Goldsource Mines Announces $3 Million Financing Via Short Form Offering Document and Private Placement

April 18 2011 - 7:02PM

Marketwired Canada

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES

Goldsource Mines Inc. ("Goldsource" or the "Company") (TSX

VENTURE:GXS)(FRANKFURT:G5M) is pleased to announce that it has entered into an

agreement with Canaccord Genuity Corp. ("Canaccord Genuity" or the "Agent") to

act as agent on a commercially reasonable efforts basis, in connection with the

offering for sale, by way of a TSX Venture Exchange Short Form Offering

Document, of up to 3,636,000 units (the "Units") at a price of $0.55 per Unit

for gross proceeds of up to $1,999,800 (the "Short Form Offering"). Each Unit

will consist of one common share of the Company and one-half of one common share

purchase warrant (each whole warrant, a "Warrant"). Each Warrant will entitle

the holder to subscribe for one additional common share at a price of $0.70 for

a period of 24 months from the date of closing.

In addition to the Short Form Offering, the Company has negotiated a

commercially reasonable efforts private placement ("Brokered Private Placement")

with Canaccord Genuity for approximately $1 million in any combination of units

(the "PP Units") at $0.55 per PP Unit (up to a maximum of 1,830,000 PP Units)

and flow-through common shares (the "Flow-Through Shares") at a price of $0.60

per Flow-Through Share (up to a maximum of 835,000 Flow-Through Shares). Each PP

Unit will have the same terms as the Units offered under the Short Form

Offering. The Company has also granted the Agent an option to solicit additional

subscriptions for PP Units and Flow-Through Shares, exercisable 48 hours prior

to closing, to raise additional gross proceeds of up to $150,975.

On closing of the Short Form Offering and Brokered Private Placement (the

"Offerings"), the Company will pay the Agent a cash fee equal to 6.5% of the

gross proceeds raised through the Offerings and will issue to the Agent warrants

(the "Agent's Warrants") equal to 6.5% of the aggregate number of Units, PP

Units and Flow-Through Shares issued pursuant to the Offerings. Each Agent's

Warrant shall be exercisable into one common share of the Company at a price of

$0.70 per common share for a period of 24 months from the closing of the

Offerings.

The funds raised from the Offerings will be used to fund on-going work programs

on the Company's properties and for general working capital purposes.

Closing of the Offerings is anticipated to occur on or before May 12, 2011 and

is subject to the receipt of applicable regulatory approvals including approval

of the TSX Venture Exchange.

Goldsource Mines Inc. is a Canadian resource company engaged in the exploration

and development of Canada's newest coal field in the province of Saskatchewan.

The Company has drilled only a portion of this new thermal coal field and has

discovered 17 coal deposits of varying size with coal thicknesses up to 126

meters within the permit area of the Border Coal Project. Headquartered in

Vancouver, BC, the Company is managed by experienced mining and business

professionals.

J. Scott Drever, President

GOLDSOURCE MINES INC.

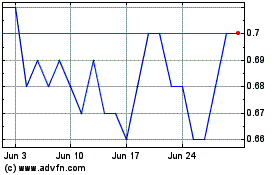

Goldsource Mines (TSXV:GXS)

Historical Stock Chart

From Dec 2024 to Jan 2025

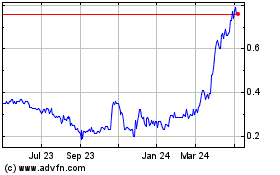

Goldsource Mines (TSXV:GXS)

Historical Stock Chart

From Jan 2024 to Jan 2025