Form 8-K - Current report

July 12 2024 - 3:08PM

Edgar (US Regulatory)

false

0001424657

0001424657

2024-06-17

2024-06-17

0001424657

CUEN:CommonStockParValue0.001PerShareMember

2024-06-17

2024-06-17

0001424657

CUEN:WarrantsEachExercisableForOneShareOfCommonStockMember

2024-06-17

2024-06-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): July 12, 2024 (June 17, 2024)

Cuentas, Inc.

(Exact name of registrant as specified in its charter)

| Florida |

|

001-39973 |

|

20-3537265 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

| incorporation or organization) |

|

|

|

Identification Number) |

235 Lincoln Rd., Suite 210

Miami Beach, FL

(Address of principal executive offices)

33139

(Zip Code)

(800) 611-3622

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered under Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value $0.001 per share |

|

CUEN |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each exercisable for one share of Common Stock |

|

CUENW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive

Agreement.

On June 17, 2024, Cuentas, Inc. (“Cuentas”) was

advised that the Buyer of the “Brooksville Property” located at 19200 Cortez Boulevard, Brooksville, Florida 34601 was still

interested to structure a deal to acquire the property and develop it but need additional time to complete this process. On June 19, 2024,

Cuentas was advised by Brooksville Development Partners, LLC (“Company”) that the contract

for the sale of the “Brooksville Property” located at 19200 Cortez Boulevard, Brooksville, Florida 34601 was terminated by

the Buyer on June 7, 2024 as this was the final date for return of their refundable escrow deposit. On July 11, 2024, Cuentas received

definitive notice that the Buyer was no longer able to commit to purchase the property.

The property was originally

purchased April 28, 2023 for $5.05 Million and was under contract to be sold for $7.2 Million. Cuentas contributed $2 million to the original

purchase price and almost $65k towards engineering expenses. The $3.05 million mortgage with Republic Bank of Chicago was amended and

restated on January 27, 2024 for $3.055 million. Additionally, a $500,000 Loan Extension Agreement was executed between the Company and

ALF Trust u/a/d 09/28/2023 to ensure the Promissory Note necessary to fund the interest reserve and fees relating to the Loan Extension

Agreement and the working capital needs of the Company.

Brooksville Development Partners,

LLC (“Company”) consists of Brooksville Development DE, LLC (the “Class A Member” with 30% Membership Interest),

Cuentas Inc, (a “Class B Member” with 63% Membership Interest) and Brooksville FL Partners, LLC, (a “Class B Member”

with 7% Membership Interest), collectively the “Members”.

Cuentas is not restricted at

this time to offer the property to other potential buyers and/or developers.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CUENTAS INC. |

| |

|

|

| Date: July 12, 2024 |

By: |

/s/ Shalom Arik Maimon |

| |

|

Shalom Arik Maimon |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

VIA EMAIL

Brooksville Development Partners, LLC

Two Northfield

Plaza, Suite 320

Northfield, IL 60093

Attn: Alex Zdanov

Email: EMAIL REDACTED

Ruchim & Hudson, P.C.

3000 Dundee Road

Suite 415

Northbrook, IL 60062

Attn: Mitchell Ruchim

Email: EMAIL REDACTED

Chicago Title Insurance Company

5215 Old Orchard Rd #400

Skokie, IL 60077

Attn.: Alisa Habibovic

Phone: PHONE REDACTED

Email: EMAIL REDACTED

| Re: | Purchase and Sale Agreement between Brooksville Development

Partners, LLC, a Florida limited liability company (“Seller”), and Terwilliger Brothers Residential LLC, a Florida

limited liability company (“Buyer”), dated effective as of April 9, 2024 (the “Agreement”) |

Dear All:

As you know, this firm represents Buyer in connection with

the above referenced Purchase Agreement. Capitalized terms used but not defined herein shall have the meanings set forth in the Agreement.

Buyer hereby terminates the Purchase Agreement pursuant

to Section 4 thereof. Buyer will provide Escrow Agent with instructions for the return of the Deposit under separate cover.

Please contact me in the event you have any questions.

| |

Very truly yours, |

| |

|

| |

/s/ Mathew S. Poling |

| |

Mathew S. Poling |

TAMPA

Tel: 813.223.7474

Fax: 813.229.6553 |

|

ST. PETERSBURG

Tel: 727.896.7171

Fax: 727.820.0835 |

| |

|

|

101 E. KENNEDY BOULEVARD

SUITE 2700

TAMPA, FL 33602

|

WWW.TRENAM.COM |

200 CENTRAL AVENUE

SUITE 1600

ST. PETERSBURG, FL 33701 |

v3.24.2

Cover

|

Jun. 17, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity File Number |

001-39973

|

| Entity Registrant Name |

Cuentas, Inc.

|

| Entity Central Index Key |

0001424657

|

| Entity Tax Identification Number |

20-3537265

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

235 Lincoln Rd.

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Miami Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33139

|

| City Area Code |

800

|

| Local Phone Number |

611-3622

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CUEN

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock

|

| Trading Symbol |

CUENW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CUEN_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CUEN_WarrantsEachExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

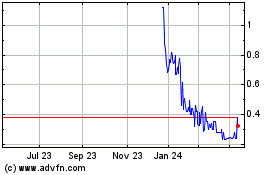

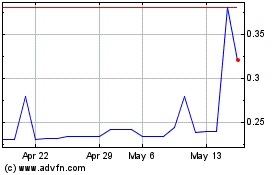

Cuentas (CE) (USOTC:CUEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cuentas (CE) (USOTC:CUEN)

Historical Stock Chart

From Jan 2024 to Jan 2025