Mkango Resources Ltd. (AIM/TSX-V: MKA) (the “Company” or “Mkango”)

is pleased to announce that, further to the previous announcement

on May 16, 2023, Maginito Limited (“Maginito”) has completed the

transaction to increase its ownership in HyProMag Limited

(“HyProMag”) to 100% for a cash and share consideration (the

“Transaction”).

The consideration payable to the selling

HyProMag shareholders (the “Vendors”) comprises £1m (C$1.7m) in

cash and the issue of 9,742,031 Mkango common shares (the

“Consideration Shares”) equivalent to £1m (C$1.7m) at a price equal

per share to 10.2648 pence based on the volume weighted average

price of a Mkango common share on the AIM Market of the London

Stock Exchange (“AIM”) for the 10 business days ended on May 14,

2023, being the date prior to the date of the share purchase

agreement.

In addition, up to a further £3m (C$5.1 m) may

be payable to the Vendors in four tranches, either in cash or in

Mkango common shares (at Mkango’s option), conditional upon the

achievement by HyProMag of certain production milestones in the

period to 30 June 2026. The Consideration Shares are subject to a

one-year lock up (which includes the four month plus one day

statutory hold period applicable in Canada, which expires on

December 3, 2023) and the shares which may be issued on milestones

will have a six-month lock up (and a statutory hold period

applicable in Canada, which will expire four months plus one day

after issuance, if any).

Mkango has closed the Transaction as an

“Expedited Acquisition” under applicable rules of the TSX Venture

Exchange (the “TSX-V”). Mkango intends to seek TSX-V approval for

the Transaction in accordance with the rules applicable to

Expedited Acquisitions.

Under the terms of the Transaction, if Maginito

is listed on a recognised stock exchange, Mkango is entitled to

transfer shares of Maginito held by Mkango equivalent in value to

the milestone payments (instead of issuing Mkango shares) to the

Sellers, upon the attainment of the milestones.

Admission to trading on AIM and Total

Voting Rights

Application has been made for the Consideration

Shares, which will rank pari passu with the existing

common shares of no par value each ("Common Shares") of the

Company, to be admitted to trading on AIM ("Admission") and it is

expected that Admission of the Consideration Shares will become

effective and dealings will commence at 8:00 a.m. BST on or around

August 4, 2023.

Following the issue of these Placing Shares, the

total issued share capital of the Company will consist of

253,172,896 Common Shares. The Company does not hold any

Common Shares in Treasury. Therefore, the total current voting

rights in the Company following Admission will

be 253,172,896 and this figure may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Maginito

Maginito is focused on developing green

technology opportunities in the rare earths supply chain,

encompassing neodymium (NdFeB) magnet recycling as well as

innovative rare earth alloy, magnet, and separation

technologies.

As a result of completion of the Transaction,

Maginito holds a 100% interest in HyProMag focused on short loop

rare earth magnet recycling in the UK, a 90% direct and indirect

interest (assuming conversion of Maginito’s recently announced

convertible loan) in HyProMag GmbH, a company focused on short loop

rare earth magnet recycling in Germany, and a 100% interest in

Mkango Rare Earths UK Ltd (“Mkango UK”), a company focused on long

loop rare earth magnet recycling in the UK via a chemical route. A

new US subsidiary, to be jointly owned by Maginito and CoTec, is

expected to be formed to develop rare earth recycling opportunities

in the United States.

In March 2023, CoTec invested £1.5 million

(C$2.6 million) into Maginito, and Maginito and CoTec agreed to

collaborate on the commercialisation of downstream rare earth

technologies in the United States. Mkango UK was at the same time

transferred to become a subsidiary of Maginito. In connection with

CoTec’s investment, John Singleton, Chief Operating Officer of

CoTec, was appointed to the Board of Maginito.

HyProMag

HyProMag was founded in 2018 by the late

Professor Emeritus Rex Harris, former Head of The Magnetic

Materials Group (“MMG”) within the School of Metallurgy and

Materials at the University of Birmingham (“UoB”), Professor Allan

Walton, current Head of the MMG, and two Honorary Fellows, Dr John

Speight and Mr David Kennedy, leading world experts in the field of

rare earth magnetic materials, alloys and hydrogen technology, with

significant industry experience. The HPMS process for extracting

and demagnetising NdFeB alloy powders from magnets embedded in

scrap and redundant equipment was originally developed within the

MMG and subsequently licenced to HyProMag. The MMG has been active

in the field of rare earth alloys and processing of permanent

magnets using hydrogen for over 40 years. Originated by Professor

Emeritus Rex Harris, the hydrogen decrepitation method, which is

used to reduce NdFeB alloys to a powder, is now ubiquitously

employed in worldwide magnet processing.

Under the terms of the Transaction, the founding

Directors and management of HyProMag will continue to provide

support and work closely with Maginito to further scale-up and

roll-out the HPMS technology.

HyProMag is establishing short loop recycling

facilities for NdFeB magnets at Tyseley Energy Park in Birmingham,

UK and other locations using the patented HPMS process to provide a

sustainable solution for the supply of NdFeB magnets and alloys for

a wide range of markets including, for example, automotive and

electronics. Short loop magnet recycling is expected to have a

significant environmental benefit, requiring an estimated 88% less

energy versus primary mining to separation to metal alloy to magnet

production. The plant at Tyseley Energy Park is being developed

together with the UoB, with a minimum capacity of 100tpa NdFeB

(neodymium, iron, boron). This £4.3 million (C$7.3 million) project

is being funded by Driving the Electric Revolution, an Industrial

Strategy Challenge Fund challenge delivered by UK Research and

Innovation (“UKRI”). The focus of the project is to take the HPMS

technology to a greater scale and efficiency with revolutionary new

design of processing equipment and extensive automation of

processing methods for inert atmosphere powder handling and

pressing. HyProMag is the primary industrial user and operator of

the plant. First production is targeted for late 2023, which

follows successful piloting at the UoB in 2022 as featured on BBC

Midlands News: https://youtu.be/9P-dsNCffWw.

HyProMag GmbH

In November 2021, HyProMag established an

80%-owned subsidiary in Germany, HyProMag GmbH, to roll out

commercialisation of HPMS technology into Germany and Europe. The

remaining 20% equity interest is owned by Professor Carlo Burkhardt

of Pforzheim University.

HyProMag GmbH is developing a similar sized

plant to that at Tyseley Energy Park and will be the first in

Germany using the patented HPMS process. First production is

targeted for 2024. Maginito has entered into a convertible loan

agreement (the “Convertible Loan”) with HyProMag GmbH. Under the

terms of the Convertible Loan, Maginito has granted HyProMag GmbH a

loan facility for €2.5 million (C$3.7 million) available to be

drawn down in accordance with an agreed investment plan. Upon

conversion of the Convertible Loan, Maginito’s direct and indirect

equity interest in HyProMag GmbH will increase from 80% to 90%.

This investment by Maginito will contribute to

the matched funding requirements to unlock the €3.7 million (C$5.40

million) grants announced by Mkango on November 23, 2022, for

development of the production facility in Baden-Württemberg

State.

About Mkango

Resources Ltd.

Mkango's corporate strategy is to develop new

sustainable primary and secondary sources of neodymium,

praseodymium, dysprosium and terbium to supply accelerating demand

from electric vehicles, wind turbines and other clean technologies.

This integrated Mine, Refine, Recycle strategy differentiates

Mkango from its peers, uniquely positioning the Company in the rare

earths sector. Mkango is listed on the AIM and the TSX-V.

Mkango is developing its flagship Songwe Hill

rare earths project (“Songwe”) in Malawi with a Definitive

Feasibility Study completed in July 2022 and an Environmental,

Social and Health Impact Assessment approved by the Government of

Malawi in January 2023. Malawi is known as "The Warm Heart of

Africa", a stable democracy with existing road, rail and power

infrastructure, and new infrastructure developments underway.

In parallel, Mkango and Grupa Azoty PULAWY,

Poland's leading chemical company and the second

largest manufacturer of nitrogen and compound fertilizers in

the European Union, have agreed to work together towards

development of a rare earth separation plant at Pulawy in Poland

(the “Pulawy Separation Plant”). The Pulawy Separation Plant will

process the purified mixed rare earth carbonate produced at Songwe

Hill.

Through its ownership of Maginito

(www.maginito.com), Mkango is also developing green technology

opportunities in the rare earths supply chain, encompassing

neodymium (NdFeB) magnet recycling as well as innovative rare earth

alloy, magnet, and separation technologies.

Mkango also has an extensive exploration

portfolio in Malawi, including the Mchinji rutile exploration

project, the Thambani uranium-tantalum-niobium-zircon project and

Chimimbe nickel-cobalt project.

For more information, please

visit www.mkango.ca

About CoTec Holdings Corp.

CoTec is a publicly traded investment issuer

listed on the TSX-V under the ticker CTH, and the OTCQB under the

ticker CTHCF. The company is an ESG-focused company investing in

innovative technologies that have the potential to fundamentally

change the way metals and minerals can be extracted and processed

for the purpose of applying those technologies to undervalued

operating assets and recycling opportunities, in rare earths, low

carbon iron ore (green steel) and copper as the company seeks to

transition into a mid-tier mineral resource producer. CoTec is

committed to supporting the transition to a lower carbon future for

the extraction industry, a sector on the cusp of a green revolution

as it embraces technology and innovation.

For more information, please

visit www.cotec.ca.

Market Abuse Regulation (MAR)

Disclosure

The information

contained within this

announcement is deemed by the Company to

constitute inside information as stipulated under the

Market Abuse Regulations (EU) No. 596/2014 ('MAR') which

has been incorporated into UK law by the European Union

(Withdrawal) Act 2018. Upon the

publication of this announcement via

Regulatory Information Service, this inside information is now

considered to be in the public domain.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements (within the meaning of that term under applicable

securities laws) with respect to Mkango and CoTec. Generally,

forward looking statements can be identified by the use of words

such as “plans”, “expects” or “is expected to”, “scheduled”,

“estimates” “intends”, “anticipates”, “believes”, or variations of

such words and phrases, or statements that certain actions, events

or results “can”, “may”, “could”, “would”, “should”, “might” or

“will”, occur or be achieved, or the negative connotations thereof.

Readers are cautioned not to place undue reliance on

forward-looking statements, as there can be no assurance that the

plans, intentions or expectations upon which they are based will

occur. By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and other forward-looking

statements will not occur, which may cause actual performance and

results in future periods to differ materially from any estimates

or projections of future performance or results expressed or

implied by such forward-looking statements. Such factors and risks

include, without limiting the foregoing, the availability of (or

delays in obtaining) financing to develop Songwe Hill, the Tyseley

Recycling Plant, the HyProMag GmbH Recycling Plant, the Mkango UK

Pilot Plant, the Pulawy Separation Plant, governmental action and

other market effects on global demand and pricing for the metals

and associated downstream products for which Mkango is exploring,

researching and developing, geological, technical and regulatory

matters relating to the development of Songwe Hill, the ability to

scale the HPMS and chemical recycling technologies to commercial

scale, competitors having greater financial capability and

effective competing technologies in the recycling and separation

business of Maginito and Mkango, availability of scrap supplies for

Maginito’s recycling activities, government regulation (including

the impact of environmental and other regulations) on and the

economics in relation to recycling and the development of the

Tyseley Recycling Plant, the HyProMag GmbH Recycling Plant, the

Mkango UK Pilot Plant, the Pulawy Separation Plant and future

investments in the United States pursuant to the proposed

cooperation agreement between Maginito and CoTec, the outcome and

timing of the completion of the feasibility studies, cost overruns,

complexities in building and operating the plants, and the positive

results of feasibility studies on the various proposed aspects of

Mkango’s, Maginito’s and CoTec’s activities. The forward-looking

statements contained in this news release are made as of the date

of this news release. Except as required by law, the Company and

CoTec disclaim any intention and assume no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law. Additionally, the Company and CoTec undertake no

obligation to comment on the expectations of, or statements made

by, third parties in respect of the matters discussed above.

For further information on Mkango,

please contact:

Mkango Resources Limited

| William Dawes |

|

Alexander Lemon |

| Chief Executive Officer |

|

President |

| will@mkango.ca |

|

alex@mkango.ca |

| Canada: +1-403-444-5979 |

|

|

| www.mkango.ca |

|

|

| @MkangoResources |

|

|

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint BrokerJeff Keating,

Kasia BrzozowskaUK: +44 20 3470 0470

Alternative Resource

CapitalJoint BrokerAlex Wood, Keith DowsingUK: +44 20 7186

9004/5

Bacchus Capital

AdvisersFinancial AdviserRichard AllanUK: +44 203 848

1642UK: +44 7857 857 287richard.allan@bacchuscapital.co.uk

Tavistock CommunicationsPR/IR

AdviserJos Simson, Cath DrummondUK: +44 (0) 20 7920

3150mkango@tavistock.co.uk

For further information on CoTec, please

contract:

CoTec Holdings Corp.Braam

JonkerChief Financial Officerbraam.jonker@cotec.caCanada: +1 604

992-5600

The TSX Venture Exchange has neither

approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any equity or other

securities of the Company in the United States. The securities of

the Company will not be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities Act") and

may not be offered or sold within the United States to, or for the

account or benefit of, U.S. persons except in certain transactions

exempt from the registration requirements of the U.S. Securities

Act.

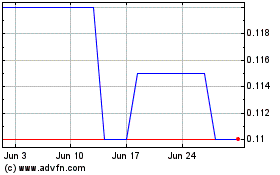

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Jan 2024 to Jan 2025