New Zealand Energy Corp. ("NZEC" or the "Company"), an oil and

natural gas company with exploration and development prospects in

New Zealand, has released the results of its second quarter ended

June 30, 2011. Details of the Company's financial results are

described in the Unaudited Consolidated Financial Statements and

Management's Discussion and Analysis which, together with further

details on each of the Company's projects, are available on the

Company's website at www.newzealandenergy.com and on SEDAR at

www.sedar.com. All amounts are in Canadian dollars unless otherwise

stated.

NZEC has completed a number of significant milestones and we are

moving quickly toward our objective of becoming New Zealand's next

oil and natural gas producer. In early August we completed our

initial public offering and commenced trading on the TSX Venture

Exchange. The $20 million raised in the IPO has left us well

positioned to complete our first discovery well and execute an

aggressive exploration strategy, with four more wells planned by

year end.

The Copper Moki-1 well, NZEC's first discovery well, was

production tested earlier in August over a 48-hour period and

flowed 41.8 API oil at a consistent rate of 1,100 barrels per day

along with 855 mcf per day of natural gas. The well will be placed

on an extended production test to determine the reservoir size and

flow conditions and NZEC has entered into a contract to sell its

test volumes of oil at a premium to the Brent reference price .

NZEC's in-country team has initiated the steps to obtain a mining

permit to achieve long-term production, and is actively engaging

with local communities as the project advances.

The Copper Moki-1 well was completed in three sands over an

interval of 12.2 metres within the Mt. Messenger Formation in New

Zealand's Taranaki Basin. The Taranaki Basin currently produces all

of New Zealand's oil and gas, producing approximately 55,000

barrels of crude oil per day and 460 million cubic feet per day of

natural gas. NZEC has identified additional prospective zones

within the Copper Moki-1 area and plans to drill three additional

wells in the Taranaki Basin by year end.

On its East Coast Basin properties, NZEC will re-enter the

Ranui-1 well in Q4-2011 to deepen the well through the Whangai

Formation oil shale and collect core for analysis. Originally

drilled by the previous owner in 2008 to a depth of 1,135 metres,

Ranui-1 encountered 224 metres of prospective Whangai Shale. On the

company's Castlepoint Permit, NZEC will core two test holes to

determine the thickness and reservoir characteristics of the two

prospective oil shale formations, the Waipawa and the Whangai. NZEC

plans to explore this area using modern North American technology

that has proven highly successful in developing North America's

shale targets, such as the Bakken Formation. There are 300 known

oil and natural gas seeps in the East Coast Basin that have been

proven to originate from the oil shale formations in the area.

With nearly two million acres of exploration permits, an

extensive database of exploration data compiled over more than 25

years and an exceptional technical team, NZEC is well positioned to

become a significant player in the oil and gas industry. We look

forward to reporting progress to our shareholders as the projects

advance.

(1) American Petroleum Institute

(2) Thousand cubic feet

(3) The reference against which two thirds of the world's internationally

traded crude oil supplies are priced.

FINANCIAL SNAPSHOT

---------------------------------------------------------------------------

For the six months For the financial

ended period ended

June 30, 2011 December 31, 2010

---------------------------------------------------------------------------

Revenue - -

Net loss and comprehensive loss $ (2,652,278) $ (10,338,136)

Interest income 26,676 -

Loss per share - basic and diluted (0.04) (0.24)

Current assets 5,630,748 6,229,650

Total assets 10,683,239 6,301,322

Total liabilities 416,153 371,958

Shareholders' equity 10,267,086 5,929,364

---------------------------------------------------------------------------

RECENT DEVELOPMENTS

-- On July 7, 2011, NZEC and Discovery Geo Corporation ("Discovery Geo")

entered into an indemnity agreement pursuant to which Discovery Geo

agreed to indemnify NZEC against any claims for existing royalties or

the right to receive future royalties in excess of 3% on the Ranui

Permit (exclusive of the 5% royalty payable to the Crown).

-- On July 14, 2011, NZEC, AGL Upstream Gas (MOS) Pty Limited ("AGL") and

L&M Energy Limited ("L&M") entered into an agreement pursuant to which

AGL assigned its 50% interest in the Alton Permit joint venture to NZEC.

In addition, pursuant to this agreement, L&M waived its pre-emptive

rights in respect of the Alton Permit and consented to the sale of AGL's

interest in the Alton Permit. On July 26, 2011, the Corporation

announced the completion of drilling of the Talon-1 exploration well on

the Alton Permit. Funding 100% of the drilling costs (estimated at

$2,400,000) was a condition of the Corporation's acquisition of its 50%

working interest in the permit and the Corporation has assumed

operatorship of the permit. The Corporation has no further earning

obligations pursuant to the assignment from AGL.

-- On August 3, 2011 (the "Listing Date"), the Corporation completed its

initial public offering of 20,000,000 common shares at $1.00 per common

share (the "Offering Price") for gross proceeds of $20,000,000 (the

"Offering") and commenced public trading on the TSX Venture Exchange

(the "Listing"). Under the symbol "NZ", the Offering was completed

through a syndicate of agents (the "Agents"). The Agents were granted an

over-allotment option to subscribe for an additional 3,000,000 common

shares, on the same terms, at any time up to 30 days after the Listing

Date. The Agents received a 6% commission on the proceeds of the

Offering, which was paid in cash and common shares. Warrants were also

issued totalling 3% of the common shares issued pursuant to the

Offering, and are exercisable at $1.00 for a period of 18 months from

the Listing Date.

-- On August 3, 2011, the Corporation granted stock options to directors,

officers and consultants to purchase an aggregate 4,828,000 common

shares at the Offering price for a period of five years from the Listing

Date. These stock options will vest over a 24-month period, with 25% of

the stock options vesting every six months after the Listing Date.

-- On August 3, 2011, NZEC paid US$500,000 to Discovery Geo as partial

payment of the purchase price for the Ranui Permit. On August 24, 2011,

the Corporation paid the remaining US$500,000 and initiated the issuance

of 1,000,000 common shares for final consideration to of the Ranui

Assignment Agreement.

-- On August 24, 2011, the Corporation announced that the Copper Moki-1

well was production tested earlier in August over a 48-hour period and

flowed 41.8 API oil at the consistent rate of 1,100 barrel per day along

with 855 mcf per day of natural gas. The well will be placed on an

extended production test to determine the reservoir size and flow

conditions and NZEC has entered into a contract to sell its test volumes

of oil at a premium to the Brent reference price.

PROPERTY REVIEW

Within the Taranaki Basin, the following PEPs have been, or are

in the process of being, acquired:

1. On March 3, 2011, New Zealand's Minister of Energy granted an assignment

of the Eltham Permit to NZEC. The Eltham Permit covers approximately

92,467 acres (374 km(2)) of which approximately 31,877 acres (129 km(2))

are offshore in shallow water.

2. On June 24, 2011, NZEC entered into the Alton Agreement with AGL

pursuant to which the Corporation will acquire a 50% interest in the

Alton Permit and associated joint venture with L&M, which owns the other

50% of the permit. The Alton Permit is adjacent to the Eltham Permit and

covers approximately 119,203 acres (482 km(2)).

Within the East Coast Basin, located on the east coast of New

Zealand's North Island, the following PEPs have been, or are in the

process of being, acquired:

1. On November 24, 2010, the Minister of Energy granted the Castlepoint

Permit to NZEC. The Castlepoint Permit covers approximately 551,042

onshore acres (2,230 km(2)).

2. On February 22, 2011, NZEC entered into a permit acquisition agreement

with Discovery Geo, pursuant to which Discovery Geo has agreed to assign

its 100% interest in the Ranui Permit to NZEC upon completion of certain

conditions. The Ranui Permit is adjacent to the Castlepoint Permit and

covers approximately 223,087 acres (903 km(2)). The Corporation must

undertake certain geophysical and geochemical studies prior to re-

entering a suspended well on the property.

3. On September 3, 2010, NZEC applied to the Minister of Energy for the

East Cape Permit. The application is uncontested and the Corporation

expects the East Cape Permit to be granted to NZEC upon completion of

Crown Mineral's review of the application. The East Cape Permit covers

approximately 1,067,495 onshore acres (4,320 km(2)) on the northeast tip

of the North Island.

PETROLEUM PROPERTY ACTIVITIES, OPERATIONS AND CAPITAL

EXPENDITURES FOR THE SIX-MONTH PERIOD ENDED JUNE 30, 2011

Taranaki Basin

During the six-month period ended June 30, 2011, the Corporation

incurred $3,413,195 in capitalized exploration and development

costs relating to the Eltham Permit. Of the costs incurred during

the period, $110,131 related to asset retirement costs, $353,172

was recorded for consulting services and $2,716,191 for well

development. As a result of funding and drilling the Copper Moki-1

discovery well, reprocessing 438 km of 2D seismic data and carrying

out a number of other technical studies to the satisfaction of the

Ministry of Energy, the Corporation earned a 100% interest in the

Eltham Permit which was assigned to NZEC on March 3, 2011. Total

expenditures incurred as of June 30, 2011 relating to the Eltham

Permit amounted to $3,421,462.

As of June 30, 2011, the Corporation paid $1,104,952 as deposit

toward the acquisition of the Alton Permit pursuant to the Alton

Agreement.

East Coast Basin

During the six-month period ended June 30, 2011, the Corporation

incurred $46,624 in capitalized exploration costs on the

Castlepoint Permit. Total expenditures incurred as of June 30, 2011

relating to the Castlepoint Permit amounted to $115,111.

In February 2011, the Corporation entered into the Ranui

Assignment Agreement with Discovery Geo, pursuant to which

Discovery Geo agreed to assign to NZEC its 100% interest in the

Ranui Permit. Upon satisfaction of the conditions of assignment,

NZEC will pay Discovery Geo US$1,000,000 and will issue 1,000,000

common shares to Discovery Geo. As of June 30, 2011, the

Corporation incurred $16,533 in capitalized acquisition costs

relating to the Ranui Permit. On August 3, 2011, NZEC paid

US$500,000 to Discovery Geo as partial payment of the purchase

price for the Ranui Permit. On August 24, 2011, the Corporation

paid the remaining US$500,000 and initiated the issuance of

1,000,000 common shares for final consideration to of the Ranui

Assignment Agreement.

During the six-month period ended June 30, 2011, the Corporation

did not capitalize any exploration or acquisition costs relating to

the East Cape Permit.

OUTLOOK

Use of Proceeds

On August 3, 2011, NZEC closed the Offering for gross proceeds

of $20,000,000. NZEC's intended use of the net proceeds over the

next 12 to 15 months is outlined below:

----------------------------------------------------------------------------

Anticipated

use Current

of proceeds anticipated Expected

in the use of Completion

Property Operation Prospectus proceeds Date

----------------------------------------------------------------------------

Taranaki Basin:

Eltham Permit - Drill and tie $ 6,600,000 $ 6,600,000 2013

in 1 well

targeting

Urenui/Mt.

Messenger

Formation

- Complete and

tie in Copper

Moki-1 Well

- Reprocess 3D

seismic

survey

Alton Permit - Drill and $ 6,500,000 $ 6,500,000 2013

complete

Talon-1

Well

- Commence

drilling of

second

exploration

well

East Coast Basin:

Castlepoint Permit - Drill 2 core $ 625,000 $ 625,000 2012

wells

- Technical

studies

- Reprocess 2D

seismic data

Ranui Permit - Re-enter and $ 3,175,000

evaluate

Ranui-1 Well

- Technical

studies,

seismic $ 3,175,000 2011

processing

and core

sampling

East Cape Permit(i) - Technical $ 290,000 $ 290,000 2012

studies and

surveys

- Evaluate and

analyze data

Working capital as at June 30, 2011 $ 206,000 $ 442,904

Other:

Costs of the Offering (Paid) $ 400,000 $ 431,700 Paid

(including legal, regulatory, audit

and printing expenses)

Agents' commission (Paid) $ 730,000 $ 511,395 Paid

Reserves for acquisition $ 2,500,000 $ 2,500,000

opportunities

----------------------------------------------------------------------------

$25,284,000 $25,333,999

----------------------------------------------------------------------------

(i) Budget contingent on receipt of permit

As at the date of the filing of the MD&A, management does

not anticipate any significant changes to its current anticipated

use of proceeds.

RESULTS OF OPERATIONS FOR THREE-MONTH PERIOD ENDED JUNE 30,

2011

Period Expenses

During the three-month period ended June 30, 2011, the

Corporation incurred total expenses of $1,109,045. Management fees,

professional and consultant fees recorded during the period were

significant as the Corporation continued its development activities

and as a result of the Offering. Management fees were in line with

the consulting agreements entered into with J. Proust &

Associates Ltd. ("JPA") and Wexford Energy Ltd ("Wexford") as

detailed in the related party transactions recorded during the

period. Travel and promotion materially related to travel costs

associated with marketing of the Offering. On February 21, 2011,

the Corporation entered into an asset purchase agreement ("IRBA

Agreement") with Ian R. Brown Associates Limited ("IRBA") pursuant

to which the Corporation acquired certain assets and agreed to

offer employment to certain IRBA employee. As a result of the IRBA

Agreement, the Corporation began incurring office and general costs

for a larger office in Wellington, along with the additional salary

and wages of its in-country staff. The remaining general and

administrative costs were reflective of the Corporation's current

stage of development.

Interest Income

The Corporation earned $19,222 of interest income on its excess

cash and cash equivalent balances held during the three-month

period ended June 30, 2011.

Net Loss and Funds from Operations

The Corporation generated net loss of $1,089,823 ($0.01 per

share) for the period ended June 30, 2011.

ABOUT NEW ZEALAND ENERGY

NZEC is an oil and natural gas company engaged in the

exploration, acquisition and development of petroleum and natural

gas assets in New Zealand. NZEC's property portfolio collectively

covers nearly two million acres in the Taranaki Basin and East

Coast Basin of New Zealand's North Island. NZEC holds two petroleum

exploration permits (Eltham Permit and Castlepoint Permit) and a

50% interest in a petroleum exploration permit (Alton Permit,

pending completion of certain conditions), one pending petroleum

exploration permit pursuant to an assignment agreement (Ranui

Permit), and one pending non-competitive petroleum exploration

permit application (East Cape Permit).

The Company's management team has extensive experience exploring

and developing oil and natural gas fields in New Zealand and

Canada, and takes a multi-disciplinary approach to value creation

with a track record of successful discoveries. NZEC plans to add

shareholder value by executing a technically disciplined

exploration program focusing on the discovery of onshore and

offshore oil and natural gas resources in the politically and

fiscally stable country of New Zealand. The Company's strategy is

to develop its existing portfolio of assets and to pursue further

exploration opportunities in other areas with proven hydrocarbon

systems. NZEC will continue to evaluate strategic acquisitions from

time to time where it views further exploration and development

opportunities exist, and may participate in future tenders offered

by the Government of New Zealand to acquire additional petroleum

exploration permits or petroleum mining permits.

On behalf of the Board of Directors

John Proust, Chief Executive Officer and Director

Forward-looking Statements

This news release contains certain forward-looking information

and forward-looking statements within the meaning of applicable

securities legislation (collectively "forward-looking statements").

The use of any of the words "anticipate", "continue", "estimate",

"expect", "may", "will", "project", "propose", "should", "believe"

and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements, including without limitation, the

speculative nature of exploration, appraisal and development of oil

and natural gas properties; uncertainties associated with

estimating oil and natural gas resources; changes in the cost of

operations, including cots of extracting and delivering oil and

natural gas to market, that affect potential profitability of oil

and natural gas exploration; operating hazards and risks inherent

in oil and natural gas operations; volatility in market prices for

oil and natural gas; market conditions that prevent the Company

from raising the funds necessary for exploration and development on

acceptable terms or at all; global financial market events that

cause significant volatility in commodity prices; unexpected costs

or liabilities for environmental matters; competition for, among

other things, capital, acquisitions of resources, skilled

personnel, and access to equipment and services required for

exploration, development and production; changes in exchange rates,

laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated

benefits of acquisitions; and other factors discussed under "Risk

Factors" in NZEC's Prospectus dated July 19, 2011. NZEC believes

the expectations reflected in those forward-looking statements are

reasonable, but no assurance can be given that these expectations

will prove to be correct. Such forward-looking statements included

in this news release should not be unduly relied upon. These

statements speak only as of the date of this news release and NZEC

does not undertake to update any forward-looking statements that

are contained in this news release, except in accordance with

applicable securities laws. In addition, this news release may

contain forward-looking statements attributed to third-party

industry sources.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: New Zealand Energy Corp. Rhylin Bailie Vice President,

Communications & Investor Relations +1 604-601-2010 New Zealand

Energy Corp. Bruce McIntyre President & Director +1

604-601-2010 +1 604-488-0319 (FAX) info@newzealandenergy.com

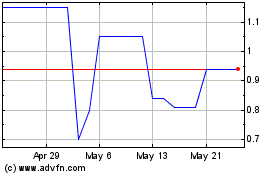

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024