Current Report Filing (8-k)

March 01 2022 - 7:40AM

Edgar (US Regulatory)

0001539894FALSE00015398942022-02-252022-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 25, 2022

Atlas Financial Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Cayman Islands | | 000-54627 | | 27-5466079 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

| | | | | |

953 American Lane, 3rd Floor Schaumburg, IL (Address of principal executive offices) | 60173 (Zip Code) |

Registrant's telephone number, including area code: (847) 472-6700

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. o

Item 1.01 Entry into a Material Definitive Agreement

As previously reported, on August 31, 2021, Atlas Financial Holdings, Inc. (the “Company”) entered into a Restructuring Support Agreement (the “RSA”) with approximately 48% of the Company’s 6.625% senior unsecured notes due 2022 (the “Notes”) issued pursuant to that certain Indenture dated as of April 26, 2017, as amended and supplemented by the First Supplemental Indenture of even date therewith between the Company and Wilmington Trust, National Association, as trustee, and subsequently holders of approximately an additional 9.0% of the Notes acceded to the RSA for a total of approximately 57% (collectively, the “Supporting Noteholders”). The RSA memorializes the agreed-upon terms for a financial restructuring through an exchange of the Notes on the terms and conditions set forth in the Exchange Term Sheet attached as an exhibit to the RSA (the “Restructuring”).

Effective as of February 28, 2022, the Company entered into an amendment of the RSA (the “Amendment”) with the Supporting Noteholders to extend the forbearance period of the Notes and the date by which the Restructuring must be completed to April 15, 2022. The Amendment is filed as Exhibit 10.1 to this Current Report. The description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment filed herewith as an exhibit to this Current Report.

Item 1.03 Bankruptcy or Receivership

On February 25, 2022, the Grand Court of the Cayman Islands (the “Cayman Court”) issued an order (the “Sanction Order”) sanctioning and approving the scheme of arrangement of the Company pursuant to section 86 of Part IV of the Companies Act (2021 Revision) of the Cayman Islands (the “Scheme”). The Scheme had been proposed by the Company and related to the Restructuring. Prior to the Cayman Court’s sanctioning of the Scheme, holders of 91.83% of the Notes in number and 99.34% par amount of those voting voted in favor of the Scheme in a scheme meeting held on February 21, 2022.

Pursuant to the Scheme, the Notes will be canceled and exchanged for new securities (the “New Notes”) on or around April 26, 2022. The accrued but unpaid interest on the Notes as of the date the New Notes are issued will effectively be added onto the principal of the New Notes. The New Notes will be issued by the Company pursuant to a second supplemental indenture and will have a maturity date of April 27, 2027. The New Notes will be unsecured, have a par value of $25.00 per note and have an interest rate of 6.625% per annum, if paid in cash, and 7.25% per annum, if paid in kind, with a paid-in-kind option allowing the Company’s to pay interest in kind for up to two years from the date the New Notes are issued. Additionally, the Company will have the option to redeem the New Notes after three years at the principal amount to be redeemed, plus any accrued but unpaid interest, with no penalty. The Company intends to utilize the extended maturity of the New Notes to execute on its technology and analytics driven managing general agency strategy, with the objective of creating value for all stakeholders. The New Notes are expected to be issued in reliance on the exemption to registration provided by Section 1145 of the Bankruptcy Code; however, the Company intends to use its best efforts to seek registration of the New Notes following the Restructuring.

The Scheme is subject to certain conditions precedent (unless such conditions are waived), including that a U.S. Bankruptcy Court enters an order (or orders) recognizing the Cayman proceeding commenced before the Cayman Court and enforcing the Scheme within the territorial jurisdiction of the United States (the “Recognition and Enforcement Order”). In the coming days, the Company intends to commence the recognition proceeding under chapter 15 of the United States Bankruptcy Code by filing a petition (the “Recognition Petition”) to obtain the Recognition and Enforcement Order. The filing of the Recognition Petition will be made in accordance with the RSA. The filing of the Recognition Petition will not impact the Company’s day-to-day operations.

The Sanction Order and the Scheme are filed as Exhibits 2.1 and 2.2, respectively, to this Current Report. The descriptions of the Sanction Order and the Scheme do not purport to be complete and are qualified in their entirety by reference to the Sanction Order and the Scheme filed herewith as exhibits to this Current Report.

The Company is authorized to issue 800,000,001 ordinary voting common shares and, as of February 28, 2022, had 15,052,839 ordinary voting common shares issued and 14,797,334 ordinary voting common shares outstanding. The Scheme does not affect the authorized, issued or outstanding ordinary voting common shares of the Company.

Information regarding the assets and liabilities of the Company as of the most recent practicable date is hereby incorporated by reference to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, filed with the United States Securities and Exchange Commission on November 8, 2021.

DLA Piper LLP (US) is acting as restructuring legal counsel to the Company, together with Conyers Dill & Pearman LLP retained as Cayman Islands local counsel, in connection with the Restructuring.

Item 7.01. Regulation FD Disclosure.

On March 1, 2022, the Company issued a press release announcing the Sanction Order. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference. The information disclosed under this Item 7.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements and information within the meaning of the federal securities laws regarding the Company and its businesses. Such statements are based on the current expectations, estimates, projections, and assumptions made by management. The words “anticipate,” “expect,” “believe,” “may,” “should,” “estimate,” “project,” “outlook,” “forecast” or similar words are used to identify such forward looking information. The forward-looking events and circumstances discussed in this report may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting the Company, including risks regarding the effects and duration of the COVID-19 outbreak, the insurance industry, economic factors, and the equity markets generally and the other risk factors discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and subsequent periodic reports. Many of these uncertainties and risks are difficult to predict and beyond management’s control. No forward-looking statement can be guaranteed, including, without limitation, statements regarding the success of the Restructuring. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made, and the Company and its subsidiaries undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 2.1 | |

| 2.2 | |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Certain portions of this exhibit (indicated by "[*****]") have been omitted pursuant to Item 601(b)(10) of Regulations S-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | ATLAS FINANCIAL HOLDINGS, INC.

(Registrant) |

| By: | /s/ Paul A. Romano |

| | Name: | Paul A. Romano |

| Title: | Vice President and Chief Financial Officer |

| | | March 1, 2022 |

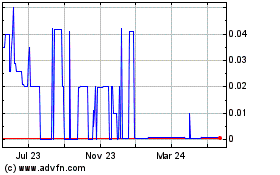

Atlas Financial (CE) (USOTC:AFHIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

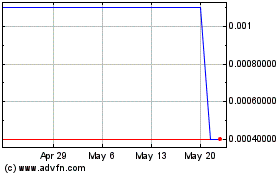

Atlas Financial (CE) (USOTC:AFHIF)

Historical Stock Chart

From Nov 2023 to Nov 2024