CVW Cleantech Welcomes New CEO, Akshay Dubey; Announces Stock Option Grant and Private Placement

September 06 2022 - 6:30AM

CVW CleanTech Inc. (the "Company" or "CVW CleanTech")

(TSX-V: CVW) CVW CleanTech Inc. (TSX-V:CVW (the

“Company” or “CVW CleanTech”) is pleased to announce the

appointment of Akshay Dubey as Chief Executive Officer (“CEO”),

effective September 14, 2022. Mr. Dubey will relocate to Calgary

from November 1, 2022 and lead the Company into the next phase of

its evolution, as it focuses on commercializing its patented oil

sands reprocessing technologies and applying a unique financial

structure to a rapidly growing clean tech industry. In addition,

Mr. Dubey will be appointed to the Board of Directors.

Mr. Dubey, previously reported directly to the

Board of Directors of BaseCore Metals LP (“BaseCore”) which he led

since its inception and was recently sold for $525M. His focus

included identifying and executing additional stream and royalty

investments in the base metals sector, along with managing their

portfolio of assets. Previous to BaseCore, Mr. Dubey was a

Principal within the Natural Resources team at Ontario Teachers’

Pension Plan Board (“OTPP”), where he gained extensive experience

in both the energy and mining sectors; including originating and

structuring various investments, such as the Heritage Royalty

platform, and BaseCore. Before joining OTPP, Mr. Dubey worked for

CIBC in their investment banking division within the mining group

based in Toronto, Canada. He holds a Bachelors of Business

Administration (Hons.) from the Schulich School of Business at York

University.

Mr. Dubey said: “I am incredibly excited by this

unique opportunity and I am grateful to the Board and shareholders

for entrusting me with the responsibility of leading CVW Cleantech

through this pivotal period as we look to transform the Company. I

strongly believe that CVW Cleantech’s core aim of creating value

from waste through the reprocessing of oil sands tailings to

produce hydrocarbons and critical minerals is necessary to create a

more sustainable world. The reduction in overall emissions and

environmental impact of those tailings is also key to the long-term

viability of oil sands production as we decarbonise the world and

move towards a greener future. We aim to achieve this through close

partnership with oil sands producers which will create value for

all stakeholders involved through our inventive financing structure

and will be an important component in hitting net zero emission

targets.

Mr. Dubey further noted, “Through this process,

I have been impressed with the Company’s technical team, and I am

excited to work with such a talented set of individuals who have

dedicated themselves to developing these innovative solutions for a

challenge the industry has been grappling with for decades.

Together, I am highly confident in our ability to deploy our

technology in the oil sands and create a successful platform, but

it’s the possibility to access new avenues for growth to create a

new clean tech leader in the commodity space that that truly

excites me. To demonstrate my strong level of commitment and belief

in this platform, I am pleased to be making a direct investment

into the Company.”

Mr. Darren Morcombe, who will return to his role

as Chair of the Board, said: “We are eager to have Akshay join our

leadership team at CVW CleanTech, bringing fresh ideas to the table

along with his experience in building partnerships and negotiating

unique financial structures. We have structured an incentive

structure that closely aligns the CEO’s success with that of the

business by focusing on key performance milestones that will

ultimately drive value for stakeholders and create a strong level

of common purpose. For me, the opportunity in clean tech going much

further than our current technologies.”

Stock option grantMr. Dubey will be granted 5

million stock options, 2.4 million immediately, and the remainder

when the there is sufficient equity plan headroom available. The

options will vest after a minimum of 18 months and after attaining

certain performance and market-based conditions. These options have

an exercise price of $1.27, and a term of 5 years to expiry.

Private PlacementConcurrent with the appointment

of a new CEO, CVW CleanTech further announces it proposes to offer

units for subscription, by way of a non-brokered private placement

(the “Offering”). The placement will consist of the issuance of

833,334 Units, with expected gross proceeds of $1.0 million. Each

Unit will consist of one common share and one share purchase

warrant. Each warrant entitles the holder to acquire one common

share at a price of $1.80 per share for a period of four years from

the date of issuance. Under the terms of his employment contract,

Mr. Dubey is required to invest a minimum of $250,000 as part of

this placement. The common shares and warrants issued pursuant to

the offering will be subject to a four month hold period from the

closing date. The Offering is subject to the approval of the TSX

Venture Exchange, and is anticipated to close by mid October

2022.

About CVW CleanTech Inc.

CVW is a clean technology innovator that has

focused on providing solutions to the mining sector of Canada's oil

sands industry. The Company's CVW™ technology provides sustainable

solutions to reduce the environmental footprint of the oilsands

industry. Our technology reduces the environmental impact of oil

sands froth treatment tailings, while economically recovering

valuable products that would otherwise be lost. CVW™ recovers

bitumen, solvents, heavy minerals and water from tailings,

preventing these commodities from entering tailings ponds and the

atmosphere: volatile organic compound and greenhouse gas emissions

are materially reduced; hot tailings water is improved in quality

for recycling; and residual tailings can be thickened more readily.

A new minerals industry would be created with the production and

export of zircon and titanium, essential ingredients in the

ceramics and pigment industries.

Disclosure regarding forward-looking

information

This news release contains forward-looking

statements and information within the meaning of applicable

Canadian securities laws (collectively, "forward-looking

information") that reflect the current expectations of management

about the future results, performance, achievements, prospects or

opportunities for CVW CleanTech Inc.

Forward-looking statements are frequently, but

not always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “potential”, “possible” and

similar expressions, or statements that events, conditions or

results “will”, “may”, “could” or “should” occur or be achieved.

These forward-looking statements are based on various assumptions

including expectations regarding satisfaction or waiver of the

closing conditions to the Offering; the size of the Offering; use

of proceeds of the Offering; the anticipated closing time of the

Offering, if at all; the receipt of TSX Venture Exchange approval

for the Offering and related transactions; the anticipated timing

of when additional headroom under the Company's stock option plan

will be available and the ability of the Company to grant the full

5.0 million options to Mr. Dubey; the state of the economy; results

of operations; performance; business prospects and opportunities;

future exchange and interest rates; impact of increasing

competition; the ability of the Company to access capital;

availability of potential transactions and interests from third

parties in pursuing potential transactions with the Company. While

the Company considers these assumptions to be reasonable based on

information currently available to it, they may prove to be

incorrect.

By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and

uncertainties and other factors that contribute to the possibility

that the predicted outcome will not occur, including, without

limitation: the ability of the Company to satisfy the applicable

conditions to closing of the Offering; the ability of the Company

to obtain all required approvals to complete the Offering; and the

risk that the additional stock options cannot be granted to Mr.

Dubey in a timely manner. Readers are cautioned that the foregoing

list of factors is not exhaustive.

Although the Company believes that the

expectations represented in such forward-looking statements are

reasonable, there can be no assurance that such expectations will

prove to be correct. As a consequence, actual results may differ

materially from those anticipated in the forward-looking

statements, including the underlying assumptions thereto, as a

result of numerous risks, uncertainties and factors including: the

inability of the Company to satisfy the applicable conditions to

closing of the Offering or to obtain all required approvals to

complete the Offering; the risk that the headroom required under

the Company's stock option plan to grant the additional stock

options cannot be obtained in a timely manner or at all; the

possibility that opportunities will arise that require more cash

than the Company has or can reasonably obtain; dependence on key

personnel; dependence on corporate collaborations; potential

delays; uncertainties related to early stage of technology and

product development; uncertainties as to fluctuation of the stock

market; uncertainties as to future expense levels and the

possibility of unanticipated costs or expenses or cost overruns;

and other risks and uncertainties which may not be described

herein. The Company has no policy for updating forward-looking

information beyond the procedures required under applicable

securities laws. You should not unduly rely on forward-looking

statements. The forward-looking statements contained in this news

release are made as the date of this news release and the Company

does not undertake any obligation to update publicly or to revise

any of the included forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be

required by applicable securities law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please contact:

|

Darren Morcombe |

Ingrid Meger |

|

|

|

|

Executive Chair and Interim CEO403.460.8135 |

Vice President Finance & CFO403.460.8135 |

|

|

|

|

PR@CVWCleanTech.com |

Ingrid.Meger@CVWCleanTech.com |

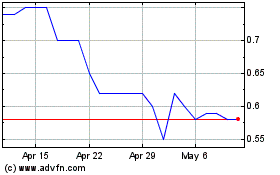

CVW Cleantech (TSXV:CVW)

Historical Stock Chart

From Nov 2024 to Dec 2024

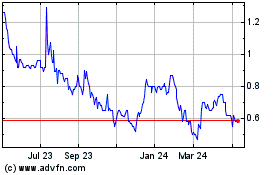

CVW Cleantech (TSXV:CVW)

Historical Stock Chart

From Dec 2023 to Dec 2024