UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

Commission File Number: 001-40816

_____________________

Argo Blockchain plc

(Translation of registrant’s name into English)

_____________________

Eastcastle House

27/28 Eastcastle Street

London W1W 8DH

England

(Address of principal executive office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F

☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit

No.

1

|

Description

PrimaryBid

Offer dated 18 July 2023

|

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION, DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE PURPOSES

OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000

("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021).

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

18 July 2023

ARGO BLOCKCHAIN PLC

("Argo" or "the Company")

PrimaryBid Offer

●

Argo announces a conditional

offer for subscription of new Ordinary Shares

via PrimaryBid;

●

The Issue Price for

the new Ordinary Shares is 10 pence

per new Ordinary Share representing a discount of approximately 14

per cent. to the 30 trading day VWAP of the Company's existing

Ordinary Shares for the period ended on 18 July 2023, and a

discount of 25.92 per cent to the closing mid-price of the

Company's Ordinary Shares on 18 July 2023;

●

The

PrimaryBid Offer is available to both existing shareholders and new

investors;

●

Investors can access the

PrimaryBid Offer through PrimaryBid's

website and

on PrimaryBid's

app;

●

Investors can

also participate through PrimaryBid's extensive network of retail

brokers, wealth managers and investment platforms (subject to such

partners' participation), which includes AJ Bell, Hargreaves

Lansdown and interactive investor;

●

Applications

for new Ordinary Shares through

participating partners can be made from tax efficient savings

vehicles such as ISAs or SIPPs, as well as General Investment

Accounts (GIAs). Some partners may only accept applications from

existing shareholders;

●

There

is a minimum subscription of £250 per investor in the

PrimaryBid Offer;

●

No

commission will be charged to investors by PrimaryBid on

applications to the PrimaryBid Offer.

PrimaryBid Offer

Argo Blockchain PLC, a global leader in cryptocurrency mining (LSE:

ARB; NASDAQ: ARBK), is pleased to announce, a

conditional offer for subscription of new ordinary shares of

£0.001 each in the capital of the Company (Ordinary

Shares) via PrimaryBid at an issue

price of 10 pence per new Ordinary Share

(the Issue

Price), being

a discount of approximately 14 per cent. to the 30 trading day VWAP

of the Company's existing Ordinary Shares for the period ended on

18 July 2023, and a discount of 25.92 per cent to the closing

mid-price of the Company's Ordinary Shares on 18 July 2023

(the PrimaryBid Offer).

The Company is also conducting a placing of new Ordinary Shares at

the Issue Price by way of an accelerated bookbuilding process

(the Placing) as announced earlier today.

The PrimaryBid Offer is conditional on the new Ordinary Shares to

be issued pursuant to the PrimaryBid Offer and the Placing being

admitted to the standard listing segment of the Official List of

the Financial Conduct Authority and admitted to trading on the main

market for listed securities of London Stock Exchange plc

(Admission). Admission is expected to take place on or

before 8.00 a.m. on 24

July 2023.

The PrimaryBid Offer will not be completed without the Placing also

being completed, but the Placing is not conditional on the

PrimaryBid Offer.

The proceeds of the proposed Placing and PrimaryBid Offer

(Capital

Raise) will be used to reduce

the Company's outstanding indebtedness and to pursue strategic

growth projects.

The Company currently has approximately £59.1 million of debt

outstanding, including approximately £25.0 million owed to

Galaxy Digital under an asset-backed loan and approximately

£31.4 million of senior unsecured notes. The Company believes

that using a portion of the proceeds to reduce its indebtedness

will be accretive to shareholders by reducing interest expense and

strengthening the balance sheet.

The Company is evaluating a number of novel opportunities with

power generators to help capture the full economic value of their

stranded or underutilized energy. A portion of the proceeds from

the Capital Raise will be used to pursue growth projects of this

nature, which the Company believes will create long term

shareholder value.

The Company operates two mining facilities located in Quebec and

Texas and has offices in the US, Canada and the UK. The Company

aims to provide efficient and cost-effective mining operations by

utilising renewable energy sources.

Reason for the PrimaryBid Offer

While the Placing has been structured as a non-pre-emptive offer

within the Company's existing authorities from shareholders for

non-pre-emptive offers so as to minimise cost, complexity and time

to completion, the Company has a significant and valued retail

investor base and is therefore pleased to provide retail investors

with the opportunity to participate in the PrimaryBid Offer, so as

to enable access to Placing Shares at the same time and price as

institutional investors.

Existing shareholders and new investors can access the PrimaryBid

Offer through PrimaryBid's

website and

on PrimaryBid's

app. The

PrimaryBid app is available on the UK Apple App Store and Google

Play Store.

Investors can also participate through PrimaryBid's extensive

partner network of investment platforms, retail brokers and wealth

managers, subject to such partners' participation. Participating

partners include:

●

Hargreaves

Lansdown; and

Applications for new Ordinary Shares through

participating partners can be made from tax efficient savings

vehicles such as ISAs or SIPPs, as well as GIAs. Some partners may

only accept applications from existing

shareholders.

After consideration of the various options available to it, the

Company believes that the separate PrimaryBid Offer is in the best

interests of shareholders, as well as wider stakeholders in the

Company.

The PrimaryBid Offer will open to investors resident and physically

located in the United Kingdom following the release of this

Announcement. The PrimaryBid Offer is expected to close at 8.00

p.m. on 18 July 2023 and may close early if it is

oversubscribed.

There is a minimum subscription amount of £250 per

investor in the PrimaryBid

Offer.

The Company reserves the right to scale back any order at its

discretion. The Company and PrimaryBid reserve the right to reject

any application for subscription under the PrimaryBid Offer without

giving any reason for such rejection.

Investors who apply for new Ordinary Shares through

PrimaryBid's website or PrimaryBid's app will not be charged any

fee or commission by PrimaryBid. It is vital to note that once an

application for new Ordinary Shares has been made and accepted via

PrimaryBid, an application cannot be withdrawn.

Investors wishing to apply for new Ordinary Shares through

their investment platform, retail broker or wealth manager using

their ISA, SIPP or GIA should contact them for details of the

process, their terms and conditions and any relevant fees or

charges.

The new Ordinary Shares to be issued pursuant to the

PrimaryBid Offer will be issued free of

all liens, charges and encumbrances and will, when issued and fully

paid, rank pari

passu in

all respects with the new Ordinary Shares to be issued

pursuant to the Placing and the Company's existing Ordinary

Shares.

For further information on PrimaryBid, the PrimaryBid Offer or for

a copy of the terms and conditions (including the procedure for

application and payment for new Ordinary Shares) that

apply to registered users of PrimaryBid in addition to the terms

and conditions set out in this Announcement,

visit www.PrimaryBid.com or

email PrimaryBid at enquiries@primarybid.com.

Brokers wishing to offer their customers access to the PrimaryBid

Offer and future PrimaryBid transactions, should

contact partners@primarybid.com.

Important notices

The PrimaryBid Offer is offered under the exemptions from the need

for a prospectus allowed under the FCA's Prospectus Regulation

Rules. As such, there is no need for publication of

a prospectus pursuant to the Prospectus Regulation Rules, or

for approval of the same by the Financial Conduct Authority (as

competent authority under Regulation (EU) 2017/1129 as it forms

part of retained EU law as defined in the European Union

(Withdrawal) Act 2018).

The PrimaryBid Offer is not being made into the United States,

Australia, Canada, the Republic of South Africa, Japan or any other

jurisdiction where it would be unlawful to do so.

This Announcement is not for publication or distribution, directly

or indirectly, in or into the United States of America. This

Announcement is not an offer of securities for sale into the United

States. The securities referred to herein have not been and will

not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

This Announcement and the information contained herein, is

restricted and is not for publication, release or distribution,

directly or indirectly, in whole or in part, in or into Australia,

Canada, the Republic of South Africa, Japan or any other

jurisdiction in which such publication, release or distribution

would be unlawful. Further, this Announcement is for

information purposes only and is not an offer of securities in any

jurisdiction.

Investors should make their own investigations into the merits of

an investment in the Company. Nothing in this Announcement amounts

to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for new Ordinary Shares and

investment in the Company carries a number of risks. Investors

should consider the risk factors set out in the Company's 2022

Annual Report, on www.PrimaryBid.com and

the PrimaryBid app before making a decision to subscribe for new

Ordinary Shares. Investors should take independent advice from a

person experienced in advising on investment in securities such as

the new Ordinary Shares if they are in any

doubt.

For further information please contact:

|

Argo Blockchain

|

|

|

Investor Relations

|

ir@argoblockchain.com

|

|

Tennyson Securities

|

|

|

Joint

Corporate Broker

Peter Krens

|

+44 207 186 9030

|

|

Tancredi Intelligent Communication

UK

& Europe Media Relations

|

|

|

Salamander Davoudi

Emma Valgimigli

Fabio Galloni-Roversi Monaco

Nasser Al-Sayed

|

argoblock@tancredigroup.com

|

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With mining facilities in Quebec, mining operations in

Texas, and offices in the US, Canada, and the UK, Argo's global,

sustainable operations are predominantly powered by renewable

energy. In 2021, Argo became the first climate positive

cryptocurrency mining company, and a signatory to the Crypto

Climate Accord. For more information,

visit www.argoblockchain.com.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date:

18 July, 2023

|

ARGO BLOCKCHAIN PLC

By:

/s/ Jim

MacCallum

Name:

Jim MacCallum

Title:

Chief Financial Officer

By:

/s/ Davis

Zapffe

Name:

Davis Zapffe

Title:

General Counsel

|

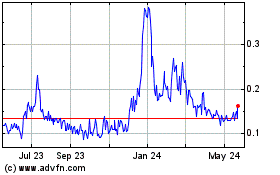

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Jan 2025 to Feb 2025

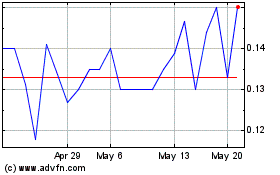

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Feb 2024 to Feb 2025