Zacatecas Silver Corp. (“Zacatecas Silver” or the “Company”,

ZAC:TSX Venture; ZCTSF: OTC Markets; 7TV: Frankfurt) is pleased to

announce an increase to its Inferred silver Mineral Resource

Estimate at the Panuco South and North Deposits within the

Zacatecas Property. The Updated Mineral Resource Estimate was

prepared by P&E Mining Consultants Inc. (“P&E”) for

Zacatecas Silver. P&E prepared the initial Inferred Mineral

Resource Estimate that was a disclosed in the Technical Report

dated January 28, 2022 titled “Independent NI 43-101 Technical

Report, Zacatecas Properties, Zacatecas State, Mexico,” filed on

SEDAR on January 28, 2022.

Highlights:

-

Updated silver Inferred Mineral Resource now consists

of:

-

Panuco South Deposit Inferred Mineral Resource of 3.04

million tonnes at 179 g/t AgEq for 17.5 million ounces

AgEq.

-

Panuco North Deposit Inferred Mineral Resource of 0.37

million tonnes at 255 g/t AgEq for 3.0 million ounces

AgEq

-

Silver Inferred Mineral Resources have increased by 25%

compared to previous MRE completed in December 2021.

-

Zacatecas plans to restart drilling at El Cristo vein

system with a goal of increasing silver resources at the Zacatecas

Properties.

Dr. Christopher Wilson, Chief Operating Officer

and director of Zacatecas Silver comments, “The most recent

drilling carried out, with assay results previously released, was a

focused drill program intercepting numerous strong silver grades

near surface and at depth. The along strike and down dip extensions

of Panuco South and Panuco North remain open to depth and continue

to represent excellent targets for further near-surface and deep

drilling.”

The Panuco South and North underground Mineral

Resource Estimate now consists of 3.41 million tonnes at

187 g/t AgEq (173 g/t Ag and 0.18 g/t Au) for 20.5 million ounces

AgEq (19.0 million ounces silver and 19.2 thousand ounces

gold) that is comprised of the following:

Table 1: Panuco South and North Underground Inferred

Mineral Resource Estimate Summary

(1-8)

|

Resource Area |

Tonnes (Mt) |

Ag (g/t) |

Au (g/t) |

Ag (Moz) |

Au (koz) |

AgEq (g/t) |

AgEq (Moz) |

|

Panuco South |

3.04 |

236 |

0.24 |

2.8 |

2.7 |

255 |

3.0 |

|

Panuco North |

0.37 |

166 |

0.17 |

16.2 |

16.4 |

179 |

17.5 |

|

Total |

3.41 |

173 |

0.18 |

19.0 |

19.2 |

187 |

20.5 |

| |

Notes: |

|

|

(1) |

Mineral Resources, which are not Mineral Reserves, do not have

demonstrated economic viability. |

| |

(2) |

The estimate of Mineral Resources

may be materially affected by environmental permitting, legal

title, taxation, socio-political, marketing or other relevant

issues. |

| |

(3) |

Resources are classified

according to Canadian Institute of Mining, Metallurgy and Petroleum

(“CIM”) Definition Standards (2014) and CIM Best Practices

(2019); |

| |

(4) |

The Inferred Mineral Resource in

this estimate has a lower level of confidence than that applied to

an Indicated Mineral Resource and must not be converted to a

Mineral Reserve. It is reasonably expected that the majority of the

Inferred Mineral Resource could be upgraded to an Indicated Mineral

Resource with continued exploration. |

| |

(5) |

Silver equivalent Mineral

Resources for the Panuco South and North Deposits were calculated

using the following metal prices: Ag at US $22.50/oz and Au at

US$1,700/oz. |

| |

(6) |

Metallurgical recoveries have

been estimated to be 85% silver and 90% gold. |

| |

(7) |

The underground Mineral

Resource Estimate uses a cut-off of 120 g/t AgEq, based on

US$/tonne costs of $45/mining, $20 processing and $10 G&A. |

| |

(8) |

AgEq = Ag g/t + (Au g/t x

80) |

| |

|

|

Mineral Resource Estimate

Assumptions

The Mineral Resource Estimate was generated

using inverse distance cubed for gold and silver for grade

interpolation within a 3-D block model, constrained by mineralized

zones defined by wireframes solid models. The bulk density value of

2.8 t/m3 used in the Mineral Resource Estimate were derived from a

regression equation based on data measured from samples collected

from re-assayed drill core completed by Zacatecas Silver.

The database for the Mineral Resource Estimate

consisted of 138 drill holes totalling 30,684 m, and 183 trenches

totalling 4,540 m, of which a total of 108 drill holes totalling

22,467 m and 113 trenches totalling 3,000 m intersected the

mineralization wireframes used for the Mineral Resource Estimate.

The drill hole database contained assays for silver and gold as

well as other metals of no economic importance. Zacatacas Silver’s

seasoned exploration team carried out extensive data verification

on the historical database by re-sampling 178 historical sample

intervals, which added to the 243 new mineralized samples making a

total of approximately 50% verified constrained sample intervals in

the Mineral Resource Estimate.

Qualified Person

The contents of this news release have been

reviewed and approved by Chris Wilson, B.Sc. (Hons), PhD, FAusIMM

(CP), FSEG, FGS, Chief Operating Officer of Zacatecas Silver, and

by Eugene Puritch, P.Eng, FEC, CET, President of P&E Mining

Consultants Inc., who is independent of the Company. Dr. Wilson and

Mr. Puritch are Qualified Persons as defined by NI 43-101. Dr.

Wilson is the Qualified Person for all technical information in

this news release, excluding the Mineral Resource Estimate.

About Zacatecas Silver

Corp.

The Company has two key projects. The Esperanza

Gold Project in Morelos State, Mexico and the Zacatecas Silver

Project in Zacatecas State, Mexico.

Esperanza is an advanced stage, attractive

low-cost, low-capital-intensity and low-technical-risk growth

project located

in Morelos state, Mexico. Alamos has

progressed the project through advanced engineering, including

metallurgical work, while also focusing on stakeholder engagement,

including building community relations. The Company announced a

Mineral Resource Estimate at Esperanza consisting of a Measured and

Indicated Mineral Resource Estimate of 30.5 million tonnes at 0.97

g/t AuEq for 956 thousand ounces AuEq and an Inferred Mineral

Resource estimate of 8.7 million tonnes at 0.98 g/t AuEq for 277

thousand ounces AuEq (see news release dated November 16,

2022).

The Zacatecas Silver Project is located in

Zacatecas state, Mexico, within the highly prospective Fresnillo

silver belt, which has produced over 6.2 billion ounces of silver.

The Company holds 7,826 hectares (19,338 acres) of ground that is

highly prospective for low-sulphidation and

intermediate-sulphidation silver base metal mineralization and

potentially low-sulphidation gold-dominant mineralization. Previous

to this press release, the Company announced a Mineral Resource

Estimate at the Panuco Deposit consisting of 2.7 million tonnes at

187 grams per tonne (g/t) silver equivalent (AgEq) (171 g/t silver

(Ag) and 0.17 g/t gold (Au)) for 16.4 million ounces AgEq (15

million ounces silver and 15,000 ounces gold) (see news release

dated December 14, 2021).

The Property is 25 kilometres (km) southeast of

MAG Silver Corp.'s Juanicipio Mine and Fresnillo

PLC's Fresnillo Mine. The Property shares common

boundaries with Pan American Silver Corp. claims and El Orito,

which is owned by Endeavour Silver.

On behalf of the CompanyBryan SlusarchukChief Executive Officer

and Director

Forward-Looking Statements

Information set forth in this news release

contains forward-looking statements that are based on assumptions

as of the date of this news release. These statements reflect

management’s current estimates, beliefs, intentions and

expectations. They are not guarantees of future performance.

Zacatecas Silver cautions that all forward looking statements are

inherently uncertain and that actual performance may be affected by

many material factors, many of which are beyond their respective

control. Such factors include, among other things: risks and

uncertainties relating to Zacatecas Silver’s limited operating

history, its proposed exploration and development activities on its

mineral properties and the need to comply with environmental and

governmental regulations. Accordingly, actual and future events,

conditions and results may differ materially from the estimates,

beliefs, intentions and expectations expressed or implied in the

forward-looking information. Except as required under applicable

securities legislation, Zacatecas Silver does not undertake to

publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Exchange) accepts responsibility for the adequacy

or accuracy of this release.

For further information: Adam Ross, Investor

Relations, Direct: (604) 229-9445, Toll Free: 1(833) 923-3334,

Email: info@zacatecassilver.com

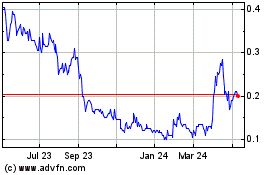

Zacatecas Silver (TSXV:ZAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

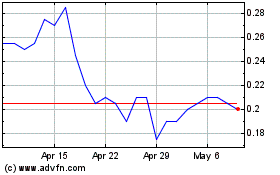

Zacatecas Silver (TSXV:ZAC)

Historical Stock Chart

From Dec 2023 to Dec 2024