ID Logistics : Increase of Resources Allocated to the Liquidity Agreement

July 13 2023 - 6:31AM

Business Wire

Regulatory News:

In accordance with the provisions of Article 4 of AMF Decision

No. 2021-01 of June 22, 2021, ID Logistics Group (Paris:IDL) today

increased by one million euros the resources allocated to the

liquidity agreement concluded with ODDO BHF SCA.

After this increase in the cash amount allocated to the

liquidity agreement, the resources available are as follows as of

July 13, 2023:

- 3,698 ID Logistics Group shares

ID Logistics Group Société anonyme with share capital of

€ 3 086 664.00 Registered office : 55 chemin des Engrenauds – 13660

Orgon – FRANCE Registration number 439 418 922 at the Trade and

Companies Register of Tarascon ISIN code : FR0010929125 – IDL

About ID Logistics Group :

ID Logistics, managed by Eric Hémar, is an international

contract logistics group with revenue of €2.5 billion in 2022. ID

Logistics manages 375 sites across 18 countries representing more

than 8 million square meters of warehousing facilities in Europe,

America, Asia and Africa, with 30,000 employees. With a client

portfolio balanced between retail, e-commerce and consumer goods,

ID Logistics is characterized by offers involving a high level of

technology. Developing a social and environmental approach through

a number of original projects since its creation in 2001, the Group

is today resolutely committed to an ambitious CSR policy. ID

Logistics shares are listed on the regulated market of Euronext

Paris, compartment A (ISIN code: FR0010929125, Ticker: IDL).

This translation is only for the convenience of English-speaking

readers. Only the French text has legal value.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230713505612/en/

ID Logistics Yann Perot - CFO Tél. : +33 (0)4 32 52 96 00 -

yperot@id-logistics.com

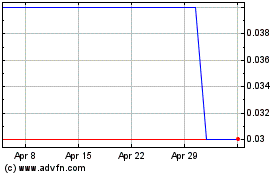

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

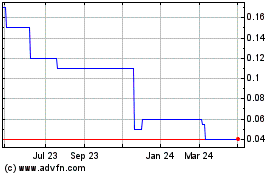

Imaging Dynamics (TSXV:IDL)

Historical Stock Chart

From Apr 2023 to Apr 2024