Halcones Precious Metals Closes First Tranche of Private Placement Offering

July 14 2023 - 6:00AM

Halcones Precious Metals Corp. (TSXV: HPM) (the

“

Company” or “

Halcones”) has

closed the first tranche (the “

First Tranche”) of

its previously announced non-brokered private placement financing

(the “

Offering”). The Company issued 24,862,925

units (the “

Units”) at a price of $0.05 per Unit

for gross proceeds of $1,243,146.25. Please see the Company’s press

release dated June 21, 2023 for further details regarding the

Offering.

Each Unit is comprised of one common share in

the capital of the Company (each a “Common Share”)

and one-half of one Common Share purchase warrant (each whole

warrant, a “Warrant”). Each Warrant entitles the

holder to purchase one Common Share at an exercise price of $0.10

per Common Share for a period of 36 months following the date

hereof. Securities issued under the Offering carry a hold period of

4 months and one day from the date hereof as required under

applicable securities laws.

The Company plans to use the aggregate net

proceeds of the First Tranche to continue the exploration work on

the Company’s Carachapampa project as well as general corporate

working capital purposes. The Company intends to complete the

second tranche of the Offering on or before August 4, 2023.

The Offering is subject to the receipt of all necessary approvals,

including the approval of the TSX Venture Exchange.

In connection with the First Tranche, Halcones

paid finder’s fees of $5,250 in cash and issued 105,000

non-transferable finder’s warrants (the “Finder’s

Warrants”). Each Finder’s Warrant entitles the

holder thereof to acquire one Common Share at a price of $0.10 for

a period of time following the date hereof.

Certain directors and officers of the Company

have subscribed for 8,562,925 Units in the First Tranche (the

“Insider Investment”). The Insider Investment

constitutes a related party transaction, as such term is defined

under the policies of the TSXV, and the Company has relied on

certain exemptions from the minority approval and formal valuation

requirements under Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special

Transactions (“MI 61-101”) as the fair market

value of the aggregate Insider Investment is below 25% of the

Company's market capitalization for the purposes of Sections 5.5(a)

and 5.7(1)(a) of MI 61-101.

The securities being offered have not, nor will

they be registered under the United States Securities Act of 1933,

as amended, and may not be offered or sold within the United States

or to, or for the account or benefit of, U.S. persons absent U.S.

registration or an applicable exemption from the U.S. registration

requirements. This release does not constitute an offer for sale of

securities in the United States.

About Halcones

Halcones Precious Metals Corp. is focused on

exploring for and developing gold-silver projects in the Maricunga

Belt, Chile, the premiere gold mining district in South America.

The Company has a team with a strong background of exploration

success in the region.

For further information, please

contact:

Vincent ChenInvestor

Relationsinfo@halconespreciousmetals.comwww.halconespreciousmetals.com

Cautionary Note Regarding

Forward-looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, regarding the First Tranche and the Offering, the

closing of the Offering, the use of proceeds of the First Tranche

and the Offering and the Company’s future plans. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of Halcones, as the case may

be, to be materially different from those expressed or implied by

such forward-looking information, including but not limited to:

general business, economic, competitive, geopolitical and social

uncertainties; the actual results of current exploration

activities; risks associated with operation in foreign

jurisdictions; ability to successfully integrate the purchased

properties; foreign operations risks; and other risks inherent in

the mining industry. Although Halcones has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. Halcones does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

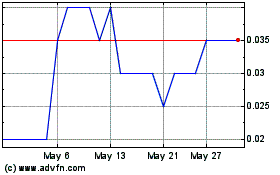

Halcones Precious Metals (TSXV:HPM)

Historical Stock Chart

From Apr 2024 to May 2024

Halcones Precious Metals (TSXV:HPM)

Historical Stock Chart

From May 2023 to May 2024