UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-KSB/A

|

(X)

|

Annual

report under section 13 or 15(d) of the Securities Act of

1934.

|

|

|

For

the fiscal year ended December 31, 2007

|

|

|

|

|

( )

|

Transition

report under section 13 or 15(d) of the Securities Act of

1934.

|

|

|

For

the Transition period from _______ to

________.

|

Commission

file number: 000-49729

UHF

Incorporated

(Name of

small business issuer in its charter)

|

Michigan

|

38-1740889

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

Number)

|

60 Port

Perry Road

North

Versailles, PA 15137

(Address

and zip code of principal executive offices)

(412)

394-4039

(Issuer’s

phone number including area code)

Securities

to be registered pursuant to Section 12(b) of the Act:

None

Securities

registered or to be registered pursuant to Section 12(g) of the

Act:

Common

Stock, par value $.001 per share

Check

whether the issuer (1) has filed all reports required to be filed by Section 13

or 15(d) of the Securities and Exchange Act of 1934 during the past 12 months

(or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days.Yes

X

No___

Check if

there is no disclosure of delinquent filers in response to Item 405 of

Regulation S-B is contained in this form, and no disclosure will be contained,

to the best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-KSB or any

amendment to this Form 10-KSB.

X

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

X

;

No __

The

issuer’s revenues for its most recent fiscal year were $0.

The

aggregate market value of the voting stock, consisting solely of common stock,

held by non-affiliates of the issuer computed by reference to the closing price

of such stock was $325,739 as of February 27, 2008.

The

number of shares of the issuer’s common stock outstanding, as of February 27,

2008 was 9,493,254.

Transitional

Small Business Disclosure

Format: Yes

X

No __

EXPLANATORY

NOTE

UHF

Incorporated is filing this Amendment on Form 10-KSB/A to amend our Annual

Report on Form 10-KSB for the fiscal year ended December 31, 2007.

We are

filing this Amendment to disclose management’s assessment of the effectiveness

of our disclosure control and procedures and internal control over financial

reporting procedures as of December 31, 2007. The assessment may be

found in Item 8A contain elsewhere in this Amendment. Exhibit 31.1

has also been modified to disclose management’s design of internal control over

financial reporting as of December 31, 2007. The modified Exhibit

31.1 may be found elsewhere in this Amendment.

PART

I

[Items 6

- 12 of Model B of Form 1-A]

ITEM

6. DESCRIPTION

OF BUSINESS.

UHF Incorporated (the “Company”) was

incorporated in Michigan on March 13, 1964 with the name State Die &

Manufacturing Company. On March 1, 1971 its name was changed to State

Manufacturing, Inc., on April 1, 1981 its name was changed to State Die and

Engineering Inc., on July 19, 1984 its name was changed to Universal Robotics

and Automation, Inc., on October 23, 1984 its name was changed to Universal

Automation Corporation, and on March 4, 1992 its name was changed to UHF

Incorporated.

In 1991, the Company became a holding

company by transferring its assets to a newly-formed, wholly-owned corporation

and by purchasing the outstanding stock of two closely held

corporations. These three subsidiaries sold their businesses in 1994,

and the Company paid its debts. Since 1994, the Company has been

inactive and has had no assets or employees. The Company has no

patents, trademarks, licenses, franchises, concessions, royalty agreements or

labor contracts and is not aware of any environmental liabilities or potential

environmental liabilities.

The Company intends to seek business

opportunities such as a merger, acquisition or other business transaction that

will cause the Company to have business operations. We cannot offer

any assurance that we will be able to effect any such business

transaction.

ITEM

7. DESCRIPTION

OF PROPERTY.

The Company neither owns nor leases any

properties. The Company’s principal executive office space is

maintained in a facility owned by its majority stockholder. The

majority stockholder permits the Company to use this space at no

charge.

ITEM

8. DIRECTORS,

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES.

Information concerning the directors

and executive officers of the Company is set forth below. The Company

has no employees.

Ronald C. Schmeiser, age 78, has been a

director, President and Chief Executive Officer of the Company since

1998. He is a Certified Public Accountant and a former Director of

Finance of the City of Pittsburgh, Pennsylvania. Mr. Schmeiser has

been the Deputy Controller and School Auditor of the Pittsburgh School District

since January 1, 2000 and prior thereto served as President of Kromer

Associates, a financial consulting firm.

The By-Laws of the Company provide for

a Board of seven directors; however there have been only three directors since

that provision was adopted in 1998. The By-Laws also provide that the

directors shall hold office for a period of three years, with one-third of the

Board of Directors being elected at each annual meeting. No

shareholder meetings have been held since 1998.

ITEM

8A. CONTROL

AND PROCEDURES.

Management has designed and implemented

a policy and procedure for reviewing on a quarterly and annual basis our

disclosure controls and procedures and our internal control over financial

reporting. Management evaluated the effectiveness of the operation of

these disclosure controls and procedures and internal control over financial

reporting procedure as of December 31, 2007, and concluded based on this

evaluation that these controls and procedures are operating

effectively.

ITEM

9. REMUNERATION

OF DIRECTORS AND OFFICERS.

No compensation was awarded to, earned

by or paid to any officers or directors of the Company during the last three

fiscal years. The Company has no remuneration or benefit plans or

arrangements.

|

ITEM

10.

|

SECURITY

OWNERSHIP OF MANAGEMENT AND CERTAIN

SECURITYHOLDERS.

|

The only security the Company has

outstanding is common stock, par value $.001 per share (“Common

Stock”). The following table sets forth information concerning

persons or entities that own of record more than five percent of the outstanding

Common Stock. Except for Dachris, Ltd., the Company has no

information concerning the beneficial ownership of the shares beyond what is

shown on the official list of the owners of record.

STOCK

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

|

Name

|

Address

|

Shares

Owned

|

|

Percent

of Class

|

|

- -

- -

|

- -

- - - - - -

|

- -

- - - - - - - -

|

|

- -

- - - - - - - - -

|

|

|

|

|

|

|

|

Dachris,

Ltd.*

|

60

Port Perry Road

|

6,331,992

|

|

66.76

|

|

|

North

Versailles, PA 15137

|

|

|

|

|

*

|

Dachris,

Ltd., a Pennsylvania corporation, is wholly-owned by David L. Lichtenstein

whose address is 60 Port Perry Road, North Versailles,

PA 15137. By virtue of Dachris, Ltd’s holding, Mr.

Lichtenstein may be deemed to “control” the

Company.

|

The following table sets forth

information concerning the beneficial ownership of Common Stock by the directors

and officers of the Company and by all directors and officers of the Company as

a group. There are no options, warrants or other rights outstanding

to purchase securities from the Company.

STOCK

OWNERSHIP OF MANAGEMENT

|

Name

|

Positions

|

Shares

Owned

|

Percent

of Class

|

|

- -

- - - -

|

- -

- - - - - - - -

|

- -

- - - - - - - - --

|

- -

- - - - - - - - - - -

|

|

|

|

|

|

|

Ronald

C. Schmeiser

|

Director,

President and

|

200,000

|

2.10

|

|

|

Chief

Executive Officer

|

|

|

ITEM

11. INTEREST

OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS.

None

ITEM

12. DESCRIPTION

OF SECURITIES.

The Company is authorized to issue up

to 50,000,000 shares of Common Stock, of which 9,493,254 are issued and

outstanding. All shares of Common Stock currently outstanding are

fully paid and nonassessable. The Common Stock has no preemptive or

conversion rights and no redemption or sinking fund provisions. All

shares have one vote on any matter submitted to a vote of shareholders, and the

holders thereof have cumulative voting rights in the election of

directors. Holders of the Common Stock are entitled to receive

dividends when and as declared by the Board of Directors out of funds legally

available therefor. Upon dissolution of the Company, the holders of

the Common Stock will be entitled to share ratably in the assets remaining after

the payment of indebtedness and other priority claims.

PART

II

|

ITEM

1.

|

MARKET

PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS.

|

Prior to January 24, 2007, there had

been no public trading market for our Common Stock. On January 24,

2007, our Common Stock was cleared to be quoted on the OTC Bulletin

Board. The trading symbol is “UHFI.” Set forth below is

the high and low closing prices for our Common Stock during our last fiscal year

ended December 31, 2007.

|

|

|

High

|

|

|

Low

|

|

|

First

Quarter, beginning January 24, 2007

|

|

$

|

.65

|

|

|

$

|

.05

|

|

|

Second

Quarter

|

|

|

.26

|

|

|

|

.12

|

|

|

Third

Quarter

|

|

|

.30

|

|

|

|

.11

|

|

|

Fourth

Quarter

|

|

$

|

.25

|

|

|

$

|

.15

|

|

|

|

|

|

|

|

|

|

|

|

The

quotations reflect inter-dealer prices, without retail mark-up, markdown or

commissions and may not represent actual transactions. The

information is derived from online stock quotation services. There

were 229 holders of record of the Common Stock as of February 27,

2008. No cash dividends were declared on the Common Stock during the

last three fiscal years. The Company has no compensation plans or

Individual compensation arrangements.

On

February 27, 2008, the closing price was $.11 per share.

ITEM

2. LEGAL

PROCEEDINGS.

To the Company’s knowledge, the Company

is not a party to any pending legal proceeding, and the Company is not aware of

any legal proceeding that may be contemplated against it by any governmental

authority.

ITEM

3. CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS.

None

ITEM

4. SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of

the Company’s security holders during the fourth quarter of fiscal year

2007.

ITEM

5. REPORTS

ON FORM 8-K

On February 12, 2007, we filed a

Current Report on Form 8-K reporting that our Common Stock had been cleared to

be quoted on the OTC Bulletin Board.

PART

F/S

UHF

INCORPORATED

FINANCIAL

STATEMENTS AND

INDEPENDENT

AUDITORS’ REPORT

December 31, 2007, 2006, and

2005

INDEPENDENT AUDITORS’

REPORT

To the

Board of Directors

and

Stockholders of

UHF

Incorporated

We have

audited the accompanying balance sheets of UHF Incorporated as of December 31,

2007 and 2006 and the related statements of operations and retained deficit and

cash flows for the years ended December 31, 2007, 2006, and

2005. These financial statements are the responsibility of the

Company’s management. Our responsibility is to express an opinion on

these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audits to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The

Company is not required to have, nor were we engaged to perform, an audit of its

internal control over financial reporting. Our audit included

consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but not

for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no

such opinion. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing

the accounting principles used and significant estimates made by management, as

well as evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of UHF Incorporated as of December 31,

2007 and 2006, and the results of its operations and its cash flows for the

years ended December 31, 2007, 2006, and 2005, in conformity with accounting

principles generally accepted in the United States of America.

LOUIS

PLUNG & COMPANY, LLP

Pittsburgh,

Pennsylvania

January

31, 2008

UHF

INCORPORATED

BALANCE

SHEETS

December 31, 2007 and

2006

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

2007

|

|

|

2006

|

|

|

|

|

|

|

|

|

|

|

CASH

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANIZATION

COST

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND

STOCKHOLDERS'

DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCRUED

EXPENSES

|

|

$

|

13,000

|

|

|

$

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities

|

|

|

13,000

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS

AND CONTINGENCIES

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS'

DEFICIT

|

|

|

|

|

|

|

|

|

|

Common

stock, $.001 par value; 50,000,000 authorized

|

|

|

|

|

|

|

|

|

|

shares,

9,493,254 issued and outstanding

|

|

|

9,481

|

|

|

|

9,481

|

|

|

|

|

|

|

|

|

|

|

|

|

PAID

IN CAPITAL

|

|

|

(9,481

|

)

|

|

|

(9,481

|

)

|

|

|

|

|

|

|

|

|

|

|

|

RETAINED

DEFICIT

|

|

|

(13,000

|

)

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' deficit

|

|

|

(13,000

|

)

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

$

|

-

|

|

|

$

|

-

|

|

The

accompanying notes are an integral part of these financial

statements.

UHF

INCORPORATED

STATEMENTS

OF OPERATIONS AND RETAINED DEFICIT

Years Ended December 31,

2007, 2006, and 2005

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING

EXPENSES

|

|

|

3,000

|

|

|

|

3,000

|

|

|

|

3,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

INCOME

|

|

|

(3,000

|

)

|

|

|

(3,000

|

)

|

|

|

(3,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained

Deficit - Beginning of Year

|

|

|

(10,000

|

)

|

|

|

(7,000

|

)

|

|

|

(4,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETAINED

DEFICIT - END OF YEAR

|

|

$

|

(13,000

|

)

|

|

$

|

(10,000

|

)

|

|

$

|

(7,000

|

)

|

The

accompanying notes are an integral part of these financial

statements.

UHF

INCORPORATED

STATEMENTS

OF CASH FLOWS

Years Ended December 31,

2007, 2006, and 2005

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM OPERATING ACTIVITY - NONE

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOW FROM INVESTING ACTIVITIES - NONE

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

FLOWS FROM FINANCING ACTIVITIES - NONE

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

change in cash

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

- Beginning of Year

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH

- END OF YEAR

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

The

accompanying notes are an integral part of these financial

statements.

UHF

INCORPORATED

NOTES TO FINANCIAL

STATEMENTS

1.

SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Nature of Operations

- UHF Incorporated (the “Company”) is a corporation organized under the laws of

the state of Michigan. The Company has been inactive and has not

conducted any business in the ordinary course since July 1, 1994. The

Company intends to seek business opportunities such as a merger, acquisition or

other business transaction that will cause the Company to have business

operations in the current fiscal year. The Company anticipates that

any cash requirements it may have over the next twelve months will be funded by

its majority stockholder. These fees are believed to be

immaterial. The Company accrued audit fees for the years ended

December 31, 2006 and 2005, which will be funded by the majority

shareholder.

Basis of Accounting

-

The financial statements are prepared using the accrual basis of accounting in

which revenues are recognized when earned and expenses are recognized when

incurred.

Estimates

- The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect certain reported amounts and

disclosures. Actual results may differ from these estimates and

assumptions.

New Accounting

Pronouncements

- The following is a listing of new accounting

pronouncements issued by the Financial Accounting Standards Board (FASB) and

management’s assessment regarding the effect they will have on the Company’s

results of operations and financial position. Accounting

pronouncements consist of Statements of Financial Accounting Standards (SFAS)

and FASB Interpretations (FIN).

In

September 2006, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standards No. 157 ("FAS 157"), Fair Value Measurements,

which defines fair value, establishes a framework for measuring fair value in

generally accepted accounting principles ("GAAP"), and expands disclosures about

fair value measurements. FAS 157 applies under other accounting

pronouncements that require or permit fair value measurements. Prior

to FAS 157, there were different definitions of fair value and limited guidance

for applying those definitions in GAAP. Moreover, that guidance was

dispersed among the many accounting pronouncements that require fair value

measurements. Differences in that guidance created inconsistencies that added to

the complexity in applying GAAP. The changes to current practice

resulting from the application of FAS 157 relate to the definition of fair

value, the methods used to measure fair value, and the expanded disclosures

about fair value measurements. FAS 157 is effective for financial

statements issued for fiscal years beginning after November 15, 2007, and

interim periods within those fiscal years. The Company presently does

not expect the adoption of FAS 157 to have an effect on its financial

statements.

In

February 2007, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standards No. 159 ("FAS 159"), The Fair Value Option for

Financial Assets and Financial Liabilities, which permits entities to choose to

measure many financial instruments and certain other items at fair value which

are not currently required to be measured at fair value. FAS 159 is

effective for financial statements issued for fiscal

UHF

INCORPORATED

NOTES TO FINANCIAL

STATEMENTS

years

beginning after November 15, 2007, and interim periods within those fiscal

years. The Company presently does not expect the adoption of FAS 159

to have an effect on its financial statements.

In

December 2007, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standards No. 14IR ("FAS 141 R"), Business Combinations,

which establishes principles and requirements for how the acquirer recognizes

and measures in its financial statements the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest in the acquiree, goodwill

acquired in the business combination or a gain from a bargain

purchase. FAS 141R is effective for which the acquisition date is on

or after the beginning of the first annual reporting period beginning on or

after December 15, 2008. The Company presently does not expect the

adoption of FAS 14IR to have an effect on its financial statements.

In

December 2007, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standards No.160 ("FAS 160"), Noncontrolling Interests in

Consolidated Financial Statements, which establishes accounting and reporting

standards for the noncontrolling interest in a subsidiary and for the

deconsolidation of a subsidiary. FAS 160 is effective for financial statements

issued for fiscal years beginning on or after December 15, 2008, and interim

periods within those fiscal years. The Company presently does not

expect the adoption of FAS 160 to have an effect on its financial

statements.

Management

does not believe that any other recently issued, but not yet effective

accounting pronouncements, if adopted, would have a material effect on the

accompanying financial statements.

|

2.

|

COMMITMENT AND

CONTINGENCIES

|

Management

has no knowledge and is not aware of any commitments or contingencies under

which the Company is liable. Management has also represented that

they are not aware of any pending or threatened litigation, claims, or

assessments against the Company.

PART

III

ITEM

1. INDEX

TO EXHIBITS.

(2) Restated

Articles of Incorporation and By-Laws, as amended to date, filed as Exhibit 2 to

the Company’s Registration Statement on Form 10-SB, and incorporated herein by

reference.

SIGNATURE

In

accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

UHF

INCORPORATED

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

August

15, 2008

|

|

By:

|

/s/

Ronald

C.

Schmeiser

|

|

|

|

|

|

Ronald

C. Schmeiser

|

|

|

|

|

|

President,

Chief Executive

|

|

|

|

|

|

Officer,

Chief Financial Officer, and

|

|

|

|

|

|

Principal

Accounting Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In

accordance with the Exchange Act, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on

the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UHF

INCORPORATED

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

August

15, 2008

|

|

By:

|

/s/

Ronald

C.

Schmeiser

|

|

|

|

|

|

Ronald

C. Schmeiser

|

|

|

|

|

|

President,

Chief Executive

|

|

|

|

|

|

Officer

and Chief Financial Officer

|

- 12 -

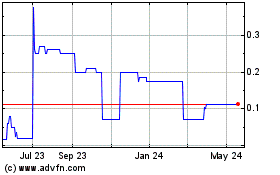

Adamant DRI Processing a... (CE) (USOTC:ADMG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Adamant DRI Processing a... (CE) (USOTC:ADMG)

Historical Stock Chart

From Jul 2023 to Jul 2024