UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024

Commission File Number: 001-40816

_____________________

Argo Blockchain plc

(Translation of registrant’s name into English)

_____________________

Eastcastle House

27/28 Eastcastle Street

London W1W 8DH

England

(Address of principal executive office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of

Form

20-F or Form 40-F.

Form

20-F ☒

Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit

No.

1

|

Description

Sale of

Mirabel Quebec Data Center & Feb Op Update dated 05 March

2024

|

Press Release

5 March 2024

Argo Blockchain plc

("Argo" or "the Company")

Sale of Mirabel, Quebec Data Center

for $6.1 Million

February Operational Update

Argo Blockchain plc (LSE: ARB; Nasdaq: ARBK), a global leader in

cryptocurrency mining, is pleased to announce that it has entered

into an agreement for the sale of its data center located in

Mirabel, Quebec (the "Mirabel Facility") for total consideration of

$6.1 million (the "Transaction"). All references to $ are to USD,

being derived from the Canadian dollar amounts at an exchange

rate of 0.74.

The Mirabel Facility has five megawatts of electrical capacity,

implying a $1.2 million per megawatt sales price for the

Transaction. The net proceeds from the Transaction are

expected to first repay the Mirabel Facility's

outstanding mortgage in full, with the remainder expected to be

used to repay debt owed to Galaxy Digital Holdings, Ltd. ("Galaxy")

(TSX: GLXY).

The Transaction is expected to strengthen Argo's balance sheet,

reducing outstanding debt by $5.4 million. The Galaxy

debt balance as of 29 February 2024, with pro forma adjustments for

the Transaction and subsequent debt repayment, is $14.0 million, a

60% reduction from the original Galaxy debt balance of $35.0

million.

Pro Forma Unaudited Debt Balances:

|

$ in millions

|

Interest Rate

|

9/30/2023

|

12/31/2023

|

2/29/2023

|

Transaction

|

Pro Forma 2/29/2024

|

|

Senior

Notes

|

8.75%

|

$40.0

|

$40.0

|

$40.0

|

-

|

$40.0

|

|

Galaxy

Debt

|

SOFR + 11%

|

27.2

|

23.5

|

18.0

|

(4.0)

|

14.0

|

|

Mirabel

Mortgage

|

Prime + 0.5%

|

1.6

|

1.5

|

1.4

|

(1.4)

|

-

|

|

Baie

Comeau Mortgage

|

Prime + 0.5%

|

1.5

|

1.4

|

1.2

|

-

|

1.2

|

|

Total

|

|

$70.3

|

$66.4

|

$60.6

|

$(5.4)

|

$55.2

|

Importantly, the Transaction enables the Company to delever the

balance sheet with minimal impact to the Company's revenue.

Following the Transaction, Argo will maintain ownership of all

mining machines currently located at the Mirabel Facility. The

Company is in the process of relocating the machines to its Baie

Comeau facility and anticipates selling certain prior

generation machines representing approximately 140 PH/s. Going

forward, the Company's total hashrate capacity is expected to

be 2.7 EH/s.

The Transaction has significant operational

benefits for Argo. It allows the Company to streamline its

operations by locating all self-mining machines

at its Baie Comeau facility. Additionally, the

Transaction reduces the Company's non-mining operating expenses by

$0.7 million annually.

The Transaction is expected to close by the end of March 2024 upon

the successful completion of customary closing conditions,

including entry into a definitive share purchase agreement and

certain regulatory approvals.

Management Commentary

Argo's Chief Executive Officer, Thomas Chippas, said, "This

Transaction demonstrates the Company's continued commitment to

strengthening the balance sheet through a focus on aggressive

deleveraging and reducing non-mining operating expenses. We are

able to exit the Mirabel Facility with

a high multiple on its power capacity, and we also realize a

premium on this real estate asset while maintaining a

strong hashrate capacity of 2.7 EH/s."

February Operational Update

During the month of February, the Company mined 92 Bitcoin, or 3.2

Bitcoin per day. This 21% reduction in daily Bitcoin production

compared to the prior month was primarily due to a

maintenance-related outage at the Cottonwood substation which

is owned

and operated by an unaffiliated third party. Total downtime from

the outage was approximately 77 hours, or 11% of the month. The

maintenance was completed on 21 February 2024, and normal

operations have resumed. Additionally, Bitcoin production in

February was negatively impacted by a 5% higher average network

difficulty compared to the prior month.

Mining revenue in February 2024 amounted to $4.5 million, a

decrease of 15% compared to the prior month (January 2024: $5.3

million).

As of 29 February 2024, the Company held digital assets worth the

equivalent of 14 Bitcoin.

Argo CEO Thomas Chippas said, "Despite the decrease in Bitcoin

production due to maintenance on the Cottonwood substation, we

expect that our realized power

prices at Helios for February will be significantly lower than

normal due to favorable power market conditions. Lower

power prices will have a beneficial impact to our mining profit,

mining margin, and operating cash flow for the

month."

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's current

views, interpretations, beliefs or expectations with respect to the

Company's financial performance, business strategy and plans and

objectives of management for future operations. These statements

include forward-looking statements both with respect to the Company

and the sector and industry in which the Company operates.

Statements which include the words "remains confident", "expects",

"intends", "plans", "believes", "projects", "anticipates", "will",

"targets", "aims", "may", "would", "could", "continue", "estimate",

"future", "opportunity", "potential" or, in each case, their

negatives, and similar statements of a future or forward-looking

nature identify forward-looking statements. All forward-looking

statements address matters that involve risks and uncertainties

because they relate to events that may or may not occur in the

future, including the risk that the Company may receive the

benefits contemplated by its transactions with Galaxy, the Company

may be unable to secure sufficient additional financing to meet its

operating needs, and the Company may not generate sufficient

working capital to fund its operations for the next twelve months

as contemplated. Forward-looking statements are not guarantees of

future performance. Accordingly, there are or will be important

factors that could cause the Company's actual results, prospects

and performance to differ materially from those indicated in these

statements. In addition, even if the Company's actual results,

prospects and performance are consistent with the forward-looking

statements contained in this document, those results may not be

indicative of results in subsequent periods. These forward-looking

statements speak only as of the date of this announcement. Subject

to any obligations under the Prospectus Regulation Rules, the

Market Abuse Regulation, the Listing Rules and the Disclosure and

Transparency Rules and except as required by the FCA,

the London Stock Exchange, the City Code or applicable law and

regulations, the Company undertakes no obligation publicly to

update or review any forward-looking statement, whether as a result

of new information, future developments or otherwise. For a more

complete discussion of factors that could cause our actual results

to differ from those described in this announcement, please refer

to the filings that Company makes from time to time with

the United States Securities and Exchange Commission and

the United Kingdom Financial Conduct Authority, including the

section entitled "Risk Factors" in the Company's Annual Report on

Form 20-F.

For further information please contact:

|

Argo

Blockchain

|

|

|

Investor

Relations

|

ir@argoblockchain.com

|

|

Tennyson

Securities

|

|

|

Corporate

Broker

Peter

Krens

|

+44

207 186 9030

|

|

Fortified

Securities

|

|

|

Joint

Broker

Guy

Wheatley, CFA

|

+44

74930989014

guy.wheatley@fortifiedsecurities.com

|

|

Tancredi

Intelligent Communication

UK &

Europe Media Relations

|

|

|

Salamander

Davoudi

Helen

Humphrey

|

argoblock@tancredigroup.com

|

About

Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With mining operations in Quebec and Texas, and

offices in the US, Canada, and the UK, Argo's global,

sustainable operations are predominantly powered by renewable

energy. In 2021, Argo became the first climate positive

cryptocurrency mining company, and a signatory to the Crypto

Climate Accord. For more information, visit www.argoblockchain.com.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date:

05 March, 2024

|

ARGO BLOCKCHAIN PLC

By:

/s/ Jim

MacCallum

Name:

Jim MacCallum

Title:

Chief Financial Officer

|

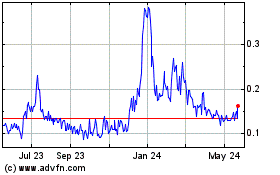

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Jan 2025 to Feb 2025

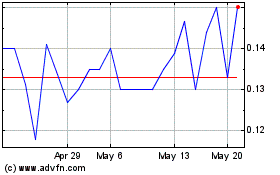

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Feb 2024 to Feb 2025