BARON CAPITAL SUBSIDIARIES TO ENTER MJ AND OIL SECTORS

October 13 2016 - 7:00AM

InvestorsHub NewsWire

TGGI to enter the marijuana

market

Baron outlines plans for its three blank check

shell companies

Coconut Creek, FL -- October 13, 2016 --

InvestorsHub NewsWire -- Baron Capital Enterprises, Inc. (OTCPK:

BCAP) is pleased to announce that its subsidiary Trans Global

Group Inc. (OTCPK:

TGGI) is entering the growing marijuana

business.

TGGI is filing a Tier 1 Reg A offering to raise

funds to enter the marijuana sector. Tier 1 Reg A offerings allow

companies to raise up to $20 million in a twelve-month period.

Funds raised will be used to invest in operating facilities, as

well as the purchase of existing locations and

licenses.

There are multiple revenue streams within the

marijuana sector that range from growing marijuana, to warehousing,

to financial services. The objective is to invest capital into

several companies that work within the marijuana space. Investments

would range from a minimum of 25% up to 100% equity acquisition, or

joint ventures with existing companies, with current management

staying in place. Over time certain investments will be spun off

through a distribution to the shareholders of the Company.

Over the course of the next 45 days a name and ticker change will

take place, along with the filing of the Tier 1 Reg A offering, and

the launch of a new website. During the Reg A funding process,

capital will be raised in $500,000 increments to limit dilution of

the company, so as to maintain a higher share

price.

BLANK

CHECK SHELL COMPANIES

Baron Capital owns three blank check shell

companies that were created in 1998. Each of the companies has a

minimum of 46 shareholders allowing them to become public traded

corporations as conditions permit. A blank

check company is a development stage company that has no

specific business plan or purpose or has indicated its business

plan is to engage in a merger or acquisition with an unidentified

company or companies, other entity, or person.

Baron will bring each blank check shell company

public as a holding company. Each company will have its own

business plan and will focus on a different market

sector.

White Financial will be the first company

brought public through an S-1 registration as a development stage

company in the Oil & Gas sector. The company will raise funds

to be used to buy into re-work wells that produce a minimum of 10

bpd and have an extraction cost of between $8 - $15 per

barrel. White Financial will be renamed prior to the S-1 being

filed. Since the company has never had operations the audit

process will take very little time to prepare.

The White Financial S-1 will be filed before the

end of the current calendar year. Shareholders of Baron will

be offered an opportunity to exchange all or part of their shares

of Baron for shares of White. Those shares will be registered as

part of the S-1. The conversion ratio will be determined at

the time of the S-1 filing and will be based on the then-current

market price of Baron.

Baron intends to cultivate its own client network through its blank

check companies. Deals will be signed with the intention of

bringing the client companies public. This strategy will allow

Baron to earn fees, as well as increasing Baron’s balance sheet

through its holdings in each client

company.

Baron business model works when its clients pay

on time and each client works to enhance their shareholders value.

This is evidenced via the growth of Baron’s assets and can be seen

on Baron’s recently filed financial statements.

Baron has been working to address the DTC chill issue and

accumulated deficit. After speaking with Counsel through a

series of filings which will include a domicile change, both the

DTC issue and accumulated deficit will be addressed by the end of

the current fiscal year.

The foregoing press announcement contains forward-looking

statements that can be identified by such terminology such as

“believes,” “expects,” “potential,” “plans,” “suggests,” “may,”

“should,” “could,” “intends,” or similar expressions. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results

to be materially different from any future results, performance or

achievements expressed or implied by such statements. In

particular, management's expectations could be affected by among

other things, uncertainties relating to our success in completing

acquisitions, financing our operations, entering into strategic

partnerships, engaging management and other matters disclosed by us

in our public filings from time to time. Forward-looking statements

speak only as to the date they are made. The Company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the

forward-looking statements are made.

Contact:

Matt Dwyer

matt@bcapent.com

954-623-3209

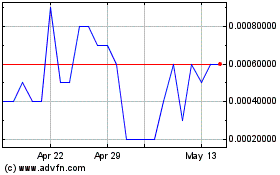

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

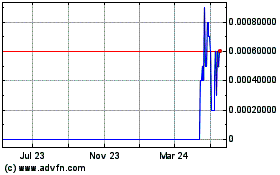

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Baron Capital Enterprise Inc (CE) (OTCMarkets): 0 recent articles

More Baron Capital Enterprise, Inc. (PC) News Articles