Li-FT Closes $10.1 Million In Flow-Through Share Financings

March 27 2024 - 8:24AM

Li-FT Power Ltd. (“

LIFT” or the

“

Company”) (

TSXV: LIFT)

(

OTCQX: LIFFF)

(

Frankfurt: WS0) is pleased

to announce it has closed the previously announced marketed public

offering (the “

Public Offering”) of 1,179,500

common shares of the Company issued on a “flow-through” basis (each

a “

Flow-Through Share”) at a price of $6.05 per

Flow-Through Share. The Public Offering generated aggregate gross

proceeds of $7,135,975. The Flow-Through Shares will qualify as

“flow-through shares” (within the meaning of subsection 66(15) of

the Income Tax Act (Canada)).

The Public Offering was led by Canaccord Genuity

Corp. on behalf of a syndicate of agents, including SCP Resource

Finance LP. and Beacon Securities Limited (collectively, the

“Agents”).

The Public Offering was completed pursuant to a

prospectus supplement dated March 20, 2024 (the “Prospectus

Supplement”) to the Company’s Canadian amended and

restated base shelf prospectus dated December 22, 2023 (the

“Base Shelf Prospectus”). The Base Shelf

Prospectus and the Prospectus Supplement are available under the

Company’s profile on SEDAR+ at www.sedarplus.ca.

In connection with the Public Offering, the

Company paid to the Agents a cash commission of 5.0% of the gross

proceeds from the Public Offering, excluding gross proceeds from

the sale of Flow-Through Shares to purchasers on a president’s list

of the Company in respect of which the Agents’ cash commission was

equal to 2.0% of the gross proceeds from such sales.

Additionally, the Company completed a concurrent

non-brokered private placement (the “Private

Placement”) of 689,660 common shares of the

Company issued on a “flow-through” basis (each a “Private

Placement Flow-Through Share”) at a price of $4.35 per

Private Placement Flow-Through Share for gross proceeds of

$3,000,021. The Private Placement Flow-Through Shares will qualify

as “flow-through shares” (within the meaning of subsection 66(15)

of the Income Tax Act (Canada)). No finder’s fees were paid in

connection with the Private Placement. All of the Private Placement

Flow-Through Shares issued pursuant to the Private Placement are

subject to resale restrictions under applicable Canadian securities

legislation until July 28, 2024.

The gross proceeds of the Public Offering and

Private Placement will be used by the Company to incur eligible

“Canadian exploration expenses” that will qualify as “flow-through

critical mineral mining expenditures” as such terms are defined in

the Income Tax Act (Canada) (the “Qualifying

Expenditures”) related to the Company’s Yellowknife

Lithium Project located in the Northwest Territories, Canada on or

before December 31, 2025. All Qualifying Expenditures will be

renounced in favour of the subscribers effective December 31,

2024.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of the securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful, including any of the

securities in the United States of America. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “1933 Act”) or any

state securities laws and may not be offered or sold within the

United States or to, or for account or benefit of, U.S. Persons (as

defined in Regulation S under the 1933 Act) unless registered under

the 1933 Act and applicable state securities laws, or an exemption

from such registration requirements is available.

About LIFT

LIFT is a mineral exploration company engaged in

the acquisition, exploration, and development of lithium pegmatite

projects located in Canada. The Company’s flagship project is the

Yellowknife Lithium Project located in Northwest Territories,

Canada. LIFT also holds three early-stage exploration properties in

Quebec, Canada with excellent potential for the discovery of buried

lithium pegmatites, as well as the Cali Project in Northwest

Territories within the Little Nahanni Pegmatite Group.

For further information, please

contact:

| Francis

MacDonald Chief Executive

Officer Tel: + 1.604.609.6185

Email: info@li-ft.com

|

Daniel

GordonInvestor RelationsTel: +1.604.609.6185Email:

daniel@li-ft.com |

| Website: www.li-ft.com |

|

| |

|

Cautionary Statement Regarding Forward-Looking

Information

Certain statements included in this press

release constitute forward-looking information or statements

(collectively, “forward-looking statements”), including those

identified by the expressions “anticipate”, “believe”, “plan”,

“estimate”, “expect”, “intend”, “may”, “should” and similar

expressions to the extent they relate to the Company or its

management. The forward-looking statements are not historical facts

but reflect current expectations regarding future results or

events. This press release contains forward looking statements

relating to the use of proceeds of the Public Offering and Private

Placement and the timing of incurring the Qualifying Expenditures

and the renunciation of the Qualifying Expenditures. These

forward-looking statements and information reflect management's

current beliefs and are based on assumptions made by and

information currently available to the Company with respect to the

matters described in this press release.

Forward-looking statements involve risks and

uncertainties, which are based on current expectations as of the

date of this press release and subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements.

Additional information about these assumptions and risks and

uncertainties is contained under “Risk Factors” in the Company's

annual information form filed on March 30, 2023, which is available

under the Company's SEDAR+ profile at www.sedarplus.ca, and in

other filings that the Company has made and may make with

applicable securities authorities in the future. Forward-looking

statements contained herein are made only as to the date of this

press release and we undertake no obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by law.

We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release.

Neither the TSX Venture Exchange (the “TSXV”)

nor its Regulation Services Provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

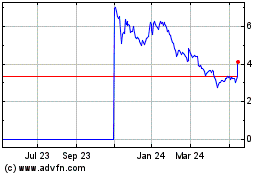

Li FT Power (TSXV:LIFT)

Historical Stock Chart

From Dec 2024 to Jan 2025

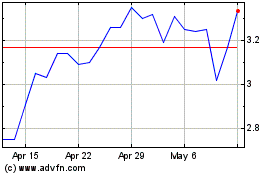

Li FT Power (TSXV:LIFT)

Historical Stock Chart

From Jan 2024 to Jan 2025