BANXA Announces Audit Update, Third Tranche of Private Placement Closing and AGM Results

December 08 2023 - 9:18AM

Banxa Holdings Inc. (TSXV: BNXA) (OTCQX: BNXAF) (FSE: AC00)

("

Banxa'' or the "

Company")

announces an update on the FY23 audit.

As announced on November 29, 2023, the

independent accounting firm reviewed Banxa’s agency revenue

recognition policy and determined that Banxa’s revenue recognition

policy is sound. Banxa and the independent accounting firm have had

detailed discussions with Banxa’s audit partner, PKF Antares

(“PKF”), on the agency revenue recognition policy.

PKF is currently reconsidering its view of Banxa’s agency revenue

recognition policy and is expected to provide a final response on

its view in a matter of days. Following this response, Banxa will

have clarity on its audit completion timeline.

“It has been frustrating to revisit a well

established accounting policy of Banxa that has led to extensions

of the audit completion deadline. The Board and Management team

understand the frustration of our Shareholders to endure another

audit delay. However, Banxa has made every effort to ensure an

expeditious and thorough completion of the FY23 audit. Despite

these delays Banxa’s business has continued to get stronger and I

am confident the market will soon begin to reflect the intrinsic

value of the business,” said Executive Director and Head of

Corporate Affairs, Zafer Qureshi.

Closing of Third Tranche of Non-Brokered

Private PlacementFurther to its news release dated October

10, 2023, it has raised additional gross proceeds of CAD$150k under

the third tranche of its non-brokered private placement (the

“Private Placement”) through the sale of

convertible debenture units of the Company (the “Note

Units”) comprised of unsecured convertible debentures of

the Company (each, a "Note") in the principal

amount of CAD$150k and 75,000 common share purchase warrants in the

capital of the Company (“Warrants”). Each Warrant

is exercisable into one common share in the capital of the Company

(a “Common Share”) at an exercise price of

CAD$1.00 for a period of 36 months from the date of issuance.

Please see the Company’s news release dated October 10, 2023 for

additional details regarding the terms of the Private Placement.

Banxa’s has now raised CAD$5.7M in total gross proceeds across the

three tranches of the Private Placement.

Closing of additional tranches of the Private

Placement remain subject to acceptance by the TSX Venture Exchange

(the “TSXV”). The proceeds from the Private

Placement are intended to be used for general working capital

purposes. All securities issued pursuant to the Private Placement

are and will be subject to a four month hold period from the date

of issue.

Annual General Meeting

ResultsAll matters were approved at the Company’s Annual

General shareholders meeting (the “Meeting”) held

on November 30, 2023. At the Meeting the Company’s shareholders

elected the Company’s board of directors, Holger Arians, Zafer

Qureshi, Leigh Travers and Joshua (Jim) Landau, as well as approved

the appointment of the Company’s auditor, PKF Antares Professional

Corporation, Chartered Professional Accountants. The Company’s

shareholders approved the Company’s 10% rolling stock option plan

in accordance with the requirements of the TSX Venture

Exchange.

CONTACTSMedia:

Ethan Lyle banxa@wachsman.com

Investors: Zafer Qureshi

investors@banxa.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

ENDS

ON BEHALF OF THE BOARD OF DIRECTORSPer: "Zafer

Qureshi” Zafer Qureshi = Executive Director and Head, Corporate

Affairs, +1-888-332-2692

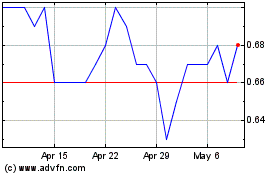

Banxa (TSXV:BNXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

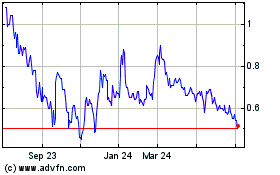

Banxa (TSXV:BNXA)

Historical Stock Chart

From Apr 2023 to Apr 2024