Galane Gold Ltd. (“Galane Gold” or the Company”) (TSX-V: GG; OTCQB:

GGGOF) announces it has completed an update of the 2014 preliminary

economic assessment (“PEA”) on the Summit Mine and Banner Mill

(collectively, “Summit”).

Galane has developed a more detailed mine plan

for Summit (assisted by a new survey of the underground mine),

changed the mining and trucking operations to owner operator,

completed a detailed analysis of the plant restart requirements and

updated all the operating costs relating to Summit. The key results

of the updated PEA based on the current known resources are:1,

2

- A 7-year mine life;

- Average annual production of:

- 9,500 ounces of gold

- 444,000 ounces of silver

- 14,700 ounces of gold equivalent

production;3

- Capital cost of US$13.4

million;

- Peak funding requirement of US$8.2

million;

- Project payback in 26 months;

- Pre-tax NPV (5%) of US$66.4 million; and

- All-in sustaining cash cost of

US$864 per ounce of gold.

Nick Brodie, CEO of Galane Gold, commented

“Galane Gold’s management team, as they did with our Galaxy

property, has worked extensively with the information available to

it including several site visits, a review of historical paper

records, a re-survey of the Summit mine, and a detailed restart

review of the Banner Mill, and has identified efficiency

improvements to the previous operations. From this, the Company has

built a comprehensive mine plan, robust financial model and a

short-term path to production for Summit.

To maximize the return to stakeholders, we have

moved to an owner operator model for the underground mining and

trucking to the plant, and have increased the size of the plant so

that it can produce 100% concentrate as the final product. These

are steps we already carried out at Galaxy and therefore we have

the right management team available to successfully implement this

plan.

The PEA results represent a positive outcome

with the all-in sustaining cost of US$864 per ounce placing the

operation firmly within our objective of building a gold mining

company with low cost operations that can generate positive cash

flows through commodity cycles.4 The current life of Summit is only

constrained by the known resource and, as we have done repeatedly

at both Mupane and Galaxy, we expect that as we progress, we will

extend life at depth through exploration.4

We are now progressing conversations with debt

providers and potential concentrate off-takers to put a financing

package together to restart the operations at Summit as soon as

possible and will update the market when appropriate on our

progress.4”

Notes

1 The PEA is an update of the economic model

provided by Waterton Precious Metals Fund II Cayman, the previous

owner of Summit, to the Company with an effective date of September

17, 2014, which was included in the "Technical Report,

Preliminary Economic Assessment, Summit Gold-Silver Project, Grant

and Hidalgo Counties, New Mexico", prepared by Douglas F. Irving,

P.E., Susan C. Bird, P.Eng., and Tracey D. Meintjes, P. Eng. of

Chapman, Wood and Griswold, Inc. in Albuquerque, New Mexico (the

“Technical Report”). The PEA has been updated by the creation of a

new mine plan, updated costings, revised off-take terms and updated

metal prices. Please see Appendix 1 and 2 for further details.2 The

updated PEA is preliminary in nature, and includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves. There is no certainty that

the updated PEA will be realized. 3 Based on US$1,850 per ounce of

gold and US$22 per ounce of silver 4 This is forward-looking

information and is based on a number of assumptions. See

“Cautionary Notes”.

About Galane Gold

Galane Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements South

Africa and New Mexico. Galane Gold is a public company and its

shares are quoted on the TSX Venture Exchange (“TSXV”) under the

symbol “GG” and the OTCQB under the symbol “GGGOF”. Galane Gold’s

management team is comprised of senior mining professionals with

extensive experience in managing mining and processing operations

and large-scale exploration programmes. Galane Gold is committed to

operating at world-class standards and is focused on the safety of

its employees, respecting the environment, and contributing to the

communities in which it operates.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, those regarding the Company

being able to implement its plans to bring Summit into production,

maximizing shareholder returns, production at and life of Summit,

financing available to restart operations at Summit, technical,

financial and business prospects of the Company, future financial

position and results of operations, strategy, proposed

acquisitions, plans, objectives, goals and targets, and any

statements preceded by, followed by or that include the words

“believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”,

“may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”,

“project”, “seek”, “should” or similar expressions or the negative

thereof, are forward-looking statements. These statements are not

historical facts but instead represent only the Company’s

expectations, estimates and projections regarding future events.

These statements are not guarantees of future performance and

involve assumptions, risks and uncertainties that are difficult to

predict. Therefore, actual results may differ materially from what

is expressed, implied or forecasted in such forward-looking

statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in South Africa and New Mexico;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in South Africa and New Mexico; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Information of a technical and scientific nature

that forms the basis of the disclosure in the press release has

been prepared and approved by Kevin Crossling Pr. Sci. Nat.,

MAusIMM. and Business Development Manager for Galane Gold, and a

“qualified person” as defined by NI 43-101. Mr. Crossling has

relied on information included in the Technical Report, which was

prepared by an advisory company that offers a wide range of

exploration, mining, management, valuation, financing and advisory

services (the "Author"). The Technical Report relies on historical

drilling and sampling. The Author used information relating to

operational methods and expectations provided to it by various

sources. The Technical Report provides that: (a) the historical

mineral resource model is based on available sampling data

collected over the history of the project area; (b) the grade

models were verified using visual and statistical methods and

deemed to be globally unbiased; (c) the blocks were classified into

historical mineral resource categories based on the variogam

parameters and restrictions on the number of composites and drill

holes used in each pass of the interpolation; (d) only the

historical mineral resources lying within the legal boundaries are

reported; and (e) no modifying factors were applied to the

historical in-situ mineral resources.

Neither the TSXV nor its regulation services

provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:Nick BrodieCEO, Galane Gold Ltd.+ 44 7905

089878Nick.Brodie@GalaneGold.comwww.GalaneGold.com

Appendix 1: Detailed summary of annual

production numbers

|

|

|

Yr 1 |

Yr 2 |

Yr 3 |

Yr 4 |

Yr 5 |

Yr 6 |

Yr 7 |

|

LOM |

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US

measurements |

|

|

|

|

|

|

|

|

|

| Total

Primary development |

Ft |

675 |

2,715 |

3,500 |

3,960 |

2,900 |

- |

- |

|

13,750 |

| Total

Secondary development |

Ft |

459 |

702 |

909 |

747 |

1,419 |

1,100 |

644 |

|

5,980 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Primary Waste development |

Ft |

260 |

1,550 |

2,160 |

2,760 |

1,440 |

- |

- |

|

8,170 |

| Total

Primary Waste development |

t |

4,680 |

27,900 |

38,880 |

49,680 |

25,920 |

- |

- |

|

147,060 |

| Total

Secondary Waste development |

Ft |

- |

- |

210 |

75 |

320 |

- |

- |

|

605 |

| Total

Secondary Waste development |

t |

- |

- |

1,145 |

409 |

654 |

- |

- |

|

2,207 |

| Total

Primary Reef development |

Ft |

415 |

1,165 |

1,340 |

1,200 |

1,460 |

- |

- |

|

5,580 |

| Total

Primary Reef development |

t |

7,470 |

20,970 |

24,120 |

21,600 |

26,280 |

- |

- |

|

100,440 |

| Total

Primary Reef development grade Au |

Oz/dst |

0.05 |

0.09 |

0.08 |

0.10 |

0.12 |

0.00 |

0.00 |

|

0.09 |

| Total

Primary Reef development grade Ag |

Oz/dst |

3.78 |

4.32 |

3.66 |

6.39 |

5.31 |

0.00 |

0.00 |

|

4.83 |

| Total

Secondary Reef development |

Ft |

459.0 |

702.0 |

699.0 |

672.0 |

1,099.0 |

1,100.0 |

644.0 |

|

5,375 |

| Total

Secondary Reef development |

t |

2,502 |

3,826 |

3,810 |

3,662 |

5,990 |

5,995 |

3,510 |

|

29,294 |

| Total

Primary Reef development grade Au |

Oz/dst |

0.08 |

0.09 |

0.13 |

0.11 |

0.09 |

0.14 |

0.13 |

|

0.11 |

| Total

Primary Reef development grade Ag |

Oz/dst |

4.66 |

4.70 |

4.20 |

3.68 |

4.57 |

6.46 |

3.97 |

|

4.75 |

| Total

Stoping |

t |

16,194 |

70,988 |

93,476 |

101,899 |

105,028 |

129,813 |

128,235 |

|

645,635 |

| Total

Primary Reef development grade Au |

Oz/dst |

0.08 |

0.09 |

0.10 |

0.11 |

0.09 |

0.14 |

0.13 |

|

0.11 |

| Total

Primary Reef development grade Ag |

Oz/dst |

4.03 |

4.64 |

4.39 |

3.93 |

3.47 |

8.40 |

5.46 |

|

5.21 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Reef |

t |

26,166 |

95,784 |

121,406 |

127,162 |

137,297 |

135,808 |

131,745 |

|

775,368 |

| Total Reef

grade Au |

Oz/dst |

0.07 |

0.09 |

0.10 |

0.11 |

0.10 |

0.14 |

0.13 |

|

0.11 |

| Total Reef

grade Ag |

Oz/dst |

4.02 |

4.57 |

4.24 |

4.34 |

3.87 |

8.31 |

5.42 |

|

5.14 |

| Total Reef

Ounces Au |

Oz |

1,804 |

8,752 |

11,728 |

13,791 |

13,212 |

19,114 |

16,924 |

|

85,324 |

| Total Reef

Ounces Ag |

Oz |

105,082 |

438,105 |

514,339 |

552,205 |

531,929 |

1,128,677 |

714,466 |

|

3,984,804 |

| Total Reef

Ounces Recovered Au |

Oz |

1,407 |

6,827 |

9,148 |

10,757 |

10,306 |

14,909 |

13,200 |

|

66,553 |

|

Total Reef Ounces Recovered Ag |

Oz |

81,964 |

341,722 |

401,185 |

430,720 |

414,905 |

880,368 |

557,284 |

|

3,108,147 |

Appendix 2: Detailed cash flow model

with key assumptionsAll pricing is based on actual quotes

or current costs with the assumption on usage based on historic

actual production.

|

|

|

|

Yr 1 |

Yr 2 |

Yr 3 |

Yr 4 |

Yr 5 |

Yr 6 |

Yr 7 |

|

LOM |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Mass Pull |

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

Flot Recovery Au |

78 |

% |

|

|

|

|

|

|

|

|

|

|

|

Flot Recovery Ag |

78 |

% |

|

|

|

|

|

|

|

|

|

|

|

Conc Tons |

|

|

262 |

|

958 |

1,214 |

1,272 |

1,373 |

1,358 |

1,317 |

|

7,754 |

|

Conc Grade Au |

|

|

5.38 |

|

7.13 |

7.53 |

8.46 |

7.51 |

10.98 |

10.02 |

|

8.58 |

|

Conc Grade Au |

|

|

167 |

|

222 |

234 |

263 |

233 |

341 |

312 |

|

267.0 |

|

Conc Grade Ag |

|

|

2,960.55 |

|

4,311.67 |

4,500.51 |

4,737.51 |

4,733.85 |

7,117.26 |

4,967.00 |

|

5,042.99 |

|

Conc Au Oz |

|

|

1,407 |

|

6,827 |

9,148 |

10,757 |

10,306 |

14,909 |

13,200 |

|

66,553 |

|

Conc Ag Oz |

|

|

81,964 |

|

341,722 |

401,185 |

430,720 |

414,905 |

880,368 |

557,284 |

|

3,108,147 |

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

MetalPrice |

Concentratepayable |

|

|

|

|

|

|

|

|

- |

|

Au |

1,850 |

|

97 |

% |

2,524,630 |

|

12,250,479 |

16,415,399 |

19,303,319 |

18,493,411 |

26,754,113 |

23,688,009 |

|

119,429,359 |

|

Ag |

22 |

|

97 |

% |

1,749,108 |

|

7,292,348 |

8,561,282 |

9,191,567 |

8,854,066 |

18,787,056 |

11,892,437 |

|

66,327,865 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

|

4,273,738 |

|

19,542,827 |

24,976,681 |

28,494,886 |

27,347,477 |

45,541,169 |

35,580,446 |

|

185,757,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining Cost |

|

|

|

|

|

|

|

|

|

|

|

Mining Contractor/Owner |

|

1,314,409 |

|

4,017,040 |

4,570,800 |

4,760,217 |

4,308,826 |

1,580,160 |

1,375,800 |

|

21,927,251 |

|

Fuel |

|

131,410 |

|

444,440 |

563,324 |

590,030 |

637,060 |

630,148 |

611,298 |

|

3,607,709 |

|

Labour |

|

592,500 |

|

790,000 |

790,000 |

790,000 |

790,000 |

790,000 |

790,000 |

|

5,332,500 |

|

Safety |

|

26,951 |

|

98,658 |

125,048 |

130,976 |

141,416 |

139,882 |

135,698 |

|

798,629 |

|

Consultants Monthly |

|

160,000 |

|

240,000 |

240,000 |

240,000 |

240,000 |

240,000 |

240,000 |

|

1,600,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plant Cost |

|

|

|

|

|

|

|

|

|

|

|

Power |

|

133,617 |

|

379,306 |

480,768 |

503,560 |

543,697 |

537,799 |

521,711 |

|

3,100,458 |

|

Fuel |

|

15,176 |

|

55,555 |

70,416 |

73,754 |

79,632 |

78,769 |

76,412 |

|

449,714 |

|

Trucking |

|

553,005 |

|

1,792,704 |

2,197,609 |

2,288,565 |

2,448,743 |

2,425,204 |

2,361,003 |

|

14,066,833 |

|

Labour |

|

300,026 |

|

763,732 |

910,000 |

910,000 |

910,000 |

910,000 |

900,182 |

|

5,603,940 |

|

Reagents Etc |

|

570,535 |

|

1,973,158 |

2,500,964 |

2,619,528 |

2,828,325 |

2,797,641 |

2,713,953 |

|

16,004,104 |

|

Conc treatment Charge |

275.00 |

|

Per t |

71,956 |

|

263,407 |

333,867 |

349,694 |

377,568 |

373,472 |

362,300 |

|

2,132,263 |

|

Refining Charge Gold |

10.00 |

|

Per t |

13,647 |

|

66,219 |

88,732 |

104,342 |

99,964 |

144,617 |

128,043 |

|

645,564 |

|

Refining Charge Silver |

1.25 |

|

Per t |

99,381 |

|

414,338 |

486,436 |

522,248 |

503,072 |

1,067,446 |

675,707 |

|

3,768,629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Admin |

|

|

|

|

|

|

|

|

|

|

|

Labour |

|

305,000 |

|

610,000 |

610,000 |

610,000 |

610,000 |

610,000 |

457,500 |

|

3,812,500 |

|

Safety& Environmental |

|

13,500 |

|

18,000 |

18,000 |

18,000 |

18,000 |

18,000 |

18,000 |

|

121,500 |

|

Permits |

|

13,500 |

|

18,000 |

18,000 |

18,000 |

18,000 |

18,000 |

18,000 |

|

121,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost |

|

4,314,613 |

|

11,944,556 |

14,003,964 |

14,528,914 |

14,554,303 |

12,361,138 |

11,385,607 |

|

83,093,095 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flow |

|

(40,875 |

) |

7,598,270 |

10,972,717 |

13,965,972 |

12,793,175 |

33,180,031 |

24,194,839 |

|

102,664,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM severence tax |

0.20 |

% |

8,152 |

|

37,605 |

48,067 |

54,991 |

52,562 |

88,881 |

69,050 |

|

359,306 |

|

NSR Royalty |

0.50 |

% |

20,379 |

|

94,011 |

120,166 |

137,477 |

131,405 |

222,202 |

172,625 |

|

898,265 |

|

Carson |

0.18 |

% |

7,337 |

|

33,844 |

43,260 |

49,492 |

47,306 |

79,993 |

62,145 |

|

323,376 |

|

Summit royalty after cap |

5.0 |

% |

203,794 |

|

940,114 |

981,092 |

- |

- |

- |

- |

|

2,125,000 |

|

Total royalties |

|

|

239,662 |

|

1,105,574 |

1,192,584 |

241,959 |

231,272 |

391,076 |

303,819 |

|

3,705,947 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF after Royalties |

|

(280,537 |

) |

6,492,696 |

9,780,133 |

13,724,013 |

12,561,902 |

32,788,955 |

23,891,020 |

|

98,958,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPEX |

|

|

|

|

|

|

|

|

|

|

|

Mining - standard |

|

1,095,650 |

|

24,150 |

24,150 |

24,150 |

24,150 |

- |

204,150 |

|

1,396,400 |

|

Mining - owner |

|

5,261,250 |

|

- |

- |

1,315,313 |

- |

1,052,250 |

- |

|

7,628,813 |

|

Exploration |

|

79,016 |

|

333,742 |

548,290 |

572,129 |

572,129 |

500,612 |

55,177 |

|

2,661,094 |

|

Plant |

|

547,588 |

|

25,000 |

- |

- |

- |

- |

- |

|

572,588 |

|

Admin |

|

55,000 |

|

- |

- |

- |

- |

- |

- |

|

55,000 |

|

Rehab |

|

- |

|

- |

- |

- |

- |

- |

- |

|

- |

|

Trucking |

|

489,000 |

|

326,000 |

- |

150,000 |

- |

100,000 |

- |

|

1,065,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total CAPEX |

|

7,527,504 |

|

708,892 |

572,440 |

2,061,591 |

596,279 |

1,652,862 |

259,327 |

|

13,378,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCF after CAPEX |

|

|

(7,808,042 |

) |

5,783,804 |

9,207,693 |

11,662,422 |

11,965,624 |

31,136,093 |

23,631,693 |

|

85,579,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Au equivalent payable |

|

2,310 |

|

10,564 |

13,501 |

15,403 |

14,782 |

24,617 |

19,233 |

|

100,409 |

|

AISC |

|

1,971 |

|

1,235 |

1,126 |

959 |

1,000 |

518 |

608 |

|

864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

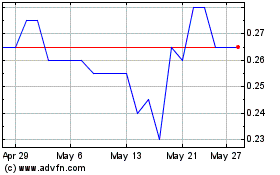

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Jan 2024 to Jan 2025