Atico Mining Enters into an Agreement with the Colombian Government Over El Roble Property Royalty Dispute and Provides Update on the Title Renewal

December 29 2021 - 6:00AM

Atico Mining Corporation (the “Company” or “Atico”) (TSX.V: ATY |

OTCQX: ATCMF) announces it has entered into an agreement (the

“Agreement”) with the National Mining Agency (“NMA”) in Colombia

related to the ongoing royalty dispute covering the El Roble

property. While the Company has maintained that it has been in good

standing with the requirements for a new title, with this agreement

the company has formally been brought into good standing by the

NMA.

As a part of the Agreement, the NMA and the

Company have also agreed to settle the dispute via binding

arbitration at the Center for Arbitration and Conciliation of the

Bogota Chamber of Commerce for the purposes of seeking an expedited

resolution to the ongoing claim, which is currently being resolved

in Colombian courts where the proceedings can last several years.

In contrast, the arbitration rules state the final decision by the

tribunal takes approximately six to twelve months from the

commencement of the arbitration process. To the extent that a final

ruling is made in favor of the Company, the Payment Plan will

cease, and any amounts already paid will be offset against future

royalty obligations. As advised by its Colombian legal counsel, the

Company continues to believe that it has a strong case for a

positive outcome in an upcoming arbitration.

The Agreement calls for the Company to enter

into a five-year Payment Plan, payable in biannual instalments for

a total amount of approximately US$21.9 million plus interest at a

6% annual rate. The Company will make an initial upfront payment of

US$1 million, followed by US$3.2 million in year 1, US$3.3 million

in year 2, US$3.4 million in year 3, US$5.8 million in year 4 and

US$9.7 million in year 5. The total amount payable represents all

outstanding royalty payments which the NMA has claimed through to

the end of December 2021. The parties have agreed to this interim

arrangement until a final arbitration decision is made.

For this arrangement to comply with Colombian

law, a secured guarantee equal to the value of the agreed payment

plan is required. The Company intends to provide the required

guarantee by granting security over 9,700 wet metric tonnes of

concentrate. The security and the guarantee will be released

proportionally as payments are made in accordance with the payment

schedule. The security may be substituted for another type at a

later date.

The Company continues to work towards renewing

the title to the El Roble property claims which are set to expire

on January 23, 2022. If the Company is unable to obtain the new

title on time, it will continue operating after the expiration date

while the process for the new title continues, as pronounced by the

NMA in response to a formal query made by the company. Although the

process for the new title is progressing favorably, there is no

assurance at this stage that the Company will obtain a new

title.

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on

exploring, developing and mining copper and gold projects in Latin

America. The Company generates significant cash flow through the

operation of the El Roble mine and is developing its high-grade La

Plata VMS project in Ecuador. The Company is also pursuing

additional acquisition of advanced stage opportunities. For more

information, please visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. GanozaCEOAtico Mining

Corporation

Trading symbols: TSX.V: ATY | OTCQX: ATCMF

Investor RelationsIgor DutinaTel:

+1.604.633.9022

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

securities being offered have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

‘‘U.S. Securities Act’’), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account

or benefit of, a "U.S. person" (as defined in Regulation S of the

U.S. Securities Act) unless pursuant to an exemption therefrom.

This press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward

Looking Statements

This announcement includes certain

“forward-looking statements” within the meaning of Canadian

securities legislation. All statements, other than statements of

historical fact, included herein, without limitation the terms of

the payment plan, the timing of the arbitration proceedings, the

belief that the Company has a strong case for a positive outcome in

the royalty dispute, the intention to provide the required

guarantee by granting security over 9,700 tonnes of concentrate,

the potential for the guarantee of concentrate to be substituted

for other security at a later date, the potential renewal of title

to the claims comprising the El Roble property and the continuation

of operations while a new contract is perfected and a new title is

obtained , are forward-looking statements. Forward- looking

statements involve various risks and uncertainties and are based on

certain factors and assumptions. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Important factors that could cause actual results

to differ materially from the Company’s expectations include

uncertainties as to the timing and process for renewal of title to

the El Roble claims; uncertainties relating to interpretation of

drill results and the geology, continuity and grade of mineral

deposits; uncertainty of estimates of capital and operating costs;

the need to obtain additional financing to maintain its interest in

and/or explore and develop the Company’s mineral projects;

uncertainty of meeting anticipated program milestones for the

Company’s mineral projects; the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

coronavirus pandemic is minimized or not long-term; disruptions

related to the COVID-19 pandemic or other health and safety issues,

or the responses of governments, communities, the Company and

others to such pandemic or other issues; and other risks and

uncertainties disclosed under the heading “Risk Factors” in the

prospectus of the Company dated March 2, 2012 filed with the

Canadian securities regulatory authorities on the SEDAR website

at www.sedar.com. Readers should not place undue reliance on

forward-looking statements, which speak only as of the date made.

The forward-looking statements contained in this release represent

our expectations as of the date of this release. We disclaim any

intention or obligation or undertaking to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

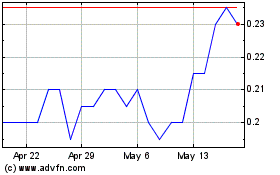

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Mar 2024 to Mar 2025