(www.amazonplc.com) and filed on SEDAR (www.sedar.com) and any

future amendments to such. Readers are also directed to the

cautionary notices and disclaimers contained herein.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

Contacts: Amazon Mining Holding Plc Cristiano Veloso President

& Chief Executive Officer +44 (0) 20 8133 7607 +44 (0) 20 7405

7773 (FAX) cv@amazonplc.com Amazon Mining Holding Plc Jed

Richardson VP Corporate Development +1(416)866-2966 +1(416)866-8829

(FAX) jed@amazonplc.com www.amazonplc.com

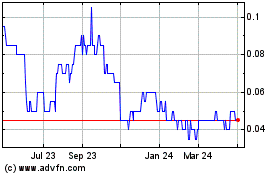

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

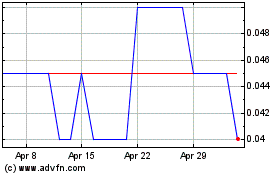

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Jan 2024 to Jan 2025