Gladiator Metals Corp.

(TSXV: GLAD / OTC: GDTRF / FSE:

ZX7) (“

Gladiator” or the

“

Company”), is pleased to announce that it has

entered into an agreement with Research Capital Corporation as the

lead agent and sole bookrunner (“

Lead Agent”), on

behalf of a syndicate of agents, including Beacon Securities

Limited (together with the Lead Agent, the

“

Agents”), in connection with a “best-efforts”

brokered private placement offering of a combination of the

following securities (the “

Offered Securities”)

for aggregate gross proceeds of up to $7,000,000 (the

“

Offering”):

(i) units of the Company (each,

a “Unit”) at a price of $0.55 per Unit. Each

comprised of one common share of the Company (a “Common

Share”) and one-half of one common share purchase warrant

(each whole warrant, a “Warrant”); and

(ii) flow-through units of the

Company to be sold to charitable purchasers (the

“Charity FT Units”) at a price of

$0.7975 per Charity FT Unit. Each Charity FT Unit will consist of

one Common Share that will qualify as “flow-through shares” within

the meaning of subsection 66(15) of the Tax Act that will be issued

as part of a charity arrangement and one-half of one Warrant.

Each Warrant shall entitle the holder thereof to

acquire one Common Share at an exercise price of $0.90, for a

period of 24 months following the Closing Date (as defined

below).

The Company will grant the Agents an option (the

“Agents’ Option”) to increase the size of the

Offering by up to an additional 15% in aggregate gross proceeds of

Units. The Agents’ Option may be exercised in whole or in part at

any time up to 48 hours prior to the Closing Date.

The net proceeds from the sale of Units will be

used for the Company’s ongoing exploration drilling program,

working capital requirements and other general corporate purposes.

The gross proceeds from the sale of Charity FT Units will be used

for exploration expenses on the Company’s Whitehorse Copper

project, located in Yukon, Canada.

The gross proceeds from the issuance of the

Charity FT Units will be used for “Canadian Exploration Expenses”

within the meaning of the Tax Act (the “Qualifying

Expenditures”), which will be incurred on or before

December 31, 2024 and renounced with an effective date no later

than December 31, 2023 to the initial purchasers of the Charity FT

Units in an aggregate amount not less than the gross proceeds

raised from the issue of Charity FT Units. If the Qualifying

Expenditures are reduced by the Canada Revenue Agency, the Company

will indemnify each subscriber of Charity FT Units for any

additional taxes payable by such subscriber as a result of the

Company’s failure to renounce the Qualifying Expenditures.

The Offering is scheduled to close on or about

the week of June 28, 2023, or on such other date as agreed upon

between the Company and the Lead Agent (the “Closing

Date”). Closing of the Offering is subject to the receipt

of all necessary regulatory and other approvals, including, but not

limited to, the approval of the TSX Venture Exchange. The Offered

Securities will be subject to a hold period of four months and one

day from the Closing Date in accordance with applicable securities

laws.

The Company has agreed to pay to the Agents a

cash commission equal to: (a)6% of the aggregate gross proceeds

arising from the sale of the Units, and (b) 2% of the aggregate

gross proceeds arising from the sale of the Charity FT Units,

subject to a reduction for certain orders on a “president’s list”.

In addition, the Company has agreed to issue to the Agents broker

warrants (“Broker Warrants”) in an amount equal to

6% of the number of Units sold in the Offering, subject to a

reduction for certain orders on a “president’s list”. Each Broker

Warrant will entitle the holder thereof to acquire one Common Share

(a “Broker Share”) at a price of $0.55 per Broker

Share for a period of 18 months following the Closing Date.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

ABOUT GLADIATOR METALS

CORP.

Gladiator Metals Corp. is a mineral exploration

company focused on the advancement of multiple high- grade copper

prospects at its Whitehorse Copper Project (the “Project”), an

advanced-stage copper (Cu) ± molybdenum (Mo) ± silver (Ag) ± gold

(Au) skarn exploration project in the Yukon Territory, Canada. The

Project comprises 314 contiguous claims covering approximately

5,380 Hectares (13,294 acres) in the Whitehorse Mining

District.

Copper mineralization was first discovered in

1897 on the Whitehorse Copper Belt, as it came to be known. The

Whitehorse Copper Belt comprised over 30 copper-related, primarily

skarn occurrences covering an area of 35 by 5 km in a northwesterly

trending arc. Exploration and mining development have been carried

out intermittently since that time with the main production era

lasting between 1967 and 1982 where production totaled 267,500,000

pounds copper, 225,000 ounces of gold and 2,838,000 ounces of

silver from 11.1 million tons of mineralized skarn ore were milled

(Watson, 1984).

The Project is accessible through numerous

access roads and trails located within 2 km of the South Klondike

Highway and the Alaska Highway. An extensive network of historical

gravel exploration and haul roads exists throughout the project

area, providing excellent access to the majority of the claim

package. Access to existing electric power facilities is available

through the main Yukon power grid.

In November 2022, Gladiator executed an option

agreement to acquire 100% of the Whitehorse Copper Project by

incurring exploration expenditure of $12m on the project, staged

payment of $300,000 in cash and the staged issue of 15m shares over

6 years. Following the exercise of the option, the Company must pay

the optionor or its designee, a 1.0% net smelter returns royalty on

the Whitehorse Copper Project.

ON BEHALF OF THE BOARD

"Jason Bontempo"

Jason Bontempo

Chief Executive Officer and Director

604-638-8063

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Certain of the statements and information in

this news release constitute "forward-looking statements" or

"forward-looking information." Any statements or information that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "expects", "anticipates", "believes", "plans",

"estimates", "intends", "targets", "goals", "forecasts",

"objectives", "potential" or variations thereof or stating that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved, or the negative of any of

these terms and similar expressions) that are not statements of

historical fact may be forward-looking statements or information.

Forward-looking statements in this news release include, without

limitation, statements relating to the Offering on the terms

contemplated herein or at all, the exercise of the Agent’s Option,

and the use of the proceeds from the Offering.

Forward-looking statements or information are

subject to a variety of known and unknown risks, uncertainties and

other factors that could cause actual events or results to differ

from those reflected in the forward-looking statements or

information, including, without limitation, the need for additional

capital by the Company through financings, and the risk that such

funds may not be raised; the speculative nature of exploration and

the stages of the Company's properties; the effect of changes in

commodity prices; regulatory risks that development of the

Company's material properties will not be acceptable for social,

environmental or other reasons; availability of equipment

(including drills) and personnel to carry out work programs; and

that each stage of work will be completed within expected time

frames. This list is not exhaustive of the factors that may affect

any of the Company's forward-looking statements or information.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially, there may be

other factors that cause results not to be as anticipated,

estimated, described or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or

information.

The Company's forward-looking statements and

information are based on the assumptions, beliefs, expectations and

opinions of management as of the date of this news release, and

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

and information if circumstances or management's assumptions,

beliefs, expectations or opinions should change, or changes in any

other events affecting such statements or information.

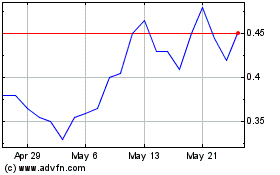

Gladiator Metals (TSXV:GLAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

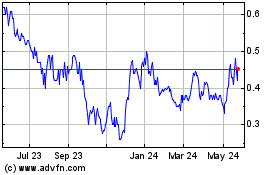

Gladiator Metals (TSXV:GLAD)

Historical Stock Chart

From Feb 2024 to Feb 2025