Quorum Releases Q1 Fiscal Year 2014 Results

May 26 2014 - 11:32AM

Marketwired Canada

Quorum Information Technologies Inc. (TSX VENTURE:QIS) ("Quorum" or the

"Company") today released its First Quarter (Q1) Fiscal Year (FY) 2014 results.

Quorum delivers its dealership management system (DMS), XSellerator(TM), and

related services to automotive dealerships throughout North America. The Company

is both a Dealer Technology Assistance Program (DTAP) strategic partner with

General Motors Corporation (GM) and a strategic partner with Microsoft. Quorum's

XSellerator product is broadly promoted to its target dealerships throughout

North America by these prominent industry partners. Quorum also supplies its

product to Chrysler, Hyundai, Kia, Nissan, Subaru, NAPA and Bumper to Bumper

franchised dealership customers as well as independent and other non-automotive

dealerships.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's Q1 FY2014 results. Some of our most significant measurable operational

results in Q1 FY2014 are as follows:

-- Customer Satisfaction Index ("CSI") semi-annual survey in Q1 FY2014

showed an average of 88% of dealer principals as "satisfied" or "very

satisfied" and an average of 81% of end users as "satisfied" or "very

satisfied" overall. The remaining 12% of dealer principals reported

"somewhat satisfied" and over 3/4 of the remaining 25% of end users

reported "somewhat satisfied". The results are up from our survey in Q3

FY2013 which reported "satisfied" or "very satisfied" comparative

numbers of 87% for dealer principals and 75% for end users.

-- Customers Satisfaction Index (CSI) - our monthly Support Center CSI

survey reported an average of over 95% "very satisfied" with the service

received from our support team.

-- Product - during Q1 FY2014 we continued work on V4.7.7 which we plan to

move into general release in Q2 FY2014. The version has new Make More

Money ("M3") initiatives that will help drive additional incremental

revenue into our dealership customers' operations. The version also has

a number of enhancements to Communicator, our 2 way text, email and

instant messaging solution that is embedded into XSellerator. Our

Dealership customers sent 183,652 messages in Q1 FY2014 compared to

79,621 in Q4 FY2013 through Communicator.

Financial Results highlights for Q1 FY2014 are as follows:

-- Sales increased by 12% to $2,202K in Q1 FY2014 from $1,959K in Q1

FY2013. The increase in sales is largely due to:

-- An increase of $96K in recurring support revenue as a result from

having more active dealership rooftops at the end of Q1 FY2014

compared to the end of Q1 FY2013.

-- An increase of $175K in net new and transitions revenue which was a

result of an increase in transitions revenue.

-- Margin after direct costs increased by $256K to $1,288K in Q1 FY2014, as

compared to $1,032K in Q1 FY2013, a 25% increase.

-- Earnings before interest, taxes, depreciation, amortization, foreign

exchange gains and losses and stock-based compensation (EBITDA)

increased by $220K to $378K in Q1 FY2014 compared to $158K in Q1 FY2013.

-- Income before deferred income tax expense increased by $206K to $168K in

Q1 FY2014 compared to a loss of $38K in Q1 FY2013.

-- Quorum had comprehensive income of $137K in Q1 FY2014 compared to a

comprehensive loss of $12K in Q1 FY2013. The improvement is largely due

to an increase in EBIDTA of $220K, offset by a combined increase in

deferred income tax expense and amortization expense of $90K.

-- Working capital increased to $1,526K at March 31, 2014 compared with

$1,454K at December 31, 2013. Cash increased to $942K at the end of

March, 2014 compared with $812K at the end of December, 2013.

Q1 FY2014 was a strong quarter with revenues up 12% to $2,202K, a 140% increase

in EBITDA to $378K, and an increase in income before deferred income tax expense

of $206.

Quorum has filed its Q1 2014 consolidated financial statements and notes thereto

as at and for the period ended March 31, 2014 and accompanying Management's

Discussion and Analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Three Months Three Months

Ended March Ended March

31, 2014 31, 2013

----------------------------------------------------------------------------

Gross revenue $ 2,202,327 $ 1,959,291

Direct costs 914,596 927,198

Margin after direct costs 1,287,731 1,032,093

Earnings before interest, taxes, depreciation

and amortization (EBITDA) 378,117 157,558

Income (loss) before deferred income tax

expense 168,464 (37,663)

Net income (loss) 82,221 (48,166)

Comprehensive income (loss) 136,579 (12,415)

Basic income (loss) per share 0.0021 (0.0012)

Fully diluted income (loss) per share $ 0.0021 $ (0.0012)

Weighted average number of common shares

Basic 39,298,438 39,298,438

Diluted 39,298,438 39,298,438

----------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSellerator product for GM, Chrysler, Hyundai,

KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSellerator is a

dealership and customer management software product that automates, integrates

and streamlines every process across departments in a dealership. One of the

select North American suppliers under General Motors' DTAP program, Quorum is

also one of largest DMS provider for GM's Canadian dealerships with 25% of the

market. Quorum is a Microsoft Partner in both Canada and the United States.

Quorum Information Technologies Inc. is traded on the Toronto Venture Exchange

(TSX-V) under the symbol QIS. For additional information please go to

www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the period ended

March 31, 2014. Any forward-looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

The TSX Venture Exchange does not accept responsibility for the adequacy or

accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Quorum Information Technologies Inc.

Maury Marks

403-777-0036 ext 104

MarksM@QuorumDMS.com

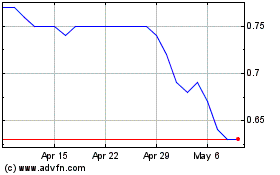

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

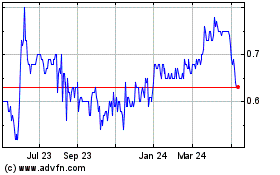

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Dec 2023 to Dec 2024